Retirement contingency planning is a critical component of personal finance management that involves preparing for the various challenges and uncertainties one might face during retirement years. A well-structured contingency plan helps ensure financial security and independence throughout retirement, allowing individuals to maintain their desired lifestyle and adapt to unexpected circumstances. To begin retirement planning, it is essential to estimate the various expenses one will face during their retirement years. These expenses can be categorized into the following: This includes essential costs such as housing, food, utilities, transportation, and clothing. To estimate these expenses, individuals can use their current spending habits as a baseline and adjust for anticipated lifestyle changes. Retirement planning should account for potential healthcare expenses, such as premiums, copayments, and prescription medications. Estimating these costs is particularly important, as healthcare expenses tend to increase with age. Many retirees plan to travel and pursue hobbies during their retirement years. It's essential to budget for these activities to maintain a desired lifestyle without straining finances. Other expenses may include gifts, charitable donations, and financial support for family members. These should also be considered when estimating retirement expenses. To ensure financial security in retirement, it is crucial to identify and optimize income sources. These may include: Social Security benefits are a primary source of income for many retirees. Understanding the optimal claiming strategy can help maximize lifetime benefits. Some individuals may have access to pension plans or annuities that provide a steady income stream during retirement. It's essential to understand the terms and conditions of these plans to make the most of them. Retirement income may also come from personal savings, 401(k) plans, IRAs, and other investments. A well-diversified portfolio can help ensure a steady income stream and protect against market volatility. Some retirees choose to work part-time or engage in freelance activities to supplement their retirement income. This can also provide a sense of purpose and maintain social connections. After estimating retirement expenses and identifying income sources, it's important to analyze the difference between the two, known as the retirement income gap. If a gap exists, individuals may need to adjust their retirement goals and expectations or explore additional income sources. A diversified income strategy can help protect against the risks associated with relying on a single income source. This may involve investing in different assets, such as stocks, bonds, and real estate, or developing passive income streams from royalties or rental properties. An emergency fund serves as a financial safety net in case of unexpected expenses or events, such as medical emergencies or job loss. It is generally recommended to have three to six months' worth of living expenses saved in an easily accessible account. Insurance policies can provide additional financial protection during retirement. Some options to consider include: Long-Term Care Insurance helps cover the cost of long-term care services, such as assisted living or nursing home care, which are often not covered by traditional health insurance or Medicare. Disability insurance provides income replacement in case an individual becomes disabled and is unable to work. Life insurance policies can provide financial support to beneficiaries in the event of the policyholder's death, ensuring they are not left with financial burdens. Retirees may face market volatility and economic downturns that can impact their investments and savings. To mitigate these risks, individuals should consider: Regularly reviewing and rebalancing investment portfolios can help manage risk and maintain a proper asset allocation. Diversification, dollar-cost averaging, and having a long-term investment horizon are essential strategies to help minimize the impact of market fluctuations on retirement savings. Inflation and rising costs can significantly impact the purchasing power of retirement income. To address these challenges, individuals should: Regularly reassess retirement income and expenses to account for inflation and make necessary adjustments. Inflation-protected securities, such as Treasury Inflation-Protected Securities (TIPS) and real estate investments, can help safeguard retirement income against the eroding effects of inflation. Health issues and unexpected expenses can arise during retirement, putting financial plans at risk. To prepare for these events, individuals should: Estimates and regularly update anticipated healthcare expenses, including potential long-term care needs. Be prepared to make adjustments to lifestyle and spending habits in response to unexpected expenses or health issues. Regular reviews of the retirement contingency plan are crucial for identifying potential risks, assessing progress, and making necessary adjustments. Several factors may warrant adjustments to the retirement contingency plan, including: Life events such as marriage, divorce, or the birth of a child may necessitate changes to the retirement plan. Market fluctuations and economic conditions may require adjustments to investment strategies or asset allocation. Changes in Social Security benefits, tax laws, or other government policies can impact retirement plans and may require adjustments. Financial planners and retirement specialists can provide valuable guidance in developing and maintaining a successful retirement contingency plan. Expert advice can help individuals navigate complex financial decisions and optimize their retirement strategies. Retirement contingency planning plays a vital role in securing financial stability and independence throughout one's retirement years. By carefully estimating retirement expenses, identifying diverse income sources, establishing an emergency fund, and considering insurance options, individuals can create a robust and adaptable plan. Addressing potential risks and challenges, such as market volatility, inflation, and health issues, further ensures the plan's effectiveness. Regularly reviewing and adjusting the plan based on personal circumstances, financial markets, and government policies while seeking professional advice when needed, allows retirees to navigate unforeseen situations and maintain their desired lifestyle. Ultimately, a well-structured retirement contingency plan provides peace of mind and a solid foundation for a fulfilling and financially secure retirement.What Is Retirement Contingency Planning?

