A retirement plan forfeiture occurs when an employee loses the rights to some or all of their employer-contributed retirement benefits. Forfeitures typically occur when an employee fails to meet certain requirements or conditions as specified in the retirement plan. Understanding the concept of forfeiture is essential for both employees and employers in order to navigate retirement planning effectively. Both parties need to be aware of the implications of forfeitures in order to optimize retirement planning and prevent potential financial losses. There are various types of retirement plans, each with its own forfeiture rules. Some common types include defined contribution plans, such as 401(k) and 403(b) plans, and defined benefit plans, such as traditional pension plans. Understanding the specific forfeiture rules of each plan type is crucial for employees and employers to make well-informed decisions about retirement planning. Employee termination is one of the main reasons for retirement plan forfeitures. When an employee leaves a job, they may lose some or all of their employer-contributed benefits, depending on the specific plan and vesting requirements. Termination can be voluntary (resignation) or involuntary (dismissal), and the impact on retirement plan forfeitures may vary accordingly. Vesting refers to the process by which an employee gradually gains ownership of employer-contributed retirement benefits over time. If an employee leaves their job before fully vesting in their retirement plan, they may forfeit some or all of their unvested benefits. Vesting schedules, which determine the rate at which employees gain ownership of their benefits, play a crucial role in retirement plan forfeitures. Excess contributions occur when an employee or employer contributes more than the allowable limits to a retirement plan. Corrective distributions return the excess contributions to the employee or employer, and these returned amounts may be subject to forfeiture. Understanding and adhering to contribution limits is essential for minimizing the risk of forfeitures due to excess contributions. A retirement plan may be disqualified if it fails to meet certain Internal Revenue Service (IRS) and Department of Labor (DOL) requirements. Disqualification can result in the forfeiture of retirement benefits, as well as significant tax consequences for both employees and employers. Ensuring compliance with applicable regulations is crucial for avoiding plan disqualification and the resulting forfeitures. Certain retirement plans have specific rules regarding the forfeiture of benefits in the event of an employee's death or disability. These rules vary depending on the plan, and employees should be aware of the potential impact on their retirement savings. Employers should also communicate these rules clearly to help employees make informed decisions about their retirement planning. Vesting is the process by which an employee earns the right to retain employer-contributed retirement benefits, even if they leave the company. The rate at which employees become vested in their retirement plan depends on the plan's vesting schedule. Understanding the concept of vesting and the different types of vesting schedules is crucial for employees and employers in managing retirement plan forfeitures. There are three main types of vesting schedules: immediate vesting, cliff vesting, and graded vesting. Each vesting schedule has its own implications for retirement plan forfeitures. In immediate vesting, employees gain full ownership of their employer-contributed retirement benefits as soon as they are eligible for the plan. This means that there is no risk of forfeiture due to vesting requirements. Immediate vesting is more employee-friendly, but it may not provide the same incentives for long-term employment as other vesting schedules. Cliff vesting requires employees to work for a specific period before they become fully vested in their retirement plan. If an employee leaves the company before reaching the cliff, they forfeit all of their unvested employer-contributed benefits. Employers may use cliff vesting to encourage employee retention, but it can result in significant forfeitures if employees leave before reaching the vesting milestone. Graded vesting gradually increases an employee's ownership percentage of employer-contributed retirement benefits over a set period, typically expressed in years of service. Employees who leave the company before fully vesting may forfeit a portion of their unvested benefits. Graded vesting provides a more balanced approach, offering some incentives for long-term employment while still allowing employees to retain partial benefits if they leave the company early. Vesting schedules significantly impact the likelihood and extent of retirement plan forfeitures. Immediate vesting eliminates the risk of forfeiture due to vesting requirements, while cliff and graded vesting schedules can result in partial or total forfeiture of unvested benefits. Employers should carefully consider the implications of different vesting schedules on forfeitures when designing retirement plans. When retirement plan forfeitures occur, employers have several options for reallocating the forfeited funds. These options include redistributing the funds to remaining plan participants, applying the funds to reduce employer contributions, or using the funds for plan expenses. Each approach has its own benefits and drawbacks, and employers should carefully consider the best method for their specific plan. One option for reallocating forfeited funds is to distribute them among the remaining plan participants. This