Alternative investments refer to financial assets that do not fall into the traditional investment categories of stocks, bonds, and cash. These investments can include a wide range of asset classes, such as real estate, private equity, hedge funds, commodities, collectibles, structured products, and cryptocurrencies. Including alternative investments in retirement accounts can offer diversification benefits, potential for higher returns, and access to unique investment opportunities. However, alternative investments may also come with higher risks, fees, and liquidity concerns compared to traditional investments. Diversification is crucial to managing risk and optimizing returns in a retirement portfolio. Alternative investments can provide this diversification by offering exposure to assets with different risk-return profiles and low correlations to traditional asset classes. However, investors must carefully consider the risks and complexities associated with alternative investments before including them in their retirement accounts. Real Estate Investment Trusts (REITs) are companies that own and manage income-producing real estate properties. REITs can provide exposure to various real estate sectors, including commercial, residential, industrial, and retail properties. Investors can purchase shares of publicly traded REITs, which offer liquidity and income potential through dividends. Direct property ownership involves purchasing physical properties, such as residential or commercial real estate, as investment assets. Direct property investments can generate income through rental payments and potential appreciation in property value over time. However, these investments may require significant capital and ongoing management. Venture capital is a type of private equity investment in which investors provide capital to start-ups and early-stage companies with high growth potential. Venture capital investments can offer the potential for high returns but also come with significant risks, as many start-ups fail. Buyout funds are private equity investments in established companies that are not publicly traded. These funds typically acquire controlling stakes in businesses and aim to improve their performance and profitability. Buyout funds can provide attractive returns but may have high fees and require long holding periods. Hedge funds are pooled investment vehicles that employ various strategies to generate returns, such as short-selling, leveraging, and derivatives trading. These funds can provide diversification benefits and the potential for higher returns, but they may also involve higher fees and increased risks compared to traditional investments. Precious metals, such as gold, silver, and platinum, are considered alternative investments due to their unique characteristics and historical role as stores of value. These investments can provide a hedge against inflation and financial market volatility. Agricultural commodities, such as grains, livestock, and soft commodities like coffee and sugar, can be accessed through futures contracts, ETFs, or direct investments in farmland. These investments can offer diversification benefits and potential returns tied to global demand and supply dynamics. Energy commodities, such as oil, natural gas, and coal, can also be accessed through futures contracts, ETFs, or direct investments in energy production or infrastructure. These investments can provide exposure to the global energy market and help diversify a retirement portfolio. Investing in fine art can provide exposure to an alternative asset class with the potential for capital appreciation. Art investments can be made through purchasing physical pieces, investing in art funds, or participating in fractional ownership platforms. Antiques, such as vintage furniture, rare coins, and stamps, can provide diversification benefits and potential appreciation in value over time. However, these investments may be illiquid and require specialized knowledge to value and manage effectively. Fine wine investments involve purchasing and holding bottles or cases of wine with the expectation that their value will appreciate over time. Wine investments can offer diversification benefits and potential returns but may require specialized knowledge and storage facilities. Principal-protected notes are debt securities that offer the potential for capital appreciation based on the performance of an underlying asset or index while guaranteeing the return of the initial investment at maturity. These investments can provide downside protection but may have lower returns than direct investments in the underlying assets. Market-linked certificates of deposit (CDs) are FDIC-insured bank products that offer returns based on the performance of an underlying asset or index, such as stocks or commodities. These investments can provide potential for higher returns than traditional CDs while still offering principal protection. Bitcoin is a digital currency that operates on a decentralized ledger called the blockchain. Investing in Bitcoin can offer potential for high returns due to its historical price appreciation and growing acceptance as a store of value. However, Bitcoin investments also involve significant price volatility and regulatory risks. Ethereum is a blockchain platform that supports the creation of decentralized applications and smart contracts. Investing in Ether, the platform's native cryptocurrency, can provide exposure to the growing blockchain and decentralized finance industries