What Is a 403(b) Rollover to IRA?

A 403(b) rollover to an Individual Retirement Account (IRA) is a process in which funds from a 403(b) retirement plan are transferred to an IRA.

A 403(b) plan is a type of retirement savings account that is typically offered to employees of public schools, tax-exempt organizations, and certain ministers.

When you perform a rollover, you're essentially moving the money from the 403(b) plan into an IRA. The primary purpose of a 403(b) rollover to an IRA is to grant investors greater control and flexibility over their retirement investments.

This is because an IRA often provides a broader range of investment options compared to a 403(b) and may potentially offer lower fees, depending on the provider.

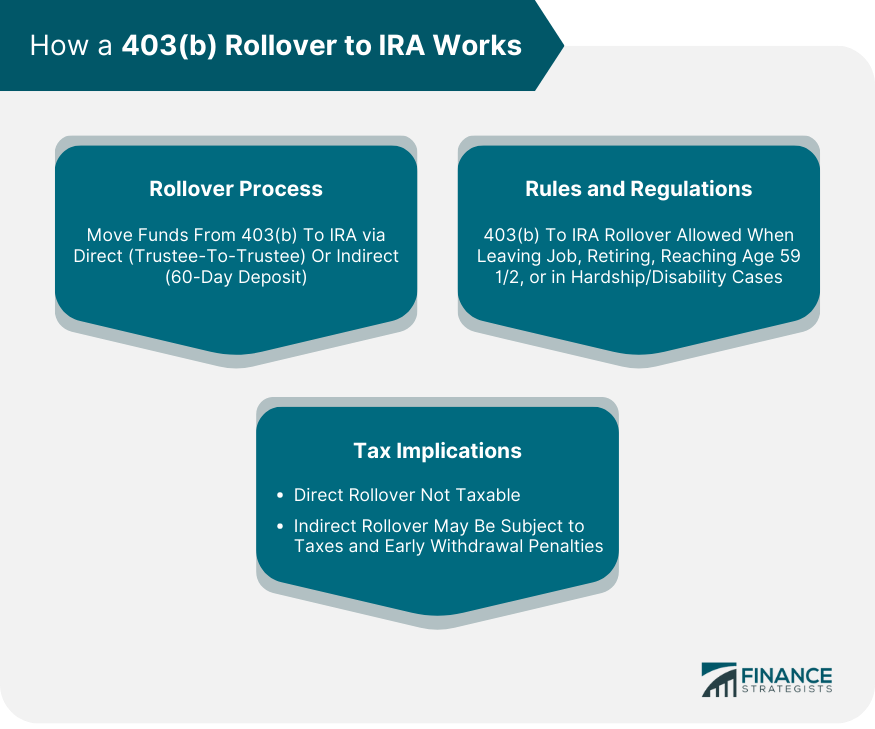

How a 403(b) Rollover to IRA Works

Understanding the mechanism of a 403(b) rollover to IRA is vital to ensure a smooth, penalty-free transfer of funds.

Rollover Process

The rollover process involves moving the funds from the 403(b) plan to the IRA. You can accomplish this via a direct rollover (trustee-to-trustee transfer) or an indirect rollover, where the funds are given to you, and you deposit them into the IRA within 60 days.

Rules and Regulations

Under IRS rules, you can roll over a 403(b) plan to an IRA when you leave your job, retire, or reach the age of 59 ½. Other circumstances like disability or financial hardship may also allow for a rollover.

Tax Implications

In general, a direct rollover from a 403(b) to an IRA is not taxable. However, an indirect rollover, if not completed within 60 days, could be considered a distribution and subject to income taxes and possibly early withdrawal penalties.

