Administrative services only, or ASO for short, is a term that finds its origins and widespread application in wealth management, particularly concerning employer-sponsored health and benefits plans. Under this model, the employer doesn't pay premiums to an insurance company. Instead, the employer assumes the financial responsibility for providing health care benefits to its employees, paying for actual health care costs as they occur. ASO plays a pivotal role in wealth management by offering a compelling alternative to traditional insured benefit plans. The ASO model allows organizations to self-fund their benefits plans, often resulting in greater financial flexibility and improved cost management. By strategically applying ASO, companies can manage cash flows more efficiently, curtail expenses, and optimize investments in employee benefits, which is a critical component of the broader wealth management strategy. An effective Administrative Services Only (ASO) strategy is essential for companies choosing to self-fund their health and benefits plans. Here are the key aspects that must be considered to ensure a successful ASO implementation: It is crucial to have a deep understanding of the ASO model and how it differs from traditional insurance models. This includes understanding the cost structures, the roles and responsibilities of all parties involved, and the potential risks and rewards. Being well-informed will enable better decision-making and effective implementation of the strategy. Since an ASO plan involves the employer assuming financial risk, having a robust risk management strategy is essential. This includes setting aside adequate reserves to cover claims, purchasing stop-loss insurance to protect against exceptionally high claims, and regularly monitoring claims activity to identify emerging risks. The provider should have the experience, capabilities, and resources to manage the plan effectively. A strong relationship with the provider can help ensure smooth operations, effective cost management, and high-quality service for plan members. Regular monitoring of the ASO plan is essential for managing costs and identifying any issues early. This involves regularly reviewing claims data, tracking plan usage, and analyzing the impact on the organization's financial performance. Regular monitoring can help organizations proactively adjust their plan and manage their financial risk effectively. Administering an ASO plan effectively requires comprehensive administrative capabilities. This includes processing claims accurately and promptly, ensuring regulatory compliance, and providing high-quality customer service to plan members. Organizations may need to invest in new resources or systems or partner with external providers to meet these requirements. Since ASO plans differ from traditional insurance plans, educating employees about how the plan works, what it covers, and how it benefits them is essential. This can help ensure employee buy-in and satisfaction, leading to a more successful ASO implementation. When choosing an ASO provider, organizations should consider several vital factors. The provider's history and previous performance in managing ASO plans can provide critical insights. Companies should look for providers with a strong track record of delivering effective solutions and customer satisfaction. A history of successful ASO implementations and a proven ability to deliver results should be critical elements to consider. A provider with a robust network can ensure better healthcare services and pricing for the employees. The provider network's depth, reach, and quality should be considered during selection. The broader and more diverse the provider's network, the better the chances of employees having access to the right care at the right time and at an affordable cost. The provider's ability to administer and manage complex benefit plans is crucial. This indicates their proficiency in handling various scenarios and catering to diverse needs. Providers that can navigate intricate benefit plans' intricacies can offer better, more personalized service that suits a company's specific requirements. ASO relies heavily on accurate data analysis and reporting for decision-making and risk management. Hence, the provider's capability in these areas can significantly impact the effectiveness of the ASO plan. A provider who uses advanced analytical tools and methodologies, and provides clear, easy-to-understand reporting, can help an organization effectively manage its ASO plan. The provider's financial stability ensures their ability to deliver services consistently over time. Companies should look for providers with solid financial health. Stability in financial performance indicates the provider's long-term viability, reducing the risk of service disruption for the organization. A well-regarded provider by peers and customers alike can be a good choice for managing ASO plans. Positive reviews and testimonials from other organizations and recognition or awards from industry bodies can provide assurance of the provider's credibility and competency in managing ASO plans. In an ASO agreement, the employer collaborates with a third-party administrator—often an insurance firm—to manage the health and benefits plan. The administrator provides the necessary services such as adjudicating claims, network management, and offering member services. However, unlike traditional insurance arrangements, the financial risk of covering health care costs lies with the employer, not the administrator. Effective risk management is an indispensable component of an ASO strategy. Companies face significant financial exposure if the right risk management safeguards are not in place. To mitigate this risk, many organizations opt for stop-loss insurance. This type of insurance offers financial protection against unusually high claims. Employers set a predetermined threshold; if health care costs exceed this threshold, the stop-loss insurance policy shoulders the additional cost. ASO is particularly attractive because of the potential cost savings it offers. Traditional insurance plans usually factor in a risk margin, administrative fee, and profit margin for the insurer. However, under the ASO model, employers pay only for the actual cost of claims plus an administrative fee, leading to significant cost savings in many cases. ASO plans to hand the reins of control over to employers, giving them the flexibility to design a benefits plan that caters to their unique needs and those of their employees. Employers get to decide the extent of the benefits offered, the level of coverage provided, and any cost-sharing arrangements, thereby enhancing customization. ASO arrangements empower employers with heightened control over their benefits plans. Companies get direct access to claims data, providing insights into usage patterns, claim costs, and potential areas of cost savings. This level of control facilitates better decision-making and more strategic planning around employee benefits. ASO also introduces an element of transparency in terms of healthcare costs and usage patterns. With access to claims data, companies can employ advanced analytics to identify trends, monitor usage, and manage costs more effectively. Despite the many benefits ASO offers, it also comes with certain risks. The primary risk is the financial exposure for employers since they shoulder the responsibility for health care costs. If these costs are higher than anticipated, it could negatively impact the employer's financial performance. This risk is even more significant for smaller organizations with fewer employees to spread the risk. Implementing and managing an ASO plan requires comprehensive administrative proficiency. The company must process claims, ensure regulatory compliance, and offer excellent customer service, among other responsibilities. Organizations might need to invest in new resources or systems or engage external providers to administer their ASO plans effectively. Implementing Administrative Services Only (ASO) in wealth management offers several key benefits. ASO provides cost efficiency by eliminating the risk margin and profit margin typically associated with traditional insurance plans. It allows for flexibility and customization, empowering employers to design benefit plans that suit their specific needs. ASO also offers increased control over benefit plans, giving employers direct access to claims data for better decision-making and strategic planning. However, there are challenges to consider. Potential financial risks arise from the employer assuming responsibility for healthcare costs, which could impact financial performance, especially for smaller organizations. Implementing ASO requires comprehensive administration, including claims processing, regulatory compliance, and customer service, which may necessitate additional investments or external partnerships. Overall, ASO offers an alternative approach to benefit plans in wealth management, providing greater financial flexibility and control while requiring careful risk management and comprehensive administrative capabilities.What Is Administrative Services Only (ASO)?

