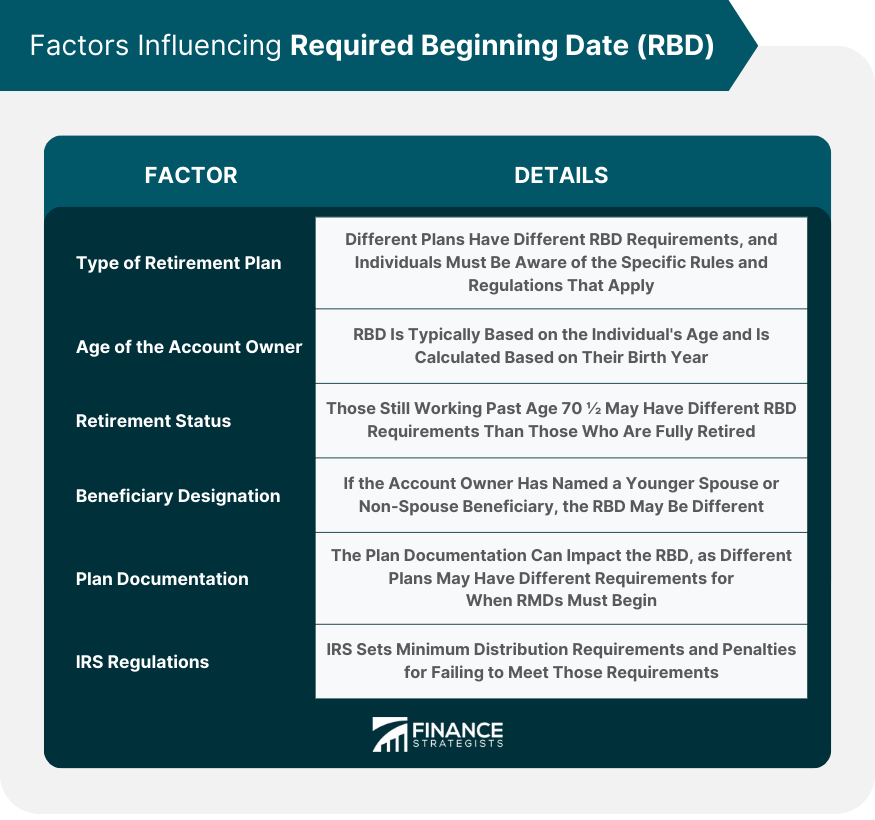

The Required Beginning Date is the date by which individuals with qualified retirement accounts must begin taking Required Minimum Distributions (RMDs) from their accounts. RMDs are a minimum amount that individuals must withdraw from their accounts each year once they reach a certain age, to avoid tax penalties and ensure compliance with Internal Revenue Service (IRS) regulations. Understanding the RBD is crucial for retirement planning, as it impacts the timing and amount of withdrawals from retirement accounts, and can affect an individual's tax liability and overall financial well-being. Failing to meet RBD requirements can result in significant penalties and tax consequences, making it essential for individuals to plan accordingly and ensure compliance with IRS regulations. The type of retirement plan an individual has can influence their RBD. Different plans have different RBD requirements, and individuals must be aware of the specific rules and regulations that apply to their plan. The age of the account owner is a critical factor in determining their RBD. The RBD is typically based on the individual's age and is calculated based on their birth year. The retirement status of the account owner can also impact their RBD. Those who are still working past the age of 70 ½ may have different RBD requirements than those who are fully retired. The beneficiary designation on the retirement account can affect the RBD. If the account owner has named a younger spouse or a non-spouse beneficiary, the RBD may be different than if they had named an older spouse or no beneficiary at all. The plan documentation can impact the RBD, as different plans may have different requirements for when RMDs must begin. IRS regulations can also impact the RBD, as the IRS sets minimum distribution requirements and penalties for failing to meet those requirements. It's essential for individuals to be aware of the specific IRS regulations that apply to their retirement plan to ensure compliance and avoid penalties. For traditional Individual Retirement Arrangements (IRA), the RBD is April 1st of the year following the year in which the account owner reaches age 72. For individuals who reached age 70 ½ before 2020, the RBD is April 1st of the year following the year in which they reached age 70 ½. Roth IRAs do not require RMDs during the account owner's lifetime, making the RBD irrelevant for these accounts. However, beneficiaries of Roth IRAs must take RMDs based on their own life expectancy. For 401(k) plans, the RBD is generally April 1st of the year following the year in which the account owner reaches age 72. However, for individuals who are still working past age 72 and do not own 5% or more of the business sponsoring the plan, the RBD may be postponed until they retire. For 403(b) plans, the RBD is generally April 1st of the year following the year in which the account owner reaches age 72. However, for certain employees with at least 15 years of service, the RBD may be postponed until the year following the year in which they have retired. Failing to take RMDs can result in significant penalties. The penalty for not taking an RMD is 50% of the amount that should have been withdrawn. For example, if an individual were required to take a $10,000 RMD but failed to do so, they would be subject to a $5,000 penalty. Failing to meet RBD requirements can also have significant tax implications. Any RMDs that are not taken by the RBD are subject to a 50% excise tax. Additionally, if an individual fails to take an RMD, they will still be required to report the distribution as income and pay any applicable taxes on the distribution. Individuals who are still working past age 70 ½ may be eligible to postpone