Voluntary Plan Termination refers to the deliberate discontinuation of an employer-sponsored benefit plan, such as a pension or 401(k) retirement plan. This usually occurs when the company can no longer afford to maintain the plan, undergoes significant structural changes, or seeks to replace the plan with a more viable alternative. The process is heavily regulated by bodies like the Employee Retirement Income Security Act (ERISA) and the Pension Benefit Guaranty Corporation (PBGC) in the United States. Depending on the type of plan, assets may be distributed to participants directly, rolled over into other retirement plans, or in the case of underfunded pension plans, partially insured by the PBGC. The termination must also be reported to appropriate governmental agencies. Employers may opt for Voluntary Plan Termination due to several reasons, including financial difficulties, the desire to shift to a different retirement plan, or changes in the workforce demographics. Some organizations may also consider terminating a plan to streamline their employee benefits offerings or to reduce administrative costs. A Standard Termination occurs when the employer demonstrates that the plan has sufficient assets to meet its obligations to participants. To qualify for a Standard Termination, the employer must provide adequate documentation, including an actuarial certification, demonstrating that the plan's assets are enough to cover all benefit liabilities. The process for Standard Termination involves several steps, including notifying plan participants, filing a Notice of Intent to Terminate with the PBGC, submitting an actuarial certification, and distributing plan assets to participants through lump-sum payments or annuities. A Distress Termination occurs when an employer is facing severe financial hardship and cannot continue to maintain the plan. To qualify for a Distress Termination, the employer must demonstrate one of the following conditions: insolvency, an inability to reorganize while maintaining the plan, or an inability to continue operations without terminating the plan. The process for Distress Termination involves several steps, including obtaining approval from the PBGC, providing notice to participants, and submitting a termination application with supporting documentation. In some cases, the PBGC may assume responsibility for the plan and provide benefits to participants up to the statutory maximum. ERISA is the primary federal law governing employee benefit plans, including pension and retirement plans. It establishes minimum standards for plan funding, disclosure, and fiduciary responsibility, as well as the rights of plan participants. ERISA also provides for the establishment of the PBGC to ensure the payment of benefits in the event of plan termination. The PBGC is a federal agency established under ERISA to protect the retirement income of plan participants. It insures defined benefit pension plans and plays a critical role in the termination process. The PBGC ensures that participants receive their benefits, up to certain limits, in the event of plan termination. The Internal Revenue Service (IRS) is responsible for enforcing the tax rules and regulations applicable to employee benefit plans, including pension and retirement plans. Employers must comply with IRS regulations when terminating a plan to ensure that the plan remains tax-qualified and that participants receive their benefits tax-free, up to certain limits. The DOL is responsible for enforcing ERISA's fiduciary and disclosure requirements, as well as ensuring that plan administrators act in the best interests of participants. Employers must comply with DOL regulations when terminating a plan to ensure that participants are adequately informed of the termination process and their rights. Before initiating a Voluntary Plan Termination, the employer must evaluate the plan's financial health. This assessment includes analyzing the plan's assets and liabilities, funded status, and actuarial assumptions. The employer should consult with actuaries, legal counsel, and other professionals to determine whether the plan has sufficient assets to cover its obligations to participants. Employers must also consider the potential consequences of plan termination on participants. This evaluation includes understanding the impact on employees' retirement security, their access to benefits, and their options for receiving distributions. Employers should also consider the potential impact on employee morale, recruitment, and retention. Based on the preliminary assessment, the employer must decide which type of termination – Standard or Distress – is appropriate for their situation. This decision will depend on the plan's financial health, the employer's financial circumstances, and the potential impact on plan participants. The employer should create a timeline for the termination process, outlining key milestones and deadlines. This timeline should account for the time required to complete the necessary filings, communicate with participants, and distribute plan assets. Employers are required to notify plan participants of their intent to terminate the plan. Employers must also provide participants with information about their rights and options in the event of plan termination. The employer must submit the necessary documents and forms to the PBGC to initiate the termination process. These documents may include the Notice of Intent to Terminate, actuarial certification, and other supporting documentation, depending on the type of termination. In addition to filing with the PBGC, the employer must also comply with IRS and DOL regulations throughout the termination process. This compliance includes filing required tax forms, adhering to fiduciary standards, and providing appropriate disclosures to participants. Upon termination of the plan, the employer must