The Free Application for Federal Student Aid (FAFSA) is a significant financial aid tool for students planning to attend college or vocational school. Administered by the U.S. Department of Education, it determines a student's eligibility for various types of federal financial aid, including grants, work-study programs, and loans. Moreover, the FAFSA often serves as a prerequisite for many state and college aid programs. Completing the FAFSA involves providing detailed information about the student's financial circumstances, including household income and assets. The inclusion of retirement income in FAFSA calculations can have substantial implications for your financial aid eligibility. When completing the FAFSA, a common question that arises pertains to the treatment of retirement income. The simple answer is yes, FAFSA does count retirement income, but how it is considered depends on the source of that income. Regular distributions from retirement accounts, such as pensions, annuities, or retirement savings withdrawals, are generally counted as income on the FAFSA. However, the balance of these retirement accounts is not reported as an asset on the FAFSA. When completing the FAFSA, you're required to provide accurate information about income. This includes wages, self-employment income, and, in some cases, retirement income. The income information you provide should be verifiable through tax returns, W-2 forms, and other official documentation. FAFSA's income reporting requirements are not merely a bureaucratic exercise; they help ensure that federal student aid is awarded equitably, based on the financial need of students and their families. The FAFSA is an annual form, meaning you need to complete it for each academic year for which you seek financial aid. The form becomes available on October 1 of the year before the academic year. The income information you provide should be from the tax year two years before the academic year. This is often referred to as the "prior-prior year." It's important to note that if your financial circumstances change significantly after filing the FAFSA, such as due to a job loss or a sizable increase in income, you should update your FAFSA form accordingly. Although FAFSA does not have a formal process for reporting income changes after the form is submitted, you can reach out to the financial aid office at the school where the student plans to attend and inform them of the change. The FAFSA considers various types of income in determining a student's financial aid eligibility. These include: This category includes income earned from employment, such as wages, salaries, tips, and other taxable employee pay. When completing the FAFSA, individuals are required to report the total amount of income they earned from their jobs. Self-employment income refers to income earned from running one's own business or engaging in freelance work. If the student or their family owns a business or farm, the income generated from these activities should be reported on the FAFSA. Income from investments, such as interest earned from savings accounts or dividends received from stocks and bonds, is also taken into account on the FAFSA. Individuals need to report the total amount of interest and dividends they received during the relevant tax year. If the student or their family owns rental properties and receives rental income, this income must be reported on the FAFSA. The net rental income, which is the income left after deducting expenses related to the rental properties, is considered. Any child support or alimony received by the student or their parents should be reported as income on the FAFSA. This includes payments received from a former spouse or co-parent. The purpose of including these amounts as income is to provide a comprehensive view of the individual's financial situation and determine their eligibility for financial aid. Taxable Social Security benefits are considered income on the FAFSA. If the student or their parents receive Social Security benefits, they are required to report the total amount received during the relevant tax year. Regular distributions from retirement accounts, such as pensions, 401(k) plans, or Individual Retirement Accounts (IRAs), are counted as income on the FAFSA. This includes both taxable and tax-exempt retirement income. In general, disability benefits are considered income on the FAFSA. However, there may be exceptions based on the specific type of disability benefits received. Individuals should report any taxable disability benefits they received during the relevant tax year. Veterans may receive various benefits, such as education assistance, disability compensation, or pension payments. The taxable portion of these benefits should be reported on the FAFSA. An essential point for families to understand is the potential impact of retirement account withdrawals on the FAFSA. While the balance of retirement accounts is not reported as an asset on the FAFSA, distributions from these accounts do count as income. This can be particularly relevant for families considering large, one-time withdrawals from retirement accounts. Such withdrawals can inflate the family's income for that year and potentially reduce the student's financial aid eligibility. As such, careful planning around retirement account withdrawals can be beneficial in the context of college financial aid planning. The FAFSA does consider retirement income in its calculations. However, it's important to note that while retirement account distributions count as income, the balance of these accounts is not reported as an asset on the FAFSA. The FAFSA includes a comprehensive list of income categories, encompassing wages, self-employment income, rental income, retirement income, and more. Significant retirement account withdrawals can have a substantial impact on the FAFSA by inflating the family's income for the year of the withdrawal. Therefore, prudent planning around retirement account withdrawals is advisable for families navigating college financial aid processes.What Is FAFSA?