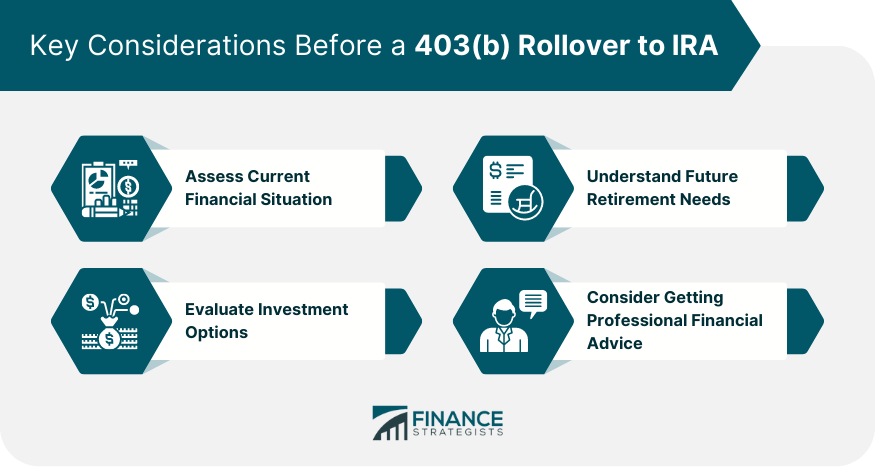

Key Considerations Before a 403(b) Rollover to IRA

Performing a 403(b) rollover to an IRA is a significant financial decision requiring careful thought and consideration.

Assess Current Financial Situation

Understanding your financial situation can help you decide whether a rollover is the right move. Consider factors like your age, income, tax bracket, and retirement goals.

Understand Future Retirement Needs

Evaluate your projected living expenses in retirement. This can help you decide if you should rollover your 403(b) to an IRA or explore other options.

Evaluate Investment Options

Consider the range of investment options offered by your 403(b) and potential IRA. Do they align with your investment goals and risk tolerance?

Consider Getting Professional Financial Advice

Since a rollover is a significant decision, it might be helpful to consult with a financial advisor who can provide personalized advice based on your individual circumstances.

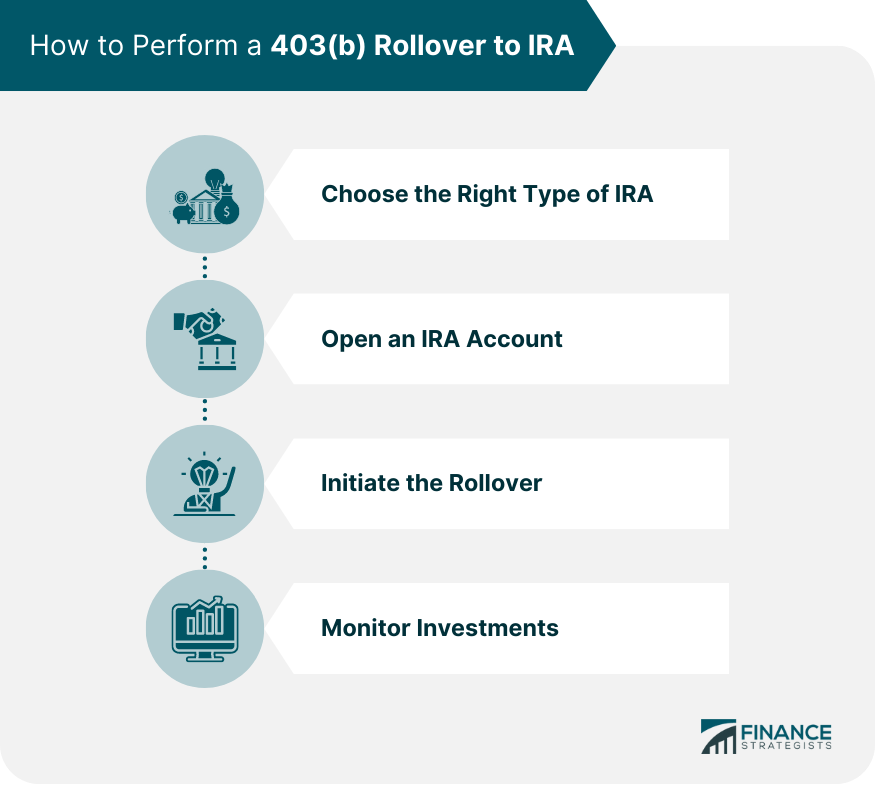

How to Perform a 403(b) Rollover to IRA

Performing a 403(b) Rollover to an IRA involves several steps.

Choose the Right Type of IRA

You can choose between a Traditional IRA and a Roth IRA, depending on your income, tax situation, and retirement goals.

Open an IRA Account

You'll need to open an IRA account with a financial institution. You can choose from banks, brokerage firms, or online investment platforms.

Initiate the Rollover

Contact the administrator of your 403(b) plan to initiate the rollover process. You'll need to fill out paperwork and possibly provide details about your new IRA.

Monitor Investments

Once the rollover is complete, it's essential to monitor your investments regularly and adjust your portfolio as needed to meet your retirement goals.