approach can help to offset losses due to forfeitures while also providing a potential incentive for remaining employees to stay with the company. However, redistribution may also complicate plan administration and reporting requirements. Another option is to use forfeited funds to offset future employer contributions to the retirement plan. This approach can help employers reduce their overall costs and simplify plan administration. However, it may not provide the same incentives for employee retention as redistributing the funds among remaining plan participants. Employers can also use forfeited funds to cover plan-related expenses, such as administrative and recordkeeping costs. This approach can help to reduce the financial burden of maintaining the retirement plan but may not provide any direct benefits to employees or encourage long-term employment. Timely and accurate processing of retirement plan forfeitures is essential for maintaining compliance with IRS and DOL regulations and ensuring the proper management of retirement plan assets. Delays or errors in forfeiture processing can result in penalties, interest, and other negative consequences. Employers should establish clear processes and procedures for handling forfeitures to minimize the risk of errors and ensure timely processing. Complying with IRS and DOL regulations is crucial for avoiding retirement plan disqualification, penalties, and other negative consequences. Employers should be familiar with the rules and requirements governing retirement plan forfeitures and ensure that their plans are structured and managed in accordance with these regulations. This may involve seeking professional guidance and assistance from retirement plan experts, such as plan administrators or financial advisors. Effective employee education and communication are key to preventing retirement plan forfeitures. Employers should provide employees with clear, accurate information about their retirement plans, including vesting schedules and potential forfeiture scenarios. This can help employees make informed decisions about their retirement savings and reduce the likelihood of forfeitures due to misunderstandings or lack of awareness. Offering a diverse range of investment options within a retirement plan can help to reduce the likelihood of forfeitures by allowing employees to tailor their investment strategies to their individual needs and preferences. This can encourage employees to remain engaged with their retirement savings and increase their overall satisfaction with the plan, potentially reducing turnover and forfeitures. Employers can implement various strategies to encourage long-term employment, such as offering competitive benefits packages, promoting a positive workplace culture, and providing opportunities for career growth and development. These efforts can help to reduce employee turnover and, in turn, minimize retirement plan forfeitures. Employers should periodically review and adjust their retirement plans to ensure they continue to meet the needs of employees and align with the organization's goals. Regular plan reviews can help identify opportunities for improvement, such as adjusting vesting schedules or modifying plan features to reduce the likelihood of forfeitures. This proactive approach can contribute to a more effective and efficient retirement plan. Retirement plan forfeitures can have tax consequences for employees, depending on the specific circumstances and the type of retirement plan involved. For example, forfeited amounts from certain plans may be considered taxable income for the employee. Employees should be aware of the potential tax implications of forfeitures and consult with a tax professional to ensure they comply with applicable tax laws and regulations. Forfeitures can also have tax consequences for employers. Depending on the type of retirement plan and the method used to reallocate forfeited funds, employers may be subject to additional taxes or deductions. Employers should consult with tax professionals to understand the tax implications of retirement plan forfeitures and ensure compliance with applicable tax laws. Employers are required to report retirement plan forfeitures to the IRS using the appropriate forms and procedures. Accurate and timely reporting is essential for maintaining compliance with tax laws and regulations. Employers should be familiar with the reporting requirements related to retirement plan forfeitures and seek professional guidance if necessary to ensure accurate reporting. Understanding retirement plan forfeitures is crucial for both employees and employers in managing their retirement planning effectively. Various factors can cause forfeitures, including employee termination, failure to meet vesting requirements, excess contributions, plan disqualification, and death or disability. Vesting schedules significantly impact the likelihood and extent of forfeitures. Employers have options for reallocating forfeited funds, including redistribution to remaining plan participants, applying funds to reduce employer contributions, and using funds for plan expenses. Preventing forfeitures involves effective employee education and communication, offering a variety of investment options, encouraging long-term employment, and periodic plan review and adjustment. Retirement plan forfeitures have tax implications for both employees and employers, and complying with IRS reporting requirements is essential. By understanding the causes and prevention of retirement plan forfeitures, employees and employers can minimize financial losses and maximize retirement savings.What Are Retirement Plan Forfeitures?

