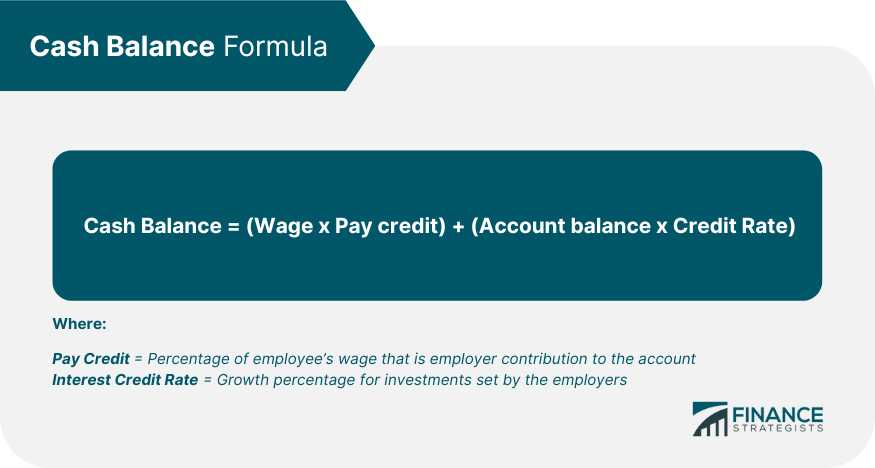

Cash balance pension plans are defined benefit plans that promise to pay out a certain amount as retirement benefit each year. They incorporate elements of 401(k)s and traditional pension plans in that they provide individual accounts to employees and guarantee a fixed amount, annually or monthly. But their formula for calculating those benefits differs from traditional pension plans. The advantages of cash balance pension plans are tax benefits, higher contribution limits, and more retirement savings. The disadvantages of cash balance pension plans are that they can be costly to implement for employers and can result in less payouts for employees. Have questions about Cash Balance Pension Plans? Click here. Cash balance plans are referred to as “hybrid” plans because they combine features of defined benefit plans and defined contribution plans. Like the former, they pay out defined benefits. But the amount of these benefits is spread out over the course of the individual’s employment history as opposed to his or her final years, as is usually the case for regular pension plans. Like 401(k)s, cash balance plans also allow employee to view their account balances over its lifetime. But these accounts are hypothetical and display hypothetical balances. Cash balance pension plans are popular with small business owners and self-employed individuals because they have higher contribution limits. For example, the maximum contribution limits for certain cash balance pension plans can be as much as $3 million. In addition to providing tax benefits, such amounts can help reduce the overall tax liability of high net-worth individuals. As it does with most defined benefit plans, the Pension Benefit Guaranty Corporation (PBGC) guarantees payouts for cash balance pension plans. Therefore, if the corporation fails for some reason, then the PBGC takes over management of the trust and makes sure that account holders are made whole. In recent years, several employers have shifted to cash balance pension plans from traditional pension plans because the former reduces overall pension obligations for companies. In a cash balance pension plan, the employer contributes to a pension fund that is divided into hypothetical individual accounts, one each for an employee. The percentage contributed varies between five percent to 7.5 percent. Contribution limits for employees increase with age. Therefore, the higher the age, the more an employee is allowed to contribute. For example, a 40-year-old employee can contribute a maximum of $130,000 to a cash balance plan in 2024 while a 70-year-old can employee contribute a maximum of $376,000. Cash balance accounts are credited each year with a balance that is calculated according to the following formula: Where, Pay Credit = Percentage of employee’s wage that is employer contribution to the account. Interest Credit Rate = Growth percentage for investments set by the employers. It can be fixed or variable. In the latter case, it is indexed to a rate of return from an asset, such as 5-year treasury or an index fund. Employers entrust management of the pension plan to investment managers to ensure that they can meet their pension-related obligations. Withdrawals from a cash balance pension plan are taxed at regular income tax rates after the age of 59.5 years. There is a 10% penalty for withdrawals made before that age. Entitled account holders can choose to take the benefits as a lump sum payment or an annuity that disburses fixed annual payments. Lump sum distributions can be rolled over to an IRA or to another employer plan. While both are defined benefit plans, there are several points of difference between cash balance plans and traditional pension plans. Here are some of them: Like 401(k)s, cash balance plans disburse benefits through individual accounts. Here are some points of difference between them: Some of the advantages of cash balance pension plans are: Some of the disadvantages of cash balance pension plans:Basics of Cash Balance Pension Plans

How Does a Cash Balance Pension Plan Work?

Cash Balance Plans vs Traditional Pension Plans

Cash Balance Plans vs 401(k) Plans

Pros and Cons of Cash Balance Pension Plans

Cash Balance Pension Plans FAQs

Cash balance pension plans are defined benefit plans that promise to pay out a certain amount as retirement benefit each year. They incorporate elements of 401(k)s and traditional pension plans in that they provide individual accounts to employees and guarantee a fixed amount, annually or monthly.

Cash balance pension plans are popular with small business owners and self-employed individuals because they have higher contribution limits. For example, the maximum contribution limits for certain cash balance pension plans can be as much as $3 million.

Cash balance accounts are credited each year with a balance that is calculated according to the following formula: (Wage x Pay credit) + (Account balance X Credit Rate).

The most notable advantages are tax benefits, higher contribution limits, and portability over a person's lifetime.

Some disadvantages to a cash balance pension plan are that they are more expensive to set up and maintain, plus its emphasis on employment over a lifetime makes it a loss-making proposition for senior executives already locked into traditional pension plans.

True Tamplin is a published author, public speaker, CEO of UpDigital, and founder of Finance Strategists.

True is a Certified Educator in Personal Finance (CEPF®), author of The Handy Financial Ratios Guide, a member of the Society for Advancing Business Editing and Writing, contributes to his financial education site, Finance Strategists, and has spoken to various financial communities such as the CFA Institute, as well as university students like his Alma mater, Biola University, where he received a bachelor of science in business and data analytics.

To learn more about True, visit his personal website or view his author profiles on Amazon, Nasdaq and Forbes.