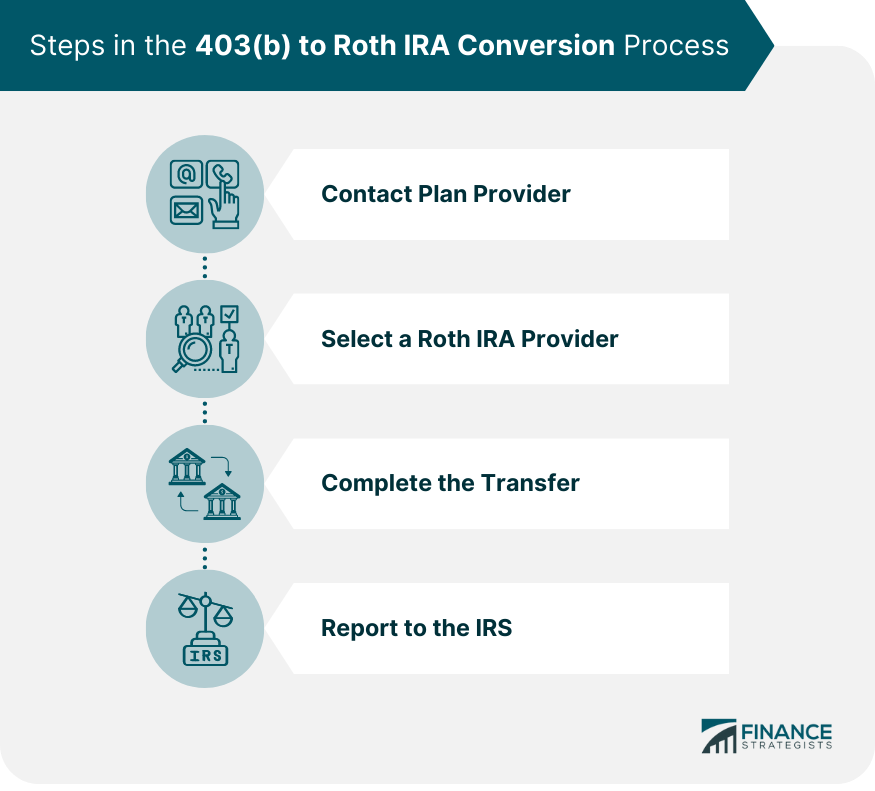

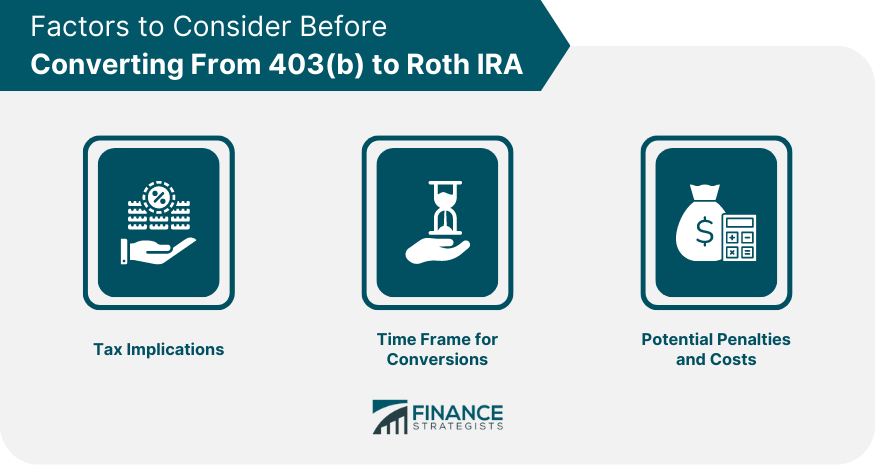

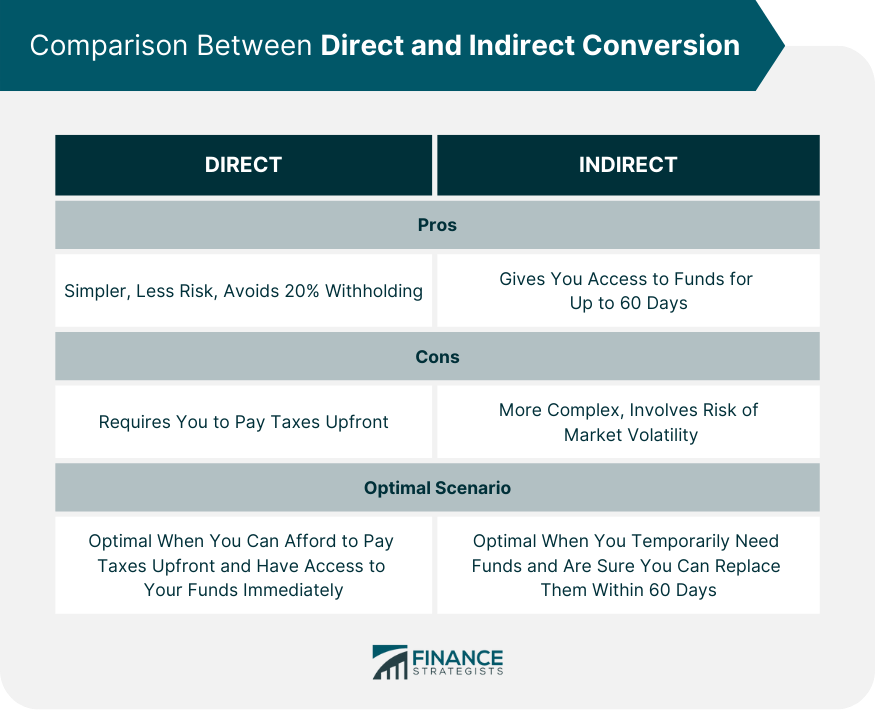

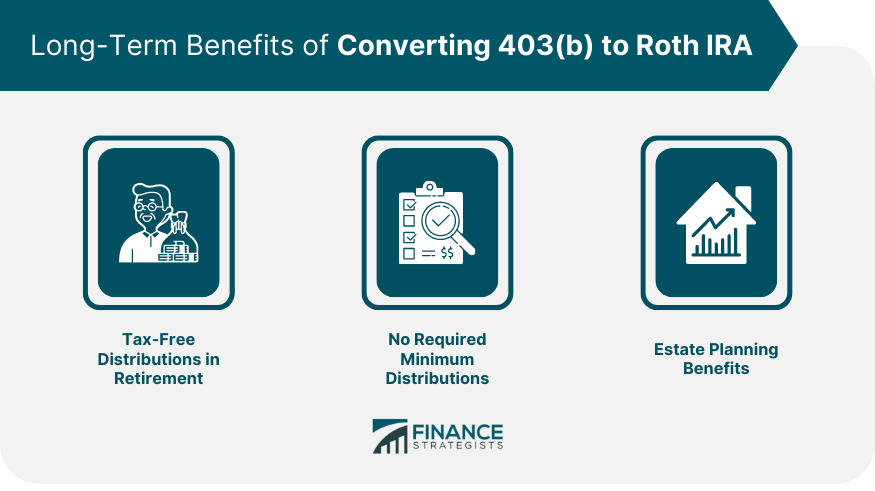

A 403(b) plan overcontribution refers to the act of contributing more to a 403(b) retirement savings plan than the annual limit set by the Internal Revenue Service (IRS). The IRS has set the limit at $23,000 for those under 50, with an additional $7,500 allowed as a "catch-up" contribution for those over 50. Overcontributing can occur inadvertently due to misunderstanding the limits or changes in employment. While the purpose of the 403(b) plan is to provide a tax-advantaged retirement saving strategy, overcontributing can lead to unwanted tax complications. Excess contributions may be subject to a 6% excess contributions excise tax each year until corrected. Thus, it's important for individuals contributing to a 403(b) plan to carefully monitor their contributions and understand the specified IRS limits to avoid the repercussions of overcontributions. The direct conversion from a 403(b) to a Roth IRA involves the following steps: Get in touch with your 403(b) provider to confirm that they permit transfers and what their process entails. If you don't already have a Roth IRA, open one with a financial institution. It is essential to choose a provider who meets your investment needs and service expectations. Once you have both accounts set up, complete the transfer from your 403(b) to your Roth IRA. The funds will move directly from the 403(b) to the Roth IRA without you having to handle them. This conversion will be taxable. Thus, ensure that you report this conversion on your tax return for the year in which you made the transfer. Before starting a conversion, there are several factors to contemplate Converting to a Roth IRA implies that you will need to pay income tax on the amount of the conversion because Roth contributions are made with after-tax dollars. Time your conversion in a way that minimizes your tax burden. This could mean initiating the conversion in a year when you expect to have a lower income. There could be potential penalties and costs associated with the conversion, depending on the terms of your specific 403(b) plan. Always double-check with your plan provider. In some circumstances, a direct conversion may not be possible or ideal, and thus, an indirect conversion comes into play. An indirect conversion involves the following steps: Withdrawal From 403(b) Plan: You withdraw the funds from your 403(b) account. Deposit