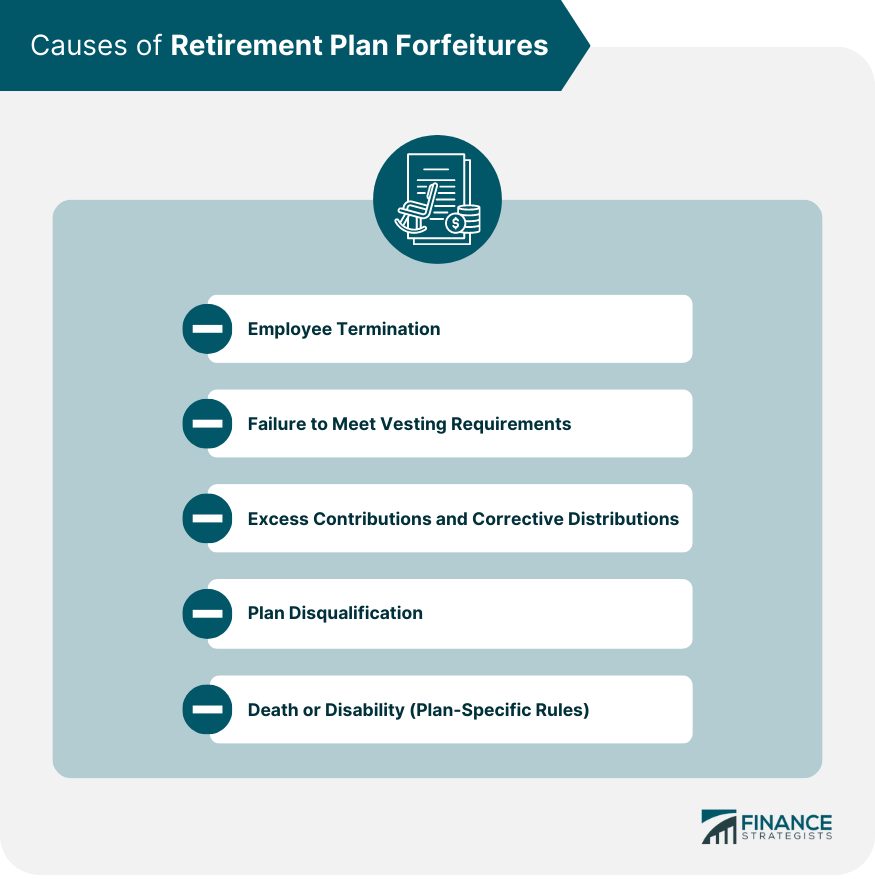

Causes of Retirement Plan Forfeitures

Employee Termination

Failure to Meet Vesting Requirements

Excess Contributions and Corrective Distributions

Plan Disqualification

Death or Disability (Plan-Specific Rules)

