The Railroad Retirement System provides a reliable safety net for retired railroad employees and their families. It was established to help employees build financial security upon retirement, ensuring a steady flow of income when the regular paychecks cease. Like the Social Security system, it's a federal program funded by both employers and employees via payroll taxes. However, it offers more generous benefits than the regular Social Security program. It's important to note that individuals who work in the railroad industry contribute to the Railroad Retirement System instead of the Social Security System. As with any retirement benefits, understanding the tax implications is crucial for financial planning. As a beneficiary of the Railroad Retirement System, you might wonder how your benefits will be taxed. The simple answer to whether railroad retirement income is taxable is, yes, it can be. However, the taxability of these benefits is subject to multiple variables. Your total income from all sources, including your railroad retirement benefits, determines how much, if any, of your benefits are subject to tax. If your total income exceeds certain limits, a portion of your benefits may become taxable. Your filing status (single, married filing jointly, married filing separately, head of household, etc.) also affects the taxability of your railroad retirement benefits. Different income thresholds apply for each filing status, potentially influencing the portion of your benefits subject to tax. Your state of residence can impact the taxability of your railroad retirement benefits as well. While federal tax laws uniformly apply, state tax laws vary widely. Some states exempt railroad retirement benefits from state income taxes, while others do not. The number of dependents you claim and any tax exemptions you're eligible for can also impact the amount of your benefits subject to tax. The more exemptions and dependents you have, the less likely your benefits are to be taxed. Understanding the components of your railroad retirement benefits is key to understanding their taxability. Tier I benefits mirror Social Security benefits. These benefits are calculated using the same formula used for Social Security, including earnings from both railroad employment and outside employment. Tier II benefits are akin to a private pension and are based only on railroad earnings. The amount of these benefits depends on the length of the railroad service and the average salary in the employee's five highest-earning years. To qualify for railroad retirement benefits, an individual must be "vested." This requires a minimum of 10 years (120 months) of railroad service. Alternatively, if an employee has at least 5 years of railroad service after 1995, they are also vested. Beyond Tier I and Tier II benefits, the Railroad Retirement System also provides additional benefits. These include sickness and unemployment benefits, as well as supplemental annuities. These benefits also have potential tax implications that we'll explore further in the next sections of this guide. Understanding how different components of the Railroad Retirement Benefits are taxed can provide a clearer picture of your tax obligations. The portion of your Tier I benefits that is equivalent to Social Security is taxed in the same manner as Social Security benefits. If your combined income (defined as your adjusted gross income, nontaxable interest, and half of your Social Security or equivalent Railroad Retirement Benefits) falls below a certain threshold, these benefits are not taxed. However, if your combined income exceeds this threshold, a portion of these benefits becomes subject to federal income tax. Any portion of Tier I benefits not equivalent to Social Security—such as the residual lump-sum payments or vested dual benefits—is fully taxable. Tier II benefits are taxed differently from Tier I benefits. Regardless of your income level, a portion of Tier II benefits is always taxable. This portion is generally considered regular income and is subject to the same tax rates. Any sickness and unemployment benefits received through the Railroad Retirement Board are considered taxable income. These benefits should be reported on your federal income tax return. Meanwhile, supplemental annuities, funded by railroad employers, are also fully taxable. As mentioned, the taxability of your Railroad Retirement benefits, particularly Tier I benefits, is heavily influenced by your total income. If your total income