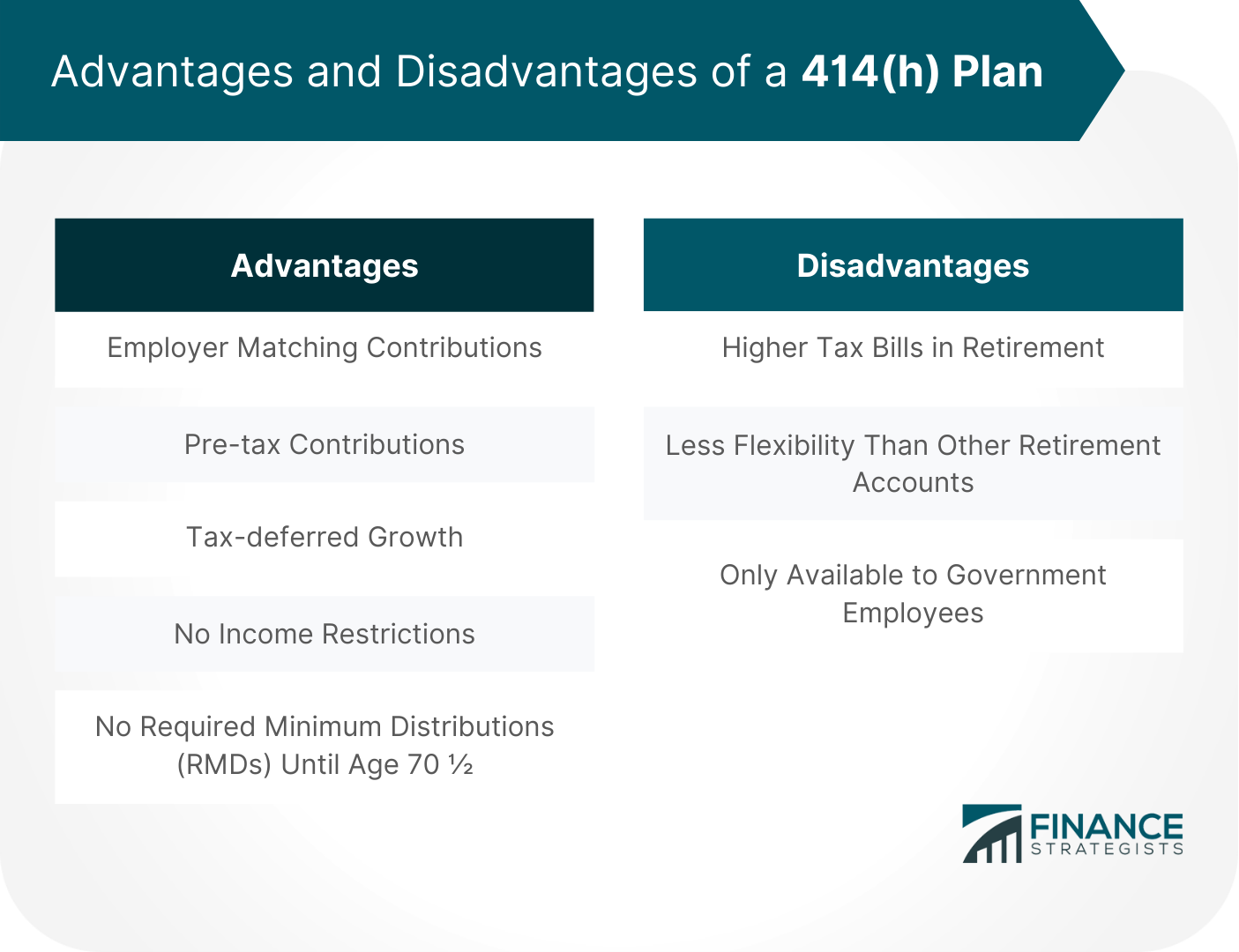

A 414(h) plan is an employer-sponsored benefit plan that defers taxation on earnings. Earnings are not taxed until they are distributed to the retiree. A 414(h) is a type of defined contribution retirement plan, along with 401(k), profit-sharing, or money purchase plans. Eligible to this type of retirement plan are government employees whether in local, state, or federal government agencies. Have questions about your 414(h) Plan? Click here. The main features of the 414 (h) include: Here are some points to consider regarding taxation of withdrawals from a 414(h) plan: Here are some advantages of the 414(h) plan: Your employer may offer matching contributions that help grow your account faster. This can be a great incentive to participate in such a retirement savings plan as it allows you to maximize your return on investment (ROI). As mentioned earlier, contributions are made with pre-tax dollars. This reduces your taxable income, which can result in a lower tax bill at the end of the year. The earnings on your account grow tax-deferred. You don't have to pay taxes on them until you withdraw the funds, which can provide you with a larger nest egg come retirement time. Unlike an IRA, there are no income restrictions as to who can participate in a 414(h) plan. This makes it a great option for those who earn a high income and want to save for retirement. Unlike other retirement savings plans, there are no required minimum distributions (RMDs) from a 414(h) plan until you reach 70 ½ years of age. This gives you more flexibility as to when you want to start taking withdrawals. Here are some potential disadvantages of the 414(h) plan: Since withdrawals from a 414(h) plan are considered taxable income, you may end up with a higher tax bill in retirement than if you had saved in other types of accounts. This is especially true if you have a large balance in your account. The disadvantage of a 414(h) is that it offers less flexibility than other retirement accounts, such as a 401(k) or IRA. For example, you are unable to borrow money from the account and there are penalties for early withdrawals. The 414(h) plan is only available to government employees. If you are not employed by the government, you will not be able to take advantage of this retirement savings plan. The 414(h) plan can be a great way to save for retirement if you are a government employee. It offers many benefits, such as employer matching contributions, pre-tax contributions, and tax-deferred growth. There are also no income restrictions or required minimum distributions (RMDs). However, there are some disadvantages to consider, such as higher tax bills in retirement and less flexibility than other retirement accounts.How Does a 414(h) Plan Work?

