Social Security Tax and Retirement Income Taxation

As you prepare for the golden years of retirement, it's vital to have a comprehensive understanding of the taxation policies that apply to your retirement income. Taxation doesn't cease when you stop working.

Understanding how different types of retirement income are taxed, including Social Security benefits, pension income, withdrawals from 401(k) or other retirement plans, and distributions from IRAs can help you manage your retirement finances.

Social Security tax is a payroll tax that finances the Social Security program. Workers pay into the program through taxes on their earnings; the Social Security Administration then uses these funds to pay benefits to individuals who are eligible for Social Security.

Retirement income taxation pertains to the taxes you pay on various income sources during retirement, which can include Social Security benefits, pension income, withdrawals from retirement accounts, and more.

Do You Pay SS Tax on Retirement Income?

Your retirement income may come from various sources, and it's critical to understand whether and how Social Security taxes apply. When you are working, you pay Social Security taxes on your income.

However, once you retire, things change. As a retiree, you no longer pay Social Security taxes on your Social Security benefits or any other retirement income.

It's essential to remember that even though you don't pay Social Security taxes on these income sources, they aren't necessarily tax-free.

Depending on your total retirement income and other factors, a portion of your Social Security benefits may be subject to federal income tax.

Moreover, other types of retirement income, such as withdrawals from retirement accounts, can also be taxable.

Taxation of Social Security Benefits

While Social Security benefits are not subject to Social Security tax, they can be subject to federal income tax under certain conditions. The federal government may tax up to 85% of your Social Security benefits, depending on your income level and filing status.

The percentage of Social Security benefits that may be taxed depends on a figure known as your combined income. This includes your adjusted gross income, any nontaxable interest, and half of your Social Security benefits.

Depending on where your combined income falls within the thresholds defined by the IRS, you may find that a portion of your benefits is subject to federal income tax.

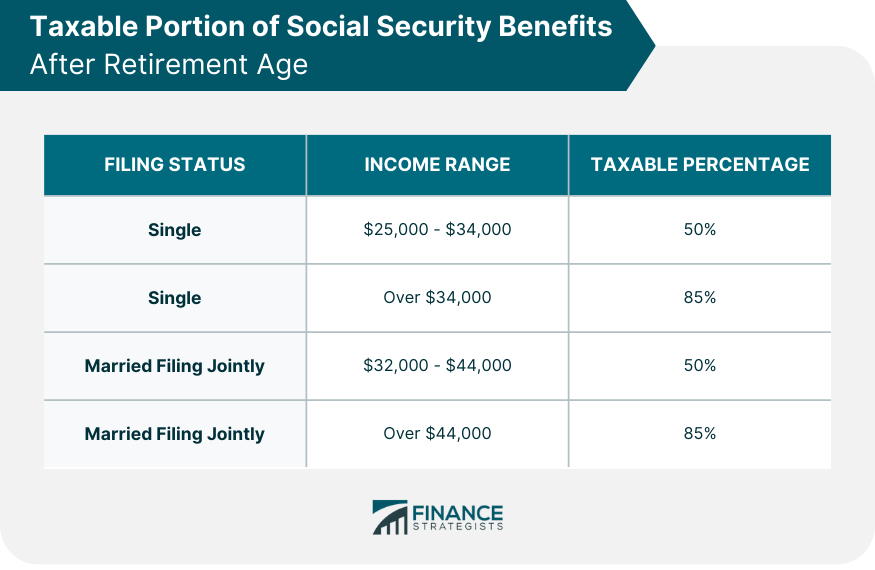

Taxable Portion of Social Security Benefits After Retirement Age

After reaching retirement age, it's important to consider the taxable portion of your Social Security. Notably, up to 85% of your Social Security benefits could be subject to taxation.

The specific amount depends on your income during that time. If you file as an individual and your income falls between $25,000 and $34,000, 50% of your benefits will be taxed. Once your income exceeds $34,000, 85% of your benefits become taxable.

For married couples filing jointly, if your combined income with your spouse is between $32,000 and $44,000, 50% of your benefits will be taxed. However, if your combined income exceeds $44,000, 85% of your benefits will be subject to taxation.

When Social Security Tax Payments Stop

You are relieved from paying any further Social Security tax once you surpass the wage base limit. The wage base limit for 2025 has increased to $176,100, up from $168,600 in 2024.

This means that if your income reaches $176,100 or more, the maximum Social Security tax you'll owe is $10,918.20. Conversely, if you earn less than $176,100, your Social Security tax payment will be lower than this maximum amount.

Taxation of Other Retirement Income Sources

Tax Treatment of Pensions

Generally, if you made after-tax contributions to your pension during your working years, a portion of your pension payments would be tax-free in retirement, with the remainder being taxable.

If your pension is entirely from pre-tax contributions, the entirety of your pension payments would typically be taxable.

