403(b) plans and pension plans are two specific types of retirement plans. A 403(b) plan, sometimes known as a tax-sheltered annuity (TSA) plan, is a retirement plan offered by public schools and certain 501(c)(3) tax-exempt organizations. It allows employees to contribute pre-tax or after-tax (Roth) dollars to the plan. On the other hand, a pension plan, also known as a defined-benefit plan, promises a specified monthly benefit at retirement. The plan may state this promised benefit as an exact dollar amount, such as $100 per month at retirement. Alternatively, it could define the benefit through a plan formula that calculates the benefit using factors such as salary and service. Understanding the differences and similarities between a 403(b) and a pension plan is crucial when planning for retirement. Each plan has its advantages and drawbacks, which may impact the quality of life during retirement. A 403(b) plan is a defined-contribution retirement plan. Under this plan, employees make contributions on a pre-tax or after-tax (Roth) basis. Employers can also make contributions to an employee's 403(b) account. Eligibility for a 403(b) plan is typically limited to employees of tax-exempt organizations recognized under Section 501(c)(3) of the Internal Revenue Code and certain public education organizations. These often include public schools, colleges, universities, churches, public hospitals, and certain non-profit entities. The IRS sets annual contribution limits for 403(b) plans. For 2024, the general limit is $23,000 ($23,500 in 2025), but it may be higher if you are age 50 or older or if you have at least 15 years of service with your current employer. Contributions grow tax-free until retirement, which can lead to substantial tax savings. Employees can decrease their taxable income through pre-tax contributions. 403(b) plans offer the option for Roth contributions, which are made post-tax but offer tax-free growth and withdrawals. Early withdrawals (before age 59½) may be subject to a 10% penalty, except in specific circumstances. Contributions are typically invested in annuities and mutual funds, potentially exposing the account to investment risks and fees. A pension plan is a type of retirement plan where an employer promises to pay a defined benefit to an employee upon retirement, calculated using factors such as length of service and salary history. Pension plans are generally offered to employees of government agencies and some large companies. The eligibility requirements for pension plans vary widely and depend on the employer’s specific plan. In a pension plan, employers typically make contributions on behalf of the employees. The contribution amount depends on what is necessary to fund the promised future benefits. Employees may also make contributions to some types of pension plans. Pension plans offer a defined benefit at retirement, providing a stable and predictable income stream. The employer bears the investment risk, not the employee. Benefits are typically insured by the Pension Benefit Guaranty Corporation (PBGC), adding an extra layer of protection for the employee. Pension plans lack portability, potentially causing employees to forfeit some or all benefits if they leave their job before retirement. In case of company bankruptcy, the inability to fulfill pension obligations may result in reduced payouts. While some benefits are insured by the PBGC, full benefits may not be guaranteed. In a 403(b) plan, employees decide the amount they wish to contribute from their salary within the limits set by the IRS. Employees have the flexibility to adjust their contributions based on their financial circumstances and retirement goals. Conversely, in traditional pension plans, employees usually do not have the option to contribute. Instead, the employer funds the plan fully. However, in some cases, particularly in government or public sector jobs, employees may also contribute a fixed percentage of their salary to the pension fund. For 403(b) plans, employer contributions are optional. If an employer chooses to contribute, they can match a percentage of the employee's contribution or contribute a fixed amount regardless of the employee's contribution. In contrast, employers are usually the primary contributors to pension plans. They fund the plan to cover the cost of the promised future benefits. The contribution amount can vary from year to year, depending on the funding status of the plan and actuarial calculations. Contributions to a traditional 403(b) plan are made pre-tax, meaning they lower the employee's taxable income in the contribution year. The investment earnings grow tax-deferred until withdrawal. Upon withdrawal, both contributions and earnings are taxed as ordinary income. In contrast, Roth 403(b) contributions are made after tax, meaning they don't lower the employee's taxable income in the contribution year. However, both contributions and earnings can be withdrawn tax-free in retirement, given certain conditions are met. Pension plan contributions are generally made pre-tax. This means that the contributions are not included in the employee's taxable income in the year of contribution. However, pension benefits are taxable when received in retirement at the retiree's ordinary income tax rates. Investment risk refers to the potential for losses related to investments within a retirement plan. In a 403(b) plan, the investment risk lies with the employee. If the investments perform poorly, the employee's retirement savings may be less than expected. On the other hand, in a pension plan, the investment risk lies with the employer. The employer is responsible for ensuring the plan has sufficient funds to pay the promised benefits, regardless of how the plan's investments perform. Longevity risk is the risk of outliving one's retirement savings. In a 403(b) plan, this risk is borne by the employee. If the employee lives longer than expected, they may deplete their 403(b) savings. In contrast, a traditional pension plan typically provides a lifetime annuity, effectively protecting the retiree from longevity risk. As long as the retiree lives, they will receive their promised pension benefits. Generally, employees can begin withdrawing from their 403(b) accounts without penalty when they reach age 59½. Required Minimum Distributions (RMDs) must start by April 1 of the year following the year the employee reaches age 72. Withdrawals before age 59½ are considered early distributions and may be subject to a 10% early withdrawal penalty in addition to regular income taxes. Certain exceptions may apply, such as distributions due to disability or certain medical expenses. The timing of pension benefit payments depends on the terms of the specific plan. Generally, employees can start receiving benefits at the plan's normal retirement age, often 65. Some pension plans allow early retirement and benefit payments, often with a reduced monthly benefit. Unlike 403(b) plans, there is usually no tax penalty for early distributions from a pension plan. However, the benefits are still taxable as ordinary income. Your retirement goals should play a significant role in deciding between a 403(b) and a pension plan. If you prefer a predictable income stream and do not want to manage your retirement savings, a pension plan may be more suitable. However, if you desire more control over your retirement savings and investment decisions, a 403(b) plan may be more appealing. You should consider the income you expect to have in retirement. A pension plan provides a specific income, while a 403(b) can provide a varying income, depending on your contribution and investment returns. If you have a low-risk tolerance and prefer certainty, a pension plan, which provides a defined benefit, may be more suitable. However, if you are willing to take on investment and longevity risk for potentially higher returns, a 403(b) plan could be a better fit. If you plan to stay with your employer for many years, a pension plan can be very rewarding. However, if you anticipate changing jobs frequently, a 403(b) plan, which is portable from one employer to another, maybe more beneficial. Your personal investment philosophy is also a significant factor. If you are knowledgeable about investments and want to direct your retirement savings, a 403(b) plan offers that flexibility. However, if you prefer to leave investment decisions to professionals, a pension plan does that for you. 403(b) and pension plans are both vehicles designed to provide income in retirement, but they operate differently. A 403(b) plan is a defined contribution plan primarily found in non-profit organizations, where employees make the contributions, and they carry the investment and longevity risks. In contrast, a pension plan, also known as a defined-benefit plan, provides a specific income in retirement, usually funded by the employer, who carries the investment risk. Choosing between a 403(b) and a pension plan depends on your personal circumstances, financial goals, risk tolerance, and employment status. It's important to thoroughly understand each plan's features and implications before making a decision. Consulting with a financial advisor can be beneficial in navigating this complex decision to ensure your choice aligns with your retirement goals.Overview of 403(b) and Pension Plans

