Income tax is a financial obligation imposed on individuals and businesses based on their income or profits. It is a significant source of funding for federal and state governments, contributing to public services. Income taxes can be complex, with many deductions, credits, and penalties potentially influencing the final amount owed. Particularly for retired individuals, understanding the nuances of income tax can be critical to maintaining financial health and avoiding unforeseen liabilities. During retirement, your income may come from several different sources, and each can have different tax implications. While some people might assume that reaching retirement means the end of paying income taxes, this is not necessarily the case. Retirees might receive income from Social Security benefits, pensions, retirement accounts, investments, and even part-time work. All these sources of income might be subject to income tax, depending on various factors like total income, filing status, and age. The short answer to whether you need to file income taxes in retirement is: it depends. Your requirement to file an income tax return depends on several factors, including your income level, age, filing status, and the type of income you receive. Some types of retirement income are taxable, while others may not be. Remember, even if you don't owe any tax, you may still want to file a tax return. You could be eligible for certain tax credits or refunds, even if your income falls below the threshold for filing a tax return. Different sources of retirement income can have different tax implications. For instance, Social Security benefits might be partly or entirely tax-free, depending on your total income. Meanwhile, withdrawals from retirement accounts, pensions, annuities, and income from part-time work or investments are usually subject to income tax. The type of retirement account you have can significantly affect your tax obligations. Withdrawals from Traditional Individual Retirement Accounts (IRAs) and 401(k) accounts, for example, are usually fully taxable. However, withdrawals from Roth IRAs are generally tax-free, as contributions to these accounts are made with after-tax dollars. Social Security benefits may or may not be subject to income tax, depending on your total income and filing status. If Social Security is your only source of income, your benefits might be tax-free. However, if you have other substantial sources of income, a portion of your benefits may be taxable. A common misconception among retirees is that Social Security benefits are always tax-free, but the reality can be more complicated. The age and income thresholds set by the Internal Revenue Service (IRS) determine whether retired individuals need to file income tax. These thresholds may vary each year, and exceeding them typically triggers a filing obligation. Your filing status, such as single, married filing jointly, married filing separately, or head of household, also affects the filing requirement. Different filing statuses have varying income thresholds and tax brackets. Pension income is usually subject to income tax. When you receive a pension from a former employer, the IRS generally treats these payments as taxable income. However, some exceptions might apply. For instance, if you contributed after-tax dollars to your pension while you were working, a portion of your pension income might be tax-free. Each pension plan has specific tax rules, so it's crucial to understand the details of your plan. Most withdrawals from retirement accounts, such as 401(k) and 403(b) accounts, are subject to income tax. These accounts are typically funded with pre-tax dollars, meaning you didn't pay taxes on the money when you contributed it. Therefore, you must pay income tax on the money when you withdraw it in retirement. Keep in mind that early withdrawals (before age 59½) may be subject to additional penalties. Investment income, including capital gains and dividends, can also be subject to income tax. The tax rate on investment income depends on several factors, including the type of investment, how long you've held it, and your overall income level. For example, long-term capital gains are usually taxed at a lower rate than ordinary income. It's essential to understand these rules when managing your investments in retirement. If you own rental property, the income you receive from tenants is usually subject to income tax. However, you can deduct certain expenses, such as maintenance, repairs, and depreciation, which can reduce your taxable rental income. Remember, selling rental property can also result in a taxable capital gain, so it's important to consider the tax implications if you're thinking of selling a rental property during retirement. Other sources of income, such as from part-time employment or freelance work, are also taxable. If you're self-employed, you're responsible for paying both the employee and employer portions of Social Security and Medicare taxes, which can significantly increase your tax liability. However, self-employment can also offer certain tax advantages, such as the ability to deduct business expenses, which can help offset your tax liability. The standard deduction is a specific dollar amount that reduces the income you're required to pay taxes on. For retired individuals, the standard deduction can significantly reduce their taxable income. Furthermore, the standard deduction is higher for individuals aged 65 or older, providing an additional tax benefit for retirees. If you are 65 or older, you can benefit from an additional standard deduction. This additional amount increases the total standard deduction for older taxpayers, thereby reducing their taxable income even further. This can result in a lower tax bill, as the amount of tax you owe is based on your taxable income after deductions are applied. If you itemize deductions on your tax return, you may be able to deduct certain medical and dental expenses that exceed a specific percentage of your adjusted gross income. This can help reduce your tax liability, especially if you have substantial medical expenses. If you itemize deductions, you can also deduct certain state and local taxes paid during the year. These can include state and local income taxes or sales taxes, as well as property taxes. The state and local tax deduction can provide a significant tax benefit, particularly for retirees living in states with high taxes. If you itemize deductions, you may be able to deduct charitable contributions made during the year. This can include donations to qualifying charities, as well as out-of-pocket expenses incurred while volunteering for a charity. The filing requirement for retired individuals is determined by factors such as the total income from retirement sources surpassing the IRS threshold. It also depends on the inclusion of Social Security benefits and the individual's filing status. To reduce taxable income, retirees can take advantage of various tax exemptions. These exemptions include the standard deduction, additional standard deduction for older taxpayers, deductions for medical and dental expenses. They could also take advantage of state and local tax deductions, as well as deductions for charitable contributions. Seeking guidance from a tax professional or referring to IRS guidelines can provide further clarity and assistance tailored to individual circumstances.Overview of Income Taxes

