Self-employed retirement plans are specialized savings plans designed for self-employed individuals, including freelancers, contractors, sole proprietors, and small business owners. These plans allow these individuals to save money for their retirement in a tax-advantaged way. They typically do not have access to employer-sponsored retirement plans, such as 401(k)s, which can make it more difficult to save. Therefore, it is important for self-employed individuals to explore alternative options for retirement savings, such as self-employed retirement plans. By doing so, they can ensure that they are able to save for their future and achieve financial security in retirement. Before selecting a retirement plan, it is essential to consider several factors that may impact your decision. These factors will help you choose the best plan for your needs and financial goals. Different retirement plans have varying income and contribution limits. Assess your income and the amount you wish to contribute to your retirement account to determine which plan suits you best. Consider the tax advantages of different retirement plans, such as tax-deferred growth, deductible contributions, or tax-free withdrawals. Evaluate the flexibility and control provided by each plan in terms of contribution and withdrawal rules, investment options, and plan administration. Examine the investment options available in each retirement plan, such as mutual funds, stocks, bonds, and other investment vehicles. Assess each retirement plan's administrative complexity and costs, including setup fees, annual maintenance fees, and reporting requirements. If you have employees, consider the impact of the retirement plan on their benefits and retirement savings options. Several retirement plan options are available to self-employed individuals. This section will discuss the most popular plans, their features, and their advantages and disadvantages. A Simplified Employee Pension (SEP) IRA is an Individual Retirement Account (IRA) specifically designed for self-employed individuals and small business owners. It allows employers to make tax-deductible contributions on behalf of eligible employees, including themselves. Contributions to a SEP IRA are tax-deductible, and the accounts' investments grow tax-deferred until withdrawn during retirement. SEP IRAs are easy to set up and have low administrative costs. However, they have lower contribution limits than other retirement plans like Solo 401(k)s. A Solo 401(k) plan is designed for self-employed individuals without any employees except for their spouse. It allows for both employee (salary deferral) and employer (profit-sharing) contributions. Contributions to a Solo 401(k) plan are tax-deductible, and the investments grow tax-deferred. Some Solo 401(k) plans also offer a Roth option, allowing for tax-free withdrawals in retirement. Solo 401(k) plans have higher contribution limits and offer more flexibility in terms of investment options compared to SEP IRAs. However, they may have higher administrative costs and complexity. A SIMPLE IRA (Savings Incentive Match Plan for Employees) is designed for self-employed individuals and small businesses with 100 or fewer employees. It allows both employee and employer contributions. Contributions to a SIMPLE IRA are tax-deductible, and the investments grow tax-deferred until withdrawn during retirement. SIMPLE IRAs are easy to set up and have low administrative costs. However, they have lower contribution limits than SEP IRAs and Solo 401(k) plans. A Defined Benefit Plan is a traditional pension plan that guarantees a specific monthly benefit at retirement based on a formula that considers factors like salary and years of service. It is suitable for self-employed individuals or small business owners who want a higher level of guaranteed retirement income. Contributions to a Defined Benefit Plan are tax-deductible, and the investments within the plan grow tax-deferred. Defined Benefit Plans offer a guaranteed retirement income, but they have higher administrative costs and complexity than other retirement plans. Roth IRA and Traditional IRAs are individual retirement accounts that provide tax advantages for retirement savings. While they are not specifically designed for self-employed individuals, they can be used as supplemental retirement savings vehicles. Contributions to a Traditional IRA may be tax-deductible, and the investments grow tax-deferred. Roth IRA contributions are made with after-tax dollars, but the investments grow tax-free, and qualified withdrawals are also tax-free. IRAs provide additional retirement savings options and can be used in conjunction with other self-employed retirement plans. However, they have lower contribution limits and income restrictions may apply. Evaluate the factors mentioned earlier and compare the features of different retirement plans to choose the one that best suits your needs and financial goals. Select a reputable financial institution, such as a bank, brokerage firm, or mutual fund company, to establish and manage your retirement plan. Follow the financial institution's guidelines to establish your retirement plan, open an account, and complete any required paperwork or online forms. Select appropriate investments for your retirement plan, considering your risk tolerance and time horizon. Make regular contributions to your account and adjust your investment strategy as needed. Ensure that you meet your retirement plan's ongoing reporting and compliance requirements, such as filing annual reports or maintaining plan documents. Retirement planning is essential for self-employed individuals, as they often lack access to employer-sponsored plans. By considering factors such as income and contribution limits, tax advantages, flexibility, investment options, and administrative complexity, you can identify the best retirement plan for your needs. Various self-employed retirement plans offer unique features and benefits, including SEP IRAs, Solo 401(k) plans, SIMPLE IRAs, Defined Benefit Plans, and Traditional and Roth IRAs. Setting up a retirement plan involves selecting the right plan, choosing a financial institution, establishing the plan and account, managing investments and contributions, and ensuring ongoing maintenance and compliance. To maximize your retirement savings, utilize strategies such as catch-up contributions, investment diversification, risk and return balancing, and tax-efficient withdrawals. Consulting with a financial advisor can help you create a tailored retirement plan that aligns with your financial goals, ensuring a secure and comfortable retirement.What Are Self-Employed Retirement Plans?