Direct Comparison: 403(b) vs Pension Plan

Understanding 403(b) Plans

Eligibility for a 403(b) Plan

Contribution Limits for a 403(b) Plan

Benefits of a 403(b) Plan

Drawbacks of a 403(b) Plan

Understanding Pension Plans

Eligibility for a Pension Plan

Contribution Process to a Pension Plan

Benefits of a Pension Plan

Drawbacks of a Pension Plan

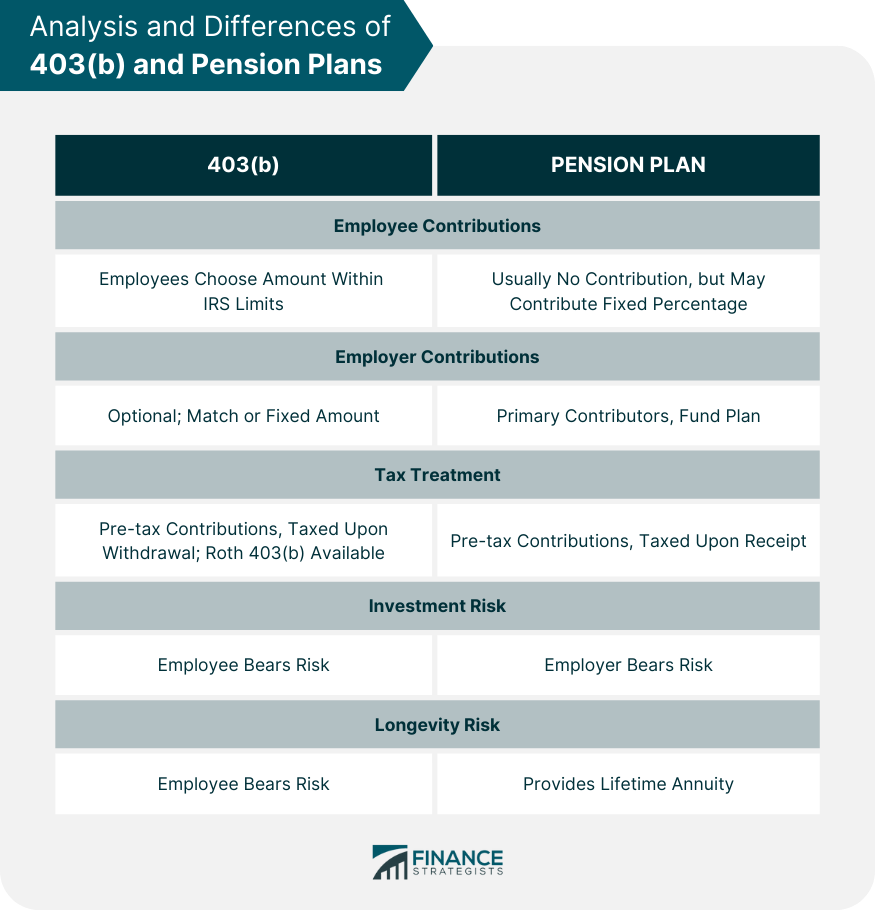

Detailed Analysis and Differences of 403(b) and Pension Plans

Contribution Differences

Employee Contributions

Employer Contributions

Tax Implications

Tax Treatment in a 403(b)

