403(b) Plan Overcontribution Overview

A 403(b) plan overcontribution occurs when the amount contributed to a 403(b) retirement savings plan exceeds the annual limit set by the Internal Revenue Service (IRS).

This limit varies yearly and accounts for regular contributions and any additional catch-up contributions for those aged 50 and above. Overcontributing can unintentionally occur due to job changes, misinterpretation of contribution limits, or administrative errors.

The impact of overcontribution is significant, with potential tax complications and penalties if not addressed promptly.

In the context of retirement planning, understanding and avoiding overcontribution to your 403(b) plan is essential to maximize the tax benefits and efficiency of your retirement savings strategy.

Correcting an overcontribution, when it does occur, involves timely withdrawal of excess funds and potential tax adjustments, highlighting the importance of diligent tracking and understanding of your 403(b) plan contributions.

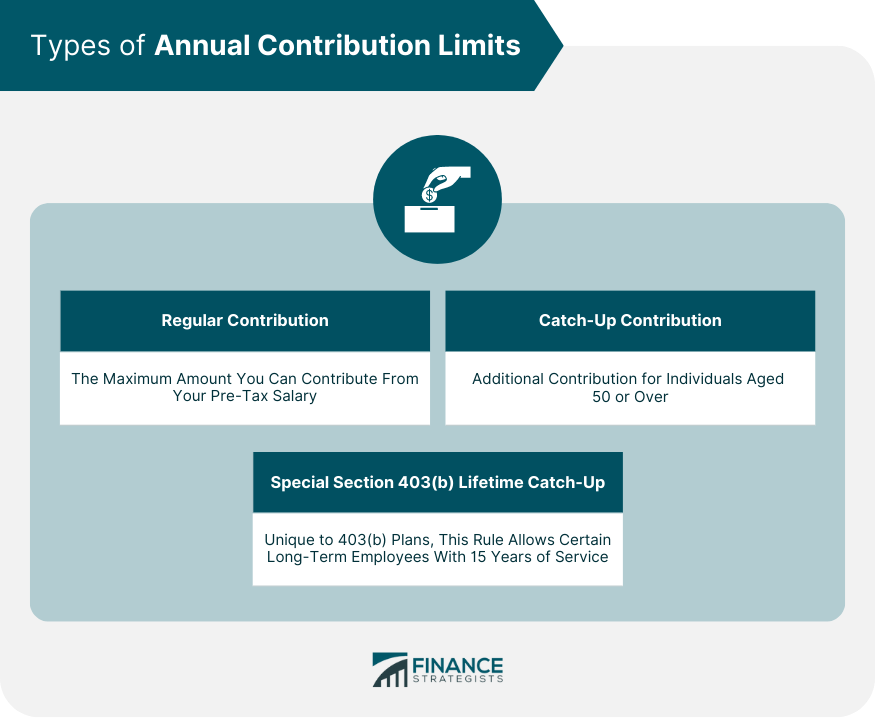

Types of Annual Contribution Limits

Understanding annual contribution limits is key to preventing overcontribution. Here's an overview of the limits in 2024 and 2025.

Regular Contribution Limits

In 2024, the basic limit on elective deferrals is $23,000 ($23,500 in 2025). This means that you can contribute up to this amount from your pre-tax salary.

Catch-up Contributions

If you're aged 50 or over by the end of the calendar year, you're allowed to contribute an additional $7,500 (for both 2024 and 2025) as a catch-up contribution, bringing your total allowed contribution to $30,000 ($31,000 in 2025).

Special Section 403(b) Lifetime Catch-up

A unique feature of 403(b) plans is the "15-year rule," which allows certain long-term employees to make additional contributions.

Under this rule, if you have 15 years of service with your current employer and your average annual contributions were less than $5,000, you could be eligible to contribute up to $3,000 more per year, up to a lifetime limit of $15,000.

Identifying Overcontributions

Identifying overcontributions can sometimes be complex, especially if you contribute to more than one retirement account. Here are some key considerations and the role of your employer in this process.

Keeping Track of Your Contributions

Monitoring your own contributions is the first line of defense against overcontributing. Regularly check your pay stubs and account statements, and keep a running total of your contributions throughout the year.

Monitoring Contributions Across Multiple Plans

If you change jobs during the year or contribute to more than one retirement plan, coordinating your contributions can be more challenging.

The contribution limits apply to the total of all your contributions to 403(b), 401(k), and other plans of this type. If you are in this situation, you may need to work with your financial advisor to track your combined contributions.