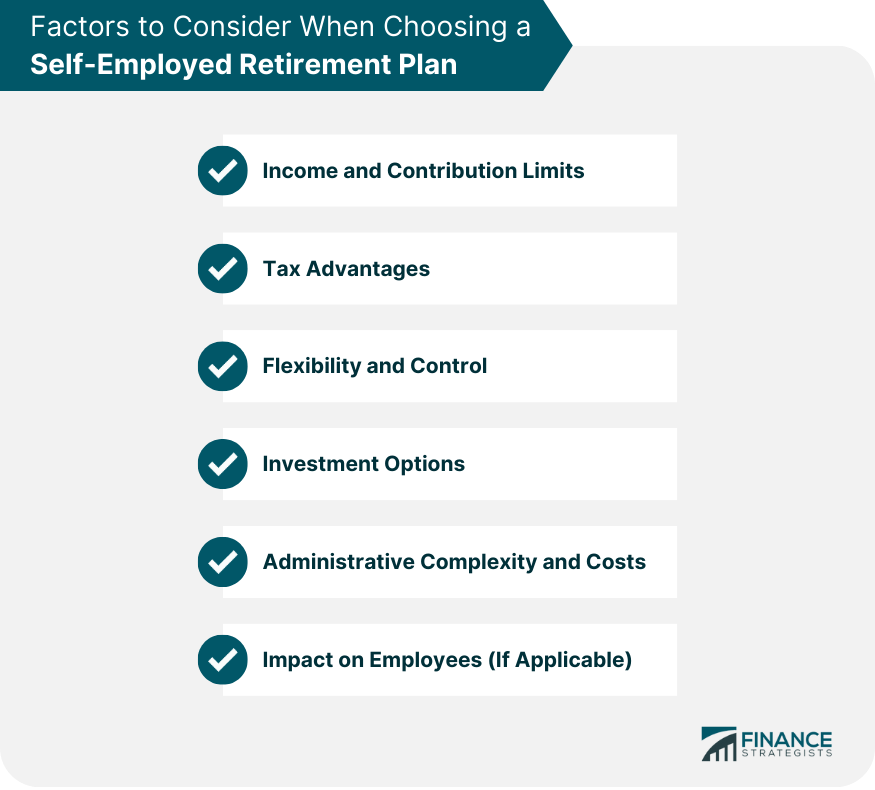

Retirement planning is essential for financial security, regardless of employment status. However, self-employed individuals face unique challenges when it comes to saving for retirement. Factors to Consider When Choosing a Self-Employed Retirement Plan

Income and Contribution Limits

Tax Advantages

Flexibility and Control

Investment Options

Administrative Complexity and Costs

Impact on Employees (If Applicable)

