A 403(b) plan is a retirement savings plan designed for employees of certain tax-exempt organizations, including educational institutions, hospitals, and nonprofit organizations. It is named after the section of the U.S. Internal Revenue Code that governs it. Similar to a 401(k) plan, a 403(b) plan allows employees to contribute a portion of their salary on a pre-tax basis, meaning the contributions are deducted from their taxable income. This provides immediate tax benefits, as the contributions reduce the participant's current taxable income. The contributions and any investment earnings grow tax-deferred until withdrawal during retirement. 403(b) plans offer employees a valuable opportunity to save for retirement. These plans typically provide a range of investment options, allowing participants to build a diversified portfolio suited to their individual risk tolerance and long-term financial goals. The contributions made to a 403(b) plan accumulate over time, helping participants build a substantial retirement nest egg. 403(b) plan cost refers to the various fees and expenses associated with participating in a 403(b) retirement plan. These costs encompass administrative fees, investment fees, and individual service fees. Administrative fees are charges associated with the administrative and operational aspects of a 403(b) plan. These fees cover services such as recordkeeping, plan compliance, and participant communication. Administrative fees can be charged based on a percentage of plan assets or a fixed fee per participant. Plan providers may have different fee structures and methodologies for calculating administrative fees. These fees cover the cost of maintaining participant records, tracking contributions, and providing account statements. Recordkeeping fees can be charged as a flat fee per participant or as a percentage of assets under management. Custodial fees are charged for the safekeeping and administration of the participant's assets within the 403(b) plan. These fees cover services such as transaction processing, investment accounting, and reporting. Some plans may impose fees specific to individual participant accounts. These fees can vary and may be charged for services such as taking out a loan, processing a withdrawal, or transferring funds between investment options. Annual maintenance fees are charged to cover the ongoing administration and management of the 403(b) plan. These fees typically cover services such as plan compliance, participant communications, and regulatory reporting. Compliance fees are charged to ensure that the plan meets all legal and regulatory requirements. These fees cover expenses related to ensuring the plan's adherence to applicable laws, such as performing required testing, preparing government filings, and engaging legal counsel. Some plans may charge fees for communication and education services provided to participants. These fees cover the cost of delivering educational materials, hosting seminars or webinars, and providing personalized guidance to plan participants. Investment fees are charges associated with the management and operation of the investment options available within a 403(b) plan. These fees cover expenses related to investment management, such as portfolio management, administration, and trading costs. Investment fees can have a significant impact on participants' retirement savings over the long term. Higher investment fees can reduce investment returns, potentially eroding the overall growth of retirement funds. Expense ratios represent the annual fees charged by mutual funds and other investment options within the plan. These ratios are expressed as a percentage of the participant's invested assets. Expense ratios cover the costs of managing the investment fund, including portfolio management, administrative expenses, and other operational costs. Sales loads are charges imposed when purchasing or selling certain investment products within the 403(b) plan. There are two main types of sales loads: Front-End Loads: Front-end loads are fees deducted from the initial investment amount. They reduce the amount initially invested and typically range from 1% to 5% of the investment. Back-End Loads: Back-end loads, also known as deferred sales charges, are fees incurred when selling or redeeming investment holdings. The fee amount can vary depending on the duration the investment has been held, with the charge typically declining over time. Transaction fees are charges associated with specific investment transactions within the 403(b) plan. These fees may be imposed when buying or selling shares of specific funds or making changes to the investment allocation. Transaction fees can vary depending on the type of transaction and the investment provider. Some investment options within the 403(b) plan may impose redemption fees when participants withdraw their funds. These fees are typically designed to discourage frequent trading and may be charged as a percentage of the redemption amount. Individual service fees are charges for specific services provided to participants, often on an individual basis. These fees are typically related to actions or requests initiated by participants, such as taking out a loan from the plan or processing a qualified domestic relations order (QDRO). Some 403(b) plans allow participants to borrow funds from their account balance, typically up to a certain limit. Loan fees may be charged when participants take out a loan from their 403(b) plan. These fees cover the administrative costs of processing the loan and ensuring compliance with loan regulations. In certain circumstances, participants may be eligible to make hardship withdrawals from their 403(b) plan. Hardship withdrawal fees may be assessed when participants request such withdrawals. These fees cover the administrative costs associated with processing and reviewing hardship withdrawal requests. In the event of a divorce or separation, a participant's 403(b) plan may be subject to a QDRO. QDRO fees may be charged when participants request the implementation of a QDRO. These fees cover the administrative costs of reviewing and processing the QDRO to