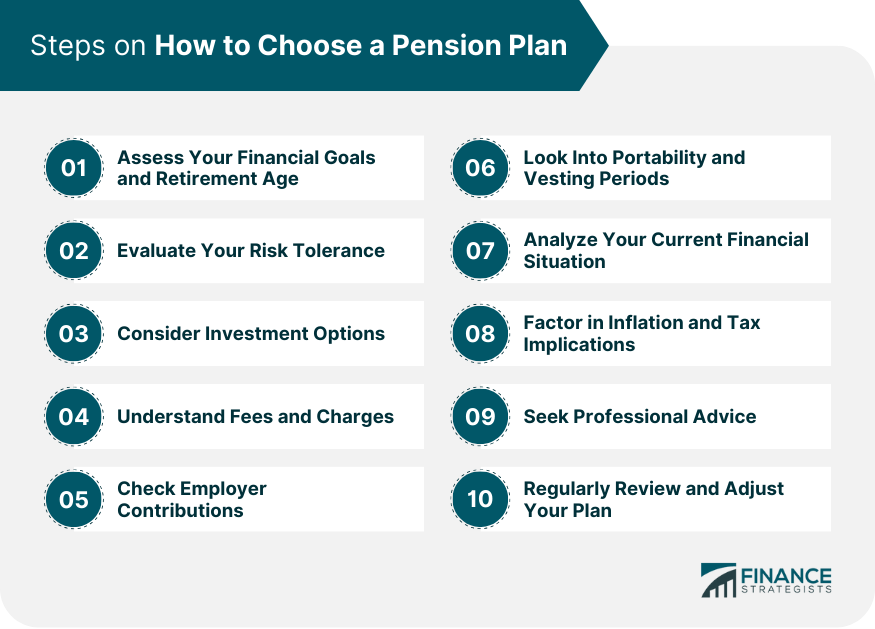

Begin by envisioning your retirement lifestyle and determining the age at which you plan to retire. Consider factors such as life expectancy, desired retirement lifestyle, and any post-retirement ambitions like travel or hobbies. Estimating your required retirement income based on these factors is crucial. This income should cover all your expenses and allow for a comfortable lifestyle. Reflect on your current savings and how they align with these retirement goals. If there's a gap, you may need to opt for a pension plan that allows for higher contributions or offers greater growth potential. Your comfort level with investment risks plays a significant role in pension plan selection. If you are comfortable with market fluctuations and have a longer timeframe until retirement, a defined contribution plan with potentially higher returns might be suitable. However, if you prefer stability and predictability in your retirement income, a defined benefit plan, which offers a fixed payout, could be a better choice. Assessing your risk tolerance involves considering your overall financial situation, including debts, dependents, and other savings, and how these might affect your ability to absorb financial losses in retirement. Investigate the variety of investment options offered by each pension plan. A plan with a wide range of investment choices allows you to diversify your portfolio, balancing risk and potential returns. Diversification is key to managing risk, especially in volatile market conditions. Additionally, look for plans that offer flexibility in changing investment choices as your retirement nears and your risk tolerance evolves. It's also wise to check the historical performance of these investment options, though past performance is not always indicative of future results. High fees can erode your retirement savings over time. It's essential to understand all associated fees, including management fees, transaction fees, and any penalties for early withdrawal or plan changes. Compare these costs across different plans to ensure you're not overpaying. Transparency in fee structures is also vital. Avoid plans with hidden costs or complicated fee structures, as they can make it difficult to understand the true cost of the plan. If your employer offers to contribute to your pension plan, this can significantly enhance your retirement savings. Understand the extent of their contributions and any conditions attached, such as vesting periods. Some employers may offer matching contributions up to a certain percentage, which can be a substantial benefit. Ensure that you contribute enough to maximize this employer match, as it's essentially free money towards your retirement. In today's dynamic job market, the ability to transfer pension benefits when changing jobs is a significant advantage. Portability ensures that your pension savings are not lost when you move to a new employer. Additionally, understanding the vesting period and the time you need to work before gaining full rights to your pension benefits is crucial. A shorter vesting period can be beneficial if you change jobs frequently. Take stock of your current financial health, including your income, savings, and any debts. This will help you determine how much you can realistically contribute to a pension plan. Consider other potential sources of retirement income, such as social security benefits, and how they might supplement your pension. Accurately assessing your financial situation will guide you in selecting a plan that meets your contribution capacity and retirement income needs. Inflation can significantly reduce the purchasing power of your retirement savings. Choose a pension plan that takes inflation into account, possibly with investments that have the potential to outpace inflation. Additionally, understanding the tax implications of different pension plans is crucial. Some plans offer tax advantages, such as tax-deferred growth or tax-free withdrawals, which can make a significant difference in your net retirement income. Navigating the complexities of pension plans can be daunting. A financial advisor can provide personalized advice based on your unique financial situation and retirement goals. They can help you understand the nuances of different plans and how they fit into your overall financial plan. Consulting a professional is especially beneficial if you have significant assets or complex financial circumstances. They can also assist in estate planning, tax strategies, and