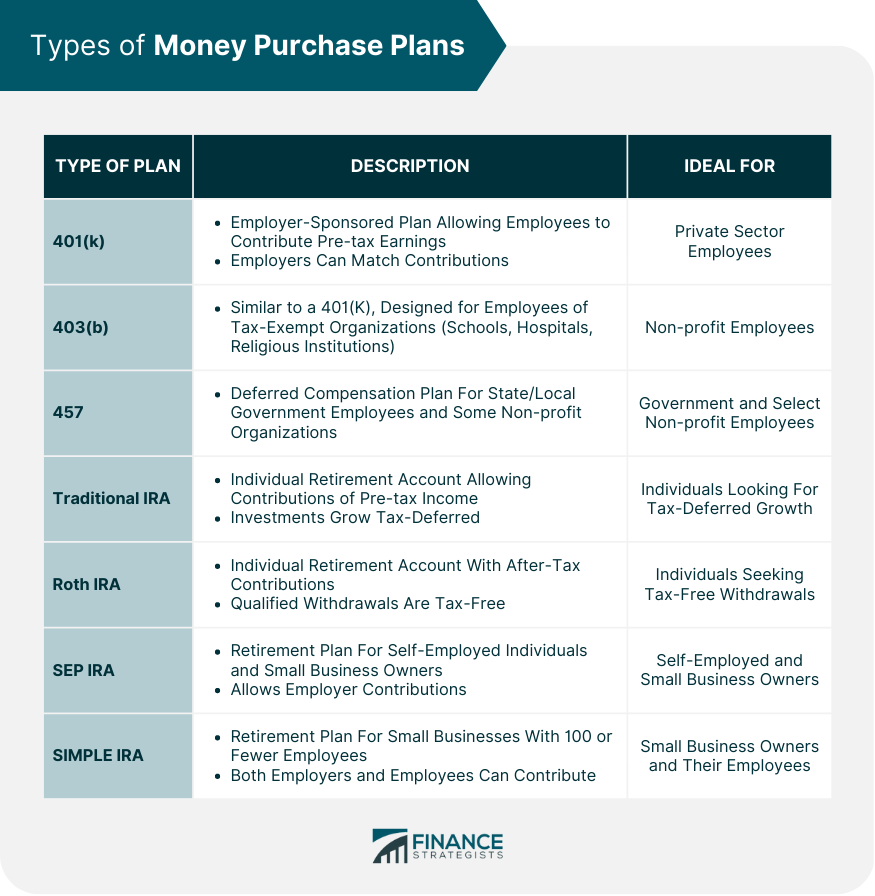

Money purchase plans are employer-sponsored retirement plans designed to help employees save for their retirement. They provide a valuable means of accumulating wealth for employees and offer tax advantages for both employees and employers. Money purchase plans are different from defined benefit plans, which promise a specific retirement benefit based on a formula that takes into account factors such as the employee's salary history and years of service. In a money purchase plan, the employee takes on more investment risk and does not have a guaranteed retirement benefit. Money purchase plans can be set up as individual accounts for each employee or as pooled accounts for all employees. They are subject to certain contribution limits and distribution rules under the Internal Revenue Code. A 401(k) plan is a popular type of defined contribution plan offered by employers. Employees can contribute a portion of their pre-tax earnings to the plan, and employers can match a percentage of those contributions. A 403(b) plan is similar to a 401(k) plan but is designed for employees of tax-exempt organizations, such as schools, hospitals, and religious institutions. A 457 plan is a deferred compensation plan for employees of state and local governments and some non-profit organizations. It allows participants to defer a portion of their salary for retirement. A traditional IRA is an individual retirement account that allows individuals to contribute pre-tax income and grow their investments tax-deferred until withdrawn in retirement. A Roth IRA is an individual retirement account where contributions are made with after-tax income, but qualified withdrawals are tax-free. A Simplified Employee Pension (SEP) IRA is a retirement plan designed for self-employed individuals and small business owners. It allows employers to contribute to their employees' retirement accounts. A Savings Incentive Match Plan for Employees (SIMPLE) IRA is a retirement plan designed for small businesses with 100 or fewer employees. Employers and employees can contribute to the plan, and contributions are tax-deductible. Money purchase plans have specific annual contribution limits set by the Internal Revenue Service (IRS). Contributions to money purchase plans are generally tax-deductible, and investment earnings grow tax-deferred until withdrawn in retirement. Vesting schedules determine when an employee has full ownership of employer contributions to their retirement account. Money purchase plans offer a range of investment options, including stocks, bonds, mutual funds, and Exchange-Traded Funds (ETFs). Participants can roll over or transfer their money purchase plan assets to other qualified retirement accounts under certain conditions. Some money purchase plans allow participants to take loans or hardship withdrawals from their accounts, subject to specific rules and restrictions. Employers must establish and maintain money purchase plans, including selecting investment options, monitoring plan performance, and ensuring regulatory compliance. Employees must meet specific eligibility requirements, such as age and length of