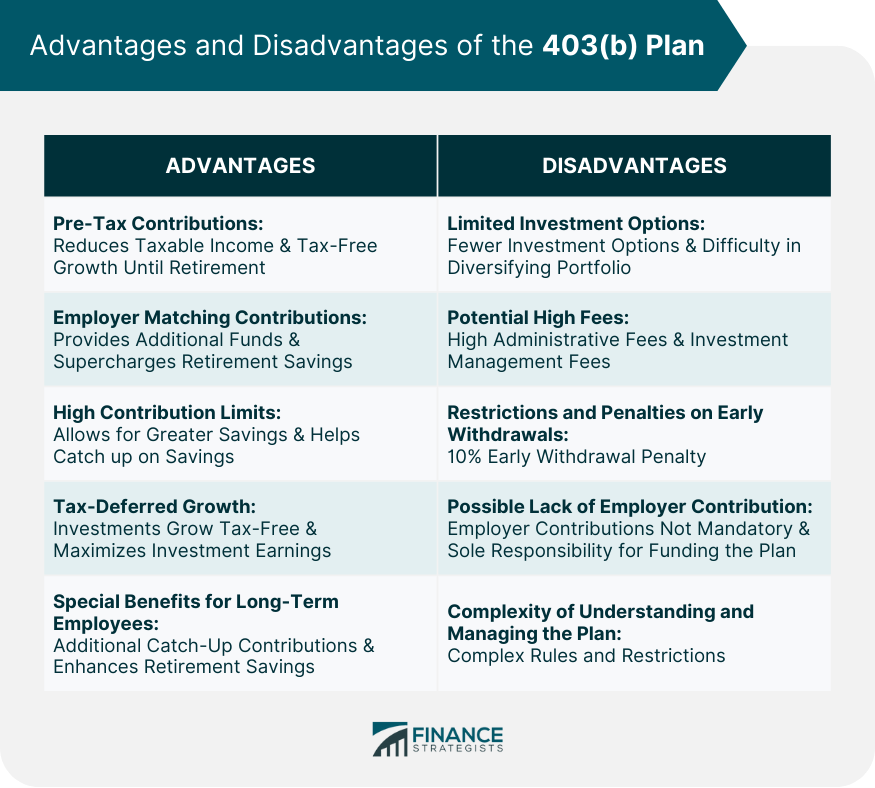

A 403(b) plan, also known as a tax-sheltered annuity (TSA) plan, is a retirement plan designed specifically for employees of public schools, certain tax-exempt organizations, and ministers. Modeled similarly to the popular 401(k) plan, it allows participants to contribute a portion of their income into a special retirement account. These contributions are typically made pre-tax, thereby reducing the taxable income of the participant. The money then grows tax-free until it is withdrawn during retirement, at which point it's taxed as ordinary income. The 403(b) plan was introduced in 1958 as part of the Internal Revenue Code, making it one of the oldest types of retirement plans in the United States. Initially, it was limited to providing annuities but has expanded over time. The Economic Growth and Tax Relief Reconciliation Act of 2001 (EGTRRA) significantly increased contribution limits and added a Roth option. Eligibility for a 403(b) plan is restricted to employees of tax-exempt organizations that fall under Section 501(c)(3) of the Internal Revenue Code, certain ministers, and public school employees. This includes employees of public schools, colleges, universities, churches, charities, hospitals, and other non-profit organizations. Providers of the 403(b) plan are typically insurance companies and mutual fund companies. Some well-known providers include TIAA-CREF, Fidelity, and Vanguard. The range of investment options can differ significantly from one provider to another, so it's important for plan participants to explore their options carefully. Pre-tax contributions are a significant advantage of the 403(b) plan. As the name suggests, these contributions are made before income tax is deducted. This means that the amount of income subject to income tax is reduced, which can lower the current tax bill. Moreover, the money in the account grows tax-free until it is withdrawn during retirement. For example, if a participant's taxable income is $75,000 and they contribute $10,000 to their 403(b) plan, their taxable income drops to $65,000. Depending on their tax bracket, this can lead to substantial tax savings. Over many years, these savings can result in a larger nest egg for retirement. Some employers offer a matching contribution, where they match the employee's contribution up to a certain percentage. This is essentially free money that can supercharge the growth of your retirement savings. For example, if your employer matches 100% of your contributions up to 5% of your salary, and you earn $50,000 a year and contribute 5%, your employer will also contribute $2,500. Different employers may have different matching rules. Some may have a vesting schedule, which means you'll only own the employer contributions after you've worked for a certain number of years. Others may match a lower percentage, like 50% instead of 100%. It's important to understand your employer's specific rules so you can take full advantage of this benefit. 403(b) plans have generous contribution limits. As of 2024, the standard contribution limit is $23,000 ($23,500 in 2025), which is higher than many other types of retirement plans. In addition, those aged 50 and older can make catch-up contributions of $7,500 (for both 2024 and 2025) for a total contribution limit of $30,500 ($31,000 in 2025). The high contribution limits allow participants to save more for their retirement. If you're behind on your retirement savings, being able to contribute more can help you catch up. And the more you contribute, the more your savings can benefit from the magic of compound interest. In a 403(b) plan, not only are your contributions made pre-tax, but the growth of your investments is also tax-deferred. This means that you don't pay taxes on interest, dividends, or capital gains while the money is in the account. This tax-deferred growth can have a significant effect on your investment earnings. For example, if you're in the 24% tax bracket and earn $1,000 in dividends in a taxable account, you'd owe $240 in taxes that year. In a 403(b), you'd owe nothing, allowing the full $1,000 to be reinvested and potentially earn more money. Over time, this can lead to significantly more money in your retirement account. 403(b) plans offer a unique benefit for long-term employees of certain organizations. If you've worked for a qualifying organization for at least 15 years, and your average annual contribution was less than $5,000, you could be eligible for an additional catch-up contribution of up to $3,000 a year, above the standard limit. This "15-year rule" can help long-term employees significantly boost their retirement savings. If you qualify and can afford to make the extra contributions, it can provide a valuable opportunity to ensure you have enough money to live comfortably in retirement. While the 403(b) plan offers many benefits, it also has several disadvantages that potential participants should consider. These drawbacks can impact the effectiveness of the plan as a retirement savings tool. 403(b) plans typically offer a more limited range of investment options compared to other retirement plans, such as the 401(k) or IRA. Many 403(b) plans are annuity-based, which means they're often limited