distribute plan assets to participants in the form of either lump-sum payments or annuities. The method of distribution will depend on the plan's terms, the participants' preferences, and the type of termination. If the plan has any remaining assets after paying benefits to participants, the employer may transfer these assets to successor plans or use them to purchase annuities for participants. The impact of plan termination on participants will depend on whether they receive immediate or deferred benefits. Immediate benefits are paid out shortly after termination, while deferred benefits are paid at a later date, such as upon the participant's retirement or reaching a certain age. Lump-sum distributions involve a one-time payment of the participant's entire vested benefit. This option can provide participants with immediate access to their benefits, but may also expose them to potential tax liabilities and investment risks. Annuities involve purchasing an insurance product that provides participants with a guaranteed stream of income for a specified period or for the rest of their lives. Annuities offer a steady source of income and protect participants from outliving their assets, but may have lower returns compared to other investment options. Participants may choose to rollover their benefits from the terminated plan to another retirement plan, such as an Individual Retirement Account (IRA) or a new employer's plan. Rollovers can help participants maintain tax-deferred growth and consolidate their retirement assets. Employers can consider amending the plan to address financial concerns or other issues without terminating the plan entirely. Plan amendments may involve changes to the benefit formula, vesting schedules, or eligibility requirements. Merging the plan with another plan can help streamline administration and reduce costs. Plan mergers involve combining two or more plans into a single plan, often as part of a corporate merger or acquisition. A plan spinoff involves splitting a plan into two or more separate plans. Spinoffs can help employers manage their liabilities, accommodate changes in workforce demographics, or facilitate corporate transactions, such as divestitures. Employers can implement a plan freeze, which involves stopping future benefit accruals for some or all participants while maintaining the plan's existing assets and liabilities. Plan freezes can help control costs and mitigate financial risks, but may also impact employee morale and retention. Employers must weigh the potential financial benefits of plan termination, such as reduced costs and liabilities, against the costs associated with the termination process, including filing fees, professional services, and potential PBGC premiums. Terminating a plan may have unintended consequences on employee morale, recruitment, and retention. Employers should consider the potential impact on their workforce and explore alternatives or mitigation strategies, such as offering replacement benefits or providing additional support to affected employees. Employers should evaluate the benefits and risks of plan termination in the context of their broader organizational goals and priorities. This evaluation should account for the potential impact on financial stability, workforce management, and long-term growth. By carefully considering the advantages and disadvantages of Voluntary Plan Termination, employers can make informed decisions that best serve the interests of their organizations and employees. Terminating a plan can be a complex process, involving numerous legal, regulatory, and financial considerations. Employers should seek guidance from experienced professionals, such as attorneys, actuaries, and financial advisors, to ensure compliance with applicable laws and regulations, and to navigate the termination process effectively. Clear and transparent communication is essential when considering a plan termination. Employers should keep employees informed about the reasons for termination, the expected timeline, and any changes to their benefits or options. Maintaining open lines of communication can help alleviate employee concerns and minimize potential negative impacts on morale and retention. If an employer decides to terminate a plan and offer replacement benefits, such as a new retirement plan or enhanced non-retirement benefits, it is essential to evaluate the effectiveness of these offerings in meeting employees' needs and expectations. Regular reviews and employee feedback can help ensure that replacement benefits align with workforce demographics, preferences, and financial goals. The regulatory environment surrounding employee benefit plans is continually evolving, and employers must stay abreast of new laws, regulations, and industry trends that may impact their plans. Monitoring these developments can help employers anticipate potential challenges, make informed decisions about plan termination or alternatives, and maintain compliance with applicable requirements. Voluntary Plan Termination is a significant action taken by employers, often as a result of financial challenges or strategic changes. It involves the ending of an employee benefits plan, impacting the retirement security of the workforce. It's crucial to note that this process is strictly regulated to safeguard employees' vested interests. Despite the termination, employees are assured of their accrued benefits, and the method of payout depends on the specifics of the plan and funding status. This act is typically the last resort for employers, after considering all possible alternatives, due to its potential impact on employee morale and its complex administrative requirements. Lastly, even though some risk is mitigated by entities like the PBGC, employees may still face financial losses, particularly if the plan was underfunded.Definition of Voluntary Plan Termination