service, to participate in a money purchase plan. Employers are responsible for plan administration and recordkeeping, which includes tracking contributions, distributions, and investment performance. Money purchase plans must comply with various federal laws and regulations, such as the Employee Retirement Income Security Act (ERISA) and the Internal Revenue Code. Employer contributions to money purchase plans are generally tax-deductible. Offering a money purchase plan can help employers attract and retain valuable employees. Employers can reduce payroll taxes by offering a money purchase plan, as employee contributions are generally not subject to Social Security and Medicare taxes. Money purchase plans provide employees with a structured way to save for retirement and benefit from the power of compounding. Many employers match a portion of employee contributions, effectively providing "free money" to help grow retirement savings. Investment earnings in money purchase plans grow tax-deferred, allowing for potentially greater growth over time. Money purchase plans expose participants to market fluctuations and the risk of investment losses. Fees associated with money purchase plans can vary and may include administrative, investment, and transaction fees. Some money purchase plans may offer a limited selection of investment options, which can restrict diversification and potential returns. If employees do not contribute enough to their money purchase plan or if investment returns are lower than expected, they may not accumulate sufficient funds for retirement. Changes in legislation or regulations could impact the tax advantages or other features of money purchase plans. Unlike money purchase plans, defined benefit plans promise a specific retirement benefit, usually based on a formula that considers factors such as salary and years of service. Annuities are insurance products that provide a guaranteed income stream in retirement. They can be a complementary option to money purchase plans, offering additional income security. Target-date funds are diversified investment portfolios that automatically adjust their asset allocation over time based on the investor's target retirement date. They can be used within a money purchase plan or as a standalone investment option. Non-qualified deferred compensation plans are for high-income employees who wish to defer income beyond the limits of qualified plans, such as 401(k)s or IRAs. These plans do not offer the same tax advantages as money purchase plans. Financial planning for retirement is essential, and money purchase plans play a vital role in helping employees save for their future. Understanding the different types of money purchase plans, their features, benefits, and potential risks can help both employers and employees make informed decisions about their retirement strategy. Ultimately, a diversified approach that includes money purchase plans and other investment options can help ensure a comfortable and secure retirement.What Is a Money Purchase Plan?

Types of Money Purchase Plans

Defined Contribution Plans

401(k) Plans

403(b) Plans

457 Plans

Individual Retirement Accounts (IRAs)