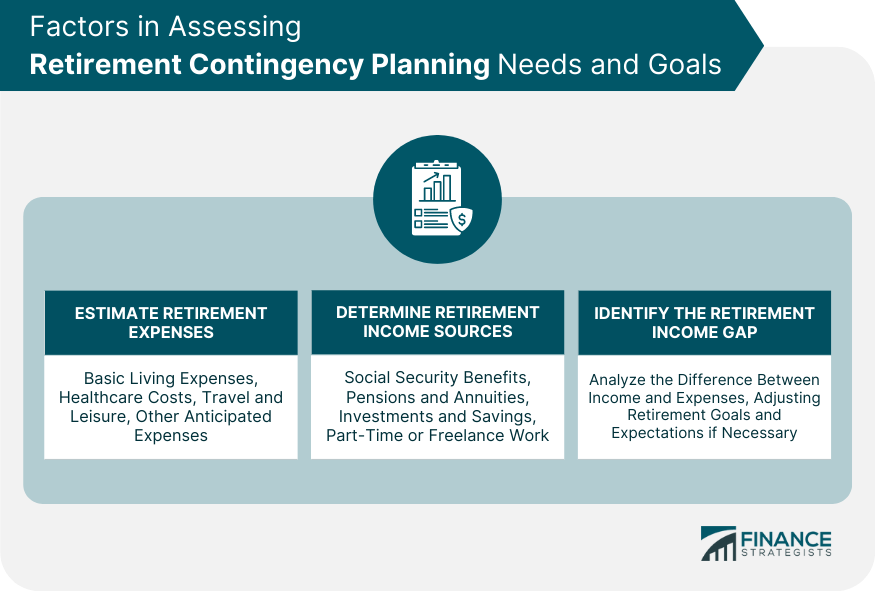

Assessing Retirement Contingency Plan Needs and Goals

Estimating Retirement Expenses

Basic Living Expenses

Healthcare Costs

Travel and Leisure Expenses

Other Anticipated Expenses

Determining Retirement Income Sources

Social Security Benefits

Pensions and Annuities

Investments and Savings

Part-Time or Freelance Work

Identifying the Retirement Income Gap

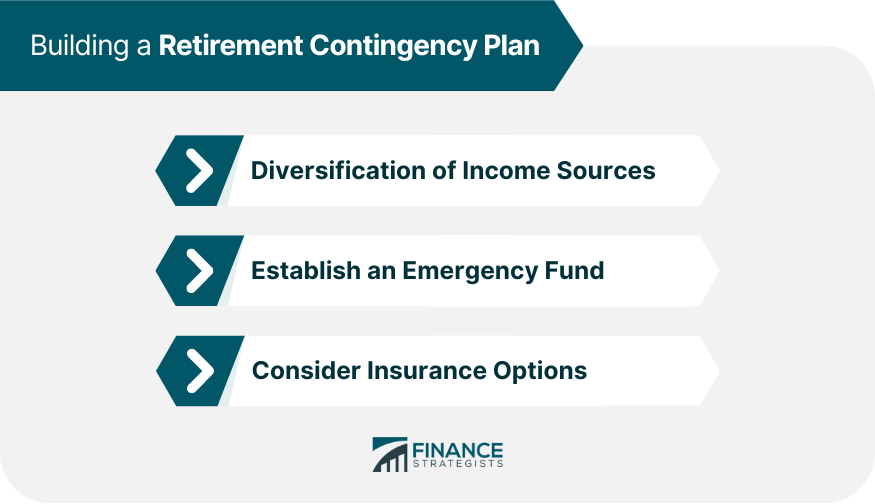

Building a Retirement Contingency Plan

Diversification of Income Sources

Establishing an Emergency Fund

Considering Insurance Options

Long-Term Care Insurance

Disability Insurance

Life Insurance

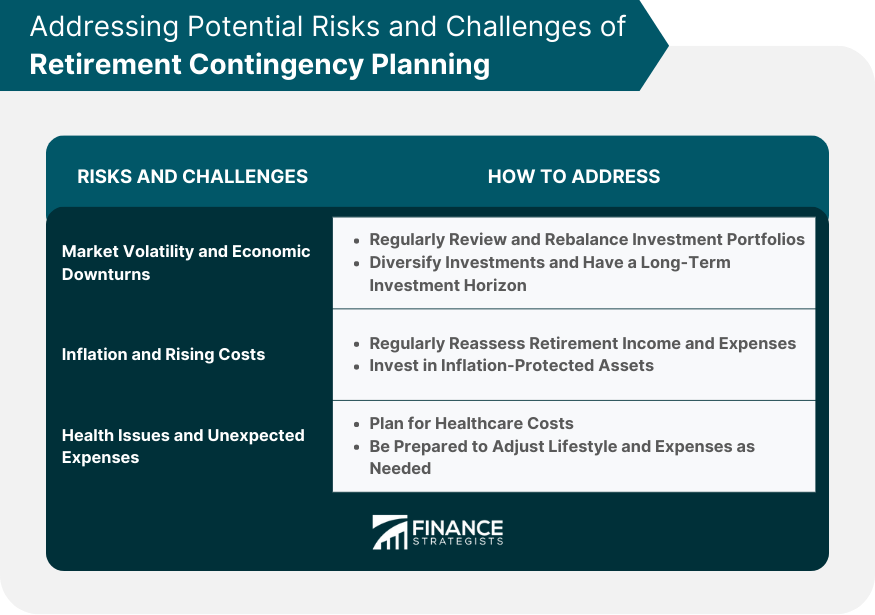

Addressing Potential Risks and Challenges of Retirement Contingency Planning

Market Volatility and Economic Downturns

Impact on Investments and Savings

Strategies to Mitigate Risk

Inflation and Rising Costs

Adjusting Income and Expenses Over Time

Investing in Assets with Inflation Protection

Health Issues and Unexpected Expenses

Planning for Healthcare Costs

Adjusting Lifestyle and Expenses as Needed

Regularly Reviewing and Adjusting the Retirement Contingency Plan

Importance of Periodic Reviews

Factors to Consider in Plan Adjustments

Changes in Personal Circumstances

Changes in Financial Markets

Changes in Government Policies and Benefits

Seeking Professional Advice

Bottom Line

Retirement Contingency Planning FAQs

Retirement contingency planning is the process of preparing for potential challenges and uncertainties during retirement, ensuring financial security and independence. It is essential because it helps individuals maintain their desired lifestyle, adapt to unexpected circumstances, and mitigate risks associated with retirement.