from all sources, including your benefits, exceeds a certain threshold, your benefits may be taxed. The nature and amount of other income you receive, such as income from a part-time job, investments, or other retirement benefits, can also influence the taxability of your railroad retirement income. This other income is included in the calculation of your combined income, which determines the taxability of your benefits. The Internal Revenue Code and associated regulations govern the tax treatment of Railroad Retirement benefits. Any changes in tax laws or policies can, therefore, affect the taxation of your benefits. For instance, adjustments in tax rates, exemptions, or the definition of taxable income can impact your tax obligations. State tax laws play a critical role in determining the taxability of your Railroad Retirement benefits. Some states exempt these benefits from state income taxes, while others may tax them in part or in full. It is crucial to understand the specific laws in your state of residence. Federal income tax withholding refers to the process by which taxes are taken out of your railroad retirement benefits before you receive them. The Railroad Retirement Board (RRB) can withhold federal taxes from your benefits if you choose. The method of calculating withholding on Railroad Retirement benefits can vary based on the type of benefit. The RRB uses IRS rules to determine withholding amounts. You can use the RRB's tax withholding election options or the IRS's tax withholding estimator to calculate the proper withholding. You can adjust your withholding at any time using Form RRB W-4P, "Withholding Certificate for Railroad Retirement Payments." If your circumstances change—for example, if you get another job or there's a change in your income—you might need to adjust your withholding to ensure the correct amount of tax is taken out of your benefits. Navigating the tax filing process can be complicated, but understanding the necessary documents can simplify it. Beneficiaries of railroad retirement benefits will need their respective tax forms (RRB-1099 and RRB-1099-R), which the Railroad Retirement Board mails each January. These forms detail the benefits you received in the previous year. Form RRB-1099 is used to report Tier I benefits received in a tax year. This form details the total amount of benefits paid, the portion that is equivalent to Social Security, and the portion that is taxable. Form RRB-1099-R reports Tier II benefits, vested dual benefits, and supplemental annuity payments. These forms will break down how much of your benefits is taxable income. Additional benefits such as sickness and unemployment are reported as income on your tax return. The RRB sends beneficiaries who received these benefits Form 1099-G. Tax credits and deductions can help lower your overall tax liability. These could include the Credit for the Elderly or Disabled and medical expense deductions. Review IRS guidelines to learn more about available credits and deductions. Consider investing in tax-deferred retirement accounts like Individual Retirement Accounts (IRA). These accounts can help reduce your current taxable income. Your decision to retire early or delay retirement can impact your taxes. Delaying retirement may lead to higher benefits, but may also mean a higher tax bill. Given the complexity of tax laws, it may be helpful to consult with a tax professional. They can provide personalized advice based on your situation and help you plan your retirement effectively. The taxation of Railroad Retirement Benefits is multifaceted. Tier I and Tier II benefits are subject to different tax treatments, with several factors such as total income, filing status, residency status, and dependents impacting their taxability. It's important to understand the required tax documents for reporting these benefits, and strategies like taking advantage of tax credits and deductions and considering the tax implications of early or delayed retirement can minimize your tax obligation. Taxes on Railroad Retirement benefits can significantly affect your retirement income, and understanding your potential tax obligation can help you better plan for the future. Consult a tax professional for personalized advice based on your specific circumstances. Given the complexity of tax laws and the significant impact taxes can have on your retirement income, it's beneficial to have expert guidance when planning your retirement strategy.Overview of the Railroad Retirement System