Reasons for Considering Voluntary Plan Termination

Types of Voluntary Plan Termination

Standard Termination

Distress Termination

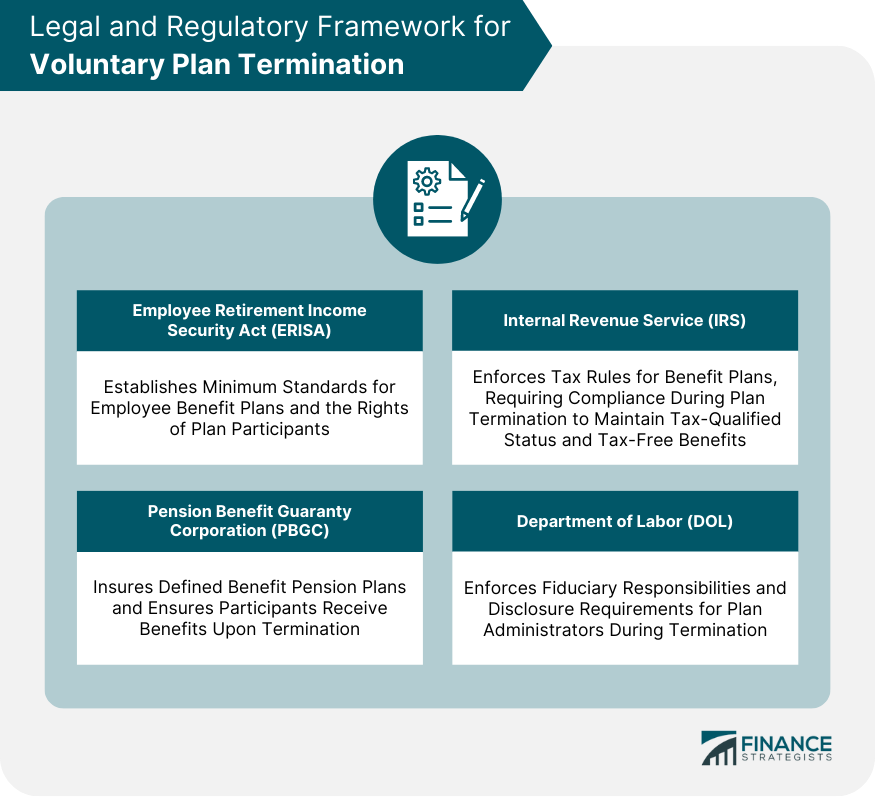

Legal and Regulatory Framework for Voluntary Plan Termination

Employee Retirement Income Security Act (ERISA)

Pension Benefit Guaranty Corporation (PBGC)

Internal Revenue Service (IRS)

Department of Labor (DOL)