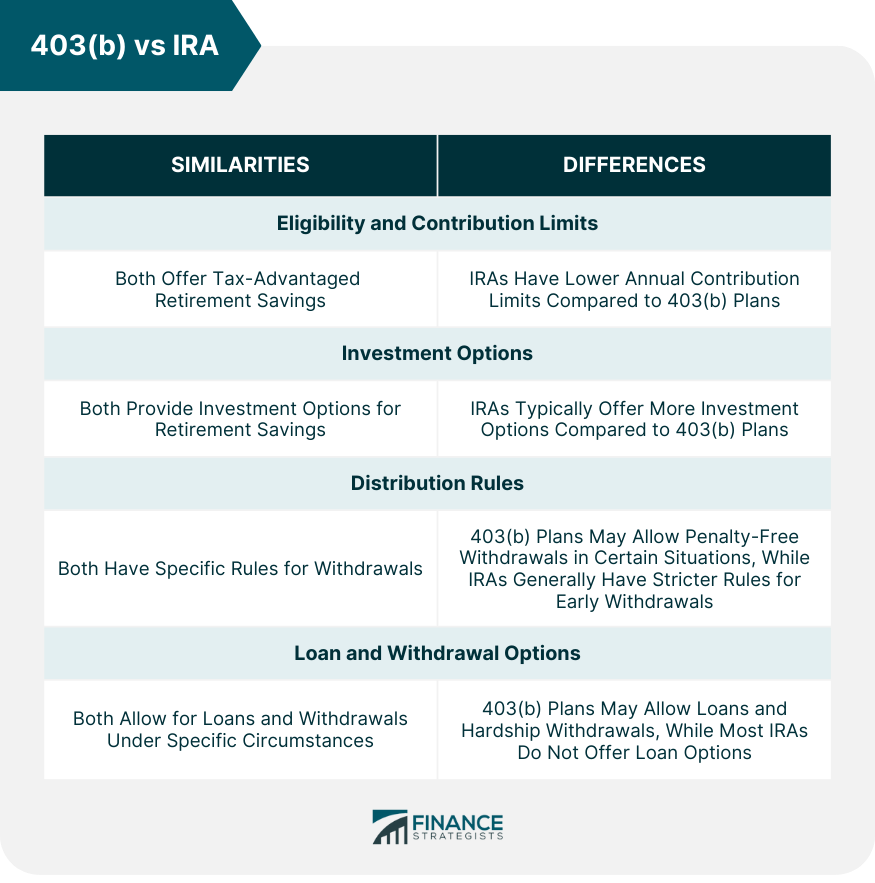

403(b) vs IRA

Comparing 403(b) plans and IRAs can help you make an informed decision about a rollover.

Eligibility and Contribution Limits

While both 403(b) and IRAs offer tax-advantaged retirement savings, their eligibility requirements and contribution limits differ. IRAs have lower annual contribution limits compared to 403(b) plans.

Investment Options

As mentioned earlier, IRAs often offer more investment options than 403(b) plans, providing greater flexibility to meet your individual investment goals.

Distribution Rules

While 403(b) plans might allow for certain penalty-free withdrawals in specific situations, IRAs typically have stricter rules for early withdrawals.

Loan and Withdrawal Options

Unlike most IRAs, 403(b) plans may allow loans and hardship withdrawals under certain circumstances.

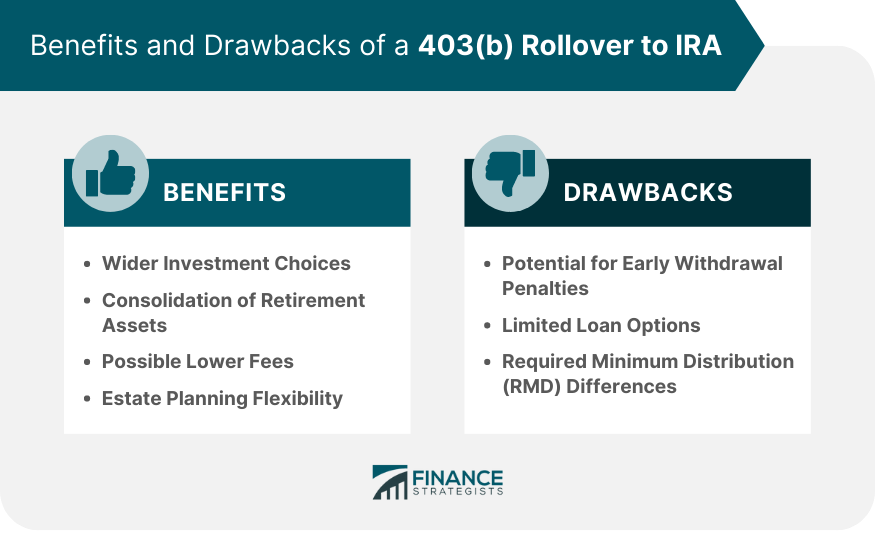

Benefits of a 403(b) Rollover to IRA

There are several advantages associated with rolling over a 403(b) plan to an IRA.