Into Roth IRA: You have 60 days to deposit the full amount withdrawn into a Roth IRA. While indirect conversion can be a viable option, it's not without its pitfalls: 60-Day Rollover Rule: If you fail to deposit the full amount withdrawn into a Roth IRA within 60 days, the withdrawal will be subject to income tax, and if you're under 59.5 years, an additional 10% early withdrawal penalty. Mandatory Withholding: When performing an indirect rollover, a mandatory 20% withholding for taxes is usually applied, which you'll need to make up out of pocket to avoid taxes and penalties. A direct conversion is generally simpler, involves less risk, and avoids the mandatory 20% withholding. On the other hand, an indirect conversion gives you access to your funds for up to 60 days, which could be beneficial in certain circumstances, but comes with added risk and complexity. The optimal scenario for a direct conversion is when you can afford to pay the tax due on conversion from other sources, and your 403(b) plan allows for in-service distributions or you're no longer employed by the plan sponsor. Conversely, an indirect conversion could be beneficial if you temporarily need the funds, and are sure you can replace the full amount within 60 days. The primary advantage of a Roth IRA is tax-free distributions in retirement. This is especially beneficial if you expect to be in a higher tax bracket during retirement. Roth IRAs don't have Required Minimum Distributions (RMDs), unlike 403(b) plans. This allows you more control over your retirement savings and can also provide significant estate planning benefits. A Roth IRA can be a powerful estate planning tool. It provides the opportunity for tax-free growth and tax-free withdrawals for your beneficiaries. Converting a 403(b) to a Roth IRA is a multi-step process that offers multiple potential benefits, including tax-free distributions in retirement, no required minimum distributions, and significant estate planning benefits. However, it also requires careful planning. Understanding the tax implications, timing the conversion to minimize tax burdens, and avoiding potential penalties are key considerations. Choosing between a direct and indirect conversion involves assessing personal financial needs, future income expectations, and employment status. Meanwhile, overcontributing to a 403(b) can lead to unwanted tax complications, highlighting the need for careful monitoring and understanding of IRS contribution limits. Ultimately, this process should be tailored to individual financial circumstances and goals, potentially with the assistance of a financial advisor. It's a complex yet potentially rewarding strategy, underscoring the intricate nature of effective retirement planning.Converting 403(b) To Roth IRA Overview

