Qualified Nonelective Contributions (QNECs) are employer contributions made to a 401(k) or other qualified retirement plans on behalf of non-highly compensated employees (NHCEs) to help meet compliance with nondiscrimination testing requirements. These contributions are separate from employee elective deferrals and are fully vested when made. QNECs serve as a tool for employers to maintain compliance with the Internal Revenue Service's (IRS) nondiscrimination testing requirements for retirement plans. These tests ensure that retirement plans do not disproportionately benefit highly compensated employees (HCEs) over NHCEs. If a retirement plan fails nondiscrimination testing, employers can use QNECs to bridge the gap between the contributions made by HCEs and NHCEs, thus bringing the plan back into compliance. The concept of QNECs originated from the Internal Revenue Code (IRC) Section 401(k) and the Tax Reform Act of 1986. These regulations introduced the need for nondiscrimination testing in retirement plans and established the framework for QNECs. To ensure fair treatment of all employees in a retirement plan, the IRS requires two types of nondiscrimination tests: the Actual Deferral Percentage (ADP) test and the Actual Contribution Percentage (ACP) test. Actual Deferral Percentage Test: This test compares the average salary deferral percentages of HCEs and NHCEs. The test ensures that the deferrals made by HCEs are not disproportionately higher than those made by NHCEs. Actual Contribution Percentage Test: This test examines the combined employer and employee contributions made to the plan. It ensures that the total contributions made on behalf of HCEs do not exceed certain limits in relation to NHCEs. IRC Section 401(m) provides the definition and conditions for QNECs. This section also outlines the role of QNECs in the ACP test, which evaluates the proportion of total contributions made to the retirement plan. QNECs are fully vested when made, meaning that employees have immediate ownership of these contributions. QNECs are funded solely by the employer and are not subject to employee elective deferrals. QNECs are allocated to NHCEs to help satisfy the nondiscrimination testing requirements. QNECs are not subject to the same withdrawal restrictions as other types of contributions, allowing employees more flexibility in accessing these funds. Employers must first identify if their retirement plan has failed nondiscrimination testing and assess the gap between HCEs and NHCEs regarding deferrals and contributions. Employers can use the ACP test to calculate the necessary QNEC amount to bring their retirement plan back into compliance. This involves identifying the relevant NHCE group and determining the appropriate contribution levels. Once the required QNEC amount is calculated, employers must allocate the contributions to eligible NHCEs. Timing is crucial, as QNEC deposits must be made within specific deadlines to satisfy compliance requirements. Employers must also ensure proper reporting and disclosure of QNECs. Using QNECs to meet nondiscrimination testing requirements allows employers to maintain their retirement plan's compliance with IRS regulations, thus avoiding potential penalties and plan disqualification. QNECs can increase retirement savings for NHCEs by providing additional employer-funded contributions, potentially improving their overall financial well-being in retirement. By ensuring that retirement plans are non-discriminatory and providing additional contributions to NHCEs, employers can foster a sense of fairness and inclusivity, which may enhance employee morale and loyalty. Employers may be eligible for tax benefits when making QNECs, as these contributions are generally tax-deductible. Safe Harbor 401(k) plans to offer an alternative to QNECs, as they are exempt from certain nondiscrimination testing requirements. However, these plans have mandatory employer contributions and specific contribution and vesting requirements. Safe Harbor 401(k) plans to provide a more streamlined approach to nondiscrimination testing compliance. However, they may only be suitable for some employers, as they require mandatory contributions and may limit plan design flexibility compared to QNECs. Employers can also consider adjusting their retirement plan design to minimize the need for QNECs and enhance overall plan compliance. Employers can modify the contribution formulas in their retirement plans to better align with the ACP test requirements and reduce the likelihood of failing nondiscrimination testing. Introducing automatic enrollment in a retirement plan can increase participation among NHCEs, potentially improving the plan's compliance with nondiscrimination testing requirements. By providing financial education and increasing awareness of the retirement plan's benefits, employers can encourage NHCEs to participate more actively, which may help improve the plan's compliance with nondiscrimination testing. Qualified Nonelective Contributions (QNECs) are employer contributions made to a 401(k) or other qualified retirement plans on behalf of non-highly compensated employees to meet compliance with nondiscrimination testing requirements. QNECs are fully vested when made, employer-funded, allocated to NHCEs, and not subject to withdrawal restrictions. The main advantages of QNECs include maintaining plan compliance and avoiding penalties, boosting retirement savings for NHCEs, enhancing employee morale and loyalty, and providing potential tax benefits for employers. Employers can calculate and implement QNECs by determining the need, calculating the required amount, and allocating contributions to eligible NHCEs. Alternatively, employers can consider Safe Harbor 401(k) plans, plan design modifications, implement automatic enrollment, and promote financial education and plan awareness.What Are Qualified Nonelective Contributions (QNECs)?