Tax Considerations of 414(h) Plan Withdrawals

Advantages of a 414(h) Plan

Employer Matching Contributions

Pre-tax Contributions

Tax-Deferred Growth

No Income Restrictions

No Required Minimum Distributions (RMDs) Until Age 70 ½

Disadvantages of a 414(h) Plan

Higher Tax Bills in Retirement

Less Flexibility Than Other Retirement Accounts

Only Available to Government Employees

Final Thoughts

414(h) Plan FAQs

The 414(h) plan is a retirement savings account that is tailored to government employees. As such, the rules and regulations are different from those of other types of retirement accounts, such as IRAs or 401(k)s offered by private companies.

Any U.S. citizen who works for a state or local government can open a 414(h) plan. However, if you do not meet this requirement, then you will not be able to contribute to the account.

When you contribute to your 414(h) plan, it is made with pre-tax dollars. This means that the amount you contribute will be subtracted from your taxable income, which can result in a lower tax bill at the end of the year.

Yes, there are penalties for early withdrawals from a 414(h) plan. If you withdraw money before you reach age 59 ½, you will typically have to pay a 10% early withdrawal penalty.

Yes, required minimum distributions (RMDs) from a 414(h) plan are taxable income. This means that you will have to pay taxes on the amount you withdraw.

True Tamplin is a published author, public speaker, CEO of UpDigital, and founder of Finance Strategists.

True is a Certified Educator in Personal Finance (CEPF®), author of The Handy Financial Ratios Guide, a member of the Society for Advancing Business Editing and Writing, contributes to his financial education site, Finance Strategists, and has spoken to various financial communities such as the CFA Institute, as well as university students like his Alma mater, Biola University, where he received a bachelor of science in business and data analytics.

To learn more about True, visit his personal website or view his author profiles on Amazon, Nasdaq and Forbes.