The savings you need for retirement depend on many variables, including when you want to retire, your retirement lifestyle, when you started saving, and how much you have already saved. However, not all retirement funds will have to come from savings. Some will likely come through Social Security. You can factor in other possible retirement income sources in your retirement planning. Here are some options to consider for approaching retirement savings that align with your retirement goals.

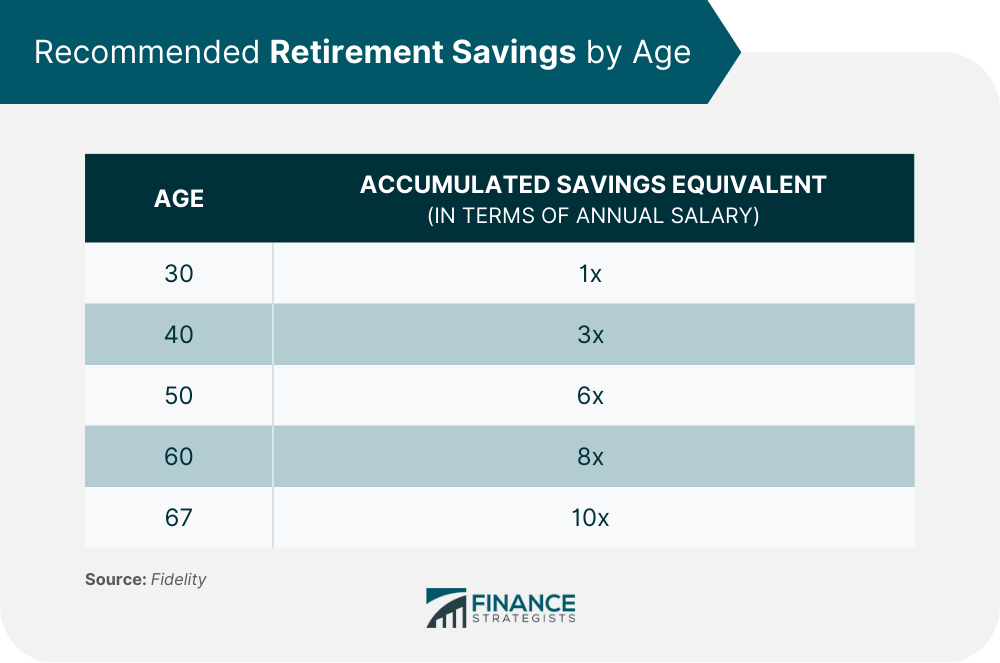

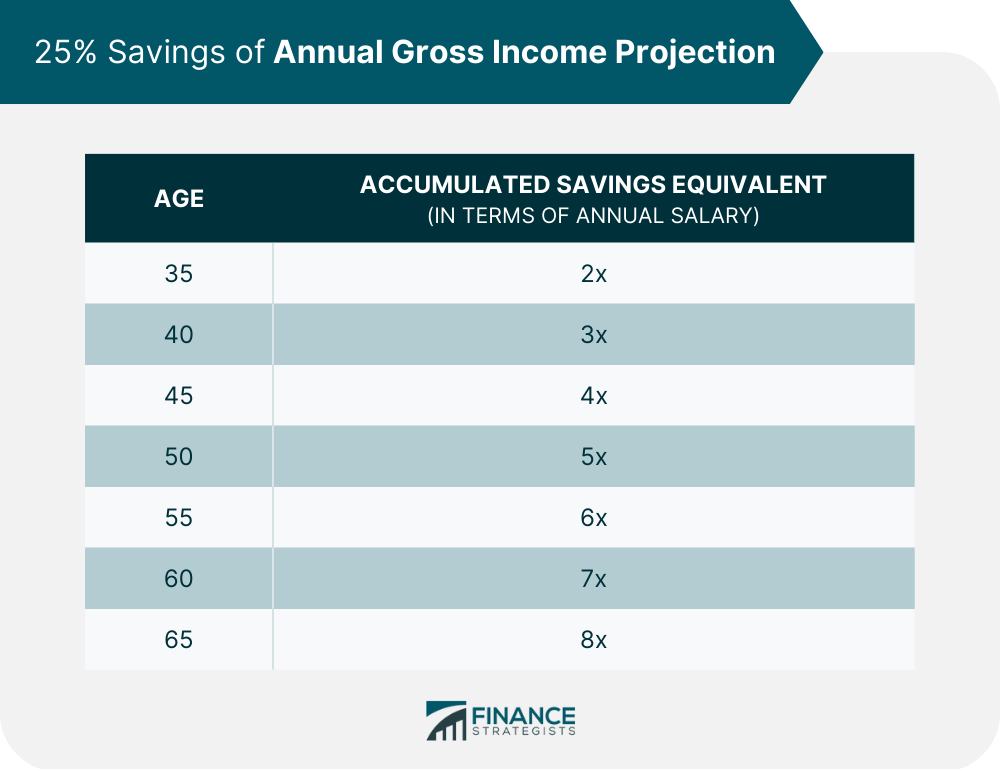

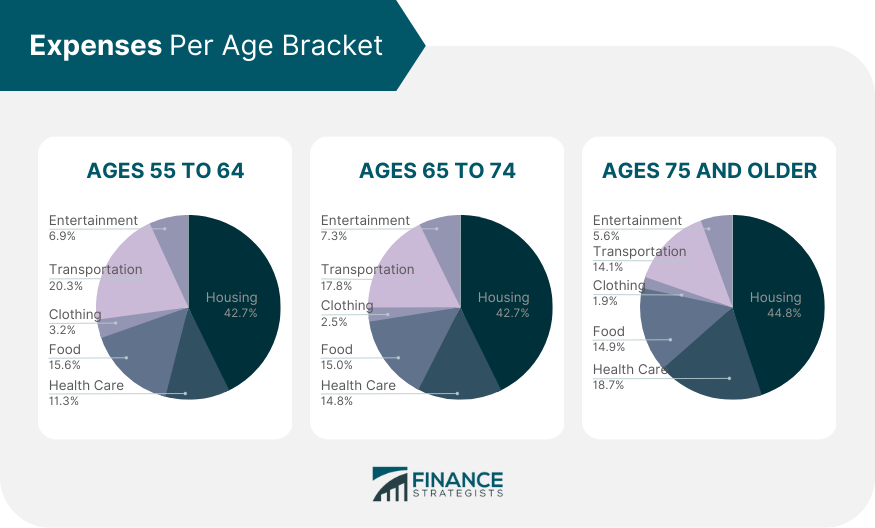

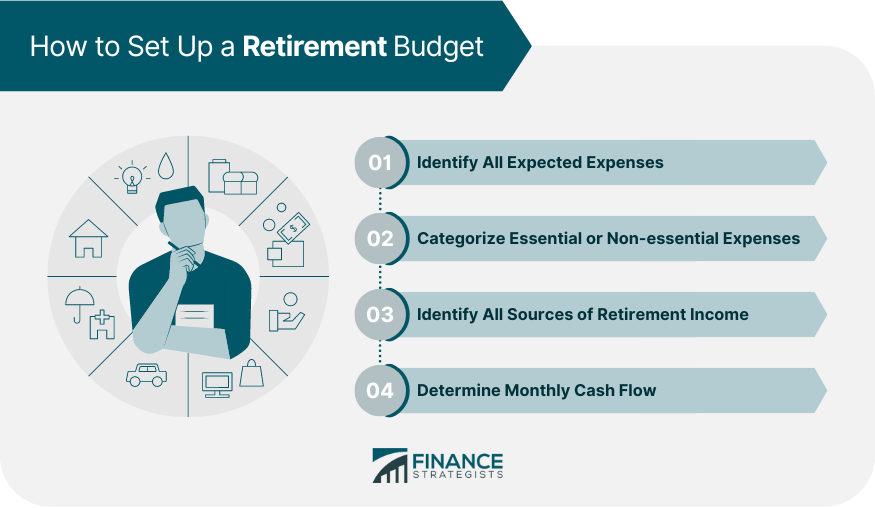

A basic rule of thumb for saving is the 80% rule. According to the theory, if your yearly income is $100,000, you should save enough from pre-retirement to earn $80,000 in retirement. The necessary amount may be changed depending on other income sources like Social Security, pensions, part-time job, one's health, and preferred lifestyle. To calculate the required savings to generate the necessary income in retirement, divide the desired annual income by 4%. If your desired annual retirement income is $96,000, you need retirement savings of $2.4M (calculated from 96,000/0.04). This calculation is based on the assumption of a 5% return on investment after considering taxes and inflation. The 4% rule is generally based on the premise of a 30-year retirement period. However, as people tend to live longer in retirement, they must ensure that their portfolios can sustain them for more extended periods. To determine the savings required at different stages of life, consider saving a percentage of your salary. It is recommended to save 15% of your gross salary from your 20s and continue doing so throughout your working years. This includes contributions to various retirement accounts, such as 401(k). By saving a consistent portion of your salary, you can accumulate significant retirement savings over time and reduce the need for drastic savings increases later in life. It is recommended to use benchmarks, such as multiples of annual earnings, for determining the amount that should have been saved for retirement by certain ages. At 30, an individual should have held an amount equal to his annual salary. At age 40, the savings amount should have been three times his annual salary. You can find further illustrations in the table below. An alternative, more intuitive approach is to save 25% of your annual gross salary, starting in your 20s. It includes 401(k) holdings, matching contributions from your employer, and other retirement savings. By following this formula, an individual should be able to accumulate their full annual salary by age 30. The savings projection in terms of annual salary is shown at age 35 and increments of five years in the table below. To compute the necessary amount for retirement, it is essential to take a comprehensive look at all the potential expenses and factor them into the financial planning process. A Bureau of Labor Statistics (BLS) study on retirement expenses show that over the age brackets below, housing expenses appear to be the highest expenditure. While the other expenses remain constant across age, health care increases over time. There are some practices that can help you save on some of these expenses. There