Tax Treatment in a Pension Plan

Risk Factors in 403(b) vs Pension Plans

Investment Risk

Longevity Risk

Distributions and Withdrawals: 403(b) vs Pension Plans

Rules for Distributions in a 403(b)

Normal Distributions

Early Distributions and Penalties

Rules for Distributions in a Pension Plan

Normal Distributions

Early Distributions and Penalties

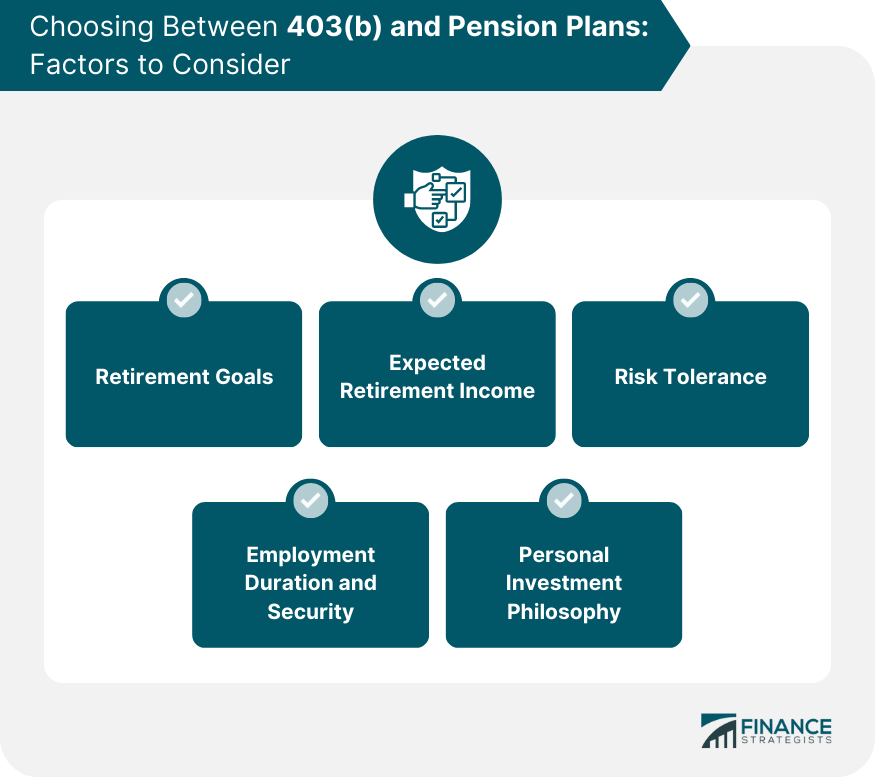

Choosing Between 403(b) and Pension Plans

Retirement Goals

Expected Retirement Income

Risk Tolerance

Employment Duration and Security

Personal Investment Philosophy

The Bottom Line

403(b) vs Pension Plan FAQs

The primary difference between a 403(b) and a pension plan is that a 403(b) is a defined contribution plan, where the employee contributes, and retirement benefits depend on investment returns. In contrast, a pension plan is a defined-benefit plan where the employer contributes, and the employee is promised a specific benefit at retirement.

Yes, if both plans are offered by the employer, an employee can contribute to a 403(b) plan and also be a participant in a pension plan.

In a traditional 403(b) plan, contributions are made pre-tax, lowering the taxable income in the contribution year, while withdrawals in retirement are taxed as ordinary income. In a pension plan, employer contributions are made pre-tax, and pension benefits are taxable when received in retirement.

In a 403(b) plan, the investment risk is borne by the employee. In a pension plan, the investment risk lies with the employer.

Yes, early withdrawals are possible in both plans, but they come with different rules. Early withdrawals from a 403(b) before age 59½ are subject to income taxes and a 10% penalty, barring certain exceptions. Pension plans may allow early retirement and benefit payments, often at a reduced rate, without additional penalties.

True Tamplin is a published author, public speaker, CEO of UpDigital, and founder of Finance Strategists.

True is a Certified Educator in Personal Finance (CEPF®), author of The Handy Financial Ratios Guide, a member of the Society for Advancing Business Editing and Writing, contributes to his financial education site, Finance Strategists, and has spoken to various financial communities such as the CFA Institute, as well as university students like his Alma mater, Biola University, where he received a bachelor of science in business and data analytics.

To learn more about True, visit his personal website or view his author profiles on Amazon, Nasdaq and Forbes.