their RBD until the year in which they retire, as long as they do not own 5% or more of the business sponsoring the plan. This exception applies to 401(k) plans and 403(b) plans. Beneficiaries of inherited IRAs are subject to different RMD rules than account owners. Generally, beneficiaries of inherited IRAs must begin taking RMDs by December 31st of the year following the year in which the original account owner passed away. Qualified Charitable Distributions (QCDs) allow individuals to donate up to $100,000 per year from their IRA to a qualified charity without incurring taxes on the distribution. QCDs can count towards the RMD requirement for individuals who are required to take RMDs. Required Beginning Date is a critical concept in retirement planning, as it determines when individuals with qualified retirement accounts must begin taking Required Minimum Distributions from their accounts. The RBD is influenced by various factors, including the type of retirement plan, the age of the account owner, their retirement status, beneficiary designation, plan documentation, and IRS regulations. Different types of retirement plans have different RBD requirements. Failing to meet RBD requirements can have significant consequences. Penalties for not taking RMDs are steep, with a 50% penalty on the amount that should have been withdrawn. There are also tax implications, as RMDs not taken by the RBD are subject to a 50% excise tax, and individuals are still required to report the distribution as income and pay applicable taxes on it. However, there are also exceptions to the RBD. By considering the factors that influence the RBD and exploring the exceptions and options available, individuals can make informed decisions about their retirement accounts and optimize their financial well-being in retirement.What Is a Required Beginning Date (RBD)?

Factors That Influence Required Beginning Date (RBD)

Type of Retirement Plan

Age of the Account Owner

Retirement Status of the Account Owner

Beneficiary Designation

Plan Documentation

IRS Regulations

RBD for Different Types of Retirement Plans

RBD for Traditional IRAs

RBD for Roth IRAs

RBD for 401(k) Plans

RBD for 403(b) Plans

Consequences of Missing RBD

Penalties for Not Taking Required Minimum Distributions

Tax Implications of Not Meeting RBD

Exceptions to RBD

Individuals Still Working Past Age 70 ½

Inherited IRAs

Qualified Charitable Distributions (QCDs)

Conclusion

Required Beginning Date (RBD) FAQs

The RBD is the age at which you must start taking Required Minimum Distributions (RMDs) from your retirement account.

The RBD is calculated based on the type of retirement plan, age of the account owner, and retirement status of the account owner.

If you miss your RBD, you will be subject to penalties and taxed on the amount that should have been distributed.

Yes, there are exceptions for individuals still working past age 70 ½, inherited IRAs, and Qualified Charitable Distributions (QCDs).

No, you cannot change your RBD once it has been determined based on IRS regulations and plan documentation.

True Tamplin is a published author, public speaker, CEO of UpDigital, and founder of Finance Strategists.

True is a Certified Educator in Personal Finance (CEPF®), author of The Handy Financial Ratios Guide, a member of the Society for Advancing Business Editing and Writing, contributes to his financial education site, Finance Strategists, and has spoken to various financial communities such as the CFA Institute, as well as university students like his Alma mater, Biola University, where he received a bachelor of science in business and data analytics.

To learn more about True, visit his personal website or view his author profiles on Amazon, Nasdaq and Forbes.