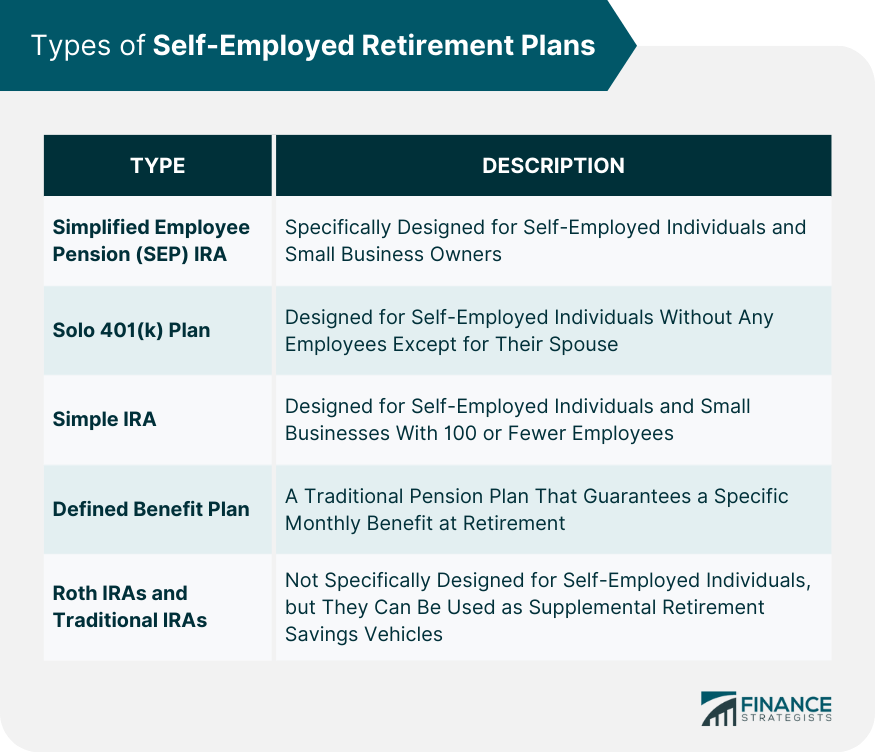

Types of Self-Employed Retirement Plans

Simplified Employee Pension (SEP) IRA

Solo 401(k) Plan

SIMPLE IRA

Defined Benefit Plan

Roth IRAs and Traditional IRAs

How to Set Up a Self-Employed Retirement Plan

Selecting the Right Plan

Choosing a Financial Institution

Establishing the Plan and Account

Managing Investments and Contributions

Ongoing Maintenance and Compliance

Conclusion

Self-Employed Retirement Plans FAQs

Self-employed retirement plans are investment plans designed for individuals who are self-employed or own a small business to save for their retirement.

The options for self-employed retirement plans include solo 401(k), Simplified Employee Pension (SEP) IRA, Savings Incentive Match Plan for Employees (SIMPLE) IRA, and individual (or solo) defined benefit plan.

Yes, contributions made to self-employed retirement plans are tax deductible, subject to certain limits.

The contribution limits for self-employed retirement plans vary depending on the type of plan and your income. For example, the contribution limit for a SEP IRA in 2023 is the lesser of 25% of your compensation or $58,000.

For tax purposes, you must set up a self-employed retirement plan by the due date of your tax return, including extensions. However, you can contribute to the plan at any time during the year or by the due date of your return.

True Tamplin is a published author, public speaker, CEO of UpDigital, and founder of Finance Strategists.

True is a Certified Educator in Personal Finance (CEPF®), author of The Handy Financial Ratios Guide, a member of the Society for Advancing Business Editing and Writing, contributes to his financial education site, Finance Strategists, and has spoken to various financial communities such as the CFA Institute, as well as university students like his Alma mater, Biola University, where he received a bachelor of science in business and data analytics.

To learn more about True, visit his personal website or view his author profiles on Amazon, Nasdaq and Forbes.