Eligibility for a Lieutenant Colonel’s pension is primarily determined by the length of service and age. These prerequisites usually entail a minimum number of years in active duty coupled with a retirement age set by military regulations. Minimum Service Duration: The eligibility for a Lieutenant Colonel's pension typically requires a minimum service duration, often spanning several decades. Mandatory Retirement Age: Military regulations often set a mandatory retirement age for Lieutenant Colonels. Understanding this age limit is crucial, as it can impact the decision to continue service or retire. Early Career Planning: For effective retirement planning, it is essential for Lieutenant Colonels to be aware of these service duration and age requirements from early in their career. Apart from general service and age requirements, specific conditions tailored to the rank of Lieutenant Colonel must be met. Unique Conditions for Lieutenant Colonels: The pension eligibility criteria for Lieutenant Colonels can include unique conditions that differ from other ranks. Variations Across Military Branches: The specific criteria for pension eligibility can vary not only by rank but also across different branches of the military. Lieutenant Colonels must be aware of the nuances in their respective branch's pension policies. Importance of Understanding Rank-Specific Entitlements: For Lieutenant Colonels, comprehending these rank-specific conditions is vital. Consultation and Resources: It is advisable for Lieutenant Colonels to seek detailed information about their pension eligibility from official military resources or through consultation with military finance experts. These conditions can vary from the criteria for other military ranks, highlighting the importance of rank-specific knowledge in understanding one's pension entitlements. The length of service plays a pivotal role in the calculation of pension benefits. Generally, the longer a Lieutenant Colonel serves, the higher the percentage of their base pay is allocated as a pension. The pay grade at the time of retirement also significantly influences pension amounts. Higher pay grades typically lead to larger pensions, rewarding the progression and advancement in rank. There is an incremental increase in pension benefits corresponding to both the duration of service and the rank achieved. This system is designed to acknowledge and reward long-term commitment and advancement within the military. The military employs specialized formulas to determine pension amounts. These formulas consider various factors, including years of service and final pay grade. These pension formulas are not static; they are periodically reviewed and updated to reflect changes in living standards and costs. This ensures that the pension remains a viable source of post-retirement income. The updates in pension formulas aim to keep pensions aligned with current economic conditions, ensuring that the benefits are adequate for retired service members' living expenses. The required minimum service time for full pension benefits can vary between different military branches. Lieutenant Colonels should be aware of their branch's specific requirements, as this significantly impacts their pension eligibility and amount. Lieutenant Colonels face a critical decision between early retirement, which may result in reduced pension benefits, and retiring at or after the standard retirement age. Delaying retirement often leads to an increase in pension benefits. This is due to the extended accumulation of service years, which typically results in a higher pension calculation. Understanding these aspects of pension calculation is essential for strategic retirement planning. Lieutenant Colonels should consider their service duration, final pay grade, and potential retirement age to Lieutenant Colonels' pension plans typically include comprehensive healthcare benefits and survivor benefits. These are crucial for ensuring long-term medical support and financial security for family members. Retirement plans may also offer additional perks, such as access to military facilities and special programs. These benefits significantly enhance the quality of life after retirement. Retirement doesn't end a Lieutenant Colonel's connection with the military. Access to facilities and involvement in veteran communities remains an integral part of post-retirement life, providing ongoing support and a sense of belonging. The skills and experience acquired during military service open numerous doors in civilian life. Many retired Lieutenant Colonels find meaningful second careers or participate actively in community services and consultancy roles. The first step in applying for a pension involves gathering all necessary documentation. This includes service records, proof of rank, identification documents, and any other paperwork required by the specific military branch. Familiarity with the application forms is essential. Lieutenant Colonels should thoroughly review these forms to understand what information is required and how to accurately complete them. If there is any confusion or need for clarification during the application process, it's advisable to seek assistance from military pension offices or a knowledgeable advisor. Once all forms are completed and documentation is gathered, the final submission should be made as per the instructions provided. After submission, receiving a confirmation of receipt is crucial to ensure the application has been successfully lodged. Retiring Lieutenant Colonels must understand how their pensions are taxed. The taxation rules may vary for different components of the pension. Effective tax planning is essential for managing potential liabilities. Consulting with tax advisors familiar with military pensions can be very beneficial in this regard. The pension plan for a Lieutenant Colonel may significantly differ from those of other military ranks, both in terms of benefits and eligibility criteria. It's important to understand these differences for comprehensive financial and career planning. A thorough comparison of benefits across ranks can provide valuable insights, helping Lieutenant Colonels make informed decisions about their retirement planning. Understanding Lieutenant Colonel pension plans is crucial for those who have dedicated their careers to military service. Eligibility for these pensions is primarily based on years of service and age, with rank-specific conditions and branch-specific variations adding complexity. Early career planning and staying informed about policy changes are essential for effective retirement planning. The calculation of pension benefits considers years of service and final pay grade, rewarding long-term commitment and advancement. Specialized military formulas ensure that pensions remain aligned with economic conditions over time, providing retirees with adequate post-retirement income. Lieutenant Colonels also need to consider their retirement age and service requirements, as well as the choice between early and standard retirement, which impacts their pension benefits. These pensions typically include healthcare and survivor benefits, enhancing financial security for retirees and their families. Thorough knowledge and strategic planning are essential for Lieutenant Colonels as they transition into retirement, ensuring a secure and fulfilling post-military life.Eligibility Criteria for Lieutenant Colonels' Pension

Service Duration and Age Requirements

This duration is a key factor in securing a full pension and may vary depending on the specific branch of the military.