to the products offered by insurance companies. Some plans might offer a selection of mutual funds, but the options are usually less diverse than what you'd find in a 401(k) or an IRA. The limited investment options can affect your ability to diversify your portfolio and tailor it to your risk tolerance and investment goals. This could potentially limit the growth of your retirement savings or expose you to higher risk. 403(b) plans, especially those that are annuity-based, can come with high fees. These can include administrative fees, investment management fees, and surrender charges, which are fees you have to pay if you withdraw funds within a certain period after investing. These fees can be complex and confusing, making it difficult for participants to understand the total cost of their investments. High fees can significantly erode your retirement savings. For example, if your investments earn a 7% return, but you're paying 2% in fees, your net return is only 5%. Over the course of several decades, this can add up to tens of thousands of dollars in lost earnings. Like many retirement plans, the 403(b) plan discourages early withdrawals by imposing penalties. If you withdraw funds before age 59½, you'll typically have to pay a 10% early withdrawal penalty on top of regular income taxes. These penalties can have a significant impact on your retirement savings. If you withdraw $10,000 early, you might have to pay $1,000 in penalties plus income taxes, significantly reducing the amount you actually receive. This discourages early withdrawals and encourages participants to save their money until retirement. While many employers offer matching contributions, they are not required to do so. This means that some participants may miss out on the "free money" that can significantly boost retirement savings. Without employer contributions, you're solely responsible for funding your 403(b) plan. If you're relying on a 403(b) as your primary retirement savings vehicle, this could make it more difficult to accumulate enough savings for a comfortable retirement. 403(b) plans can be complex and confusing, with different rules and restrictions depending on your employer and plan provider. This can make it difficult to understand how best to manage your contributions and investments. To maximize the benefits of a 403(b) plan, it's important to have a good understanding of financial planning and investing. This might involve doing your own research or consulting with a financial advisor. Understanding the rules and fees associated with your plan can help you avoid costly mistakes and make the most of your retirement savings. When choosing a retirement plan, it's not only about the plan's features. Your individual circumstances significantly influence what kind of plan is best for you. Your income level plays a pivotal role in deciding the type of retirement plan best suited for you. Higher earners might be more interested in pre-tax contributions offered by 403(b) plans because these can reduce their taxable income significantly. The tax bracket you fall into can also impact your retirement plan choice. If you're in a high tax bracket now but expect to be in a lower one during retirement, a 403(b) plan with its tax-deferred growth could be a solid option. Your age is another crucial factor to consider. If you're closer to retirement, you might want to take advantage of the catch-up contributions allowed in 403(b) plans. Your retirement goals will significantly shape the type of plan you choose. If you hope to retire early, you need a plan that grows rapidly, though it may have more risk. If you want a steady income post-retirement, you might want a plan with lower risk but consistent returns. Risk tolerance refers to your ability and willingness to lose some or all of your original investment in exchange for greater potential returns. Those with high-risk tolerance may be comfortable investing in aggressive mutual funds, while conservative investors might prefer government bonds or annuities. Finally, the availability of other retirement savings options should influence your decision. Putting all your retirement savings in a single plan might expose you to unnecessary risk. Consider diversifying your retirement savings across different types of accounts, such as 403(b), 401(k), IRA, and taxable investment accounts, based on the options available to you. When considering whether a 403(b) plan is right for you, it's crucial to weigh its pros and cons. The plan's benefits, such as pre-tax contributions, high contribution limits, and the possibility of employer matching, can offer substantial advantages. However, its drawbacks, like limited investment options, potential high fees, penalties for early withdrawals, and possible lack of employer contribution, need to be seriously considered. Personal factors also play a significant role when choosing a retirement plan. Your income level, tax bracket, age, retirement goals, risk tolerance, and availability of other retirement savings options should all be part of your decision-making process. If you're eligible for a 403(b) plan, consider consulting with a financial advisor to understand how it fits within your overall retirement strategy. Overview of 403(b) Plan