Wider Investment Choices: Unlike 403(b) plans, which often limit investment choices, an IRA typically offers a wider range of investment options, including individual stocks, bonds, mutual funds, and ETFs.

Consolidation of Retirement Assets: If you have multiple retirement accounts, rolling them into a single IRA can simplify your financial management and retirement planning.

Possible Lower Fees: Some 403(b) plans have high administrative fees. By rolling over to an IRA, you may have the opportunity to reduce these fees, depending on the IRA provider you choose.

Estate Planning Flexibility: IRAs generally offer more options and flexibility for estate planning purposes compared to 403(b) plans.

Drawbacks of a 403(b) Rollover to IRA

Despite its benefits, a 403(b) rollover to an IRA comes with potential drawbacks that need to be considered.

Potential for Early Withdrawal Penalties: IRAs typically have stricter rules regarding early withdrawals before age 59 1/2 compared to 403(b) plans.

Limited Loan Options: Unlike 403(b) plans, most IRAs don't allow loans. If you foresee needing a loan from your retirement plan, a rollover might not be the best choice.

Required Minimum Distribution (RMD) Differences: The age at which you must start taking Required Minimum Distributions (RMDs) may differ between 403(b) plans and IRAs, especially if you continue to work past the traditional retirement age.

Final Thoughts

A 403(b) rollover to an IRA provides a strategic financial move for those seeking greater investment flexibility, the potential for lower fees, and simplified asset management.

However, this maneuver is not without its challenges. For instance, IRAs often have more rigid rules regarding early withdrawals and loan limitations, plus the age for mandatory distributions may differ.

Evaluating your financial status, understanding your future retirement needs, and weighing your investment choices are critical steps before deciding on a rollover.

Professional financial guidance can offer invaluable assistance tailored to your unique situation. After initiating a rollover, ongoing monitoring of your investments is crucial to align with your retirement objectives.

Balancing the benefits and potential drawbacks helps ensure a well-informed decision that supports your long-term financial health.

403(b) Rollover to IRA FAQs

A 403(b) rollover to an IRA is the process of moving funds from a 403(b) retirement plan, usually offered to public schools and certain non-profit employees, into an Individual Retirement Account (IRA). This process is typically tax-free and provides the investor with more control and flexibility over their retirement savings.

A 403(b) rollover to an IRA works by transferring the funds from the 403(b) plan to the IRA. It can be done directly (trustee-to-trustee transfer) or indirectly, where the funds are given to you, and you deposit them into the IRA within 60 days. IRS rules allow such rollovers when you leave your job, retire, or reach the age of 59 1/2. Certain other circumstances may also allow for a rollover.

Some benefits of a 403(b) rollover to an IRA include a wider range of investment options, the possibility of lower fees, simplified financial management through consolidation of retirement assets, and more flexibility for estate planning purposes.

Potential drawbacks of a 403(b) rollover to an IRA include stricter rules on early withdrawals before the age of 59 1/2, limited loan options, and differences in the age at which you must start taking Required Minimum Distributions (RMDs).

To perform a 403(b) rollover to an IRA, first, choose the right type of IRA for you (Traditional or Roth), then open an IRA account with a financial institution. Next, contact the administrator of your 403(b) plan to initiate the rollover. After the rollover is complete, monitor your investments regularly to ensure they align with your retirement goals.

True Tamplin is a published author, public speaker, CEO of UpDigital, and founder of Finance Strategists.

True is a Certified Educator in Personal Finance (CEPF®), author of The Handy Financial Ratios Guide, a member of the Society for Advancing Business Editing and Writing, contributes to his financial education site, Finance Strategists, and has spoken to various financial communities such as the CFA Institute, as well as university students like his Alma mater, Biola University, where he received a bachelor of science in business and data analytics.

To learn more about True, visit his personal website or view his author profiles on Amazon, Nasdaq and Forbes.