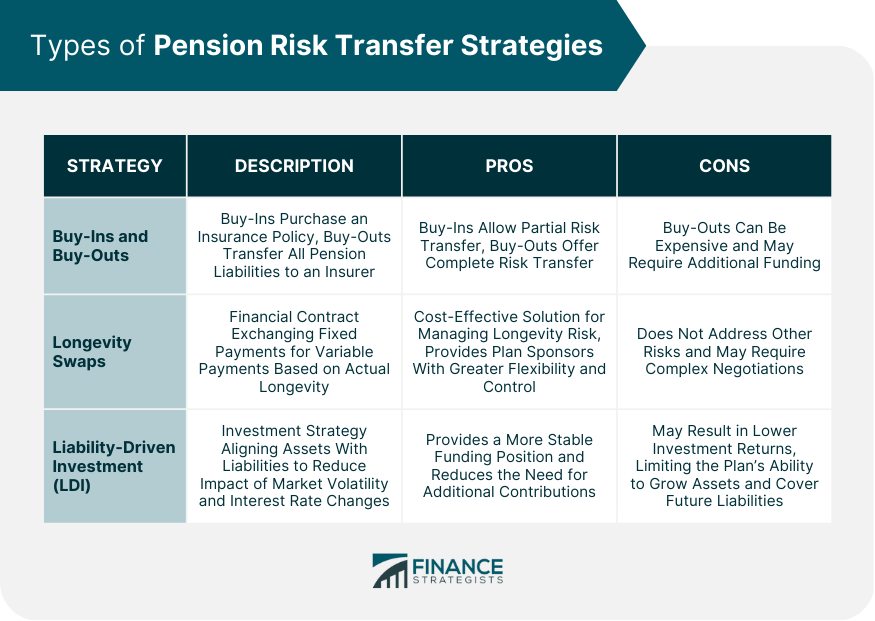

Pension risk transfer strategies are financial tools and techniques that help companies and plan sponsors manage the risks associated with their pension liabilities. These strategies are essential in today's business environment as they provide stability and predictability for both employers and employees. The primary objective of pension risk transfer strategies is to mitigate the financial risks related to pension plans while ensuring that retirees' benefits are maintained or improved. Buy-ins and buy-outs are two common pension risk transfer strategies. A buy-in involves the purchase of an insurance policy by the plan sponsor to cover a portion of the pension plan's liabilities. The policy acts as an investment that generates income to cover the pension payments. A buy-out, on the other hand, is the complete transfer of the pension plan's liabilities to an insurance company, effectively removing the pension risk from the plan sponsor's balance sheet. Buy-ins provide partial risk transfer, allowing plan sponsors to maintain control over the plan's assets and continue managing the remaining pension liabilities. Buy-outs offer a complete risk transfer solution, eliminating the pension liabilities from the plan sponsor's balance sheet. However, buy-outs can be more expensive and might require additional funding to facilitate the transaction. A longevity swap is a financial contract between a pension plan sponsor and an insurance company or other financial institution. The contract involves the exchange of fixed payments from the plan sponsor for variable payments from the insurer, based on the actual longevity of the plan's participants. This arrangement helps plan sponsors hedge against the risk of their plan members living longer than expected, which can increase the cost of providing pension benefits. Longevity swaps offer a cost-effective solution for managing longevity risk without transferring the plan's assets or liabilities. They provide plan sponsors with greater flexibility and control over their pension plan. However, longevity swaps do not address other risks, such as investment risk or changes in interest rates, and may require complex negotiations and pricing agreements. Liability-driven investment (LDI) is an investment strategy that focuses on aligning a pension plan's assets with its liabilities. This approach aims to minimize the impact of market volatility and interest rate changes on the plan's funded status. LDI involves investing in assets that closely match the plan's liabilities, such as long-duration bonds, to reduce the risk of underfunding. LDI can provide a more stable funding position and reduce the need for additional contributions from the plan sponsor. However, LDI may also result in lower investment returns, potentially limiting the plan's ability to grow assets and cover future liabilities. Understanding the plan sponsor's risk tolerance is crucial in determining the appropriate pension risk transfer strategy. Different strategies offer varying levels of risk mitigation, and selecting the right approach depends on the plan sponsor's willingness to accept or manage risk. The financial health of the company is a critical factor in selecting a pension risk transfer strategy. Companies with stronger financial positions may be more inclined to pursue buy-outs or other comprehensive risk transfer solutions, while those with weaker financial positions may opt for more cost-effective strategies, such as buy-ins or longevity swaps. The demographics of the plan's participants and the nature of the plan's liabilities can influence the selection of a pension risk transfer strategy. Factors such as the average age of plan members, life expectancy, and benefit structures should be considered when evaluating potential strategies. Regulatory requirements and changes can significantly impact pension risk transfer strategies. Plan sponsors should remain up-to-date with relevant regulations and consider their implications on potential strategies. Current and expected market conditions, such as interest rates and investment return expectations, can affect the feasibility and attractiveness of pension risk transfer strategies. Plan sponsors should consider the market environment when selecting and implementing a strategy. Actuarial and financial advisors play a critical role in assessing a pension plan's funded status, which is crucial in determining the appropriate pension risk transfer strategy. Advisors help plan sponsors evaluate potential pension risk transfer strategies by analyzing their impact on the plan's funded status, investment portfolio, and risk profile. Actuarial and financial advisors use sophisticated models and forecasting techniques to predict the potential outcomes of different pension risk transfer strategies, helping plan sponsors make informed decisions. Advisors assist plan sponsors in implementing and monitoring pension risk transfer strategies, ensuring that the chosen approach remains effective and aligned with the plan's objectives. Proactive pension risk management is essential for modern businesses to ensure the stability and sustainability of their pension plans. Plan sponsors and stakeholders should continually evaluate and monitor pension risk transfer strategies to respond to evolving market conditions, regulatory changes, and demographic shifts. By doing so, they can ensure the long-term financial security of their pension plans and the well-being of their plan participants.What Are Pension Risk Transfer Strategies?