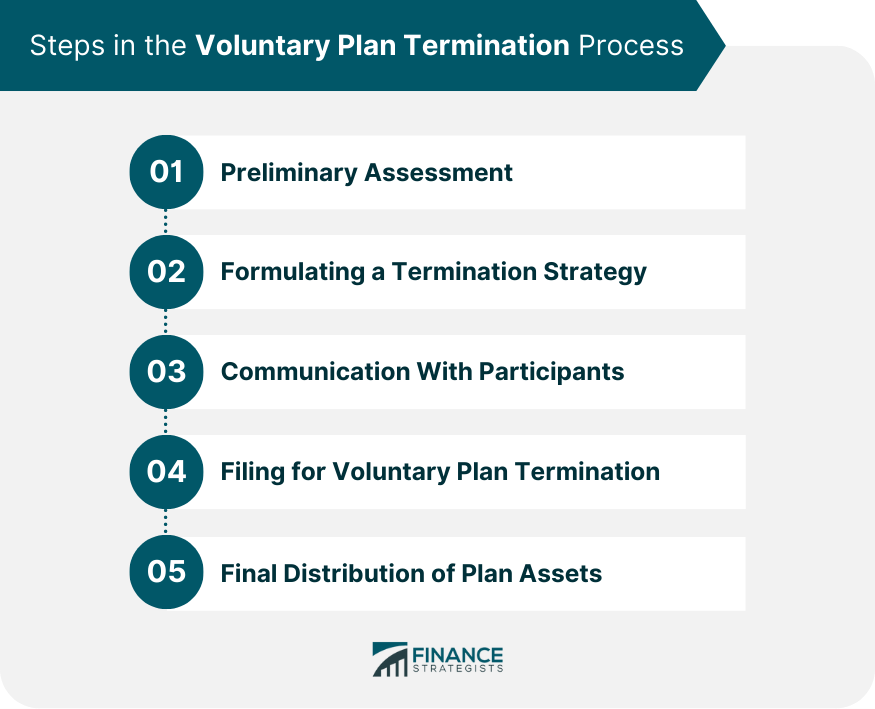

Steps in the Voluntary Plan Termination Process

Preliminary Assessment

Assessing the Financial Health of the Plan

Evaluating the Impact on Participants

Formulating a Termination Strategy

Selection of a Termination Type

Development of a Timeline

Communication With Participants

Disclosure of Termination Plans

This notification should include information about the reasons for termination, the expected timeline, and any changes to participants' benefits or options.Informing Participants of Their Rights and Options