but may involve similar risks to Bitcoin investments. Self-Directed Individual Retirement Accounts (SDIRAs) allow investors to hold alternative investments, such as real estate, private equity, and cryptocurrencies, within a tax-advantaged retirement account. SDIRAs provide greater investment flexibility but may involve higher fees and increased regulatory and management responsibilities. Exchange-traded funds (ETFs) offer a convenient way to access alternative investments through a liquid and transparent investment vehicle. ETFs can track various alternative asset classes, such as real estate, commodities, and even cryptocurrencies, providing a cost-effective and accessible option for diversifying retirement portfolios. Some mutual funds specialize in alternative investments, providing exposure to assets like real estate, private equity, and hedge funds. These funds can offer diversification benefits and professional management but may have higher fees than traditional mutual funds or ETFs. Closed-end funds are pooled investment vehicles that trade on stock exchanges and can provide exposure to alternative investments, such as private equity or real estate. These funds can offer diversification benefits but may trade at discounts or premiums to their net asset value, impacting returns. Alternative investments can help diversify a retirement portfolio by providing exposure to assets with different risk-return profiles and low correlations to traditional asset classes, such as stocks and bonds. Some alternative investments, such as real estate and commodities, can provide a hedge against inflation, helping preserve the purchasing power of retirement savings. Alternative investments can offer the potential for higher returns compared to traditional investments, particularly in the case of private equity, venture capital, and cryptocurrencies. However, these investments may also involve higher risks. Alternative investments can provide access to unique investment opportunities, such as early-stage start-ups or specialized real estate projects, which may not be available through traditional investments. Alternative investments may be less liquid than traditional investments, potentially making it more difficult for investors to sell their holdings or access their capital when needed. Valuing alternative investments, such as private equity or collectibles, can be complex and subjective, potentially leading to pricing discrepancies and difficulties in determining the true value of the investment. Some alternative investments, such as hedge funds and private equity funds, may provide limited transparency into their holdings and investment strategies, making it challenging for investors to fully assess the risks and potential returns. Alternative investments may involve higher fees than traditional investments, such as management fees, performance fees, and transaction costs. These fees can reduce overall returns and should be considered when evaluating alternative investment options. Alternative investments may be subject to regulatory changes, legal disputes, or other risks that could negatively impact their performance or value. Investors should be aware of these risks and consider the potential implications for their retirement portfolios. Before incorporating alternative investments into a retirement account, investors should assess their risk tolerance and investment objectives to determine if these investments are suitable for their financial goals and risk preferences. Investors should carefully consider the appropriate allocation to alternative investments within their retirement portfolios, taking into account factors such as their risk tolerance, investment horizon, and overall portfolio diversification. Investors should carefully evaluate specific alternative investment options, considering factors such as historical performance, fees, liquidity, and potential risks. Researching and understanding the underlying investment strategies and assets can help investors make more informed decisions. Regularly monitoring and rebalancing a retirement portfolio is crucial to maintaining the desired risk-return profile and ensuring that alternative investments continue to align with overall investment objectives. Investors should review their alternative investments periodically and make adjustments as needed based on performance, changes in risk tolerance, or shifts in financial goals. Understanding alternative investments and their potential benefits and risks is crucial for investors seeking to diversify and optimize their retirement portfolios. By incorporating a range of asset classes, investors can potentially enhance returns and reduce overall portfolio risk. Including alternative investments in retirement accounts can offer diversification benefits, potential for higher returns, and access to unique investment opportunities. However, investors must carefully consider the associated risks, fees, and complexities before incorporating these assets into their retirement planning. Developing a balanced and diversified retirement portfolio involves considering a mix of traditional and alternative investments, carefully assessing risk tolerance and investment objectives, and regularly reviewing and adjusting the portfolio as needed. Working with a financial advisor can provide valuable guidance and support in navigating the complexities of alternative investments and ensuring long-term financial success in retirement.Alternative Investments in Retirement Accounts: Overview