Types of Pension Risk Transfer Strategies

Buy-Ins and Buy-Outs

Description and Differences

Pros and Cons

Longevity Swaps

Definition and Mechanics

Advantages and Disadvantages

Liability-Driven Investment (LDI)

Overview of LDI

Benefits and Potential Drawbacks

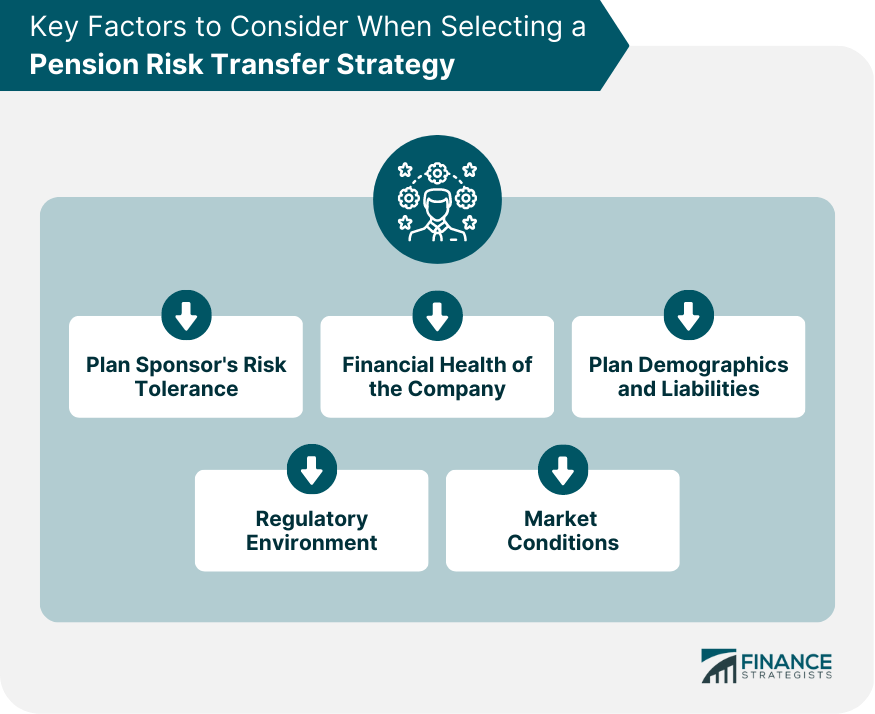

Key Factors to Consider When Selecting a Pension Risk Transfer Strategy

Plan Sponsor's Risk Tolerance

Financial Health of the Company

Plan Demographics and Liabilities

Regulatory Environment

Market Conditions

Role of Actuarial and Financial Advisors in Pension Risk Transfer

Assessing Plan's Funded Status

Evaluating Potential Strategies

Modeling and Forecasting

Implementation and Monitoring

Conclusion

Pension Risk Transfer Strategies FAQs

Pension risk transfer strategies refer to methods that companies can use to reduce or eliminate the risks associated with their pension plans, such as investment risk and longevity risk. These strategies may involve transferring some or all of the pension liabilities to an insurer or other third party.

The benefits of pension risk transfer strategies include reducing the financial and operational risks associated with pension plans, freeing up resources that can be used for other purposes, and providing greater certainty for plan participants regarding their retirement benefits.

Common pension risk transfer strategies include annuity buyouts, in which an insurer assumes responsibility for paying pension benefits to plan participants; pension plan terminations, in which a company ends its pension plan and transfers its liabilities to an insurer or other third party; and liability-driven investment strategies, which involve investing pension plan assets in a way that matches the plan's liabilities.

The risks associated with pension risk transfer strategies depend on the specific strategy being used. For example, annuity buyouts may involve risks related to the solvency and creditworthiness of the insurer, while liability-driven investment strategies may involve risks related to market fluctuations and interest rate changes.

Companies should consider a variety of factors when deciding whether to pursue pension risk transfer strategies, including their financial situation, the size and complexity of their pension plan, the risks associated with their plan, and the potential benefits and costs of different transfer strategies. It may be helpful for companies to consult with financial and legal professionals who specialize in pension risk transfer strategies to determine the best course of action.

True Tamplin is a published author, public speaker, CEO of UpDigital, and founder of Finance Strategists.

True is a Certified Educator in Personal Finance (CEPF®), author of The Handy Financial Ratios Guide, a member of the Society for Advancing Business Editing and Writing, contributes to his financial education site, Finance Strategists, and has spoken to various financial communities such as the CFA Institute, as well as university students like his Alma mater, Biola University, where he received a bachelor of science in business and data analytics.

To learn more about True, visit his personal website or view his author profiles on Amazon, Nasdaq and Forbes.