An underfunded pension plan refers to a scenario where a company's retirement plan has more liabilities, or projected obligations, than assets. In other words, the company has insufficient funds to meet all its future obligations to retirees. This imbalance poses significant financial risks for both the pension plan's participants and the sponsoring organization. Pension plans are retirement schemes in which an employer sets aside funds for its employees' future retirement benefits. These plans are typically defined-benefit plans, meaning the employer guarantees a specified retirement benefit to employees based on factors such as their salary, years of service, and age. The employer bears the investment risk and is responsible for ensuring that the plan has sufficient funds to meet its obligations. Investment returns play a crucial role in funding pension plans. When these returns fall short of expectations, the plan can become underfunded. Poor investment performance could be due to various factors, including economic downturns, unfavorable market conditions, or unsound investment decisions. Contributions from employers and employees are another primary source of pension funding. If these contributions decrease or don't keep pace with increasing liabilities, the pension plan can become underfunded. This could occur due to financial difficulties facing the company, policy changes, or employees opting out of the pension scheme. Liabilities increase when more employees join the pension plan or when existing members live longer than expected. Other factors, such as early retirements, generous benefit promises, or changes in actuarial assumptions, can also inflate liabilities, leading to an underfunded status. Demographic changes, such as an aging workforce, can exacerbate the underfunding issue. As more employees retire and start claiming benefits, the outflows from the pension plan can outstrip inflows, causing a funding shortfall. Broad economic factors such as low-interest rates, inflation, and economic recessions can also contribute to underfunding. For instance, low-interest rates can reduce the plan's investment income, while inflation can increase the value of the plan's obligations. Underfunded pension plans can jeopardize the retirement security of plan participants. If the plan becomes insolvent, retirees may not receive the full benefits they were promised. This can lead to financial hardship, particularly for those who do not have other sources of retirement income. For the sponsoring companies, an underfunded pension plan represents a financial liability that can affect their balance sheets and credit ratings. Companies may also have to divert resources from other areas to shore up the pension plan, impacting their overall business operations. On a broader scale, underfunded pension plans can pose risks to the economy. Large-scale defaults can strain the resources of the Pension Benefit Guaranty Corporation (PBGC), the federal agency that insures private-sector pension plans. Additionally, decreased consumer spending by retirees affected by benefit cuts can adversely impact the economy. In the United States, the Pension Protection Act (PPA) of 2006 is a significant legislation aimed at ensuring the financial health of defined benefit pension plans. The PPA requires employers to fully fund their pension plans and imposes stricter penalties for underfunding. It also enhances the rights of plan participants and promotes transparency by requiring greater disclosure of plan finances. The PBGC is a U.S. government agency that insures private-sector defined-benefit pension plans. If a plan becomes insolvent, the PBGC takes over and pays benefits to the plan's participants up to a certain limit. However, the PBGC itself is facing financial challenges due to the growing number of underfunded pension plans. Different countries have different regulations for pension funding. In the European Union, for instance, the Institutions for Occupational Retirement Provision (IORP) II Directive sets out rules for the funding of occupational pension schemes. It requires pension funds to be fully funded at all times and mandates regular stress testing to assess their resilience to adverse market conditions. One way to address underfunding is to increase contributions to the pension plan. This could involve the employer contributing more, employees contributing more, or both. However, this strategy might not be feasible if the company is facing financial difficulties or if employees are resistant to higher contributions. Another strategy is to reduce future benefit accruals or to adjust the terms of the plan. For example, the plan could switch from a defined benefit to a defined contribution scheme, where employees bear more of the investment risk. However, such changes often face legal and contractual obstacles and can be unpopular with employees. In a pension buyout, the employer purchases annuities from an insurance company to cover the plan's liabilities, effectively transferring the risk to the insurer. Alternatively, the pension plan's liabilities can be transferred to another entity in a transaction known as a pension risk transfer. These strategies can help the employer to eliminate pension liabilities from its balance sheet. Pension obligation bonds (POBs) are a controversial strategy that involves a municipality issuing bonds and investing the proceeds in the pension fund in the hope of earning a higher return. While POBs can provide immediate funding relief, they also carry significant risks if the invested funds do not achieve the expected returns. An underfunded pension plan occurs when a company's retirement plan has more liabilities than assets, posing financial risks for participants and the organization. Causes include poor investment returns, decreased contributions, increased liabilities, changes in demographics, and economic conditions. Implications involve jeopardizing retirement security, affecting company liabilities and operations, and posing risks to the economy. Legal frameworks such as the Pension Protection Act (PPA) and the role of the Pension Benefit Guaranty Corporation (PBGC) address underfunding. International regulations like the IORP II The directive promotes full funding and stress testing. Strategies to address underfunding include increasing contributions, adjusting benefits, pension buyouts and transfers, and pension obligation bonds. Each strategy has its considerations and potential impact.What Is An Underfunded Pension Plan?

