Police and firefighter pension plans are types of defined benefit pension plans that offer retirement benefits to police officers and firefighters who have served for a certain number of years. Police and firefighter pension plans offer guaranteed lifetime income to retired officers and firefighters, as well as survivor benefits for their beneficiaries. They may also offer inflation protection through cost-of-living adjustments (COLAs) to help maintain the value of retirement benefits over time. These plans often provide more generous benefits than defined contribution plans, especially for long-serving employees. The concept of pension plans for public employees dates back to the 19th century when some European countries started offering retirement benefits for their civil servants. In the United States, the first pension plans for public safety personnel emerged in the early 1900s, as cities recognized the need to provide financial security to police officers and firefighters who faced hazardous working conditions. Over the years, police and firefighter pension plans have evolved to meet the changing needs of public safety personnel and address financial challenges. Some key milestones include the establishment of statewide pension systems, the adoption of cost-of-living adjustments (COLAs), and the introduction of survivor and disability benefits. Several federal and state laws have shaped the development of police and firefighter pension plans. For instance, the Employee Retirement Income Security Act (ERISA) of 1974, which governs private-sector pension plans, exempts state and local government plans from many of its requirements. Additionally, individual states have enacted laws to create, modify, or regulate pension plans for their public safety personnel. Defined benefit plans promise a specific monthly benefit upon retirement, based on factors such as years of service, age, and final average salary. These plans are funded and managed by the employer, who bears the investment risk. Some key features of defined benefit plans include guaranteed lifetime income, survivor benefits, and inflation protection through COLAs. These plans often provide more generous benefits than defined contribution plans, especially for long-serving employees. Defined benefit plans rely on employer and employee contributions, as well as investment returns, to fund the promised benefits. Employers are responsible for managing the plan's investments and ensuring its long-term sustainability. Defined contribution plans, such as 401(k) and 457(b) plans, allow employees to contribute a portion of their salary to an individual account, which is invested on their behalf. The retirement benefit is based on the account balance at the time of retirement. These plans offer more flexibility and portability than defined benefit plans, as employees can choose their contribution levels and investment options. Additionally, defined contribution plans do not guarantee a specific retirement benefit, so employees bear the investment risk. Defined contribution plans are funded primarily by employee contributions, which are often matched by the employer. Employees are responsible for managing their investments and making decisions about contribution levels and asset allocation. Hybrid plans combine elements of both defined benefit and defined contribution plans. They may provide a lower guaranteed benefit than a traditional defined benefit plan, along with a supplemental defined contribution component. Hybrid plans offer a balance between the security of defined benefit plans and the flexibility of defined contribution plans. They can help employers share investment risks with employees while still providing some level of guaranteed retirement income. Like other pension plans, hybrid plans rely on employer and employee contributions, as well as investment returns, to fund the promised benefits. The management of hybrid plans typically involves both employer and employee responsibilities, depending on the plan's design. Eligibility requirements for police and firefighter pension plans typically include a minimum age and years of service. Vesting refers to the point at which an employee acquires a non-forfeitable right to their pension benefits. Vesting periods for police and firefighter pension plans can range from immediate vesting to several years of service. Police and firefighter pension plans often have specific retirement age and service requirements, which can vary based on the plan type and jurisdiction. For example, some plans may allow for early retirement after a certain number of years of service or upon reaching a specific age, while others may have mandatory retirement ages. The retirement benefit for police and firefighter pension plans is usually calculated based on a formula that takes into account factors such as years of service, final average salary, and a benefit multiplier. Payment options may include a single life annuity, joint and survivor annuity, or a lump-sum payment, depending on the plan provisions. Many police and firefighter pension plans include cost-of-living adjustments (COLAs) to help protect retirees' purchasing power from inflation. COLAs can be automatic, based on a