Background and Legal Framework of QNECs

Origins of QNECs

Overview of Nondiscrimination Testing

IRC Section 401(m) and QNECs

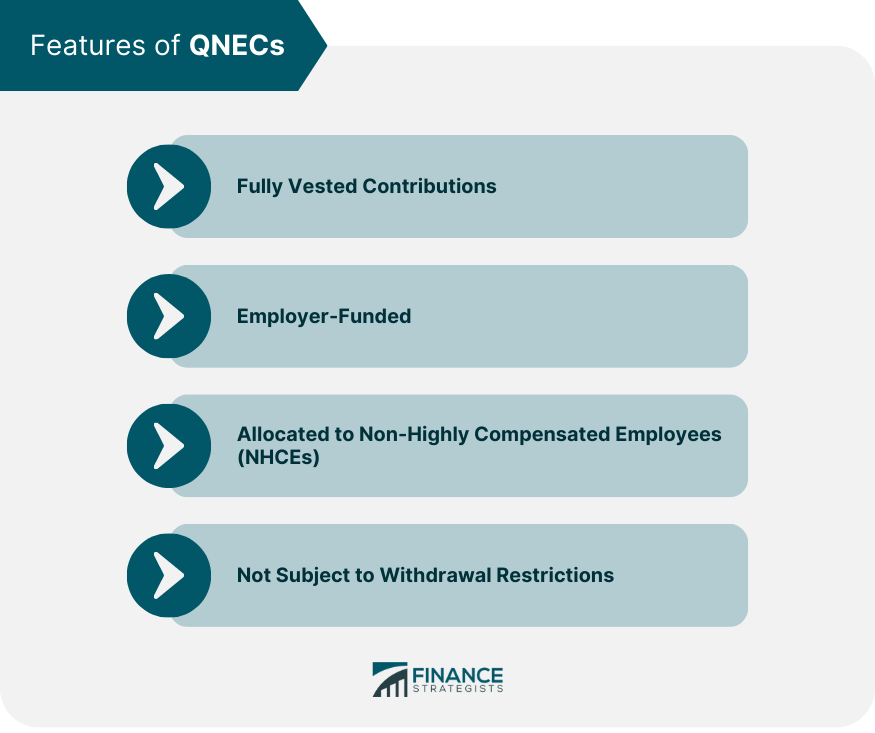

Features of QNECs

Fully Vested Contributions

Employer-Funded

Allocated to Non-Highly Compensated Employees (NHCEs)

Not Subject to Withdrawal Restrictions

Calculating and Implementing QNECs

Determining the Need for QNECs

Calculating the Required QNEC Amount

Implementing QNECs in the Retirement Plan

Advantages of QNECs

Maintaining Plan Compliance and Avoiding Penalties

Boosting Retirement Savings for NHCEs

Enhancing Employee Morale and Loyalty

Potential Tax Benefits for Employers

Alternatives to QNECs

Safe Harbor 401(k) Plans

Plan Design Modifications

Adjusting Contribution Formulas

Implementing Automatic Enrollment

Promoting Financial Education and Plan Awareness

Conclusion

Qualified Nonelective Contributions (QNECs) FAQs

Qualified Nonelective Contributions (QNECs) are employer contributions made to an employee's retirement account, such as a 401(k) plan or a defined contribution plan. QNECs are made in addition to any elective contributions that the employee may choose to make and are intended to help ensure that the plan meets certain nondiscrimination requirements.

Any employee who is eligible to participate in their employer's qualified retirement plan is eligible to receive QNECs. However, QNECs are typically made to employees who are considered highly compensated or who may receive less benefit from the plan due to nondiscrimination requirements.

The plan's nondiscrimination testing determines the amount of QNECs that an employer must contribute. The contribution amount must be enough to satisfy the plan's minimum contribution requirements while ensuring that the plan does not discriminate in favor of highly compensated employees.

QNECs are subject to the same vesting requirements as other employer contributions. Vesting determines an employee's ownership of their retirement account balance over time, and QNECs must follow the same vesting schedule as other contributions to the plan.

Yes, QNECs are subject to the same tax treatment as other contributions to the retirement plan. QNECs are typically tax-deferred, meaning that they are not subject to income tax until the employee withdraws the funds from their retirement account. However, certain types of QNECs, such as those made to a Roth 401(k) plan, may be subject to different tax rules.

True Tamplin is a published author, public speaker, CEO of UpDigital, and founder of Finance Strategists.

True is a Certified Educator in Personal Finance (CEPF®), author of The Handy Financial Ratios Guide, a member of the Society for Advancing Business Editing and Writing, contributes to his financial education site, Finance Strategists, and has spoken to various financial communities such as the CFA Institute, as well as university students like his Alma mater, Biola University, where he received a bachelor of science in business and data analytics.

To learn more about True, visit his personal website or view his author profiles on Amazon, Nasdaq and Forbes.