This knowledge allows for strategic career decisions and financial planning aligned with retirement goals. It's vital for Lieutenant Colonels to understand these parameters early in their careers to plan effectively for retirement.Rank-Specific Conditions

These might involve specific roles or responsibilities undertaken during their service, or certain achievements and recognitions required at this rank.

It affects not only their eligibility for pension but also the amount they can expect to receive. This understanding is critical for financial security and planning for life post-retirement.

Regular updates and policy changes might also influence these criteria, making ongoing education and consultation an essential part of career and retirement planning.Calculation of Pension Benefits in Lieutenant Colonel Pension Plans

Years of Service and Final Pay Grade

Military Pension Formulas

Retirement Age and Service Requirements for Lieutenant Colonel Pension Plans

Minimum Service Time

Early vs Standard Retirement Considerations

Benefit Accumulation With Extended Service

Strategic Retirement Planning

Benefits Included in Lieutenant Colonel Pension Plans

Healthcare and Survivor Benefits

Other Retirement Perks

Life After Retirement for Lieutenant Colonels

Access to Military Facilities and Community Involvement

Opportunities in Civilian Life

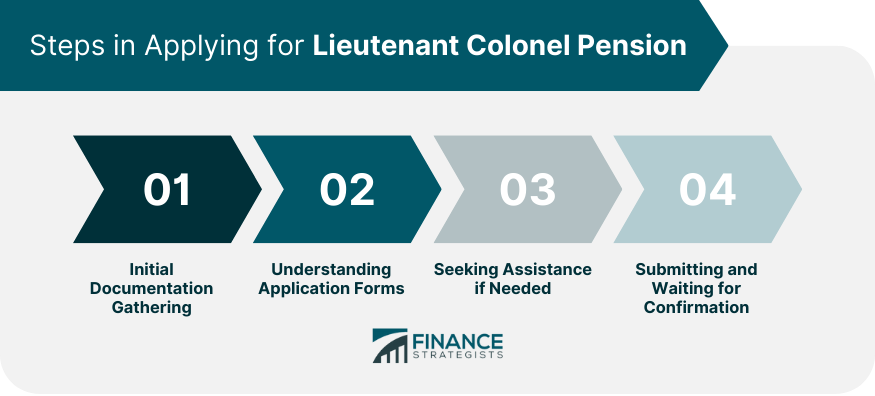

Applying for a Lieutenant Colonel Pension Plan

Initial Documentation Gathering

Understanding Application Forms

Seeking Assistance if Needed

Final Submission and Confirmation

Tax Implications of the Lieutenant Colonel Pension

Understanding Pension Taxation

Planning for Tax Efficiency

Comparison With Other Military Pension Plans

Differences Across Ranks

Evaluating Comprehensive Benefits

Conclusion

Lieutenant Colonel Pension Plans FAQs

The eligibility for Lieutenant Colonel pension plans typically includes a minimum number of years in active military service, reaching a specific retirement age set by military regulations, and meeting rank-specific conditions unique to Lieutenant Colonels.

Lieutenant Colonel pension plans are calculated based on factors like the total years of service, the final pay grade at retirement, and specific military pension formulas. The pension usually increases with longer service duration and higher ranks at retirement.

Applying for Lieutenant Colonel pension plans involves gathering the necessary documentation, understanding and completing application forms, submitting the application before deadlines, and following up regularly. It’s important to adhere to specific procedures and timelines for each military branch.

The tax implications for Lieutenant Colonel pension plans vary depending on different pension components, and state and federal tax laws. Consulting with a tax advisor familiar with military pensions is recommended for effective tax planning and understanding specific tax liabilities.

Early retirement choices can significantly affect Lieutenant Colonel's pension plans, often leading to reduced benefits. Delaying retirement, on the other hand, can result in higher pension payments due to longer service duration and increased benefit accumulation.

True Tamplin is a published author, public speaker, CEO of UpDigital, and founder of Finance Strategists.

True is a Certified Educator in Personal Finance (CEPF®), author of The Handy Financial Ratios Guide, a member of the Society for Advancing Business Editing and Writing, contributes to his financial education site, Finance Strategists, and has spoken to various financial communities such as the CFA Institute, as well as university students like his Alma mater, Biola University, where he received a bachelor of science in business and data analytics.

To learn more about True, visit his personal website or view his author profiles on Amazon, Nasdaq and Forbes.