Both 403(b) and 457(b) are employer-sponsored retirement savings plans offered to eligible public sector employees and nonprofit organization staff. These supplemental retirement plans provide options for contributing pre-tax and, in some cases, after-tax income for retirement savings. Eligible employees and their respective employers can contribute up to the annual limits set by the Internal Revenue Service (IRS). The amount available upon retirement is determined by the contributions made plus accumulated earnings minus taxes (if pre-tax dollars funded the account). Generally, these retirement plans work similarly. However, there are significant contrasts regarding employer contributions, catch-up contributions, and withdrawal penalties. Deciding between a 403(b) and 457(b) Plan? Click here. A 403(b) is a retirement plan sometimes offered to certain employees of public schools, hospital services organizations, and nonprofit or tax-exempt entities under Section 501(c)(3) of the Internal Revenue Code (IRC). Sometimes called a Tax-Sheltered Annuity (TSA) plan or Tax-Deferred Annuity (TDA) plan, the 403(b) could only be used to invest in annuity contracts when it was first established. However, most plans now offer mutual funds as an additional investment choice. Like the 401(k) plan, participants can save for retirement in a 403(b) through payroll deductions while benefiting from certain tax advantages. Employers also have the option of matching a portion of employee contributions. The 403(b) plan can allow participants to make pre-tax or post-tax contributions. With pre-tax contributions, taxes on contributions and earnings are deferred until withdrawal. On the other hand, with post-tax contributions to a Roth 403 (b) account, taxes are paid before funding the account, so qualified distributions are tax-free. Generally, 403(b) plan owners select annuity contracts and mutual funds that offer tax-deferred growth. 403(b) plans have loan provisions similar to the 401(k) plans. The amount that can be loaned is $50,000 maximum or half the balance of the plan, whichever is lower. If a loan is not repaid within five years, it is considered a taxable distribution. Furthermore, both types of plans allow employees to withdraw before retirement if they meet certain conditions, such as needing to take a hardship distribution. Below are some of the advantages of a 403(b) retirement plan: However, it also has some disadvantages: A 457(b) is a retirement savings plan offered to local and state government employees and employees of nonprofit or tax-exempt entities. Like the 403(b) plan, owners of a 457(b) plan may invest in either annuities or mutual funds. Like a 403(b), a 457(b) plan can be funded with employees' pre-tax or post-tax contributions. Employer contributions are optional, and many choose not to make any. Pre-tax contribution means funds are deducted from an employee's paycheck before taxes are withheld. This reduces the employee's annual taxable income, which can result in significant tax savings. However, taxes need to be paid once withdrawals are made later on. With post-tax contributions, withdrawal of contributions from the account is tax-free. However, taxes need to be paid upon the withdrawal of any earnings. Withdrawals from a 457(b) account are difficult if an individual is still employed by the company sponsoring the plan. However, when no longer connected with the company, individuals may make fund withdrawals without being subjected to the 10% early withdrawal penalty. Below are some of the advantages of a 457(b) retirement plan: However, it also has some disadvantages: Both plans have some similarities, but they also share vital differences. Employees engaging in the daily operations of public schools, especially those managed by Indian tribal governments, have 403(b) contribution rights given to them by the IRS. Employees of hospital service organizations and the staff of nonprofit or tax-exempt 501(c)(3) organizations are also eligible for a 403(b) plan. Meanwhile, the 457(b) is offered to local and state government employees and some nonprofit or tax-exempt organizations staff. In 2024, the maximum contribution for both a 403(b) plan and a 457(b) plan is $23,000. This is an increase from the 2023 employee contribution