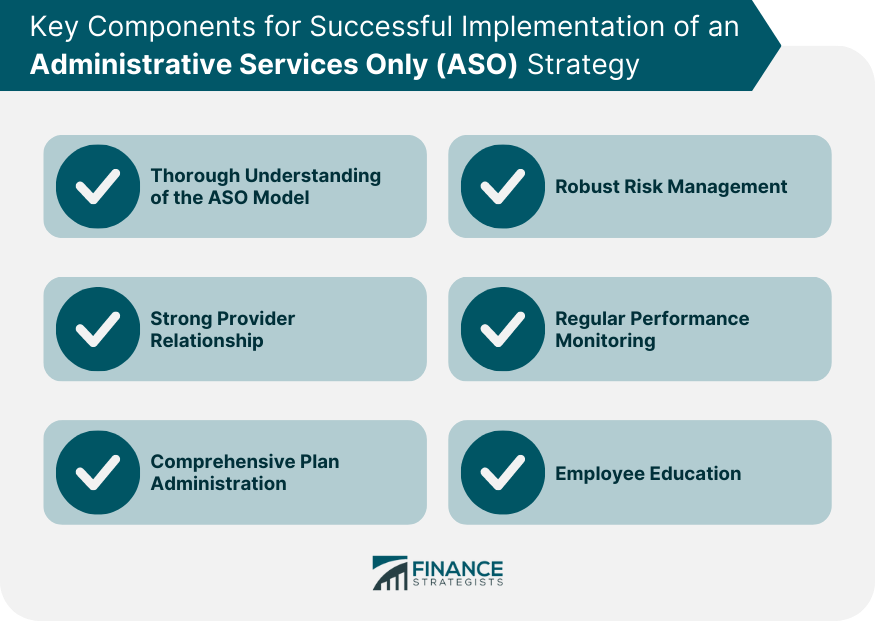

Key Components of an Effective Administrative Services Only (ASO) Strategy

Thorough Understanding of the ASO Model

Robust Risk Management

Strong Provider Relationship

Regular Performance Monitoring

Comprehensive Plan Administration

Employee Education

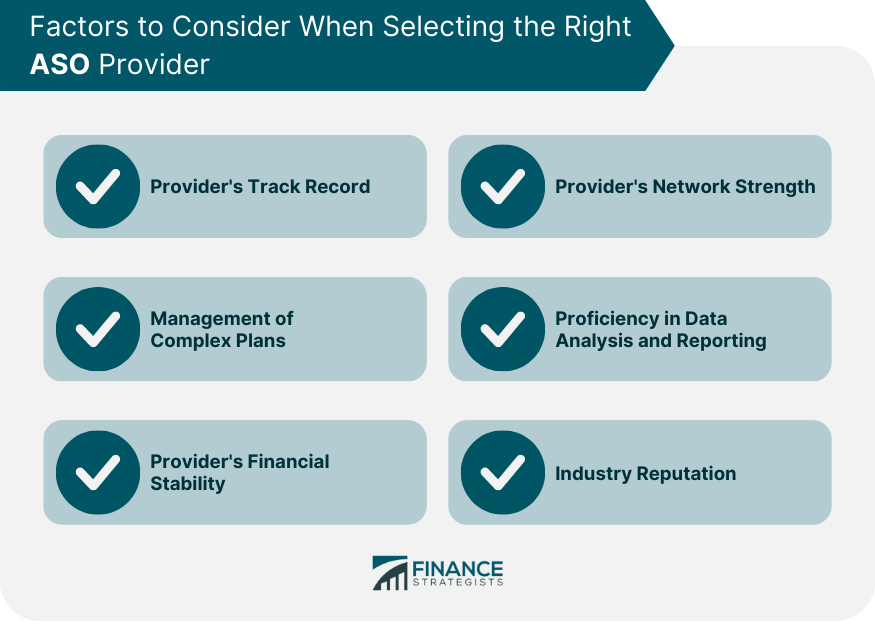

Selecting the Right Administrative Services Only (ASO) Provider

Provider's Track Record

Provider's Network Strength

Management of Complex Plans

Proficiency in Data Analysis and Reporting

Provider's Financial Stability

Industry Reputation

How Administrative Services Only (ASO) Functions in Wealth Management

Health and Benefit Plans

Risk Management

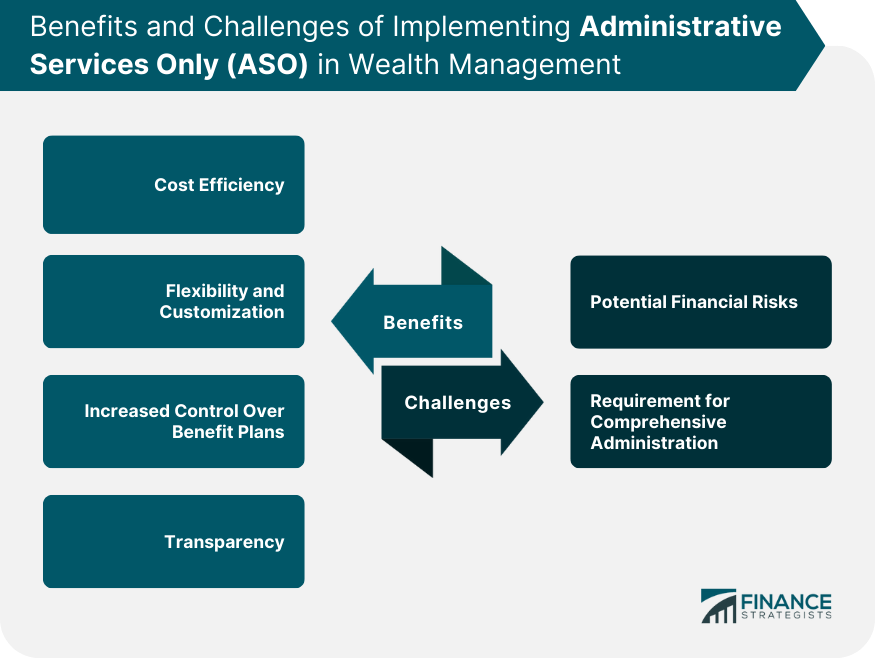

Benefits of Implementing Administrative Services Only (ASO) in Wealth Management

Cost Efficiency

Flexibility and Customization

Increased Control Over Benefit Plans

Transparency

Challenges of Administrative Services Only (ASO) in Wealth Management

Potential Financial Risks

Requirement for Comprehensive Administration

Conclusion

Administrative Services Only (ASO) FAQs

ASO, or Administrative Services Only, is a model where employers assume financial responsibility for employee health benefits.

ASO offers cost efficiency, flexibility, increased control over benefit plans, and transparency in healthcare costs and usage patterns.

Potential financial risks and comprehensive administration requirements are the key challenges of implementing ASO.

Organizations should consider factors such as the provider's track record, network strength, ability to manage complex plans, proficiency in data analysis and reporting, financial stability, and industry reputation.

Unlike traditional insured benefit plans, ASO allows employers to self-fund their benefits, resulting in greater financial flexibility and improved cost management.

True Tamplin is a published author, public speaker, CEO of UpDigital, and founder of Finance Strategists.

True is a Certified Educator in Personal Finance (CEPF®), author of The Handy Financial Ratios Guide, a member of the Society for Advancing Business Editing and Writing, contributes to his financial education site, Finance Strategists, and has spoken to various financial communities such as the CFA Institute, as well as university students like his Alma mater, Biola University, where he received a bachelor of science in business and data analytics.

To learn more about True, visit his personal website or view his author profiles on Amazon, Nasdaq and Forbes.