Role of Employer in Monitoring

Your employer's payroll department should also be monitoring your contributions. They are generally responsible for ensuring that your contributions don't exceed the limits.

However, mistakes can happen, and ultimately, you are responsible for any overcontributions.

Correcting 403(b) Plan Overcontributions

If you discover that you have overcontributed to your 403(b) plan, don't panic. There are steps you can take to correct the situation.

Withdrawal of Excess Contributions

The IRS allows you to withdraw the excess contributions, along with any earnings on those contributions, by April 15 of the following year. This withdrawal is called a "corrective distribution."

Tax Implications of Correcting Overcontributions

When you withdraw your excess contributions, they become taxable for the year you made them, not the year you withdraw them. Additionally, any earnings on the excess contributions are also taxable in the year withdrawn.

Deadline for Correcting Overcontributions

The deadline for correcting overcontributions without incurring a 6% excise tax is April 15 of the year following the overcontribution. If you miss this deadline, you'll need to pay the excise tax, and the excess contributions may also impact your contribution room for the following year.

Role of Your Plan Administrator

If you discover an overcontribution, contact your plan administrator immediately. They can help you navigate the process of withdrawing the excess contributions and any related earnings.

Preventing Future Overcontributions

Once you've experienced an overcontribution scenario, you'll want to take steps to ensure it doesn't happen again. Here are some strategies to help.

Strategies for Avoiding Overcontributions

Keeping meticulous records is the most effective strategy for avoiding overcontributions. Also, consider setting up automatic alerts or reminders to check your contributions regularly.

If you switch jobs, be sure to coordinate your contributions at your new job with those at your old job.

Understanding Your 403(b) Plan Details

Ensure you fully understand the details of your 403(b) plan, including how to make changes to your contributions and what steps to take if you find an error. The more you understand about your plan, the better equipped you'll be to manage it effectively.

Importance of Communication With Your Employer and Plan Administrator

Keep lines of communication open with your employer and your plan administrator. They can provide you with valuable information and guidance, and they can also assist you if you need to correct an overcontribution.

Conclusion

Preventing and addressing 403(b) plan overcontribution is a significant aspect of efficient retirement planning. The annual contribution limits, including the basic limit, catch-up provisions, and the "15-year rule," set by the IRS are pivotal to avoid overcontribution.

The potential tax implications and penalties for overcontribution underscore the importance of vigilant tracking of your contributions and a deep understanding of your plan details.

In instances of overcontribution, immediate action to withdraw the excess by the IRS stipulated deadline helps to mitigate the negative consequences.

Continuous communication with your employer and plan administrator serves as a critical component in managing your contributions effectively.

Learning from real-life scenarios further reinforces these strategies. Ultimately, careful planning, diligent record-keeping, and prompt action form the backbone of managing your 403(b) plan contributions effectively.

403(b) Plan Overcontribution FAQs

A 403(b) plan overcontribution occurs when the amount contributed to a 403(b) retirement plan in a given year exceeds the annual limit established by the IRS. This limit includes regular contributions and any catch-up contributions for individuals aged 50 or over.

If you overcontribute to your 403(b) plan, you could face tax complications and penalties. The excess contribution and any earnings on it are considered taxable for the year in which they were made, and failure to correct the overcontribution by the IRS deadline can result in a 6% excise tax.

The IRS allows you to correct a 403(b) plan overcontribution by withdrawing the excess amount, along with any earnings, by April 15 of the year following the overcontribution. It's advisable to contact your plan administrator for assistance in navigating this process.

Preventing a 403(b) plan overcontribution involves diligent tracking of your contributions, understanding your plan details, and maintaining open communication with your employer and plan administrator. Setting up automatic alerts or reminders to check your contributions regularly can also be helpful.

If you discover that you've overcontributed to your 403(b) plan, don't panic. Contact your plan administrator immediately. They can guide you through the process of withdrawing the excess contributions and any related earnings, thus correcting the overcontribution.

True Tamplin is a published author, public speaker, CEO of UpDigital, and founder of Finance Strategists.

True is a Certified Educator in Personal Finance (CEPF®), author of The Handy Financial Ratios Guide, a member of the Society for Advancing Business Editing and Writing, contributes to his financial education site, Finance Strategists, and has spoken to various financial communities such as the CFA Institute, as well as university students like his Alma mater, Biola University, where he received a bachelor of science in business and data analytics.

To learn more about True, visit his personal website or view his author profiles on Amazon, Nasdaq and Forbes.