limit of $22,500. Low and mid-income contributors may also be eligible for a Retirement Savings Contribution Credit, also known as Saver’s Credit. This maximum tax credit is up to $1,000 for individuals and $2,000 for jointly-filing married couples contributing to a retirement account. The employer contribution limit for the 457(b) plan is combined with the limit for employee contributions. In 2024, this limit is $23,000, which is an increase from 2023's $22,500 limit. In contrast, 403(b) enables total contributions of up to $69,000 in 2024 (increased from $66,000 in 2023). This means employers still have much leeway to add their contributions when combined with the employee contribution limit. The IRS has a specific order for calculating an individual's total 403(b) contributions since many sources must be accounted for. First, they apply the elective deferral. Then they consider the 15-year service catch-up provision and, finally, the catch-up contribution for those aged 50 and above. It is an employer's responsibility to ensure that employees contribute only what is allowed. Contributors who are at least 50 years old can also take advantage of an additional “catch-up” contribution of $7,500 per year for both the 403(b) and the 457(b) plans. In addition, each plan type also has its own additional special catch-up contribution provisions. The 403(b) has a lifetime catch-up provision which is an additional benefit for those who have been with their company for at least 15 years. It allows employees to make an extra $3,000 contribution each year for the next five years, which is a total of $15,000. Individuals with a 457(b) who have not previously contributed the maximum amount can contribute up to $46,000 (up from $45,000 in 2023) if they are within three years of regular retirement age. Employees can start collecting their benefits from the 457(b) plan without any withdrawal penalties once they leave their job. If not, distributions are allowed when the employee reaches 73 years old (or 70½ if they turned that age before 2020). This is different from the withdrawal rules of a 403(b) plan. Withdrawal of funds is already permitted starting at age 59½. A 10% federal penalty tax and income taxes will be collected if fund withdrawal is made before that age. Required Minimum Distribution (RMD) is the amount of money that must be withdrawn from a tax-deferred employer-sponsored retirement plan if individuals want to avoid the 25% excise tax. RMDs begin at age 73 for both the 403(b) and the 457(b) plans. Some investors may be able to circumvent RMDs if they roll their plan into a Roth IRA or other Roth retirement plan. Both 403(b) and 457(b) plans generally have fewer options than 401(k) plans. Investment choices are limited to annuities and mutual funds. When choosing between a 403(b) plan or a 457(b) plan, individuals can consider the following factors: Overall, both 403(b) plans and 457(b) plans can be excellent options for employees saving for retirement. However, the specific features of each type of plan should be taken into account when making a decision about which one is right for you. The 403(b) and the 457(b) are employer-sponsored retirement savings plans offered to eligible public sector employees and nonprofit organization staff. These plans have similarities in terms of investment options (annuities and mutual funds), employee contributions, and catch-up contributions for participants aged 50 years old and up. The 403(b) plan's best feature is the higher total contribution limit of $69,000 in 2024. This allows contributors to accumulate more funds in the retirement account. On the other hand, the 457(b) plan has more accessibility because funds can be withdrawn without fees when the employee leaves the company. The kind of retirement plan you can choose usually depends on the type of company or organization you work for. Some employers offer only one option, but others can offer both. In the latter case, consider your alternatives carefully. The most appropriate plan depends on your situation and retirement goals. If you are unsure, it is a good idea to speak with a financial advisor who can help you understand the differences between the two plans and make the best decision for your needs.403(b) vs 457(b): An Overview