Have questions about income taxes? Click here.Do I Have to File Income Tax if Retired?

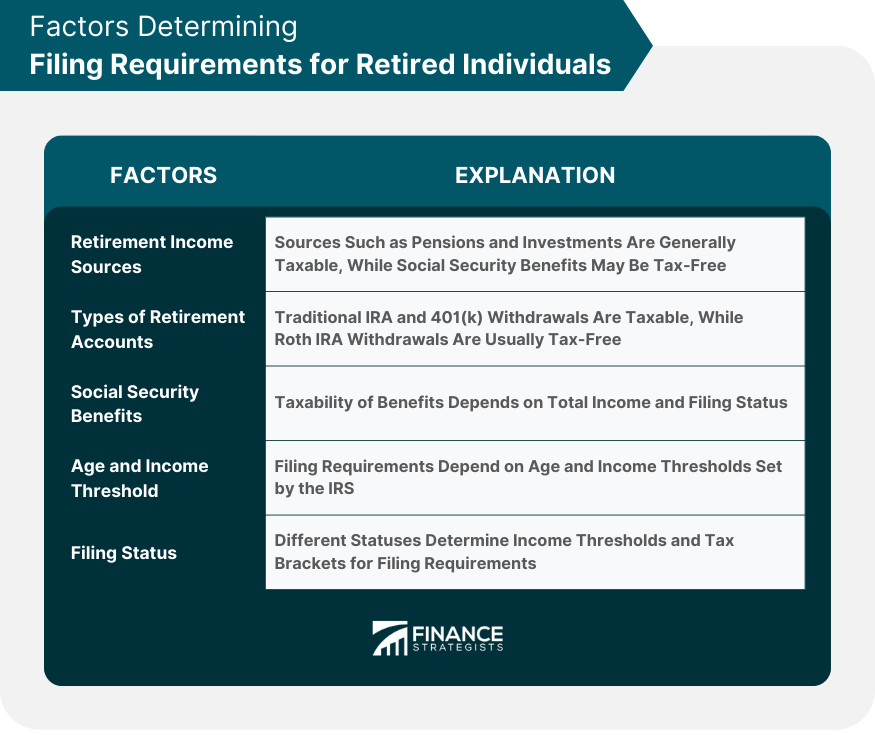

Factors Determining Filing Requirements for Retired Individuals

Retirement Income Sources

Types of Retirement Accounts

Social Security Benefits

Age and Income Threshold

Filing Status

Filing Obligations for Different Types of Retirement Income

Pension Income

Withdrawals From Retirement Accounts

Investment Income

Rental Income

Other Sources of Income

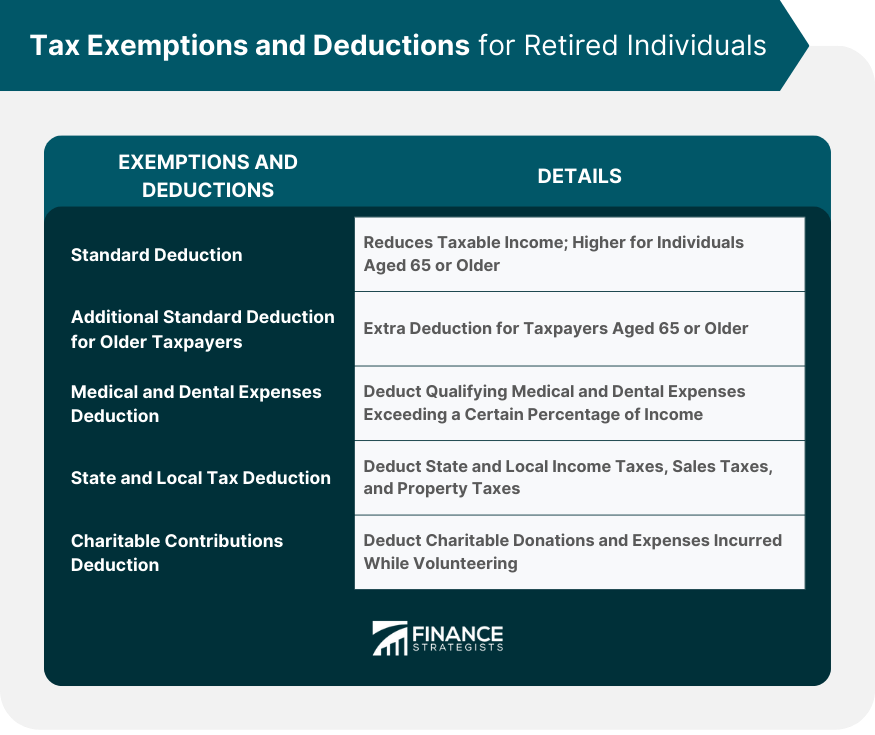

Tax Exemptions and Deductions for Retired Individuals

Standard Deduction

Additional Standard Deduction for Older Taxpayers

Medical and Dental Expenses Deduction

State and Local Tax Deduction

Charitable Contributions Deduction

Conclusion

Do I Have to File Income Tax if Retired? FAQs

Social Security benefits may be taxable, depending on your total income and filing status. If Social Security is your only source of income, your benefits might not be taxable.

Withdrawals from a Roth IRA are generally tax-free, as contributions to these accounts are made with after-tax dollars.

If you itemize deductions on your tax return, you may be able to deduct certain medical and dental expenses that exceed a specific percentage of your adjusted gross income.

Yes, taxpayers aged 65 or older can benefit from a higher standard deduction, reducing their taxable income and potentially their tax liability.

Pension income is generally subject to income tax. However, if you contributed after-tax dollars to your pension while working, a portion of your pension income might be tax-free.

True Tamplin is a published author, public speaker, CEO of UpDigital, and founder of Finance Strategists.

True is a Certified Educator in Personal Finance (CEPF®), author of The Handy Financial Ratios Guide, a member of the Society for Advancing Business Editing and Writing, contributes to his financial education site, Finance Strategists, and has spoken to various financial communities such as the CFA Institute, as well as university students like his Alma mater, Biola University, where he received a bachelor of science in business and data analytics.

To learn more about True, visit his personal website or view his author profiles on Amazon, Nasdaq and Forbes.