Brief History of the 403(b) Plan

Who Is Eligible for a 403(b) Plan?

Common Providers of the 403(b) Plan

Advantages of the 403(b) Plan

Pre-Tax Contributions

Explanation and Benefits

Impact on Income Tax

Employer Matching Contributions

Explanation and Potential Benefits

Variations in Employer Matching

High Contribution Limits

Contribution Limits in 403(b) Plans vs Other Retirement Plans

Potential Impact on Retirement Savings

Tax-Deferred Growth

What Tax-Deferred Growth Means

Effect of Tax-Deferred Growth on Investment Earnings

Special 403(b) Benefits for Long-Term Employees

Explanation of the 15-Year Rule and Catch-Up Contributions

How These Benefits Can Enhance Retirement Savings

Disadvantages of the 403(b) Plan

Limited Investment Options

Typical 403(b) Plan Offerings

How Limited Options May Impact Investment Strategy

Potential High Fees

Explanation of Common Fees in 403(b) Plans

How High Fees Can Erode Retirement Savings

Restrictions and Penalties on Early Withdrawals

Explanation of Withdrawal Rules for 403(b) Plans

Impact of Penalties on Retirement Savings

Possible Lack of Employer Contribution

Understanding That Employer Contributions Are Not Mandatory

Impact on Retirement Savings if the Employer Does Not Contribute

Complexity of Understanding and Managing the Plan

Challenges Faced by Employees in Managing the 403(b) Plan

Importance of Financial Literacy and Planning in Maximizing Plan Benefits

Personal Factors in Choosing a Retirement Plan

Income Level

Tax Bracket

Age

Retirement Goals

Risk Tolerance

Availability of Other Retirement Savings Options

The Bottom Line

403(b) Plan Pros and Cons FAQs

A 403(b) plan is a retirement savings plan available to employees of public schools, certain tax-exempt organizations, and ministers. Contributions are typically made pre-tax, and the funds grow tax-free until they are withdrawn in retirement.

Employees of tax-exempt organizations under Section 501(c)(3) of the Internal Revenue Code, certain ministers, and public school employees are eligible for a 403(b) plan.

As of 2024, the standard contribution limit for a 403(b) plan is $23,500 ($23,500 in 2025). Individuals aged 50 and older can make catch-up contributions of an additional $7,500 per year (for both 2024 and 2025).

Typically, if you withdraw funds from your 403(b) plan before age 59½, you'll face a 10% early withdrawal penalty in addition to owing regular income taxes on the amount withdrawn.

No, employer contributions to a 403(b) plan are not mandatory. However, many employers do offer matching contributions as a benefit to their employees.

True Tamplin is a published author, public speaker, CEO of UpDigital, and founder of Finance Strategists.

True is a Certified Educator in Personal Finance (CEPF®), author of The Handy Financial Ratios Guide, a member of the Society for Advancing Business Editing and Writing, contributes to his financial education site, Finance Strategists, and has spoken to various financial communities such as the CFA Institute, as well as university students like his Alma mater, Biola University, where he received a bachelor of science in business and data analytics.

To learn more about True, visit his personal website or view his author profiles on Amazon, Nasdaq and Forbes.