are effective strategies for reducing housing expenses in retirement. Paying off a mortgage eliminates the monthly mortgage payment and frees up equity that can be added to savings for other expenses. Downsizing to a smaller, more affordable home could mean lower taxes, insurance costs, and maintenance bills. Relocating to an area with a lower cost of living can also result in lower expenses for housing, food, healthcare, and other necessities. Food expenses can be reduced by cooking at home instead of buying pricey convenience items. It also allows retirees to control the ingredients and portion sizes. Meal planning helps minimize impulse purchases and reduce waste, as well. Maximizing senior discounts offered at restaurants and grocery stores and shopping during designated senior hours can help avoid crowds, reduce stress, and make grocery shopping more efficient. While your transportation costs will not entirely go down when you retire, your commute will surely cost less. Many people frequently neglect this category. One of the easiest ways to save money is to shop for auto insurance every year. Alternatively, ride-hailing services can save money, especially if you do not require a car daily. Clothing expenses for retirees can vary greatly depending on the individual. Some may prefer to splurge, while others may opt for more affordable options. For those who choose to be frugal with their clothing expenses, there are several cost-cutting measures they can consider. Shopping at thrift stores or discount outlets, using coupons and sales promotions to get great deals on clothing items, shopping online, and investing in classic pieces are all ways that retirees can save money on clothing costs. Retirement healthcare expenses can be one of the bigger costs for retirees to consider. Many retirees expect Medicare to cover all their medical expenses. However, this is not always the case. Healthcare expenses in retirement can include premiums, deductibles, and other costs related to medications. A comprehensive retirement plan should include an analysis of the potential out-of-pocket expenses associated with healthcare and other medical needs in retirement. Understanding what is covered by long-term care insurance and what is not should be part of the retirement planning process. Retirement offers the chance to explore new hobbies and activities, but it can be costly. To save money, take advantage of discounts for seniors, such as reduced admission to museums or movie theaters. Many colleges also offer inexpensive classes for retirees. There are plenty of low-cost entertainment options available for retirees who have a fixed income but still want to pursue their interests. Walks or bike rides in the park are inexpensive ways to stay physically active and enjoy the outdoors. A well-planned retirement budget can help ensure financial stability in later life while allowing you to live out your golden years with peace of mind. It is important to design a personalized retirement budget that suits your needs and objectives. To establish an effective plan, consider these key considerations: The first step in setting up a retirement budget is listing variable and fixed expenses. Take the sum of all figures and calculate the total expected expenses. Calculate the average of the last six to twelve months