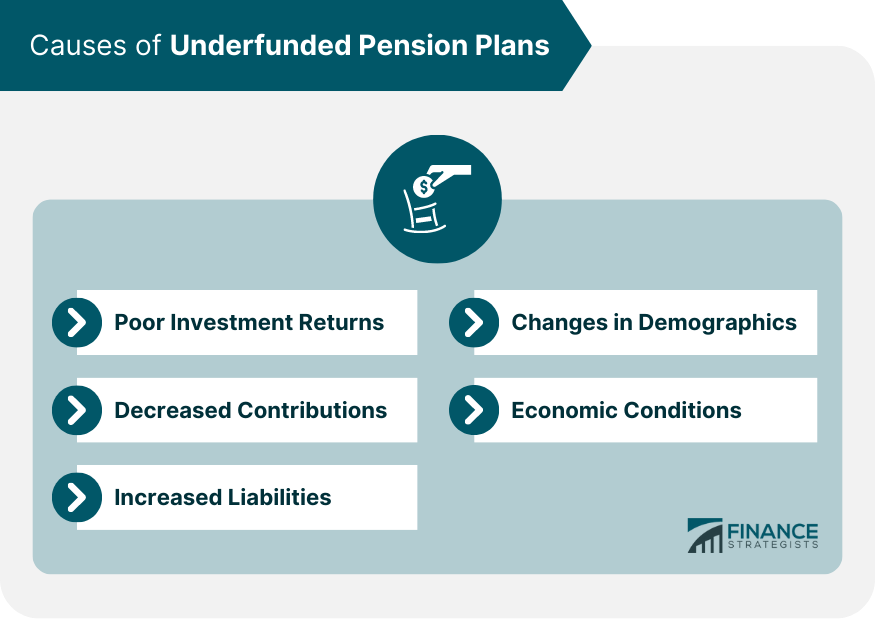

Causes of Underfunded Pension Plans

Poor Investment Returns

Decreased Contributions

Increased Liabilities

Changes in Demographics

Economic Conditions

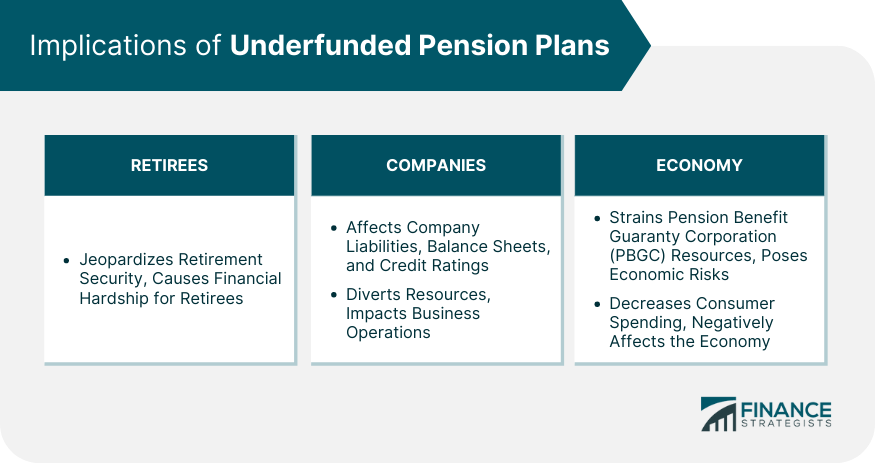

Implications of Underfunded Pension Plans

Impact on Retirees

Impact on Companies

Impact on Economy

Legal and Regulatory Framework for Pension Funding

Pension Protection Act

Role of the Pension Benefit Guaranty Corporation (PBGC)

