A 403(b) plan is a tax-advantaged retirement savings plan for employees of tax-exempt organizations, public schools, and certain ministers. Under this plan, employees may defer a portion of their salaries into this plan for retirement, leading to its alternate name: tax-sheltered annuity. A 403(b) plan works by allowing employees to allocate pre-tax dollars toward their retirement savings. These contributions are deducted directly from their paycheck and placed into the 403(b) account. For many employees in the public sector and non-profit organizations, a 403(b) is a cornerstone of their retirement strategy. It provides an opportunity to build retirement savings with pre-tax dollars, thereby reducing current taxable income, and also offers the potential for tax-deferred growth. This step involves an in-depth look at your income, expenses, outstanding debts, and your short-term and long-term financial goals. It is essentially taking stock of where you are financially. You can use tools like budget trackers and financial planning worksheets to get a clear view of your current financial standing. Knowing your financial status helps ensure you contribute an amount to your 403(b) that's affordable and won't place undue strain on your current lifestyle. The IRS imposes limits on how much you can contribute to your 403(b) each year. For 2024, the maximum contribution is $23,000, with an additional catch-up contribution of up to $7,500 for those 50 or older. It's crucial to plan your contributions to not exceed these limits while maximizing your retirement savings. The aim is to contribute as much as you can afford, taking into account your current living expenses, financial goals, and anticipated future needs. Your employer might offer to match your contributions up to a certain percentage of your salary. This is essentially free money that can help you reach your retirement goals faster. To make the most of this benefit, aim to contribute at least enough to receive the full match. Be sure to understand your employer's matching policy, including when the matching contributions are vested, which means the money is officially yours to keep even if you leave the company. It is a simple and effective way to ensure you consistently contribute to your 403(b). Usually, you can set this up with your employer's payroll department. By doing this, a chosen portion of your paycheck is automatically contributed towards your 403(b) before you even see it. This method often makes it easier to adapt to slightly lower take-home pay, and ensures you continuously build your retirement savings. Your financial situation varies over time. Changes in income, marital status, having children, or purchasing a home, among other things, can significantly impact your finances. Therefore, it's crucial to review and adjust your contribution plan annually or when you experience significant life changes. These adjustments ensure your contributions align with your current situation and goals. Are you aiming for an early retirement? Do you want to maintain your current lifestyle, or do you envision a retirement filled with travel and luxury? Do you have a spouse or children to consider in your planning? Clearly defining your retirement goals can give you an idea of how much you need to save and guide your investment choices. The earlier you start contributing to your 403(b), the more time your money has to grow. If you start contributing early in your career, you can take advantage of compounding interest over time. However, if you're closer to retirement, you might need to make larger contributions to meet your retirement goals. Furthermore, the age at which you plan to retire can also influence how aggressively you invest within your 403(b) plan. Different investment options within a 403(b) come with different levels of risk and potential returns. For example, stocks have high growth potential but come with more risk, while bonds are more stable but offer lower returns. Consider your risk tolerance and retirement timeline when choosing your investments. All contributions to your 403(b) plan are made pre-tax, which lowers your taxable income in the contribution year. However, when you start withdrawing funds in retirement, both the contributions and any earnings are taxed as ordinary income. Depending on your income in retirement, these withdrawals could place you in a different tax bracket. Understanding these tax implications will help you plan for a more financially stable retirement. If you have other retirement accounts, like a traditional or Roth individual retirement account (IRA), or even another employer-sponsored plan like a 401(k), you'll need to consider how your 403(b) contributions fit into your overall retirement savings strategy. Diversifying your retirement savings across different types of accounts can provide tax advantages, reduce risk, and increase potential returns. Whenever you contribute a part of your salary to your 403(b) plan, that portion is deducted from your income before taxes are calculated. For example, if you earn $50,000 annually and contribute $5,000 to your 403(b), you will only be taxed as if you