Filing for Voluntary Plan Termination

Submission of Required Documents to the PBGC

Compliance With IRS and DOL Regulations

Final Distribution of Plan Assets

Payment of Benefits to Participants

Transfer of Remaining Assets to Successor Plans or Annuities

Impact of Voluntary Plan Termination on Participants

Immediate vs. Deferred Benefits

Lump-Sum Distributions

Annuities

Rollover Options

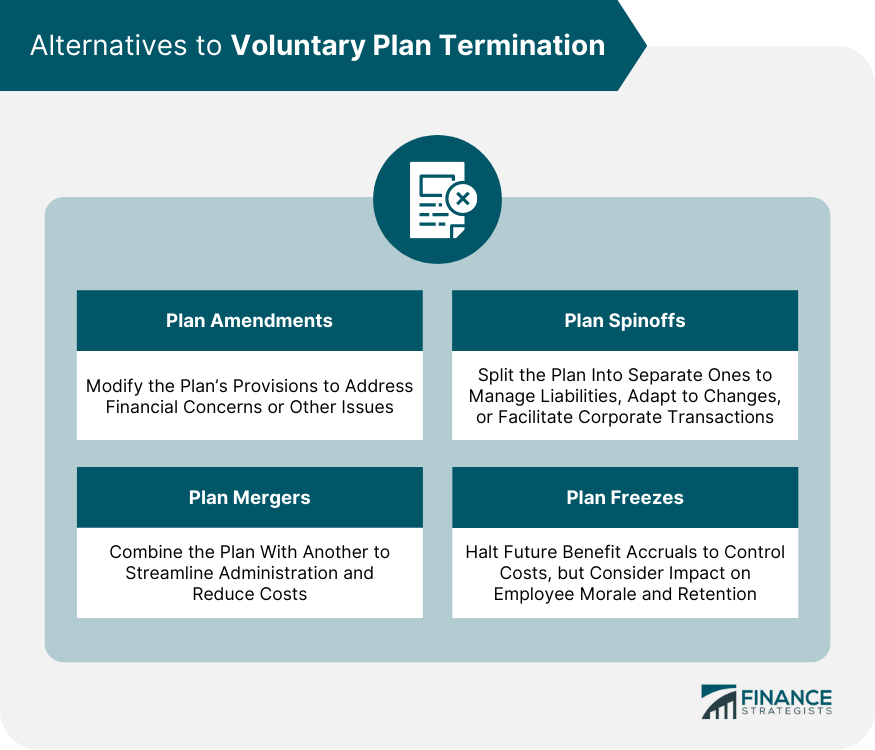

Alternatives to Voluntary Plan Termination

Plan Amendments

Plan Mergers

Plan Spinoffs

Plan Freezes

Benefits and Risks of Voluntary Plan Termination

Financial Implications for the Employer

Impact on Employee Morale and Retention

Balancing Short-Term and Long-Term Objectives

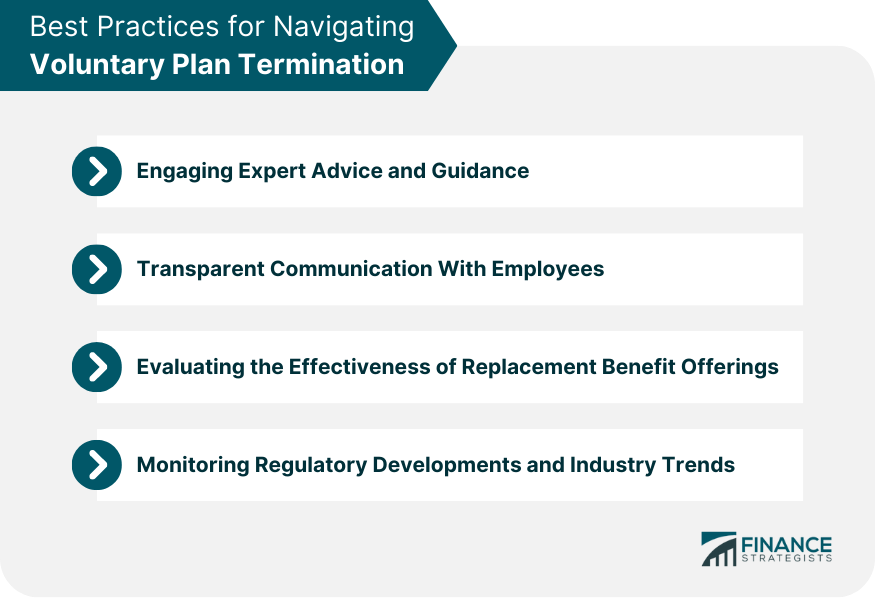

Best Practices for Navigating Voluntary Plan Termination

Engaging Expert Advice and Guidance

Transparent Communication With Employees

Evaluating the Effectiveness of Replacement Benefit Offerings

Monitoring Regulatory Developments and Industry Trends

Conclusion

Voluntary Plan Termination FAQs

A Voluntary Plan Termination is the process by which an employer decides to end an employee benefit plan, such as a pension or retirement plan, due to various reasons such as financial constraints, organizational restructuring, or changes in employee benefits landscape.

The two types of Voluntary Plan Termination are Standard Termination and Distress Termination. Standard Termination occurs when a plan has sufficient assets to cover all benefit liabilities, while Distress Termination takes place when an employer is facing severe financial hardship and cannot continue to maintain the plan.

The key regulatory bodies involved in overseeing the Voluntary Plan Termination process include the Pension Benefit Guaranty Corporation (PBGC), the Internal Revenue Service (IRS), and the Department of Labor (DOL). These agencies enforce the rules and regulations applicable to employee benefit plans and ensure compliance during the termination process.

The impact of a Voluntary Plan Termination on plan participants varies depending on the type of termination and the distribution options available to them. Participants may receive their benefits in the form of lump-sum distributions, annuities, or rollovers to other retirement plans, which can affect their retirement security and tax liabilities.

Employers can consider several alternatives to Voluntary Plan Termination, such as plan amendments, plan mergers, plan spinoffs, or plan freezes. These alternatives can help address financial concerns or other issues without terminating the plan, allowing employers to maintain retirement benefits for their employees while managing costs and risks.

True Tamplin is a published author, public speaker, CEO of UpDigital, and founder of Finance Strategists.

True is a Certified Educator in Personal Finance (CEPF®), author of The Handy Financial Ratios Guide, a member of the Society for Advancing Business Editing and Writing, contributes to his financial education site, Finance Strategists, and has spoken to various financial communities such as the CFA Institute, as well as university students like his Alma mater, Biola University, where he received a bachelor of science in business and data analytics.

To learn more about True, visit his personal website or view his author profiles on Amazon, Nasdaq and Forbes.