Does FAFSA Count Retirement Income?

FAFSA Income Reporting Requirements

Documentation and Verification of Income

Reporting Frequency and Timing

Reporting Changes in Income

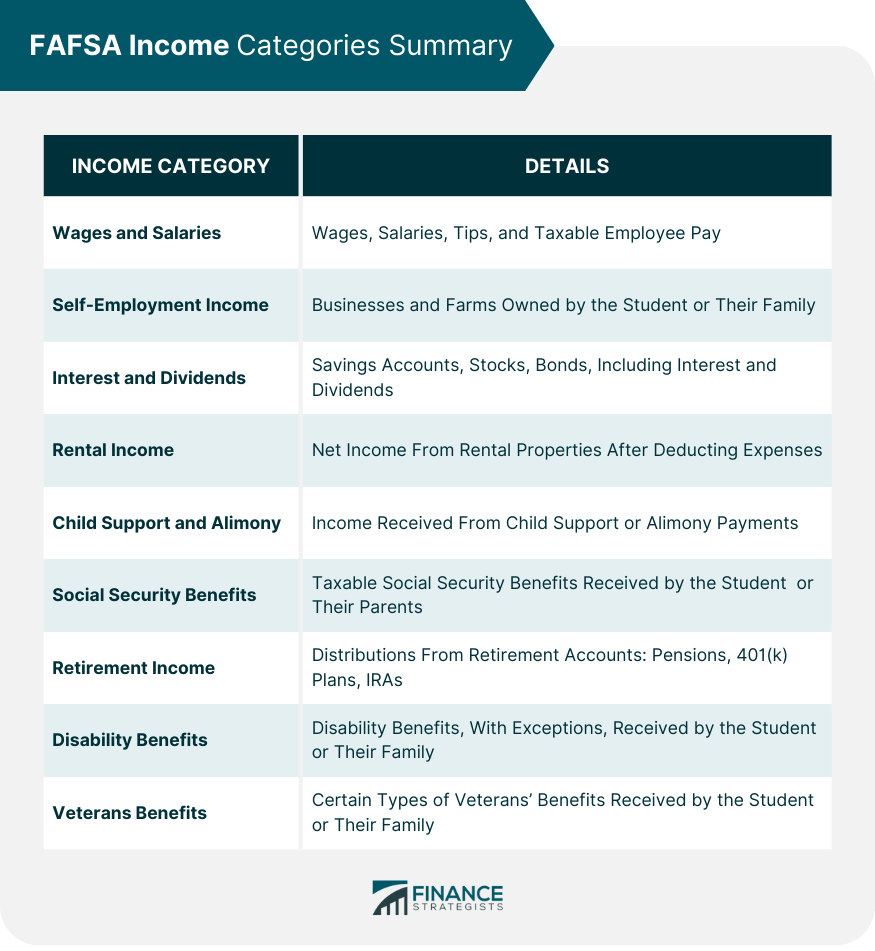

Categories of Income Considered on FAFSA

Wages and Salaries

Self-Employment Income

Interest and Dividends

Rental Income

Child Support and Alimony Received

Social Security Benefits

Retirement Income

Disability Benefits

Veterans Benefits

Effect of Retirement Account Withdrawals on FAFSA

Final Thoughts

Does FAFSA Count Retirement Income? FAQs

Yes, regular distributions from retirement accounts are generally counted as income on the FAFSA.

No, the value of retirement accounts, such as 401(k) or IRA balances, is not reported as an asset on the FAFSA.

You report various types of income on the FAFSA, including wages, self-employment income, retirement income, and more.

If your income changes significantly after you submit the FAFSA, you can contact the financial aid office at the school where the student plans to attend. They may be able to adjust your financial aid based on the updated information.

A large retirement account withdrawal can inflate your income for that year, which could potentially reduce your financial aid eligibility on the FAFSA.

True Tamplin is a published author, public speaker, CEO of UpDigital, and founder of Finance Strategists.

True is a Certified Educator in Personal Finance (CEPF®), author of The Handy Financial Ratios Guide, a member of the Society for Advancing Business Editing and Writing, contributes to his financial education site, Finance Strategists, and has spoken to various financial communities such as the CFA Institute, as well as university students like his Alma mater, Biola University, where he received a bachelor of science in business and data analytics.

To learn more about True, visit his personal website or view his author profiles on Amazon, Nasdaq and Forbes.