Traditional IRA

Roth IRA

SEP IRA

SIMPLE IRA

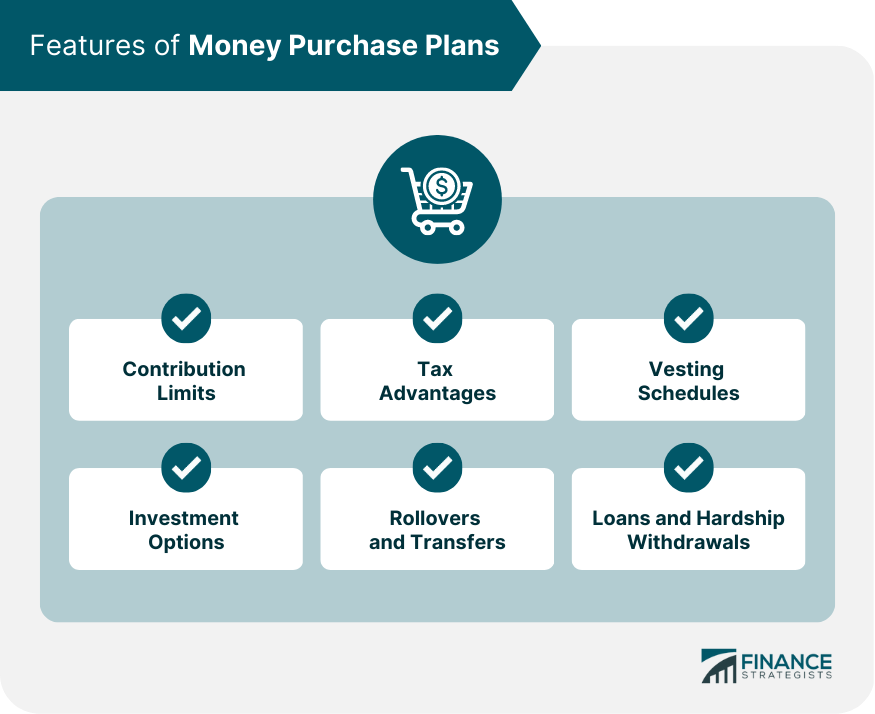

Features of Money Purchase Plans

Contribution Limits

Tax Advantages

Vesting Schedules

Investment Options

Rollovers and Transfers

Loans and Hardship Withdrawals

Setting up a Money Purchase Plan

Plan Sponsor Responsibilities

Employee Eligibility

Plan Administration and Recordkeeping

Regulatory Compliance and Reporting

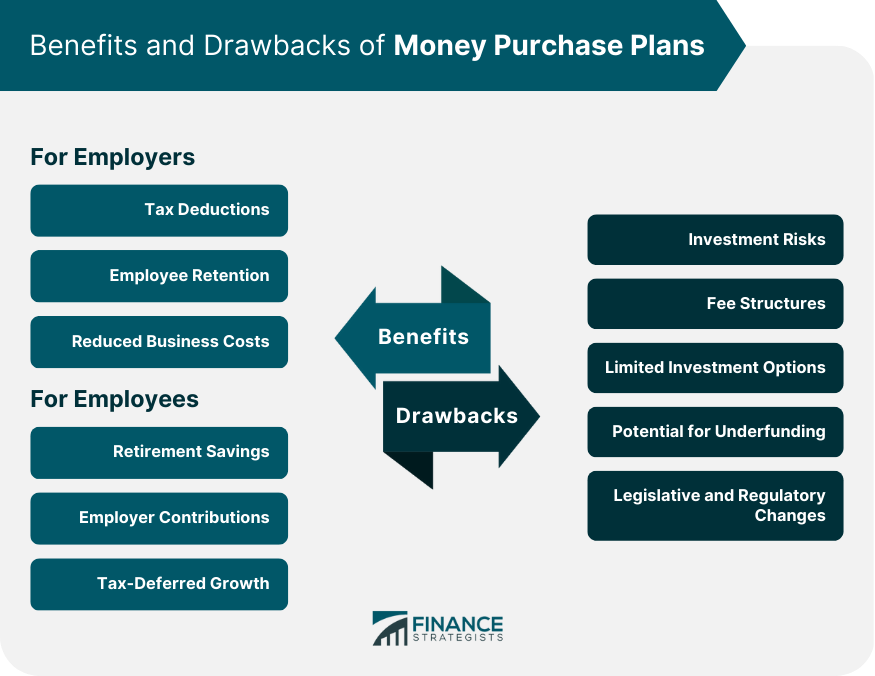

Benefits of Money Purchase Plans

For Employers

Tax Deductions

Employee Retention

Reduced Business Costs

For Employees

Retirement Savings

Employer Contributions

Tax-Deferred Growth

Potential Drawbacks and Risks

Investment Risks

Fee Structures

Limited Investment Options

Potential for Underfunding

Legislative and Regulatory Changes

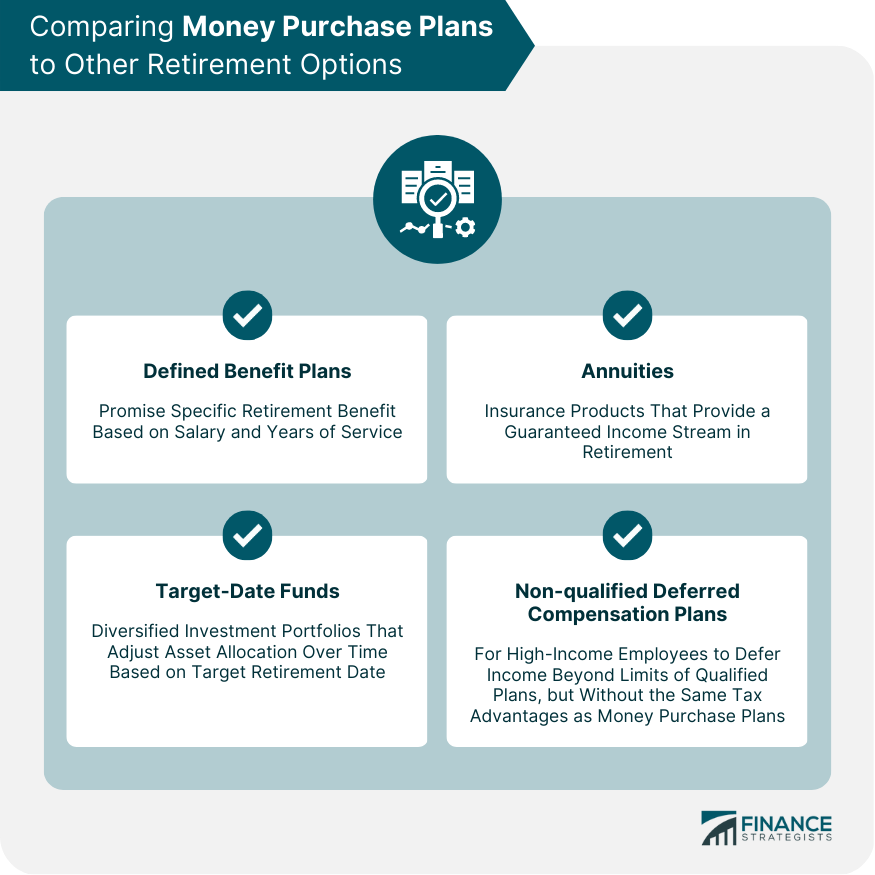

Comparing Money Purchase Plans to Other Retirement Options

Defined Benefit Plans

Annuities

Target-Date Funds

Non-qualified Deferred Compensation Plans

The Bottom Line

Money Purchase Plan FAQs

Money Purchase Plans are employer-sponsored retirement plans that help employees save for retirement. They include defined contribution plans like 401(k), 403(b), and 457 plans, as well as Individual Retirement Accounts (IRAs) such as Traditional, Roth, SEP, and SIMPLE IRAs. These plans differ from defined benefit plans, which promise a specific retirement benefit based on factors like salary and years of service. Money Purchase Plans typically offer more flexibility and control over investments.

Money Purchase Plans offer several tax advantages for both employees and employers. Employee contributions are generally tax-deductible, reducing their taxable income. Investment earnings within the plan grow tax-deferred, allowing for potentially greater growth over time. Employer contributions to Money Purchase Plans are also typically tax-deductible, providing financial incentives for businesses to offer these plans.