Diversification in retirement contingency planning involves creating multiple income sources and investing in a variety of assets. This approach helps protect against the risks associated with relying on a single income source, reduces the impact of market fluctuations, and offers better financial stability during retirement.

An emergency fund is a critical component of retirement contingency planning as it serves as a financial safety net in case of unexpected expenses or events, such as medical emergencies or sudden job loss. It is recommended to have three to six months' worth of living expenses saved in an easily accessible account.

To address potential risks and challenges in retirement contingency planning, consider the following strategies: diversify income sources and investments, establish an emergency fund, obtain appropriate insurance policies, plan for healthcare costs, and regularly review and adjust the plan based on personal circumstances, financial markets, and government policies.

It is crucial to regularly review and update your retirement contingency planning to ensure it remains effective and relevant. Generally, an annual review is recommended, but more frequent evaluations may be necessary if there are significant changes in personal circumstances, financial markets, or government policies affecting retirement.

True Tamplin is a published author, public speaker, CEO of UpDigital, and founder of Finance Strategists.

True is a Certified Educator in Personal Finance (CEPF®), author of The Handy Financial Ratios Guide, a member of the Society for Advancing Business Editing and Writing, contributes to his financial education site, Finance Strategists, and has spoken to various financial communities such as the CFA Institute, as well as university students like his Alma mater, Biola University, where he received a bachelor of science in business and data analytics.

To learn more about True, visit his personal website or view his author profiles on Amazon, Nasdaq and Forbes.