investment advice, offering a holistic approach to your retirement planning. Your financial situation and goals may change over time, as will market conditions. Regularly reviewing your pension plan ensures it remains aligned with your evolving needs. This might involve adjusting your contributions or changing your investment choices as you approach retirement. Being proactive about these adjustments can help mitigate risks and maximize returns, ensuring a more secure and comfortable retirement. Remember, a pension plan is not a set-and-forget strategy; it requires ongoing attention and management to stay on course. Defined benefit plans promise a specified monthly benefit upon retirement, often based on salary and years of service. These plans offer the security of a predictable income but are less flexible compared to other types. In contrast, defined contribution plans, such as 401(k)s, depend on the contributions made by the employee, employer, or both. The retirement benefits depend on the performance of the invested funds, offering more control but also more risk to the employee. Hybrid plans combine elements of both defined benefit and defined contribution plans. They offer a base guaranteed benefit, supplemented by additional benefits based on the plan's investment performance. This blend provides a balance between security and potential for growth. Individual financial goals and the desired retirement age play a pivotal role in selecting a pension plan. One must evaluate how the plan aligns with their retirement aspirations and the feasibility of retiring at the desired age. Risk tolerance is crucial in pension plan selection. Those with higher risk tolerance may prefer plans with potentially higher returns (like defined contribution plans), while conservative investors might opt for more stable options like defined benefit plans. The range of investment options available within a pension plan is an essential factor. A diverse portfolio can mitigate risks and increase the potential for higher returns, making it a critical consideration for long-term financial health. Understanding the fees and charges associated with a pension plan is fundamental. High fees can significantly erode retirement savings over time, so it's important to choose plans with reasonable and transparent fee structures. For plans where employers contribute, the extent and nature of these contributions can significantly impact the plan's value. Employer matching, for instance, can substantially enhance retirement savings. Portability refers to the ability to transfer pension benefits from one employer to another, which is vital for job-hoppers. Vesting periods, the time one must work before earning rights to pension benefits, are also an essential consideration. One of the most common mistakes is underestimating the cost of retirement. Failure to account for all potential expenses can lead to insufficient funds during retirement. Accurate estimation and planning are therefore crucial. Ignoring the effects of inflation and taxes on retirement savings can severely impact the effectiveness of a pension plan. Understanding and planning for these factors is vital to preserving the purchasing power of your retirement income. Neglecting regular reviews of your pension plan can lead to missed opportunities for optimization and risk mitigation. Consistent monitoring and adjustment are essential for a successful retirement strategy. Selecting the right pension plan is a multi-faceted process that requires thorough consideration of personal financial goals, retirement age, risk tolerance, and investment preferences. Defined benefit plans offer stability with fixed benefits, while defined contribution plans provide flexibility and the potential for higher returns based on investment performance. Hybrid plans blend these elements, offering a mix of security and growth potential. Key factors in choosing a pension plan include understanding fees, employer contributions, portability, and vesting periods. It's essential to accurately assess your current financial situation, including income, savings, and expected retirement expenses, and to account for inflation and tax implications. Regular monitoring and adjustments to the pension plan are crucial for aligning it with changing financial goals and market conditions. Seeking professional financial advice can also be invaluable in navigating the complexities of pension plans, ensuring a well-informed decision for a financially secure retirement.Steps on How to Choose a Pension Plan