Some Money Purchase Plans allow participants to take loans or hardship withdrawals from their accounts, subject to specific rules and restrictions. Loans must be repaid within a specified time frame, and failure to repay the loan could result in taxes and penalties. Hardship withdrawals may be allowed for immediate and significant financial needs, but these withdrawals are generally subject to taxes and penalties.

Selecting the right investment options within your Money Purchase Plan depends on factors like your risk tolerance, investment time horizon, and financial goals. A diversified portfolio, including stocks, bonds, and other asset classes, can help reduce risk and potentially increase returns. You may consider consulting with a financial advisor to help you develop a personalized investment strategy within your Money Purchase Plan.

Some potential drawbacks and risks of Money Purchase Plans include investment risks, fee structures, limited investment options, the potential for underfunding, and legislative and regulatory changes. Participants should be aware of these factors and carefully consider their own financial situation and risk tolerance when investing in a Money Purchase Plan. Diversifying investments and working with a financial advisor can help mitigate these risks.

True Tamplin is a published author, public speaker, CEO of UpDigital, and founder of Finance Strategists.

True is a Certified Educator in Personal Finance (CEPF®), author of The Handy Financial Ratios Guide, a member of the Society for Advancing Business Editing and Writing, contributes to his financial education site, Finance Strategists, and has spoken to various financial communities such as the CFA Institute, as well as university students like his Alma mater, Biola University, where he received a bachelor of science in business and data analytics.

To learn more about True, visit his personal website or view his author profiles on Amazon, Nasdaq and Forbes.