Retirement and disability planning are two important aspects of financial planning that focus on ensuring financial security during retirement years and in the event of disability. Retirement planning involves setting aside funds and making investment decisions that will provide income to support an individual or family during their retirement years. Disability planning involves preparing for the possibility of becoming disabled and unable to work, which can include setting up insurance policies, establishing a support network, and creating a financial plan to cover expenses during the disability. Both retirement and disability planning requires careful consideration of an individual's financial goals, assets, and potential risks. Effective planning in these areas can help individuals and families achieve financial stability and peace of mind. To plan for retirement, it is essential to estimate your financial needs based on life expectancy, inflation, and your desired lifestyle. Consider your expected lifespan based on factors such as age, health, and family history. This will help you determine how long your retirement savings must last. Account for inflation when calculating your retirement needs, as the cost of living is likely to increase over time. Determine the lifestyle you want to maintain during retirement and calculate the associated costs, including housing, healthcare, travel, and leisure activities. Disability planning requires an understanding of the likelihood and potential costs of disability. Research disability statistics to better understand the probability of becoming disabled and the average duration of disability. Consider the costs associated with long-term care, such as in-home care, assisted living facilities, and nursing homes. Assess your current financial situation by examining your savings, investments, Social Security benefits, pensions, and annuities. To achieve your retirement goals, you need to save and invest wisely. Take advantage of employer-sponsored retirement plans, such as 401(k)s or 403(b)s, to save for retirement and benefit from employer matching contributions. Consider opening an Individual Retirement Accounts (IRA), such as a traditional IRA or a Roth IRA, to save for retirement and enjoy tax advantages. Explore annuities and other investment options to diversify your retirement savings and generate income. Effective tax planning is essential for maximizing your retirement savings. Utilize tax-deferred retirement accounts, such as traditional IRAs and 401(k)s, to reduce your current taxable income. Consider Roth IRAs and Roth 401(k)s, which allow for tax-free withdrawals in retirement. Develop a tax-efficient withdrawal strategy to minimize taxes during retirement. Proper estate planning ensures that your assets are distributed according to your wishes. Establish wills and trusts to specify how your assets should be distributed upon your death. Ensure that your beneficiary designations on retirement accounts and life insurance policies are up to date. Consider gifting strategies to reduce your taxable estate and support your loved ones. Disability insurance provides financial protection in the event of a disability. Short-term disability insurance offers income replacement for temporary disabilities, typically lasting up to six months. Long-term disability insurance provides income replacement for extended periods of disability, usually lasting years or until retirement age. Understand the requirements and benefits of Social Security Disability Insurance (SSDI), a federal program that provides financial assistance to disabled individuals. Proper long-term care planning ensures that you have access to the care you need in the event of a disability. Long-term care insurance helps cover the costs of long-term care services, such as in-home care, assisted living facilities, and nursing homes. Explore Medicaid planning strategies to qualify for government assistance with long-term care costs if your income and assets fall below specific thresholds. Consider home modifications and community resources that can help you age in place or receive the necessary care and support during a disability. Establish legal and financial protections to ensure that your wishes are respected, and your affairs are managed in the event of a disability. Designate a durable power of attorney to manage your financial affairs if you become incapacitated. Appoint a healthcare proxy to make medical decisions on your behalf if you are unable to do so. Create living wills and advance directives to communicate your preferences for medical treatment and end-of-life care. Collaborate with professionals to create a comprehensive retirement and disability plan. Financial Planners: Consult with financial planners to develop a personalized financial plan based on your goals, risk tolerance, and time horizon. Insurance Agents: Work with insurance agents to assess your insurance needs and select appropriate coverage options. Estate Planning Attorneys: Seek the assistance of estate planning attorneys to draft essential documents, such as wills, trusts, and powers of attorney. Tax Professionals: Engage tax professionals to optimize your tax planning strategies and ensure compliance with tax laws. Importance of Periodic Reviews: Regularly review your retirement and disability plans to ensure they remain aligned with your goals, needs, and circumstances. Adjusting to Life Events and Changing Circumstances: Update your plans to account for life events and changing circumstances, such as marriage, divorce, job changes, or the birth of a child. Monitoring Investment Performance: Track the performance of your investments to ensure they are on track to meet your retirement goals and adjust your strategy as needed. Retirement and disability planning are essential components of financial planning that require careful consideration of an individual's goals, assets, and potential risks. Estimating retirement and disability needs, evaluating current assets and income sources, and implementing appropriate planning strategies are key factors for success. Retirement planning strategies include saving and investing, tax planning, and estate planning, while disability planning strategies include disability insurance, long-term care planning, and legal and financial protections. Working with professionals and regularly reviewing and adjusting plans are also critical for achieving financial stability and peace of mind. By following these guidelines, individuals and families can ensure a secure and comfortable retirement and be prepared for any potential disability.What Is Retirement and Disability Planning?