Is Railroad Retirement Income Taxable?

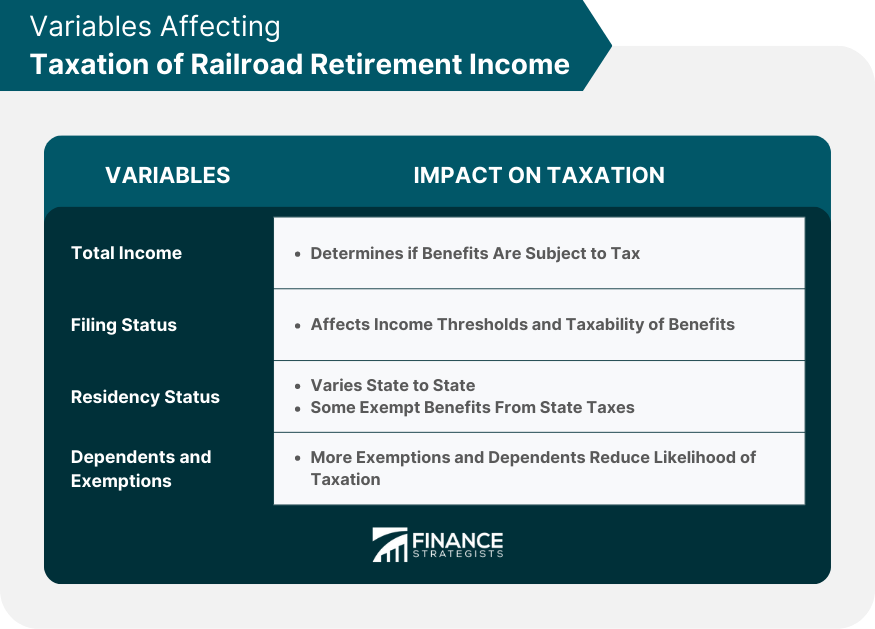

Variables Affecting the Taxation of Railroad Retirement Income

Total Income From All Sources

Filing Status

Residency Status

Dependents and Exemptions

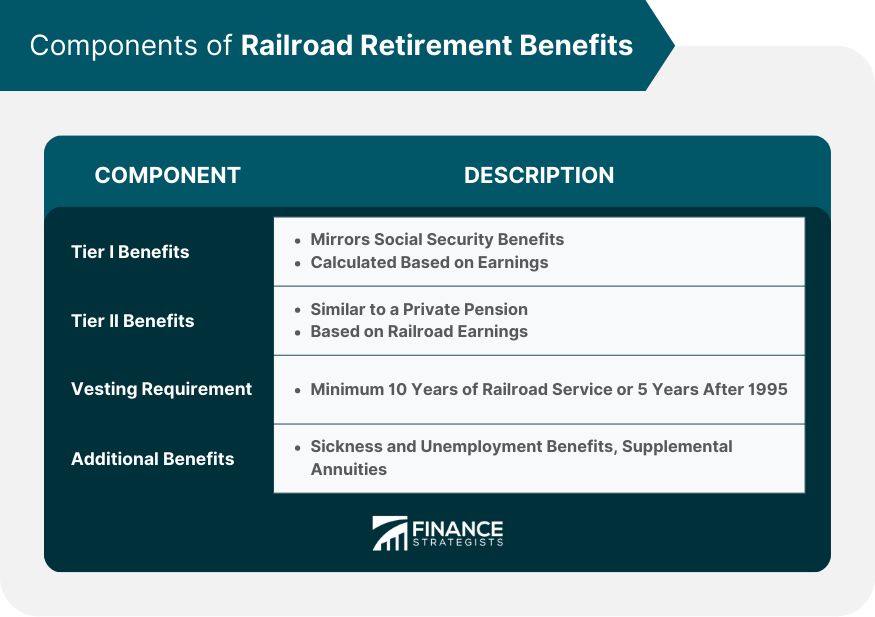

Components of Railroad Retirement Benefits

Tier I Railroad Retirement Benefits

Tier II Railroad Retirement Benefits

Vesting Requirement for Railroad Retirement Benefits

Additional Benefits

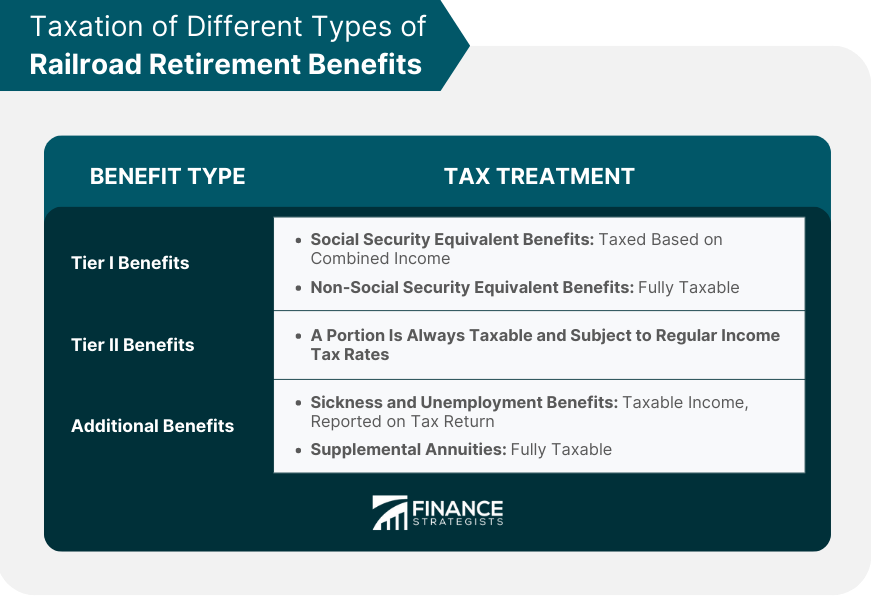

Taxation of Different Types of Railroad Retirement Benefits

Tax Treatment of Tier I Benefits

Social Security Equivalent Benefits

Non-social Security Equivalent Benefits

Tax Treatment of Tier II Benefits

Taxation of Additional Railroad Retirement Benefits

Factors Influencing Taxability of Railroad Retirement Income

Importance of Total Income

Effect of Other Sources of Income

Impact of Tax Laws and Policies

Role of State Tax Laws

Federal Income Tax Withholding on Railroad Retirement Benefits

How to Calculate Withholding on Railroad Retirement Benefits

How to Adjust Withholding

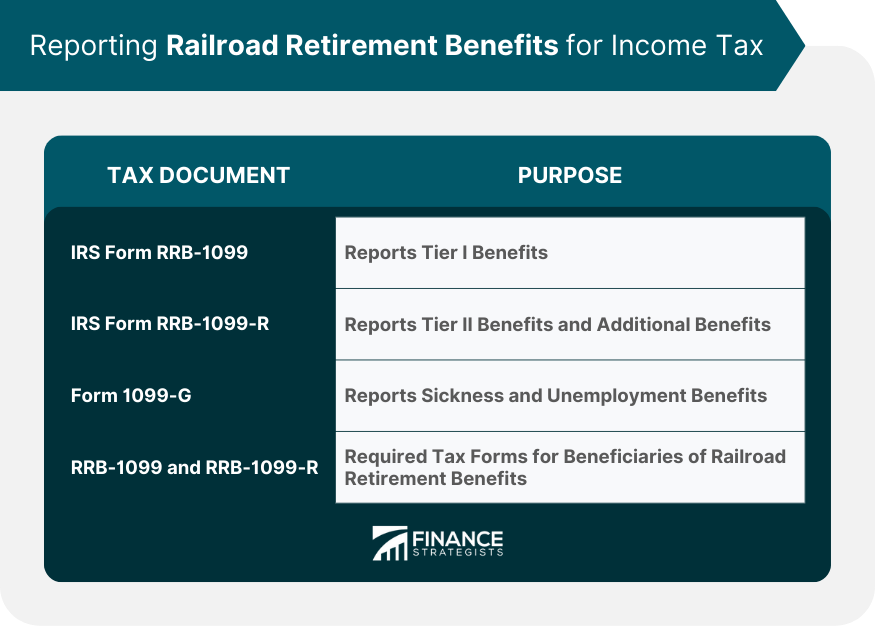

Reporting Railroad Retirement Benefits for Income Tax

Required Tax Documents

IRS Form RRB-1099: Reporting Tier I Benefits

IRS Form RRB-1099-R: Reporting Tier II Benefits

Reporting Additional Benefits

Strategies to Minimize Tax on Railroad Retirement Benefits

Taking Advantage of Tax Credits and Deductions

Using Retirement Accounts to Shelter Income

Tax Implications of Early or Delayed Retirement

Consulting With a Tax Professional

The Bottom Line

Is Railroad Retirement Income Taxable? FAQs

Yes, Railroad Retirement Income can be taxable, depending on several factors like your total income, filing status, and state of residence.

The taxability of Railroad Retirement Income varies based on the type of benefit (Tier I or Tier II) and other income sources.

The tax on Railroad Retirement Income is calculated based on IRS guidelines, considering factors like total income and filing status.

Yes, strategies like taking advantage of tax credits and deductions or using retirement accounts to shelter income can help minimize the tax on your Railroad Retirement Income.

Yes, Railroad Retirement Income must be reported on your tax return using the appropriate forms provided by the Railroad Retirement Board.

True Tamplin is a published author, public speaker, CEO of UpDigital, and founder of Finance Strategists.

True is a Certified Educator in Personal Finance (CEPF®), author of The Handy Financial Ratios Guide, a member of the Society for Advancing Business Editing and Writing, contributes to his financial education site, Finance Strategists, and has spoken to various financial communities such as the CFA Institute, as well as university students like his Alma mater, Biola University, where he received a bachelor of science in business and data analytics.

To learn more about True, visit his personal website or view his author profiles on Amazon, Nasdaq and Forbes.