Types of Alternative Investments

Real Estate

Real Estate Investment Trusts (REITs)

Direct Property Ownership

Private Equity

Venture Capital

Buyout Funds

Hedge Funds

Commodities

Precious Metals

Agricultural Commodities

Energy Commodities

Collectibles

Art

Antiques

Wine

Structured Products

Principal-Protected Notes

Market-Linked Certificates of Deposit

Cryptocurrencies

Bitcoin

Ethereum

Accessing Alternative Investments in Retirement Accounts

Self-Directed Individual Retirement Accounts (SDIRAs)

Exchange-Traded Funds (ETFs)

Mutual Funds

Closed-End Funds

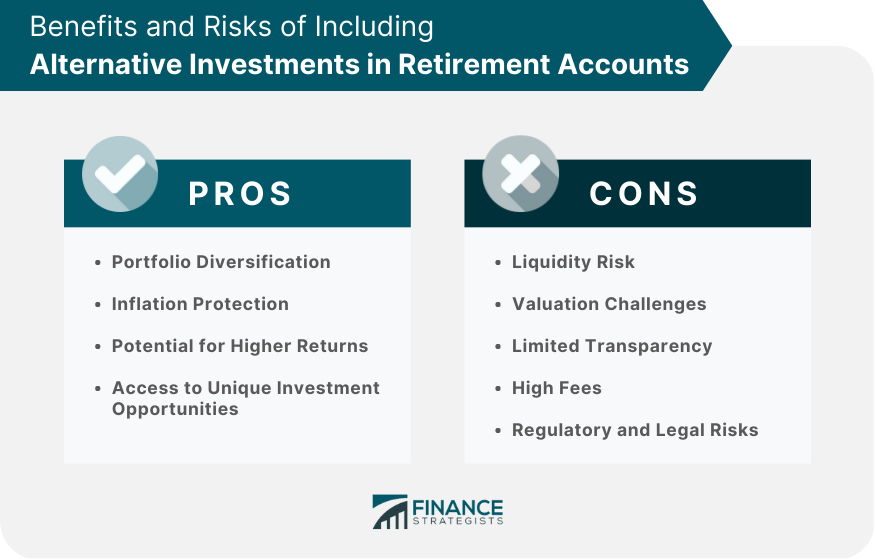

Benefits of Including Alternative Investments in Retirement Accounts

Portfolio Diversification

Inflation Protection

Potential for Higher Returns

Access to Unique Investment Opportunities

Risks of Including Alternative Investments in Retirement Accounts

Liquidity Risk

Valuation Challenges

Limited Transparency

High Fees

Regulatory and Legal Risks

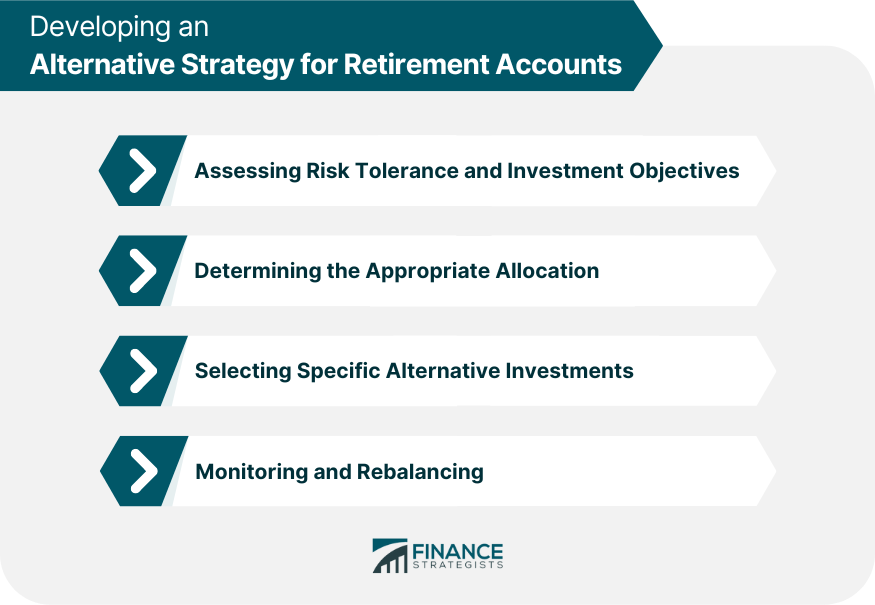

Developing an Alternative Investment Strategy for Retirement Accounts

Assessing Risk Tolerance and Investment Objectives

Determining the Appropriate Allocation

Selecting Specific Alternative Investments

Monitoring and Rebalancing

Conclusion

Alternative Investments in Retirement Accounts FAQs

Alternative investments are assets other than traditional stocks, bonds, and mutual funds that can be held in retirement accounts such as IRAs and 401(k)s. Examples include real estate, private equity, hedge funds, and commodities.

Alternative investments can offer potential benefits such as diversification and higher returns, but they also come with higher risk and fees. It is important to consult with a financial advisor to determine if alternative investments are suitable for your retirement account based on your financial goals and risk tolerance.

The tax implications of holding alternative investments in retirement accounts vary depending on the type of investment and the account structure. Some alternative investments, such as real estate, may offer tax advantages, while others may result in higher taxes or penalties for early withdrawals.

Investing in alternative investments in retirement accounts typically requires opening a self-directed IRA or 401(k) and working with a custodian that specializes in alternative investments. The process can be complex and involves additional due diligence and fees.

Examples of alternative investments that can be held in retirement accounts include real estate, private equity, hedge funds, commodities, precious metals, and cryptocurrencies. It is important to carefully evaluate the risks and benefits of each investment before making a decision.

True Tamplin is a published author, public speaker, CEO of UpDigital, and founder of Finance Strategists.

True is a Certified Educator in Personal Finance (CEPF®), author of The Handy Financial Ratios Guide, a member of the Society for Advancing Business Editing and Writing, contributes to his financial education site, Finance Strategists, and has spoken to various financial communities such as the CFA Institute, as well as university students like his Alma mater, Biola University, where he received a bachelor of science in business and data analytics.

To learn more about True, visit his personal website or view his author profiles on Amazon, Nasdaq and Forbes.