Vesting Schedules and Forfeiture

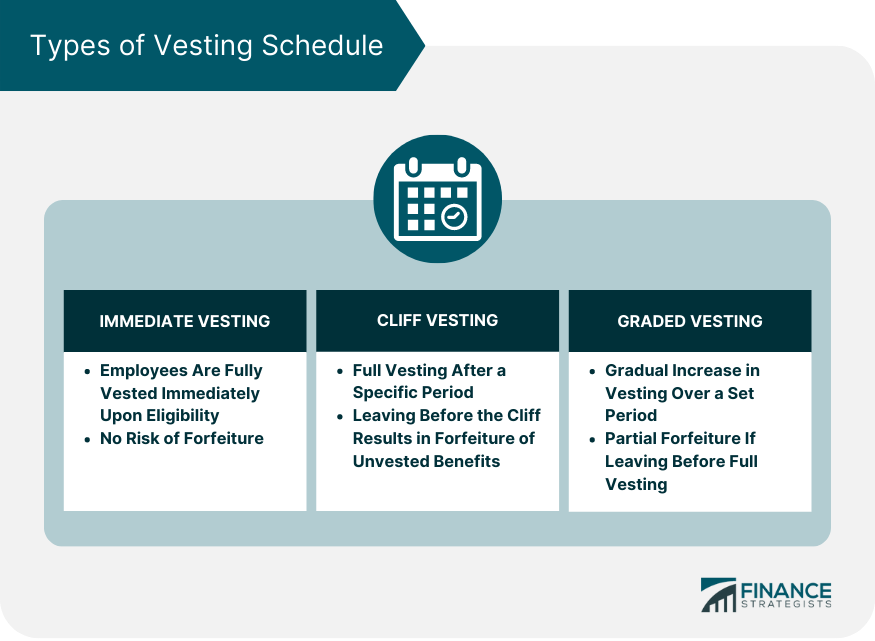

Types of Vesting Schedules

Immediate Vesting

Cliff Vesting

Graded Vesting

Impact of Vesting Schedules on Forfeitures

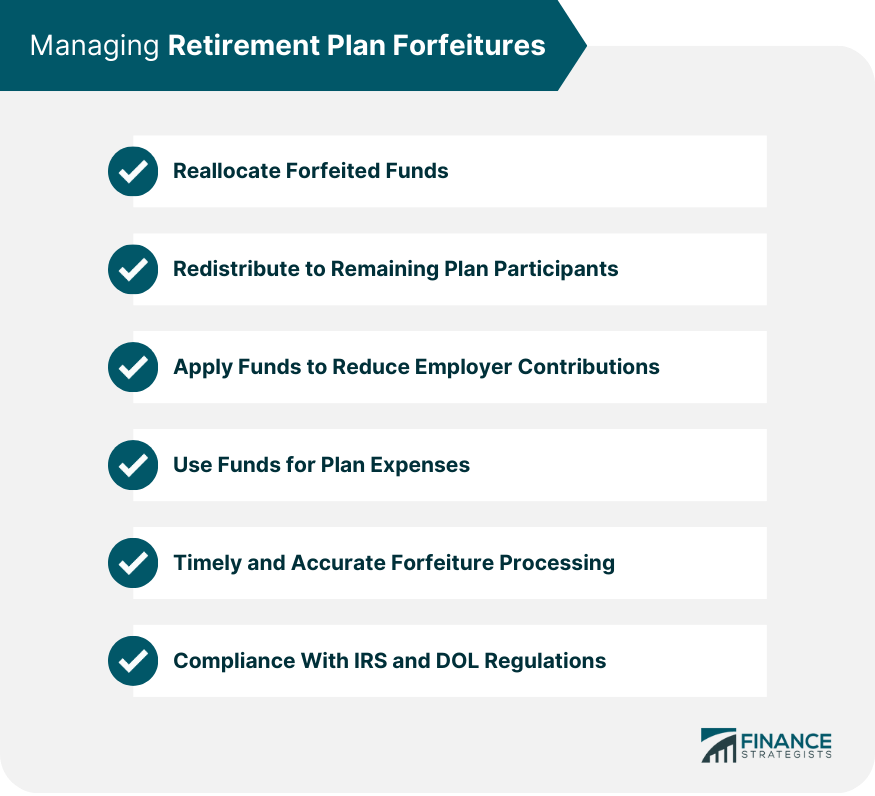

Managing Retirement Plan Forfeitures

Reallocating Forfeited Funds

Redistribution to Remaining Plan Participants

Applying Funds to Reduce Employer Contributions

Using Funds for Plan Expenses

Timely and Accurate Forfeiture Processing

Compliance with IRS and DOL Regulations

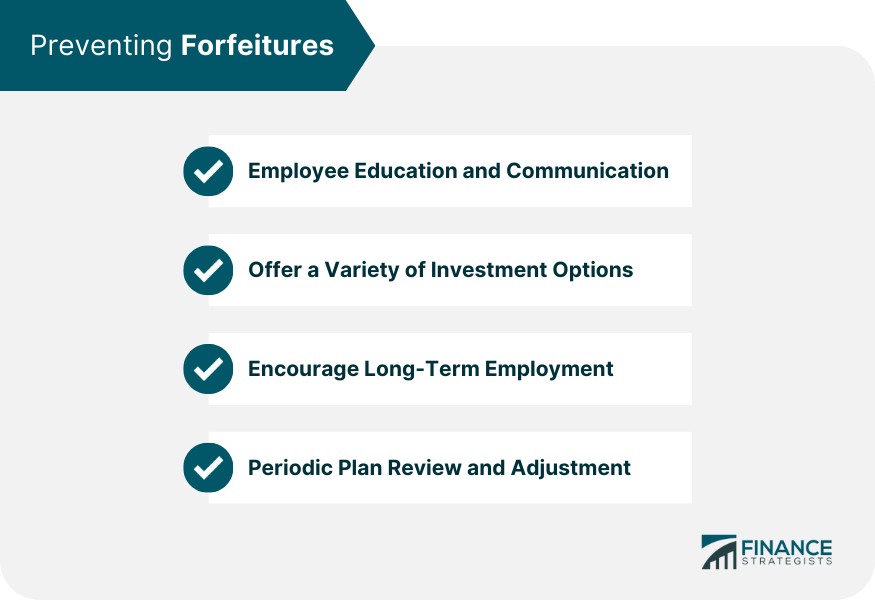

Preventing Forfeitures

Employee Education and Communication

Offering a Variety of Investment Options

Encouraging Long-Term Employment

Periodic Plan Review and Adjustment

Tax Implications of Retirement Plan Forfeitures

Tax Consequences for Employees

Tax Consequences for Employers

IRS Reporting Requirements

Final Thoughts

Retirement Plan Forfeitures FAQs

Retirement plan forfeitures occur when an employee loses the rights to some or all of their employer-contributed retirement benefits, usually due to failure to meet certain requirements or conditions. Understanding forfeitures is important for both employees and employers to effectively navigate retirement planning and prevent potential financial losses.

The main causes of retirement plan forfeitures include employee termination (voluntary or involuntary), failure to meet vesting requirements, excess contributions and corrective distributions, plan disqualification, and death or disability (depending on plan-specific rules).