Assessing Personal Financial Situation

Estimating Retirement Needs

Life Expectancy

Inflation

Lifestyle Preferences

Estimating Potential Disability Needs

Disability Statistics

Costs of Long-Term Care

Evaluating Current Assets and Income Sources

Retirement Planning Strategies

Saving and Investing

Employer-Sponsored Retirement Plans

Individual Retirement Accounts (IRAs)

Annuities and Other Investments

Tax Planning for Retirement

Tax-Deferred Retirement Accounts

Roth IRAs and Roth 401(k)s

Tax-Efficient Withdrawal Strategies

Estate Planning

Wills and Trusts

Beneficiary Designations

Gifting Strategies

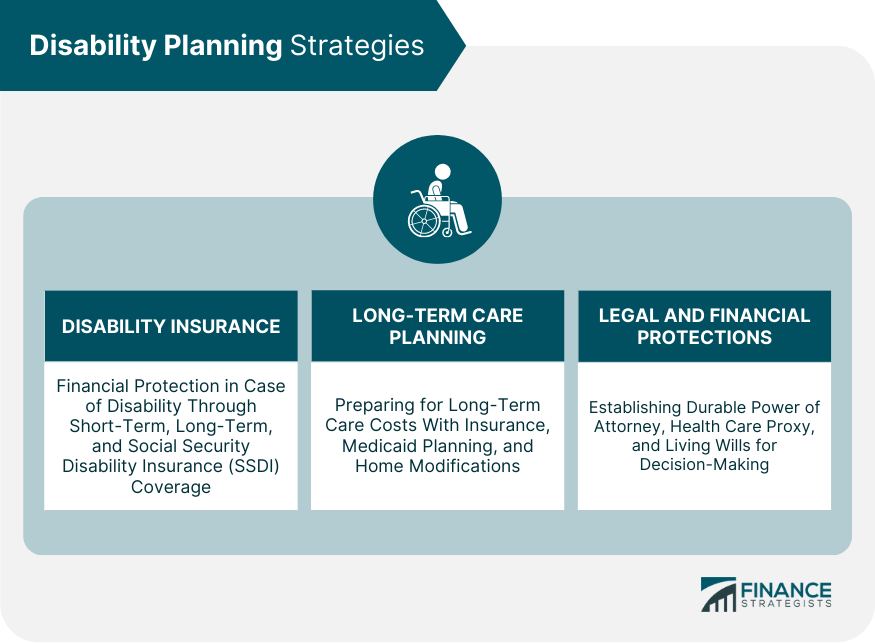

Disability Planning Strategies

Disability Insurance

Short-Term Disability Insurance

Long-Term Disability Insurance

Social Security Disability Insurance (SSDI)

Long-Term Care Planning

Long-Term Care Insurance

Medicaid Planning

Home Modifications and Community Resources

Legal and Financial Protections

Durable Power of Attorney

Health Care Proxy

Living Wills and Advance Directives

Working With Professionals

Regularly Reviewing and Adjusting Plans

Bottom Line

Retirement and Disability Planning FAQs

Retirement and disability planning is essential for maintaining financial security and independence during your retirement years and in case of a disability. By creating a comprehensive plan that considers your long-term financial needs, you can ensure a comfortable lifestyle, access to necessary care, and the ability to manage unforeseen challenges.

Begin by assessing your personal financial situation, estimating your retirement and potential disability needs, and evaluating your current assets and income sources. Then, explore various retirement and disability planning strategies, such as saving and investing, tax planning, estate planning, and insurance options. Consider working with professionals, such as financial planners, insurance agents, and estate planning attorneys, to create a personalized plan.

Key elements to consider in retirement and disability planning include assessing your financial situation, estimating your retirement and potential disability needs, creating a diversified investment portfolio, tax planning, estate planning, purchasing disability insurance, long-term care planning, and legal and financial protections.

Regularly reviewing and updating your retirement and disability planning strategy is crucial to ensure it remains aligned with your goals, needs, and changing circumstances. It is recommended to review your plans annually or whenever significant life events occur, such as marriage, divorce, job changes, or the birth of a child.

Working with professionals, such as financial planners, insurance agents, estate planning attorneys, and tax professionals, can provide valuable guidance, expertise, and resources to help you create a comprehensive and personalized plan. Professionals can assist in selecting appropriate strategies, navigating complex regulations, and ensuring that your plans are tailored to meet your specific goals and needs.

True Tamplin is a published author, public speaker, CEO of UpDigital, and founder of Finance Strategists.

True is a Certified Educator in Personal Finance (CEPF®), author of The Handy Financial Ratios Guide, a member of the Society for Advancing Business Editing and Writing, contributes to his financial education site, Finance Strategists, and has spoken to various financial communities such as the CFA Institute, as well as university students like his Alma mater, Biola University, where he received a bachelor of science in business and data analytics.

To learn more about True, visit his personal website or view his author profiles on Amazon, Nasdaq and Forbes.