The taxation rules can be complex, particularly for pensions from employment both inside and outside the U.S., and it can be beneficial to consult with a tax professional to understand your specific situation.

Tax Treatment of 401(k) and Other Employer-Sponsored Retirement Plans

Retirement plans like 401(k), 403(b), and similar employer-sponsored plans are typically funded with pre-tax dollars, which means that withdrawals in retirement are subject to ordinary income tax.

This includes both your original contributions and any investment growth in the account. However, if you have a Roth 401(k) or a Roth 403(b), your withdrawals in retirement can be tax-free, provided you meet certain conditions.

The specific rules and conditions can be complex, and they may depend on factors such as your age and the age of the account, making professional guidance a beneficial consideration.

Tax Treatment of Individual Retirement Accounts (IRAs)

Traditional and Roth IRAs are two common types of Individual Retirement Accounts, each with its tax implications.

Contributions to a traditional IRA may be tax-deductible, and the investment growth is tax-deferred. However, withdrawals in retirement are treated as ordinary income for tax purposes.

On the other hand, Roth IRA contributions are made with after-tax dollars, meaning that withdrawals in retirement are generally tax-free, provided certain conditions are met.

Determining Taxable Retirement Income

Adjusted Gross Income (AGI)

Your Adjusted Gross Income (AGI) is a key concept in taxation, including the taxation of retirement income. Your AGI is your total income for the year, minus certain adjustments or deductions.

The AGI is used to determine whether you can claim certain tax deductions and credits, and it's also used in the calculation of taxable Social Security benefits.

In the context of retirement income, your AGI can include various income sources such as Social Security benefits, pension income, withdrawals from retirement accounts, and more.

Calculating Taxable Retirement Income

Calculating your taxable retirement income involves determining the tax status of each income source, including Social Security benefits, pensions, and withdrawals from retirement accounts.

Each of these income sources has different tax rules, and the portion of each that is taxable can depend on various factors.

Generally, you would calculate the taxable amount for each income source separately and then add these amounts together to get your total taxable retirement income.

This calculation can be complex, particularly if you have multiple income sources, and it can be helpful to work with a tax professional or use tax preparation software to help you through the process.

Reporting Retirement Income on Tax Returns

Social Security benefits are reported on Form 1040, even though only a portion may be taxable. Pensions, annuities, and income from retirement account withdrawals are also reported on your tax return.

In many cases, the entity that pays your retirement income, such as the Social Security Administration or your pension plan administrator, will provide you with a tax form that reports the amount of income you received for the year.

Conclusion

Upon retirement, individuals are exempt from paying Social Security taxes on their retirement income, which includes Social Security benefits.

However, it's important to note that a portion of this income, potentially including some Social Security benefits, might be subject to federal income tax, contingent on one's total income and filing status.

The taxability of Social Security benefits adheres to specific guidelines established by the IRS, which revolve around income thresholds.

The taxable amount is determined based on adjusted gross income, non-taxable interest, and half of the Social Security benefits received. Consequently, it's possible for up to 85% of an individual's benefits to be subject to taxation.

Do You Pay SS Tax on Retirement Income? FAQs

You do not pay Social Security tax on your retirement income. Social Security tax is only paid on earned income, which is income from work. Retirement income, such as Social Security benefits, pensions, and annuities, is not considered earned income and is therefore not subject to Social Security tax. However, you may have to pay income tax on your retirement income. The amount of income tax you owe will depend on your total income, your filing status, and any deductions or credits you are eligible for.

The taxability of your Social Security income depends on your total income and filing status. In general, a portion of your Social Security benefits may be subject to federal income tax if your combined income exceeds a certain threshold.

Various types of retirement income can be taxable, including (but not limited to) Social Security benefits, pension income, and withdrawals from retirement accounts such as 401(k) plans and traditional IRAs.

To calculate your taxable retirement income, you generally need to calculate the taxable portion of each income source separately and then add them together.

Non-taxable retirement income generally does not need to be reported on your tax return. Non-taxable retirement income can include distributions from Roth IRAs, certain types of pensions, and certain types of Social Security benefits. Since this income is already exempt from taxation, there is no need to report it on your tax return. However, it's important to note that you may still need to report taxable portions of your retirement income, such as distributions from traditional IRAs or 401(k) plans.

True Tamplin is a published author, public speaker, CEO of UpDigital, and founder of Finance Strategists.

True is a Certified Educator in Personal Finance (CEPF®), author of The Handy Financial Ratios Guide, a member of the Society for Advancing Business Editing and Writing, contributes to his financial education site, Finance Strategists, and has spoken to various financial communities such as the CFA Institute, as well as university students like his Alma mater, Biola University, where he received a bachelor of science in business and data analytics.

To learn more about True, visit his personal website or view his author profiles on Amazon, Nasdaq and Forbes.