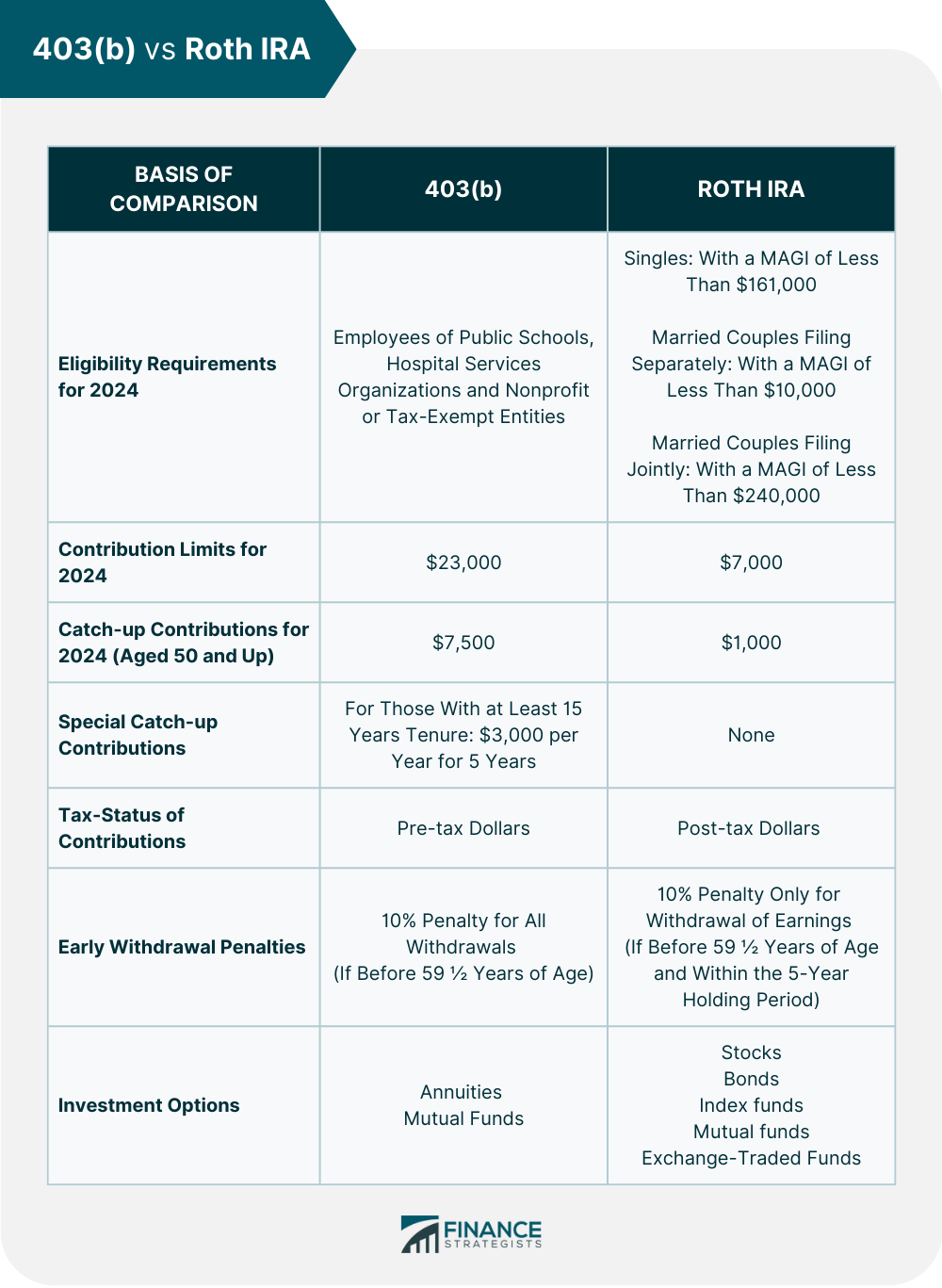

There is a wide variety of retirement plans to choose from. The 403(b) and the Roth Individual Retirement Account (IRA) are two popular account types. A 403(b) plan is offered to eligible nonprofit organization employees and public sector staff. It is similar to the 401(k), another employer-sponsored retirement account type available to employees of private companies. On the other hand, a Roth IRA is a type of individual retirement account available to individuals who earn an income within certain limits, whether they are private or public sector employees. Although individuals may have access to both a 403(b) and a Roth IRA, they may choose between the two plan types and see where they can grow their retirement savings the most. A 403(b) is a retirement plan generally offered to employees of hospital services organizations, public schools, and tax-exempt or nonprofit entities. All eligible employees in organizations offering a 403(b) plan must be allowed to make contributions, also known as elective deferrals, to their own 403(b) plan. This is known as the universal availability requirement. A 403 (b) plan allows employees to make pre-tax contributions, deferring taxes on both contributions and earnings until withdrawals are made from the account. For this reason, it is sometimes referred to as a Tax-Sheltered Annuity (TSA) or Tax-Deferred Annuity (TDA) plan. Currently, 403(b) plans can offer mutual funds as an additional choice. A Roth IRA is an individual retirement account available to anyone whose earned income falls within the plan’s income limits. Roth IRAs can be acquired without an employer. Instead, individuals coordinate with banks or other financial institutions to set one up. Individuals who work for companies that do not offer retirement plan benefits may avail of Roth IRAs as an alternative retirement savings option. Since they are not tied to a single employer, Roth IRAs can stay with individuals as they move jobs without needing rollovers. A Roth IRA allows participants to make post-tax contributions. This means that withdrawals from the account are not subject to taxes as long as the plan holder is over 59½ years old and the plan has been open for at least five years. Under a Roth IRA, contributors can invest in various financial instruments, such as stocks, bonds, index funds, mutual funds, or exchange-traded funds (ETFs). Although 403(b)s and Roth IRAs are both tax-advantaged retirement savings accounts, they have many differences, including the following A 403(b) is primarily offered to eligible employees of public schools, hospital services organizations, and nonprofit or tax-exempt entities. Employers may opt to exclude employees in a certain category such as those that work below 20 hours weekly. In contrast, a Roth IRA can be opened by anyone who meets the qualifying modified adjusted gross income (MAGI) set by the Internal Revenue Service (IRS). Depending on their MAGI, participants may be allowed to contribute a reduced amount or up to the total limit. In 2024, the required MAGI for singles is less than $161,000. For married couples filing together, their MAGI must be below $240,000. Meanwhile, for married couples filing separately and living together anytime during the year, their MAGI must not exceed $10,000. The contribution limits for 403(b) plans are similar to that of 401(k) plans. In 2024, the employee contribution limit is $23,000, an increase from the 2023 limit of $22,500. The Roth IRA's contribution limit is significantly lower than that of the 403(b) plan. In 2024, the contribution limit for Roth IRA plans is $7,000, which is an increase from the 2023 limit of $6,500. Both 403(b)s and Roth IRAs allow individuals aged 50 and up to make catch-up contributions as they near retirement age. The catch-up contribution for 403(b) plans remains the same at $7,500 in 