Step 1: Assess Your Financial Goals and Retirement Age

Step 2: Evaluate Your Risk Tolerance

Step 3: Consider Investment Options

Step 4: Understand Fees and Charges

Step 5: Check Employer Contributions

Step 6: Look Into Portability and Vesting Periods

Step 7: Analyze Your Current Financial Situation

Step 8: Factor in Inflation and Tax Implications

Step 9: Seek Professional Advice

Step 10: Regularly Review and Adjust Your Plan

Understanding Different Types of Pension Plans

Defined Benefit Plans

Defined Contribution Plans

Hybrid Plans

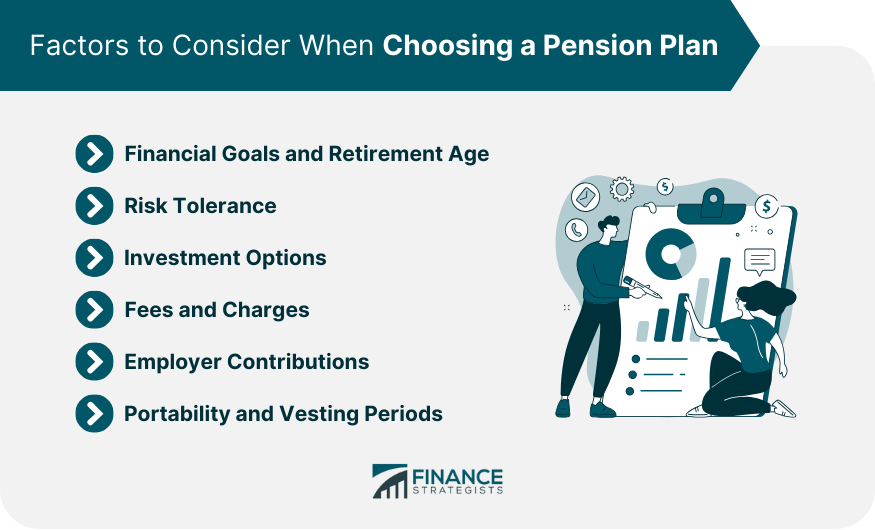

Factors to Consider When Choosing a Pension Plan

Financial Goals and Retirement Age

Risk Tolerance

Investment Options

Fees and Charges

Employer Contributions

Portability and Vesting Periods

Common Mistakes to Avoid When Choosing a Pension Plan

Underestimate Retirement Costs

Ignore Inflation and Tax Impacts

Failure to Regularly Review the Plan

Bottom Line

How to Choose a Pension Plan FAQs

Defined Benefit Plans are pension plans that promise a specific monthly benefit upon retirement, usually calculated based on the employee's salary and years of service. They offer predictable income but less flexibility than other pension plan types.

Defined Contribution Plans, like 401(k)s, are based on contributions from the employee, employer, or both. The retirement benefits depend on how these contributions, invested in various assets, perform over time, offering more control but also more risk to the employee.

Hybrid Plans combine features of both defined benefit and defined contribution plans. They provide a base guaranteed benefit, like defined benefit plans, and additional benefits that vary based on the investment performance, similar to defined contribution plans.

When selecting a pension plan, consider your financial goals, desired retirement age, risk tolerance, the range of investment options, fees and charges, employer contributions, portability, and vesting periods. Also, evaluate your current financial situation, including income, savings, and expected retirement expenses.

Regularly reviewing your pension plan is vital to ensure it aligns with your retirement goals and adapts to changing market conditions. Periodic assessments can indicate when adjustments in contributions or investment choices are necessary to keep your retirement strategy effective.

True Tamplin is a published author, public speaker, CEO of UpDigital, and founder of Finance Strategists.

True is a Certified Educator in Personal Finance (CEPF®), author of The Handy Financial Ratios Guide, a member of the Society for Advancing Business Editing and Writing, contributes to his financial education site, Finance Strategists, and has spoken to various financial communities such as the CFA Institute, as well as university students like his Alma mater, Biola University, where he received a bachelor of science in business and data analytics.

To learn more about True, visit his personal website or view his author profiles on Amazon, Nasdaq and Forbes.