earned $45,000. This can significantly lower your current income tax liability, which can lead to immediate tax savings and possibly put you in a lower tax bracket, resulting in a lesser tax rate. For example, if your employer matches 50% of your contributions up to 6% of your salary, and you earn $50,000 annually and contribute 6% ($3,000), your employer would contribute an additional $1,500. This can greatly amplify the growth of your savings and accelerate your progress toward your retirement goals. In standard taxable investment accounts, you must pay taxes on interest, dividends, and capital gains annually, even if you reinvest these earnings. However, in a 403(b), taxes on these earnings are deferred until you begin making withdrawals in retirement. This allows your contributions and earnings to compound unhindered by taxes, potentially leading to a significantly larger retirement fund. While generally, retirement plans penalize early withdrawals (those made before age 59 ½) with a 10% tax penalty, the 403(b) plan offers certain exceptions. For instance, if you encounter severe financial hardship, or have specific medical expenses, you might qualify for a penalty-free withdrawal. However, these withdrawals are subject to income tax. Additionally, some 403(b) plans allow withdrawals for first-time home purchase or college expenses, adding a level of financial flexibility in case of need. The investment options in a 403(b) plan can be quite restricted compared to other retirement savings vehicles, such as a 401(k) or an IRA. Many 403(b) plans, particularly those run by smaller employers, offer only a small selection of mutual funds or annuities. This could limit diversification and prevent you from investing in particular sectors or asset classes you believe would be beneficial. 403(b) plans, especially those that offer annuity products, can come with high administrative costs and fees. These fees, which may include sales charges, surrender charges, and management fees, can significantly eat into your retirement savings over time. It's essential to understand all the fees associated with your 403(b) plan and to compare these with the costs of other retirement savings options. Once you reach age 73, you must begin taking RMDs from your 403(b), regardless of whether you need the money. The amount you have to withdraw each year is based on an IRS formula that takes into account your age and account balance. These forced withdrawals could potentially bump you into a higher tax bracket. Furthermore, if you fail to take out the RMD, you'll face a penalty—50% of the amount that should have been withdrawn. Financial advisors can help you assess your current financial situation, determine your retirement goals, and develop a comprehensive retirement plan. They can also help you understand complex financial concepts and make informed investment decisions. It's a common misconception that financial advice is only for the wealthy or those close to retirement. On the contrary, even those in the early stages of their career can benefit immensely from professional guidance. When you're starting, an advisor can help set you on the right path, establishing a strong financial foundation and habit of saving. As you progress in your career and your income grows, they can assist in adjusting your contributions and diversifying your investments. And as you near retirement, they can provide guidance on the optimal withdrawal strategy to maximize your retirement income. Ensure your financial advisor has the necessary certifications and credentials. The Certified Financial Planner (CFP) or Chartered Financial Consultant (ChFC) designations indicate they've undergone rigorous training and adhere to high ethical standards. Experience in the field and with clients similar to you in terms of income, career stage, and financial goals, is also crucial. advisors who have successfully guided clients like you will likely be better equipped to understand your situation and needs. Finally, consider their fee structure. Some advisors charge a flat fee, others a percentage of the assets they manage for you, and some may work on commission. Ensure the fee structure is transparent, reasonable, and aligns with the value they bring. A 403(b) plan offers tax-advantaged retirement savings for employees of tax-exempt organizations, public schools, and certain ministers. Contributing to this retirement plan involves evaluating one’s financial status, determining contribution amounts, understanding and maximizing employer matching policies, and periodically reviewing the plan. A 403(b) plan provides advantages such as tax-deductible contributions, potentially increased deferrals due to employer matches, and tax-deferred growth. However, individuals should also consider limitations like limited investment options, possible high administrative costs, and required minimum distributions. Seeking the guidance of a qualified financial advisor can be instrumental in optimizing contributions, diversifying investments, and planning for an optimal withdrawal strategy, regardless of career stage or proximity to retirement.Overview of the 403(b) Plan