What Is a 403(b) Plan?

How 403(b) Plans Work

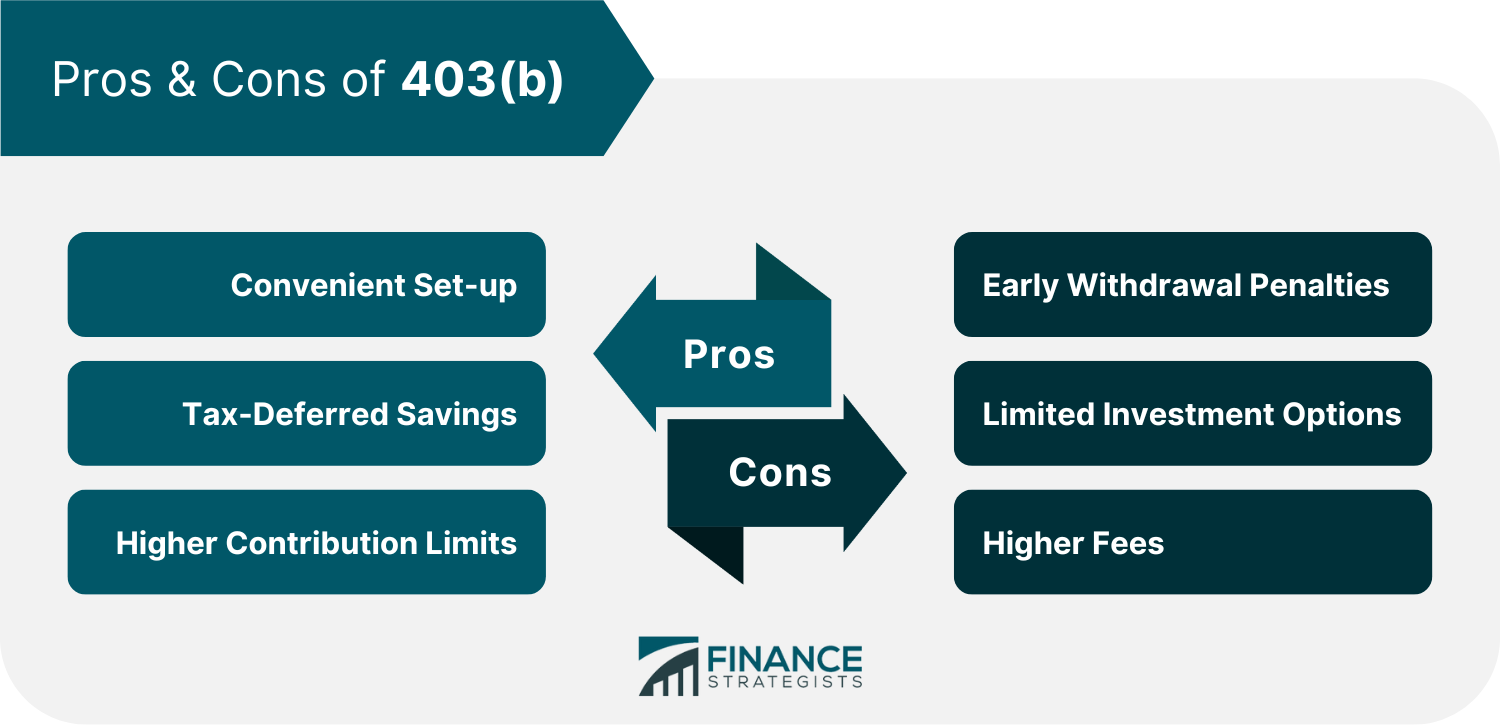

Advantages and Disadvantages of a 403(b) Plan

What Is a 457(b) Plan?

