Retirement plan conversion, commonly referred to as a Roth conversion, is the process of transferring funds from a traditional, tax-deferred retirement account to a Roth retirement account. During a Roth conversion, the individual must pay income taxes on the converted amount, as the funds are moving from a pre-tax account to an after-tax account. However, once the funds are in the Roth account, they grow tax-free, and qualified withdrawals in retirement are not subject to income taxes. A retirement plan conversion can be a strategic move for individuals who anticipate being in a higher tax bracket in retirement or want to take advantage of a Roth account's tax-free growth and withdrawal benefits. Because a retirement plan conversion can have significant tax implications, individuals should carefully consider their current and future financial situation, tax bracket, and retirement goals before proceeding. There are several reasons why individuals may consider converting their retirement plans: When changing jobs, individuals may choose to convert their old employer-sponsored retirement plan to an IRA or a new employer-sponsored plan to maintain control over their investments. Individuals may have multiple retirement accounts from previous jobs or different types of IRAs. Consolidating these accounts can simplify account management and investment strategies. Converting retirement plans can help individuals diversify their tax exposure by converting pre-tax accounts to post-tax accounts, such as a Roth IRA. Some retirement plans may offer limited investment options or have higher fees. Converting to an IRA or another plan can provide access to a wider range of investment choices and lower costs. Converting to a new retirement plan may offer additional features, such as loan provisions or more flexible withdrawal options. Additionally, some plans may have lower fees or better customer service, making them more attractive for individuals seeking to optimize their retirement savings. Several common scenarios may prompt individuals to consider converting their retirement plans: When leaving a job, individuals can transfer their 401(k) assets to a traditional or Roth Individual Retirement Account (IRA), providing more control over investment options and potentially lower fees. Individuals may convert a traditional IRA to a Roth IRA for tax diversification purposes or to take advantage of tax-free withdrawals during retirement. When starting a new job, individuals can choose to transfer their previous employer-sponsored plan assets to their new employer's plan if allowed. Upon leaving a governmental or nonprofit job, individuals may convert their 457 or 403(b) plan assets to a traditional or Roth IRA to maintain control over their investments and simplify account management. When considering a retirement plan conversion, individuals should follow these steps: Review your overall financial situation, retirement goals, and investment strategies to determine if a conversion aligns with your objectives. Consider the benefits and drawbacks of converting your retirement plans, such as tax implications, investment options, and fees. Review the rules and restrictions of your current retirement plan and the plan you intend to convert to, ensuring you meet all eligibility requirements. Before deciding, consult with a financial advisor or tax professional to discuss your situation and the potential consequences of conversion. Once you have decided to proceed with the conversion, complete all necessary paperwork and follow the steps required by your current and new retirement plan providers. Understanding the tax implications of retirement plan conversions is crucial for making informed decisions: Certain conversions may result in taxable events, such as: Traditional IRA to Roth IRA: The amount converted is generally treated as taxable income. 401(k) to Roth IRA: The amount converted is typically considered taxable income. Some conversions do not result in immediate tax consequences, including: Traditional IRA to Traditional IRA: No taxes are incurred as long as the rollover is completed within 60 days. 401(k) to Traditional IRA: Pre-tax funds rolled over into a traditional IRA maintain their tax-deferred status. To minimize taxes associated with conversions, consider the following strategies: Timing the Conversion: Convert during a year when you expect to have a lower income or be in a lower tax bracket. Spreading the Conversion Over Multiple Years: Convert a portion of your retirement assets each year to spread the tax liability across several years. Utilizing Existing Tax Losses: Use any existing tax losses to offset the taxable income generated by a conversion. Avoid these common mistakes when converting retirement plans: Failing to understand the tax consequences of conversion can lead to unexpected tax liabilities and financial setbacks. If the rollover is not completed within 60 days, the transaction may be considered a distribution, resulting in taxes and possible penalties. Ensure that you have taken any required minimum distributions (RMDs) before converting, as RMDs cannot be rolled over or converted to another retirement account. Before converting, review the investment options and fees associated with your new retirement plan to ensure they align with your goals and risk tolerance. When converting a retirement plan, update your beneficiary designations to ensure your assets are distributed according to your wishes upon your death. Retirement plan conversion or Roth conversion involves transferring funds from a traditional, tax-deferred retirement account to a Roth retirement account. Although the converted amount is subject to income taxes, funds in the Roth account grow tax-free, and qualified withdrawals in retirement are not subject to income taxes. Individuals may consider converting their retirement plans due to changing jobs, consolidating multiple accounts, tax planning and diversification, improved investment options, access to better features or lower fees, and other reasons. Before proceeding with retirement plan conversion, individuals should carefully evaluate their current and future financial situation, tax bracket, and retirement goals, and seek advice from financial advisors or tax professionals. Common mistakes to avoid during retirement plan conversion include not considering tax implications, failing to observe the 60-day rollover rule, overlooking required minimum distributions, ignoring investment options and fees, and neglecting beneficiary designations. By staying proactive and informed about retirement assets, individuals can work towards a secure and comfortable retirement.What Is Retirement Plan Conversion?