ensure compliance with legal requirements. Participants who wish to engage in estate planning or require legal documents related to their 403(b) plan may incur additional fees. These fees cover the costs of legal services and document preparation related to the participant's retirement plan and beneficiary designations. The organization or institution that sponsors the 403(b) plan can impact the cost. Different providers may have different fee structures and pricing models. It is important for participants to review and compare the fee schedules and administrative costs of different plan providers to identify the most cost-effective options. The range of investment options available within the 403(b) plan can influence the cost. Some investment options may have higher expense ratios or transaction fees, which can increase the overall investment fees. Participants should consider the variety, quality, and cost-efficiency of the investment options offered within their plan. The size of the 403(b) plan and the number of participants can impact the cost. Larger plans often benefit from economies of scale, which can result in lower administrative and operational costs. Conversely, smaller plans may have higher per-participant costs. Participants should be aware of the potential cost implications associated with the size of the plan they are enrolled in. The features and services provided by the 403(b) plan can affect the cost. Plans with additional services such as educational resources, investment advice, or personalized guidance may have higher administrative fees. Participants should assess the value and relevance of these services in relation to the associated costs. The cost of ensuring compliance with applicable regulations and legal requirements can impact the overall cost of a 403(b) plan. Plan providers must allocate resources to ensure the plan meets all necessary compliance obligations. These costs may be reflected in the administrative fees charged to participants. The extent and nature of employer contributions can influence the cost for participants. Employers that match employee contributions or provide additional non-elective contributions incur costs associated with these contributions. While these contributions can enhance retirement savings, participants should consider any associated expenses when evaluating the overall cost of the plan. Participants with multiple 403(b) accounts can consider consolidating them into a single plan. Consolidation reduces administrative redundancies and may lead to cost savings by eliminating duplicate fees. Participants can proactively engage with plan providers to negotiate lower administrative fees. Discussing fee structures, exploring alternative pricing models, or leveraging collective bargaining power in the case of unions can potentially result in reduced costs. Participants should regularly review their 403(b) plan fees. Stay informed about any changes to the fee structure and compare fees with industry benchmarks. If fees seem excessive, consider exploring alternative plan providers or investment options. Expense ratios represent the annual fees charged by mutual funds and other investment options. Participants should select investment options with low expense ratios to minimize ongoing investment fees. Consider low-cost index funds or passively managed funds as they typically have lower expense ratios compared to actively managed funds. Target-date funds are investment options designed for specific retirement dates. These funds automatically adjust the asset allocation over time to become more conservative as retirement approaches. Target-date funds often have built-in diversification and reasonable expense ratios, making them a convenient and cost-effective choice for many participants. ETFs are similar to mutual funds but trade on exchanges like individual stocks. They often have lower expense ratios than traditional mutual funds and can be a cost-effective way to gain exposure to various asset classes. Participants should not solely focus on minimizing fees but also consider the impact of investment performance on the overall cost of a 403(b) plan. Research the historical performance of investment options within the plan. While past performance is not indicative of future results, it can provide insights into the consistency and long-term returns of different funds. Diversification helps spread risk and potentially enhance returns. By investing in a mix of asset classes, participants can reduce the impact of poor performance in a single investment and potentially improve overall portfolio performance. Regularly monitor the performance of investments and rebalance the portfolio as needed. Rebalancing ensures the portfolio remains aligned with the intended asset allocation, optimizing the potential for returns while managing risk. A 403(b) plan is a retirement savings plan available to employees of tax-exempt organizations. Participants can contribute a portion of their salary on a pre-tax basis, providing immediate tax benefits. The contributions and investment earnings grow tax-deferred until retirement. However, participants should be aware of the costs associated with 403(b) plans. 403(b) plan costs include administrative fees, investment fees, and individual service fees. Administrative fees cover recordkeeping, compliance, and participant communication. Investment fees are associated with managing the investment options, such as expense ratios and sales loads. Individual service fees are charged for specific participant requests or actions. To minimize 403(b) plan costs, participants can consolidate accounts, negotiate with plan providers, and regularly review fees. Selecting low-cost investment options, understanding historical performance, diversifying investments, and monitoring the portfolio are also effective strategies. Factors influencing costs include the plan provider, investment options, plan size, features, compliance requirements, and employer contributions. By understanding and managing 403(b) plan costs, participants can maximize their retirement savings and ensure a more financially secure future.403(b) Plan: Overview