How 457(b) Plans Work

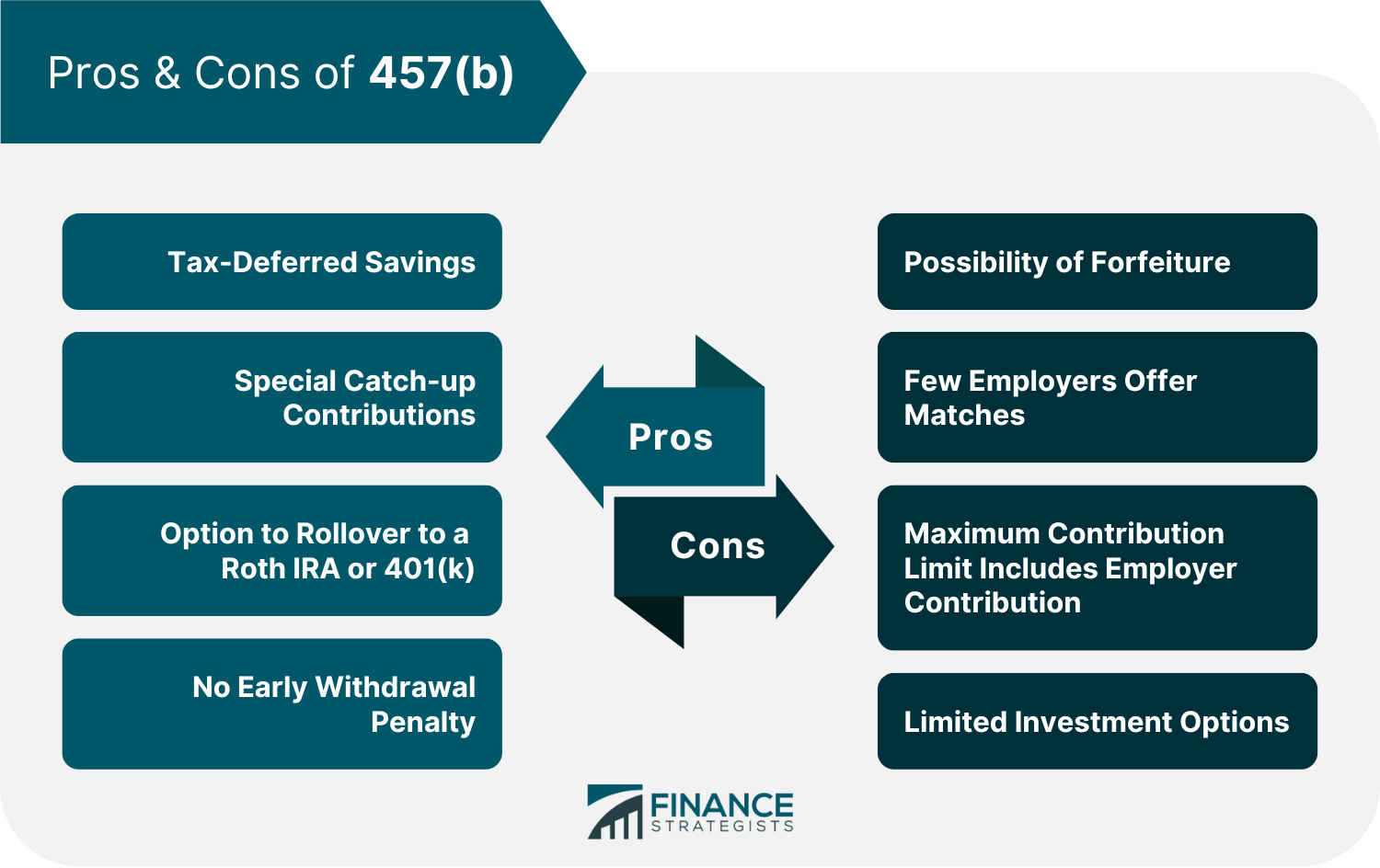

Advantages and Disadvantages of a 457(b) Plan

Differences Between a 403(b) Plan and a 457(b) Plan

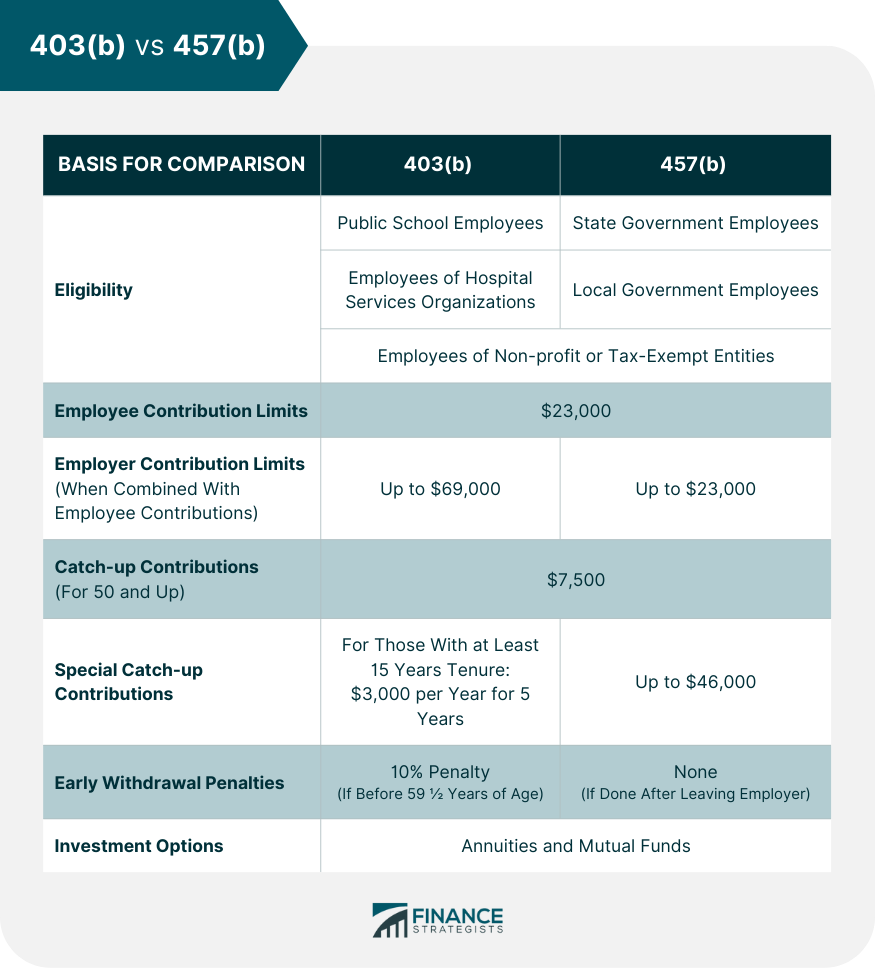

Eligibility

Employee Contribution Limits

Employer Contribution Limits

Catch-up Contributions

Early Withdrawal Penalties

Investment Options

Choosing0Between 403(b) And 457(b) Plans

The Bottom Line

403(b) vs 457(b) FAQs

The 403(b) plan is widely used for those employed in public schools and hospital services organizations, while the 457(b) plan is offered to state and local government employees. The 403(b) has a higher total contribution limit. However, the 457(b) plan is more liquid since funds can be withdrawn penalty-free once the employee leaves the company.

Yes, employers that want to attract top-tier, high-paying executives typically offer both 403(b) and 457(b) plans. These accounts can be funded simultaneously, allowing you to take advantage of the separate contribution limits for each one.

For 2024, the total contribution limit for a 457(b) plan is $23,000. Regular catch-up contributions of up to $7,500 are also permitted for contributors aged 50 years and above. Lastly, those within three years of the federal retirement age can make a special catch-up contribution of up to $46,000.

Yes, you can roll over funds from a 403(b) to a 457(b). However, the rollover must be performed within 60 days to avoid penalty fees. Also, a 20% mandatory withholding tax will apply if the amount rolled over is considered a retirement plan distribution.

The primary distinction between a 401(k) and 403(b) retirement plan is the type of employer that offers them. Usually, for-profit and private companies offer 401(k)s while public sector companies and nonprofit organizations offer 403(b)s.

True Tamplin is a published author, public speaker, CEO of UpDigital, and founder of Finance Strategists.

True is a Certified Educator in Personal Finance (CEPF®), author of The Handy Financial Ratios Guide, a member of the Society for Advancing Business Editing and Writing, contributes to his financial education site, Finance Strategists, and has spoken to various financial communities such as the CFA Institute, as well as university students like his Alma mater, Biola University, where he received a bachelor of science in business and data analytics.

To learn more about True, visit his personal website or view his author profiles on Amazon, Nasdaq and Forbes.