to assess your variable expenses. These are critical expenditures that can change in amount from month to month, like electric bills, but they still must be paid for consistently. Once you have identified these costs, it will be much easier to determine how much money you need each month to live comfortably after retirement. Consider setting aside some funds for unexpected expenses or emergency situations that can arise during retirement. After listing all expected expenses from your budget, categorize essential from non-essential expenses. This gives you a better idea of where your money needs to go first and how much money is available for discretionary spending. Essential expenses are maintenance of a bare-minimum lifestyle, like food, clothing, housing and utilities, transportation, health care remittances, taxes, and insurance premiums. On the other hand, there are also non-essential expenses such as luxury purchases or entertainment expenses like cable services, streaming services, and the like. The next step in setting up a retirement budget is to identify all of your sources of income. This includes guaranteed sources, such as Social Security and pension benefits, and non-guaranteed sources, such as rental income or other investments. Knowing how much you can expect each month will help you plan for your future financial security. Additionally, it is important to understand that some sources of income may fluctuate throughout retirement due to market conditions or other factors. Another next step in creating a retirement budget is to determine the monthly cash flow by subtracting expenses from income. If the end result is negative, it is necessary to revise the monthly budget. If otherwise, the excess funds may be used for leisure or travel. Once you have set up your retirement budget and determined how much money you have coming in each month and going out, it is time to adjust your retirement goals and spending. If the numbers do not add up as intended, then you will need to make some changes. Review and update your retirement budget every few months. This can help keep you on track and ensure you are still meeting your goals. With a little effort each month, it is possible to achieve financial freedom in retirement. Retirement planning is crucial for post-retirement stability. The amount needed to save for retirement depends on various factors such as age, lifestyle, planned retirement age, and inflation, among other factors. Common methods for determining the necessary retirement savings include the 80% pre-retirement income method, the 4% rule, the retirement savings by salary, retirement savings by age, and the 25% savings of annual gross income. Planning out a retirement budget strategy is important to factor in all potential retirement expenses, such as housing, food, transportation, clothing, healthcare, and entertainment. To create a retirement budget, follow these steps: (1) identify all expected expenses, (2) then categorize the essential and non-essential expenses, (3) list down all sources of income, (4) determine the monthly cash flow, and (5) adjust retirement goals and spending. It is important to talk to a retirement planning specialist to guide you on setting up a retirement plan that best fits your needs and lifestyle.How Much Do You Need to Save to Retire?