International Regulations

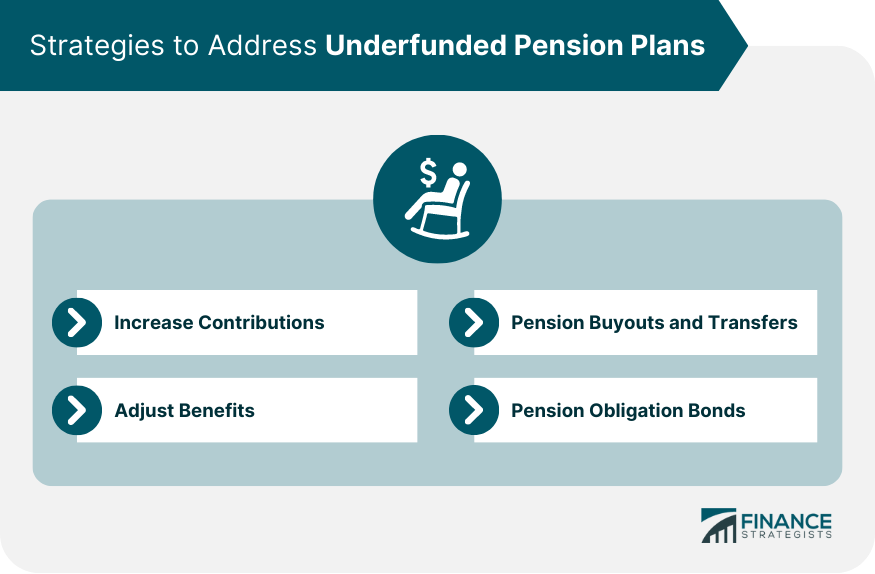

Strategies to Address Underfunded Pension Plans

Increasing Contributions

Adjusting Benefits

Pension Buyouts and Transfers

Pension Obligation Bonds

Final Thoughts

Underfunded Pension Plan FAQs

An underfunded pension plan is a retirement plan that has more projected liabilities, or future obligations, than it does assets or funds. This means the plan doesn't have enough money to pay out all of the future benefits that have been promised to employees.

Several factors can cause a pension plan to become underfunded. These include poor investment returns, decreased contributions from employers or employees, increased liabilities due to factors like higher-than-expected employee longevity, demographic changes such as more retirees than active workers, and adverse economic conditions.

For retirees, underfunded pension plans can mean reduced benefits or uncertainty about future benefit payments. For companies, an underfunded pension plan can represent a large financial liability that can affect their balance sheets, credit ratings, and overall financial health. In some cases, it might even lead to bankruptcy.

Strategies to address underfunded pension plans include increasing contributions to the plan, reducing future benefit accruals, switching from a defined benefit to a defined-contribution scheme, pension buyouts and transfers, and issuing pension obligation bonds. However, the suitability of each strategy will depend on the specific circumstances of the plan and the stakeholders involved.

The PBGC is a U.S. government agency that insures the benefits of private-sector defined-benefit pension plans. If a plan becomes insolvent, the PBGC steps in to pay benefits to the plan's participants up to a certain limit. However, the PBGC itself is facing financial challenges due to the growing number of underfunded pension plans.

True Tamplin is a published author, public speaker, CEO of UpDigital, and founder of Finance Strategists.

True is a Certified Educator in Personal Finance (CEPF®), author of The Handy Financial Ratios Guide, a member of the Society for Advancing Business Editing and Writing, contributes to his financial education site, Finance Strategists, and has spoken to various financial communities such as the CFA Institute, as well as university students like his Alma mater, Biola University, where he received a bachelor of science in business and data analytics.

To learn more about True, visit his personal website or view his author profiles on Amazon, Nasdaq and Forbes.