2024. On the other hand, the catch-up contribution for individuals aged 50 and up with a Roth IRA is $1,000, which is the same limit as in 2023. With a 403(b), employers may match employee contributions up to the annual contribution limit. However, this is not an option with a Roth IRA as it is not tied to a specific employer. In addition, 403(b)s have a lifetime catch-up provision benefit for individuals working with their employer for at least 15 years. It allows employees to contribute an extra $3,000 annually for the next five years, a total of $15,000. Contributions to a 403(b) are made with pre-tax dollars, which means individuals can save on taxes in the year the contribution is made. However, they need to pay income taxes on both contributions and earnings upon withdrawal during retirement. In addition, if individuals withdraw from a 403(b) before age 59 ½, they may be subjected to a 10% early withdrawal penalty. With a Roth IRA, contributions are made with after-tax dollars. This means that the withdrawal of contributions is tax-free, but the withdrawal of earnings can be subjected to a 10% early penalty if done before age 59 ½ and within the 5-year holding period. The investment choices for 403(b) are more limited than those of a Roth IRA. Employees can generally only invest their 403(b) contributions in annuities and mutual funds. In contrast, Roth IRAs offer more investment options. Individuals can invest in financial vehicles such as stocks, bonds, index funds, mutual funds, and exchange-traded funds (ETFs). Below are some of the advantages individuals can gain from investing in either a 403(b) or a Roth IRA: Both 403(b) plans and Roth IRAs have their share of disadvantages, such as the following: The 403(b) plan and the Roth IRA plan have their respective benefits and drawbacks. If you are eligible for both retirement plans, you do not necessarily have to choose between the two. You can contribute to both if your employer offers a 403(b) plan and your annual income does not exceed the limit for a Roth IRA plan. This would provide you with various retirement accounts, allowing you to take advantage of their different tax advantages. If you can afford to contribute more than the Roth IRA limitation, are aged 50 and up, or have worked for the employer sponsoring the plan for at least 15 years, you can take advantage of the 403(b)’s more significant contribution limits to increase your retirement savings. On the other hand, if you prefer to have more investment choices or want a plan that you can easily keep even if you switch employers, the Roth IRA’s relative flexibility might be more suitable to your situation. If you decide to invest in both plan types and your employer is offering to match your contributions, it might be better to max out your 403(b) contributions before putting money into your Roth IRA. The 403(b)s and the Roth IRA are both retirement plans which provide contributors with different tax advantages. The two plans also differ in many aspects, such as eligibility requirements, contribution limits, tax status, withdrawal rules, and investment options. For instance, a 403(b) is typically offered to employees of hospital services organizations, public schools, and tax-exempt or nonprofit entities. Meanwhile, a Roth IRA can be opened by anyone whose earned income falls within the plan’s income limits, even without an employer sponsor. Individuals eligible for both plans do not necessarily have to choose between the two. However, 403(b)s might be more suitable for those who wish to avail of their employer’s matching contributions. Meanwhile, Roth IRAs might suit those who prefer more investment choices. If you are considering whether to invest in a 403(b) plan, a Roth IRA plan, or even both, consulting with a financial advisor might help you determine the one most suited to your needs.403(b) vs Roth IRA: An Overview