Reasons to Perform a Retirement Plan Conversion

Changing Jobs or Careers

Consolidating Multiple Retirement Accounts

Tax Planning and Diversification

Improved Investment Options and Flexibility

Access to Better Features or Lower Fees

Common Retirement Plan Conversion Scenarios

401(k) to IRA

Traditional IRA to Roth IRA

Rollover From One Employer Plan to Another

Conversion of a Governmental or Nonprofit Plan to an IRA

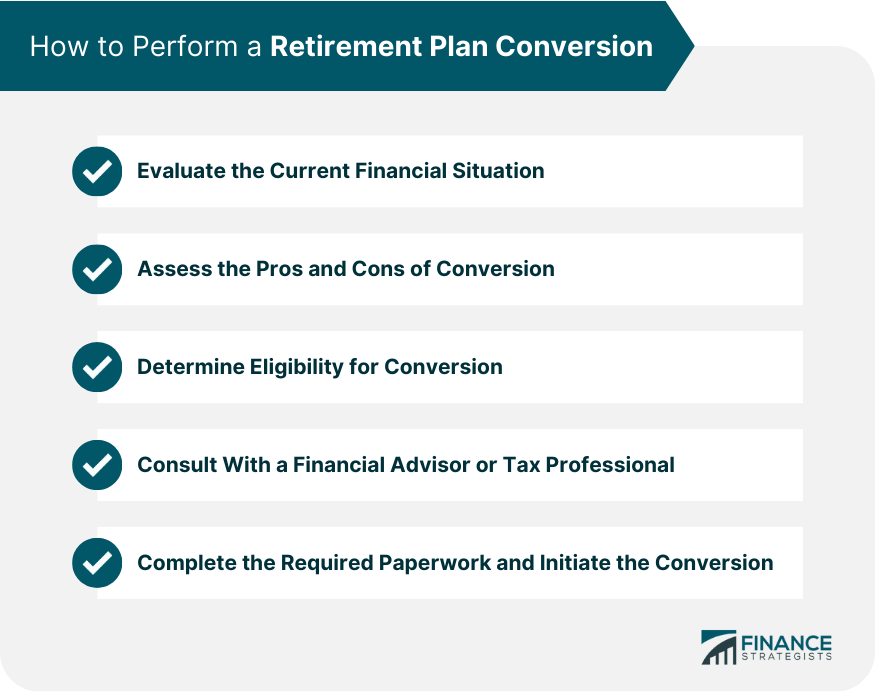

How to Perform a Retirement Plan Conversion

Evaluate the Current Financial Situation

Assess the Pros and Cons of Conversion

Determine Eligibility for Conversion

Consult With a Financial Advisor or Tax Professional

Complete the Required Paperwork and Initiate the Conversion

Tax Implications of Retirement Plan Conversion

Taxable Conversions

Non-Taxable Conversions

Tax Strategies for Minimizing Conversion Taxes

Mistakes to Avoid During Retirement Plan Conversion

Not Considering Tax Implications

Failing to Observe the 60-Day Rollover Rule

Overlooking Required Minimum Distributions (RMDs)

Ignoring Investment Options and Fees

Neglecting Beneficiary Designations

Conclusion

Retirement Plan Conversion FAQs

A retirement plan conversion is the process of transferring funds from one type of retirement plan to another, such as from a traditional IRA to a Roth IRA.

A retirement plan conversion may benefit individuals who expect to be in a higher tax bracket in the future, as it allows them to pay taxes on their retirement savings now at a lower tax rate.

A retirement plan conversion typically results in a taxable event, as any pre-tax contributions or earnings are subject to income tax in the year of conversion. However, a conversion to a Roth IRA may provide tax-free distributions in retirement.

Yes, anyone with funds in a qualifying retirement plan can do a conversion as long as they meet the eligibility requirements for the receiving plan and comply with any applicable tax laws and regulations.

To initiate a retirement plan conversion, you must contact your current and receiving plan administrators and follow their specific procedures for initiating the transfer. It's also recommended to consult with a financial advisor or tax professional to ensure the conversion is appropriate for your specific financial situation.

True Tamplin is a published author, public speaker, CEO of UpDigital, and founder of Finance Strategists.

True is a Certified Educator in Personal Finance (CEPF®), author of The Handy Financial Ratios Guide, a member of the Society for Advancing Business Editing and Writing, contributes to his financial education site, Finance Strategists, and has spoken to various financial communities such as the CFA Institute, as well as university students like his Alma mater, Biola University, where he received a bachelor of science in business and data analytics.

To learn more about True, visit his personal website or view his author profiles on Amazon, Nasdaq and Forbes.