Steps in the 403(b) to Roth IRA Conversion Process

Contact Plan Provider

Select a Roth IRA Provider

Complete the Transfer

Report to the IRS

Factors to Consider Before Converting From 403(b) to Roth IRA

Indirect Conversion From 403(b) to Roth IRA

Steps in Indirect Conversion

Pitfalls to Avoid in Indirect Conversion

Comparison Between Direct and Indirect Conversion

Pros and Cons

Optimal Scenarios for Each Conversion Type

Long-Term Benefits of Converting 403(b) to Roth IRA

Tax-Free Distributions in Retirement

No Required Minimum Distributions

Estate Planning Benefits

Conclusion

Converting 403(b) To Roth IRA FAQs

The primary steps in converting a 403(b) to a Roth IRA include contacting your 403(b) plan provider, selecting a Roth IRA provider, completing the transfer, and reporting the conversion to the IRS.

Prior to converting your 403(b) to a Roth IRA, you should consider the tax implications, the optimal time frame for conversions, and any potential penalties or costs associated with the conversion.

A direct conversion from a 403(b) to a Roth IRA is simpler and avoids mandatory withholding, while an indirect conversion allows access to your funds for up to 60 days but comes with added risks and complexity.

Long-term benefits of converting a 403(b) to a Roth IRA include tax-free distributions in retirement, no required minimum distributions, and significant estate planning benefits.

Due to the complexities involved in converting a 403(b) to a Roth IRA, it's advisable to consult with a financial advisor, particularly if you have a large 403(b) balance or a complex financial situation.

True Tamplin is a published author, public speaker, CEO of UpDigital, and founder of Finance Strategists.

True is a Certified Educator in Personal Finance (CEPF®), author of The Handy Financial Ratios Guide, a member of the Society for Advancing Business Editing and Writing, contributes to his financial education site, Finance Strategists, and has spoken to various financial communities such as the CFA Institute, as well as university students like his Alma mater, Biola University, where he received a bachelor of science in business and data analytics.

To learn more about True, visit his personal website or view his author profiles on Amazon, Nasdaq and Forbes.