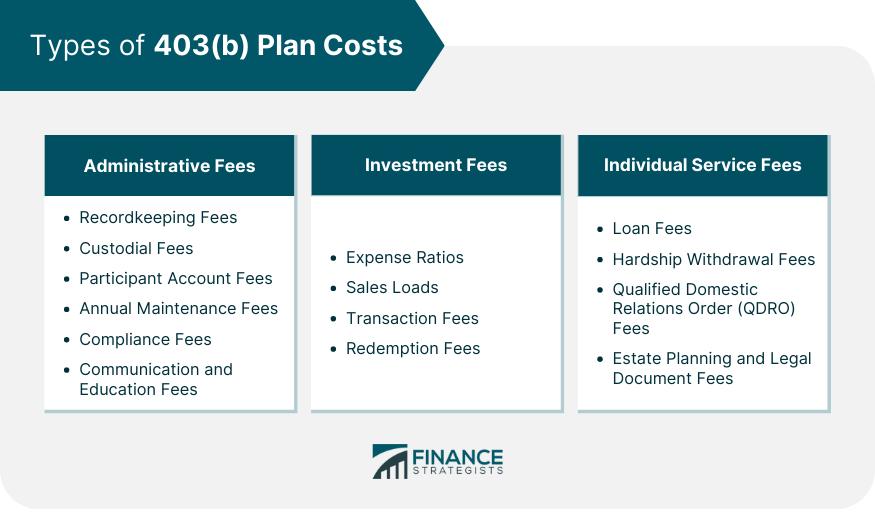

What Are 403(b) Plan Costs?