specific index like the Consumer Price Index, or ad hoc, determined by the plan's governing body. Police and firefighter pension plans often provide survivor benefits for spouses and dependents in the event of the member's death, as well as disability benefits for members who become disabled before retirement. These benefits can be an essential source of financial security for the families of public safety personnel. Police and firefighter pension plans are funded through a combination of employee contributions, employer contributions, and investment returns. The specific contribution rates and funding policies can vary depending on the plan type and jurisdiction. Pension plans invest their assets in a diversified portfolio of stocks, bonds, real estate, and other investments to generate returns and fund future benefits. Investment strategies and risk tolerance levels can differ among plans, but they generally aim to balance the need for long-term growth with the risk of short-term market fluctuations. Actuarial assumptions are used to estimate the future costs of pension benefits and determine the required contributions to fund those benefits. Key assumptions include the expected rate of investment return, salary growth, inflation, and demographic factors such as mortality and retirement rates. Regular actuarial valuations help ensure the plan's financial health and sustainability. Police and firefighter pension plans face several challenges to their long-term sustainability, including underfunding, demographic shifts, and economic factors. Underfunding occurs when plan assets are insufficient to cover promised benefits, while demographic shifts, such as an aging workforce, can strain the plan's resources. Economic factors, such as low interest rates and market volatility, can also impact the plan's investment returns and funding levels. In response to funding challenges and concerns about the sustainability of public pension plans, some jurisdictions have implemented reforms, such as increasing employee contributions, raising retirement ages, modifying benefit formulas, and transitioning to hybrid or other contribution plans. Proponents of traditional pension plans argue that they provide essential financial security for police officers and firefighters, who face unique risks and challenges in their careers. Additionally, they contend that these plans help attract and retain qualified public safety personnel. Critics of traditional pension plans argue that they are unsustainable and place an undue burden on taxpayers. They advocate for pension reforms, such as shifting to defined contribution or hybrid plans, which can help control costs, share investment risks, and provide more flexibility for employees. They also argue that these alternative plans can still offer competitive benefits to attract and retain qualified public safety personnel. Pension reforms can have significant implications for the recruitment and retention of police officers and firefighters. While some reforms may help ensure the long-term sustainability of pension plans, they may also reduce the attractiveness of public safety careers. Understanding the balance between cost control and maintaining a competitive benefits package is crucial for policymakers and plan administrators. One of the primary challenges facing police and firefighter pension plans is ensuring they have adequate funding to meet their long-term obligations. This requires regular monitoring of plan assets, liabilities, and contribution rates, as well as adjustments to actuarial assumptions and investment strategies as needed. Effective management of investment risks is critical for the financial health of police and firefighter pension plans. This involves maintaining a diversified investment portfolio, monitoring market conditions, and adopting appropriate risk management strategies to help protect plan assets and generate sustainable returns. Transparency and accountability are essential for maintaining public trust in police and firefighter pension plans. This includes providing regular financial reports, actuarial valuations, and performance updates to stakeholders, as well as engaging in open communication and consultation with plan members, employers, and the public. Innovative pension plan designs, such as hybrid plans, can help strike a balance between the financial security provided by defined benefit plans and the flexibility and cost control offered by defined contribution plans. Policymakers and plan administrators should explore new plan designs that meet the needs of public safety personnel while addressing long-term sustainability concerns. Police and firefighter pension plans play a vital role in ensuring the financial security of public safety personnel and their families. Understanding the history, types, components, funding, sustainability, reforms, and best practices related to these plans is essential for policymakers, plan administrators, and public safety personnel alike. As demographic, economic, and policy landscapes continue to evolve, it is crucial to adapt pension plans to meet the changing needs of police officers, firefighters, and the communities they serve.What Are Police and Firefighter Pension Plans?