What Is a 403(b) Plan?

When it was first created, a 403(b) plan only allowed employees to invest in annuity contracts. What Is a Roth IRA?

403(b) vs Roth IRA: Key Differences

Eligibility Requirements

Contribution Limits

Catch-Up Contribution Limits

Additional Contributions

Taxes and Withdrawals

Investment Options

403(b) vs Roth IRA: Pros

403(b) Pros

Roth IRA Pros

403(b) vs Roth IRA: Cons

403(b) Cons

Roth IRA Cons

403(b) vs Roth IRA: Which Is Better?

Final Thoughts

403(b) vs Roth IRA FAQs

Yes, you can have both a 403(b) and a Roth IRA. If your employer offers the 403(b) plan and your modified adjusted gross income falls within the Roth IRA limits, then you can have both accounts.

The best type of plan is the one that most suits your current needs. Generally, 403(b)s might be more suitable for those who wish to save more and avail of their employer’s matching contributions. Meanwhile, Roth IRAs might suit those who prefer more investment choices and want to keep their plans easily even if they switch employers.

There are many reasons why rolling over your 403(b) to a Roth IRA might be a good move. These include wanting to take advantage of tax-free withdrawals after retirement, wanting more investment choices, or preferring a plan that can be easily kept even if you transfer jobs.

A 403(b) is typically offered to eligible nonprofit organization employees and public sector staff. Meanwhile, a Roth IRA can be opened by anyone whose earned income falls within the plan’s limits. The two plans also differ in terms of contribution limits, tax status, withdrawal rules, and investment options.

The 403(b) plans have limited investment options and early withdrawal penalties for both contributions and earnings. Meanwhile, Roth IRAs have an income cap on who can be eligible and contribution limits lower than that of the 403(b).

True Tamplin is a published author, public speaker, CEO of UpDigital, and founder of Finance Strategists.

True is a Certified Educator in Personal Finance (CEPF®), author of The Handy Financial Ratios Guide, a member of the Society for Advancing Business Editing and Writing, contributes to his financial education site, Finance Strategists, and has spoken to various financial communities such as the CFA Institute, as well as university students like his Alma mater, Biola University, where he received a bachelor of science in business and data analytics.

To learn more about True, visit his personal website or view his author profiles on Amazon, Nasdaq and Forbes.