Administrative Fees

Recordkeeping Fees

Custodial Fees

Participant Account Fees

Annual Maintenance Fees

Compliance Fees

Communication and Education Fees

Investment Fees

Expense Ratios

Sales Loads

Transaction Fees

Redemption Fees

Individual Service Fees

Loan Fees

Hardship Withdrawal Fees

Qualified Domestic Relations Order (QDRO) Fees

Estate Planning and Legal Document Fees

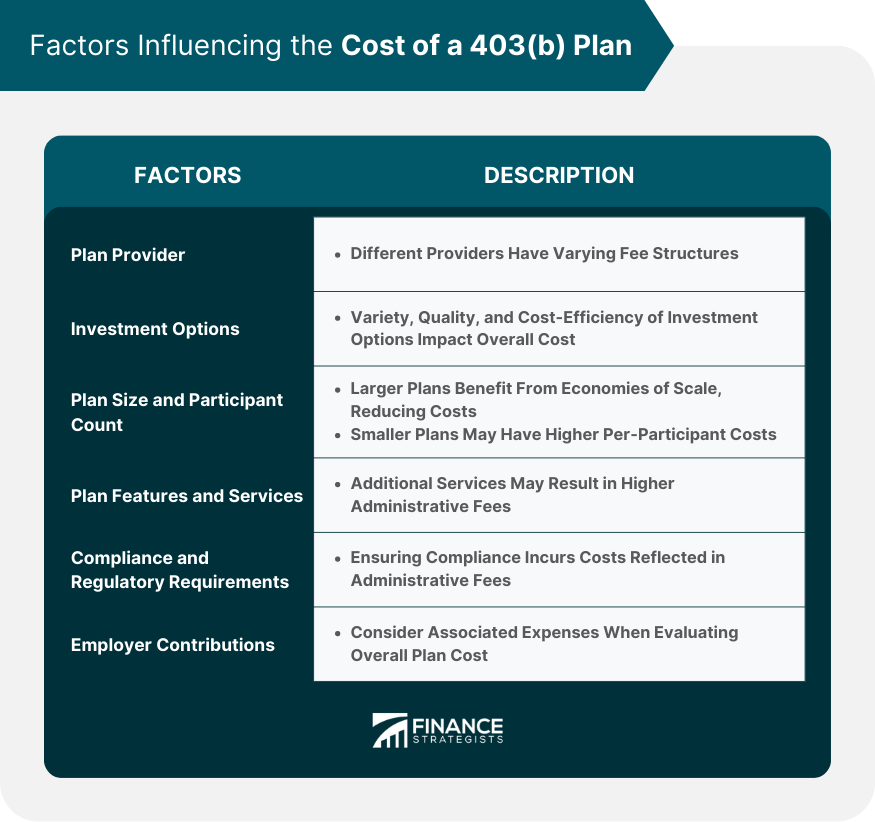

Factors Influencing the Cost of a 403(b) Plan

Plan Provider

Investment Options

Plan Size and Participant Count

Plan Features and Services

Compliance and Regulatory Requirements

Employer Contributions

Minimizing 403(b) Plan Cost

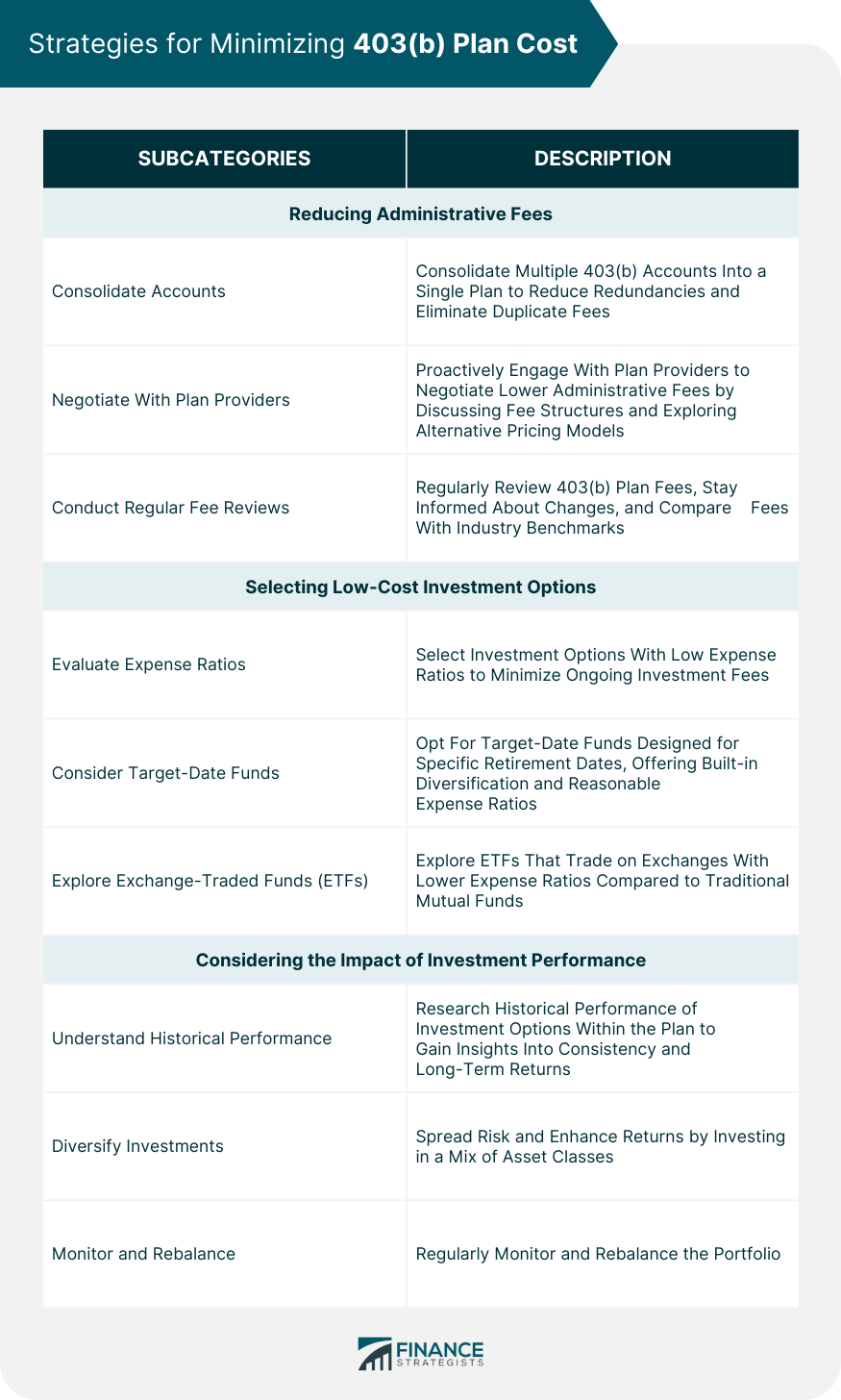

Strategies for Reducing Administrative Fees

Consolidate Accounts

Negotiate With Plan Providers

Conduct Regular Fee Reviews

Selecting Low-Cost Investment Options

Evaluate Expense Ratios

Consider Target-Date Funds

Explore Exchange-Traded Funds (ETFs)

Considering the Impact of Investment Performance on Overall Cost

Understand Historical Performance

Diversify Investments

Monitor and Rebalance

Conclusion

403(b) Plan Cost FAQs

A 403(b) plan cost refers to the fees and expenses associated with participating in a 403(b) retirement plan.

The components include administrative fees, investment fees, and individual service fees.

Consolidate accounts, negotiate with providers, and regularly review fee structures to minimize administrative costs.

Look for low expense ratios, consider target-date funds or ETFs, and assess historical performance.

Diversify investments, regularly monitor and rebalance your portfolio, and prioritize low-cost investment options.

True Tamplin is a published author, public speaker, CEO of UpDigital, and founder of Finance Strategists.

True is a Certified Educator in Personal Finance (CEPF®), author of The Handy Financial Ratios Guide, a member of the Society for Advancing Business Editing and Writing, contributes to his financial education site, Finance Strategists, and has spoken to various financial communities such as the CFA Institute, as well as university students like his Alma mater, Biola University, where he received a bachelor of science in business and data analytics.

To learn more about True, visit his personal website or view his author profiles on Amazon, Nasdaq and Forbes.