These plans promise a specific monthly benefit upon retirement, based on factors such as years of service, age, and final average salary. The plans are typically funded and managed by the employer, who bears the investment risk.Historical Background of Police and Firefighter Pension Plans

Early Origins of Pension Plans in the Public Sector

Evolution of Pension Plans for Police and Firefighters

Key Milestones and Legislation

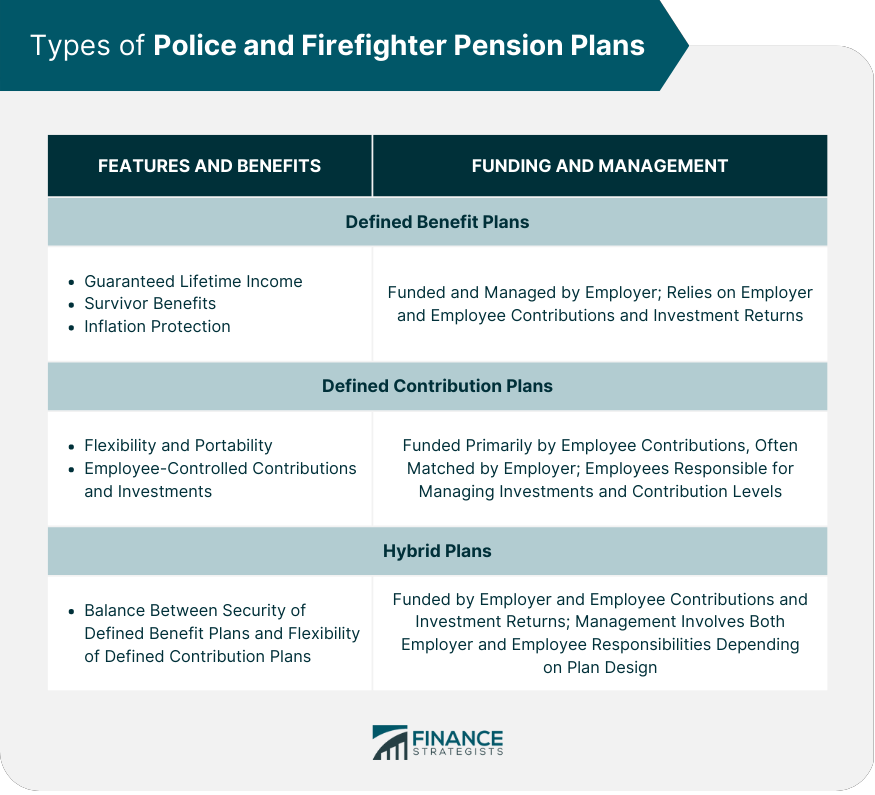

Types of Police and Firefighter Pension Plans

Defined Benefit Plans

Features and Benefits

Funding and Management

Defined Contribution Plans

Features and Benefits

Funding and Management

Hybrid Plans

Features and Benefits

Funding and Management

Key Components of Police and Firefighter Pension Plans

Eligibility and Vesting

Retirement Age and Service Requirements

Benefit Calculation and Payment Options

Cost-Of-Living Adjustments

Survivor and Disability Benefits

Funding and Sustainability of Police and Firefighter Pension Plans

Sources of Funding

Investment Strategies and Risks

Actuarial Assumptions and Valuations

Challenges to Sustainability

Pension Reforms and Policy Debates

Overview of Recent Pension Reforms

Arguments for Maintaining Traditional Pension Plans

Arguments for Pension Reform and Alternatives

Impact of Reforms on Police and Firefighter Recruitment and Retention

Best Practices for Managing Police and Firefighter Pension Plans

Ensuring Adequate Funding

Managing Investment Risks

Fostering Transparency and Accountability

Adopting Innovative Pension Plan Designs

Conclusion

Police and Firefighter Pension Plans FAQs

Police and firefighter pension plans are retirement plans that are specifically designed for police officers and firefighters. These plans provide retirement benefits to members of these professions based on their years of service and salary earned.

Police and firefighter pension plans are typically funded through a combination of employee contributions and employer contributions. Employee contributions are typically deducted from the employees' salaries, while employer contributions are paid by the government or the agency that employs the officers or firefighters.

Police and firefighter pension plans typically offer retirement benefits, including a monthly pension payment, survivor benefits, and disability benefits. The exact benefits offered may vary depending on the plan and the specific terms of the agreement.

Yes, police officers and firefighters can also receive Social Security benefits, although the amount they receive may be reduced due to their pension plan benefits. This is due to the Windfall Elimination Provision, which reduces Social Security benefits for individuals who also receive a pension from a job where they did not pay Social Security taxes.

The funding status of police and firefighter pension plans can vary depending on the plan and the government agency that sponsors it. In some cases, these plans may be underfunded, which means they do not have enough assets to cover the promised benefits. This can create financial challenges for the sponsoring agency and may lead to the need for increased contributions or benefit reductions.

True Tamplin is a published author, public speaker, CEO of UpDigital, and founder of Finance Strategists.

True is a Certified Educator in Personal Finance (CEPF®), author of The Handy Financial Ratios Guide, a member of the Society for Advancing Business Editing and Writing, contributes to his financial education site, Finance Strategists, and has spoken to various financial communities such as the CFA Institute, as well as university students like his Alma mater, Biola University, where he received a bachelor of science in business and data analytics.

To learn more about True, visit his personal website or view his author profiles on Amazon, Nasdaq and Forbes.