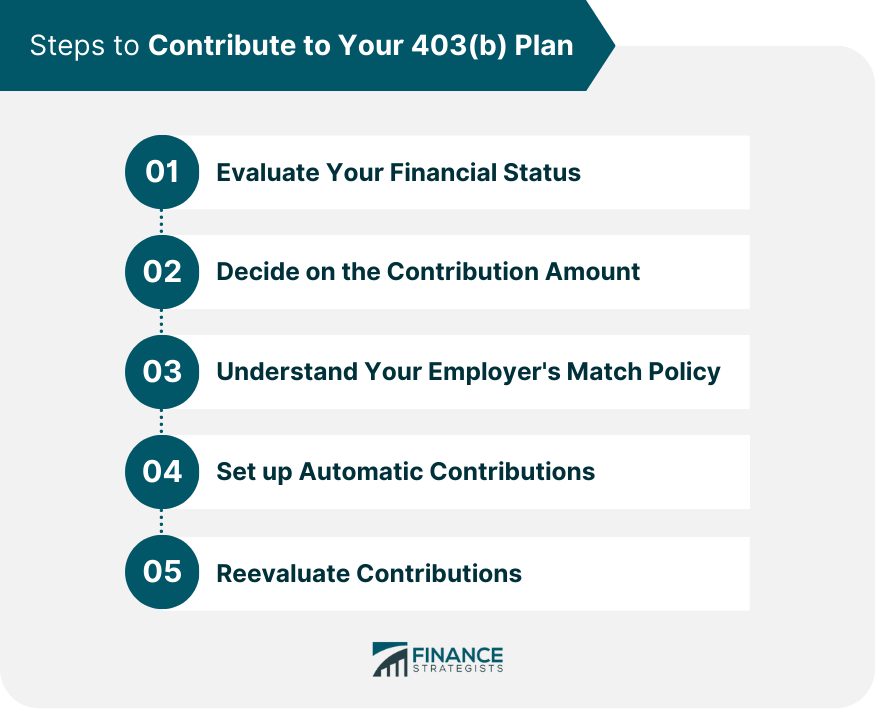

Steps to Contribute to Your 403(b) Plan

Evaluate Your Financial Status

Decide on the Contribution Amount

Understand Your Employer's Match Policy

Set up Automatic Contributions

Reevaluate Contributions

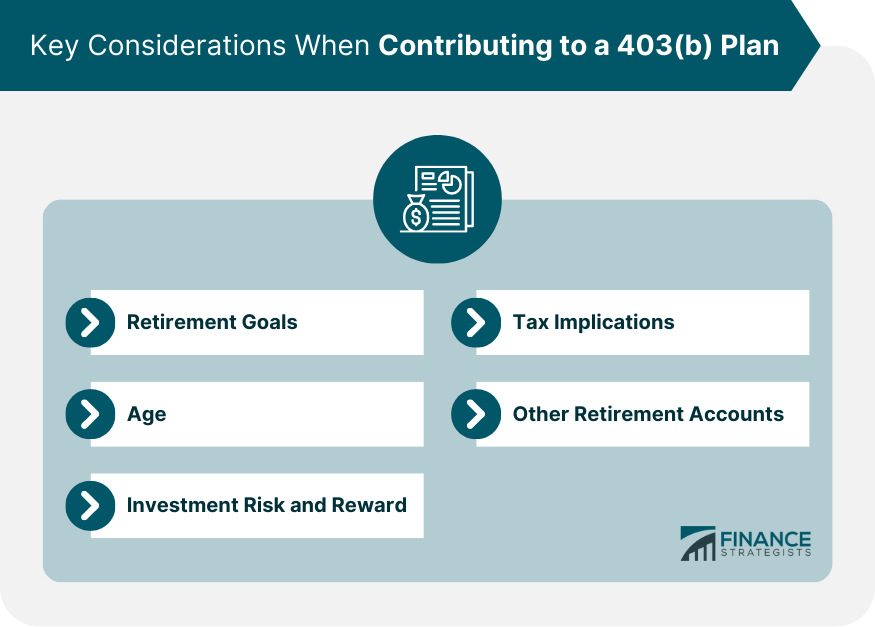

Key Considerations When Contributing to a 403(b) Plan

Retirement Goals

Age

Investment Risk and Reward

Tax Implications

Other Retirement Accounts

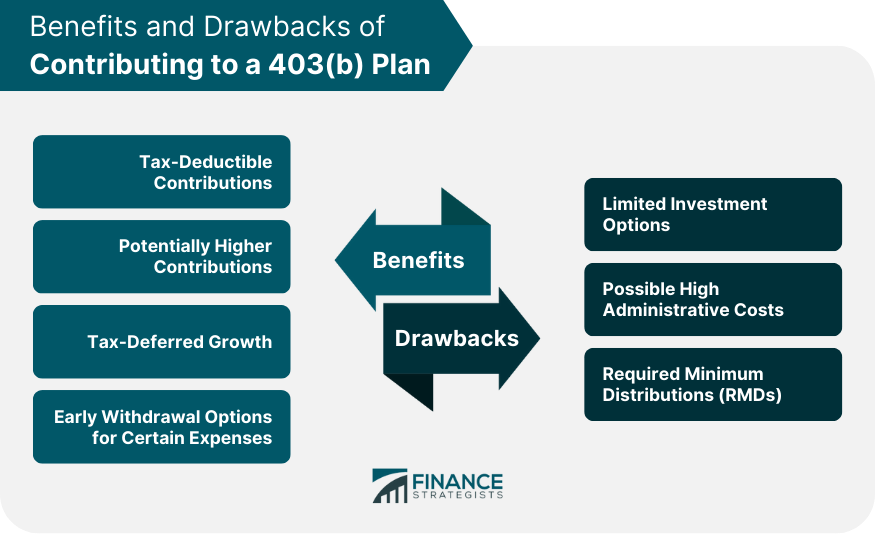

Benefits of Contributing to a 403(b) Plan

Tax-Deductible Contributions

Potentially Higher Contributions Through Employer Match

Tax-Deferred Growth

Early Withdrawal Options for Certain Expenses

Drawbacks of Contributing to a 403(b) Plan

Limited Investment Options

Possible High Administrative Costs

Required Minimum Distributions (RMDs)

Financial Advisors and Your 403(b) Plan

How They Can Help

When to Seek Their Advice

Choosing a Suitable Financial Advisor

Final Thoughts

How to Contribute to Your 403(b) FAQs

The IRS imposes contribution limits for 403(b) plans. For 2023, the maximum contribution is $22,500 per year for individuals under 50, with an additional catch-up contribution of up to $7,500 for those 50 or older.

Yes, contributing to your 403(b) plan is typically done through payroll deductions. You can set up automatic contributions with your employer's payroll department, where a portion of your paycheck is deducted and directed towards your 403(b) account.

Employer matching contributions to a 403(b) plan are not mandatory. However, some employers do offer a matching program, where they will contribute a certain percentage of your salary based on your contributions. It's important to understand your employer's matching policy to maximize this benefit.

Yes, you can adjust your contribution amount to your 403(b) plan. It's recommended to regularly review and reassess your financial situation and goals to determine if you need to increase or decrease your contributions. Be sure to follow any guidelines or deadlines set by your employer for making changes.

Yes, contributing more than the IRS limits to your 403(b) plan can result in penalties. It's important to stay within the annual contribution limits to avoid any potential penalties or tax implications. If you have questions or need guidance on contribution limits, consulting with a financial advisor or your plan administrator can help ensure compliance.

True Tamplin is a published author, public speaker, CEO of UpDigital, and founder of Finance Strategists.

True is a Certified Educator in Personal Finance (CEPF®), author of The Handy Financial Ratios Guide, a member of the Society for Advancing Business Editing and Writing, contributes to his financial education site, Finance Strategists, and has spoken to various financial communities such as the CFA Institute, as well as university students like his Alma mater, Biola University, where he received a bachelor of science in business and data analytics.

To learn more about True, visit his personal website or view his author profiles on Amazon, Nasdaq and Forbes.