The 80% Pre-Retirement Income

The 4% Rule

Retirement Savings by Salary

Retirement Savings by Age

The 25% Savings of Annual Gross Income

Retirement Expenses

Housing

Food

Transportation

Clothing

Healthcare

Entertainment

How to Set Up a Retirement Budget

Identify All Expected Expenses

Categorize Essential or Non-essential Expenses

Identify All Sources of Retirement Income

Determine Monthly Cash Flow

Adjust Retirement Goals & Spending

The Bottom Line

Retirement Expenses FAQs

The 4% rule is a method of determining how much to save for retirement. To calculate the required savings to generate the necessary income in retirement, divide the desired annual income by 4%. If your desired annual retirement income is $96,000, you need retirement savings of $2.4 million.

These are the steps in creating a retirement budget: (1) identify all expected expenses, (2) then categorize the essential and non-essential expenses, (3) list down all sources of income, (4) determine the monthly cash flow, and (5) adjust retirement goals and spending.

The biggest expense in retirement is housing, according to the U.S. Bureau of Labor Statistics. It comprises at least 42% of the retirement budget.

The most recent BLS statistics show that the average monthly expenses for people 65 and older, including rent, groceries, and healthcare, are roughly $4,345.

The amount you should save for retirement depends on several factors, including your current income, spending, and retirement goals. As a general rule of thumb, financial experts suggest saving at least 15% of your income for retirement, including any employer contributions to a 401(k) or similar plan.

True Tamplin is a published author, public speaker, CEO of UpDigital, and founder of Finance Strategists.

True is a Certified Educator in Personal Finance (CEPF®), author of The Handy Financial Ratios Guide, a member of the Society for Advancing Business Editing and Writing, contributes to his financial education site, Finance Strategists, and has spoken to various financial communities such as the CFA Institute, as well as university students like his Alma mater, Biola University, where he received a bachelor of science in business and data analytics.

To learn more about True, visit his personal website or view his author profiles on Amazon, Nasdaq and Forbes.