Vesting schedules, which determine the rate at which employees gain ownership of employer-contributed retirement benefits, significantly impact the likelihood and extent of retirement plan forfeitures. Immediate, cliff, and graded vesting schedules each have different implications for forfeitures, and employers should carefully consider these when designing retirement plans.

To minimize retirement plan forfeitures, employers and employees should focus on effective communication, offering diverse investment options, and encouraging long-term employment. Periodic plan reviews and adjustments can also help identify opportunities for improvement and reduce the likelihood of forfeitures.

Retirement plan forfeitures can have tax consequences for both employees and employers, depending on the specific circumstances and the type of retirement plan involved. Employees may face taxable income from forfeited amounts, while employers may be subject to additional taxes or deductions. Accurate and timely reporting of forfeitures to the IRS is essential for maintaining compliance with tax laws and regulations.

True Tamplin is a published author, public speaker, CEO of UpDigital, and founder of Finance Strategists.

True is a Certified Educator in Personal Finance (CEPF®), author of The Handy Financial Ratios Guide, a member of the Society for Advancing Business Editing and Writing, contributes to his financial education site, Finance Strategists, and has spoken to various financial communities such as the CFA Institute, as well as university students like his Alma mater, Biola University, where he received a bachelor of science in business and data analytics.

To learn more about True, visit his personal website or view his author profiles on Amazon, Nasdaq and Forbes.