Rental income in retirement refers to the steady stream of income generated from renting out real estate properties during one's retirement years. This income serves as a significant financial resource to supplement other forms of retirement income like social security, pensions, or savings. The primary purpose of securing rental income in retirement is to ensure a consistent cash flow and to diversify income sources, which aids in financial stability. Given the economic uncertainties and inflation, having a stable rental income can have a substantial positive impact on retirees by helping to maintain their lifestyle and covering any unforeseen expenses. The context of rental income in retirement revolves around careful planning, wise investment decisions, and effective property management. This strategy offers potential financial security but also requires knowledge about the real estate market, property maintenance, and tenant management. Rental income works through a relatively simple process: A property owner rents out their property (residential, commercial, or vacation) to tenants and charges a pre-agreed-upon amount of rent, typically collected monthly. This rent becomes the owner's income. Depending on the rental agreement, the owner might also earn additional income from services like laundry or parking. However, it's important to remember that rental income isn't pure profit. Property owners must consider ongoing expenses like mortgage payments, property taxes, insurance, maintenance costs, and potential property management fees, which are deducted from the gross rental income. The potential of utilizing rental income as a significant source of retirement funding is immense. This steady inflow can conveniently cater to various needs, including day-to-day living expenses, healthcare costs, and even fulfilling travel aspirations during your golden years. Notably, it acts as a financial cushion, insulating retirees from market volatility that could negatively impact their wealth, a risk often associated with investments in volatile assets like stocks and bonds. By adding a tangible asset like real estate to your retirement plan, you cultivate an additional layer of financial security, contributing to a worry-free, comfortable retirement. Before investing in rental properties, you must assess your financial capability. You need to understand your current financial situation, your risk tolerance, and your future financial goals. There are various types of rental properties, each with its pros and cons. You might opt for residential, commercial, or vacation rentals, depending on your financial goals, market understanding, and personal preferences. Real estate should be part of a balanced investment portfolio. This means understanding how it fits with other investments and ensuring that you are not over-investing in one area. Acquiring the rental property involves research, inspections, financing, and, finally, purchase. It's crucial to carry out due diligence to ensure the property aligns with your financial goals and risk tolerance. Managing a rental property can be time-consuming. Some owners opt for self-management, while others hire property managers. Both options have their pros and cons, and your decision should depend on your financial capacity, time availability, and personal preference. A well-defined tenant selection process can help you avoid potential legal complications and ensure consistent rental income. Understanding the legal and regulatory aspects of owning rental property is crucial. These include zoning laws, landlord and tenant laws, and property tax regulations, among others. Continuous Cash Flow: Rental properties can provide a steady stream of income, which is especially beneficial during retirement when regular salary stops. Potential for Property Appreciation: Over time, properties generally increase in value, which can contribute to an overall rise in net worth. Tax Benefits: Property owners often qualify for various tax deductions related to rental properties, which can help lower overall tax liability. Inflation Hedge: Real estate is often considered a good hedge against inflation. As living costs increase, so typically does rent, allowing income from the property to keep pace with inflation. Leverage: Allows property investors to buy more property with less of their own money, thereby increasing potential returns. Rental Vacancies: When properties go unrented, the owner must cover all costs, which can strain finances. Maintenance and Repairs: Properties require ongoing maintenance and occasional costly repairs, which can erode the profitability of rental income. Managing Tenants: Dealing with tenants and the legalities of rental agreements can be complex and time-consuming. Market Risk: Real estate markets can fluctuate, which can impact both rental income and property values. Liquidity Risk: Unlike stocks or bonds, real estate is not easily liquidated. This can pose a problem if funds are needed quickly. Rental income can provide a steady income stream in retirement, but it shouldn't be your only source. Combine it with other retirement savings such as 401(k) plans, Individual Retirement Accounts (IRAs), and Social Security benefits to ensure a well-diversified retirement income. While rental properties can be a great investment, it's important to ensure you're not overly concentrated in real estate. Balance your investment portfolio with other asset classes to reduce risk. Just like any investment strategy, your approach to rental income should be flexible. It's crucial to review and adjust your plan based on changes in the market and your personal needs. The integration of rental income into your retirement strategy presents significant potential benefits. This passive income source can offer a steady stream of funds, serving as a financial safety net during the golden years of your life. While it may help manage everyday expenses, health care costs and fulfill retirement dreams, it's essential to remember that rental income also necessitates careful planning and astute financial decisions. It requires a keen understanding of the real estate market and effective property and tenant management. As a part of a balanced retirement plan, rental income should complement other retirement savings to ensure diversification and reduce risk. Adaptability remains crucial to navigate changes in the market and personal circumstances, leading to a more secure and enjoyable retirement.Rental Income in Retirement: Overview

How Rental Income Works

Potential of Rental Income for Retirement Funding

Preparing for Rental Income in Pre-retirement Years

Assessing Your Financial Capability

Deciding on the Type of Rental Property

Role of Real Estate in Your Investment Portfolio

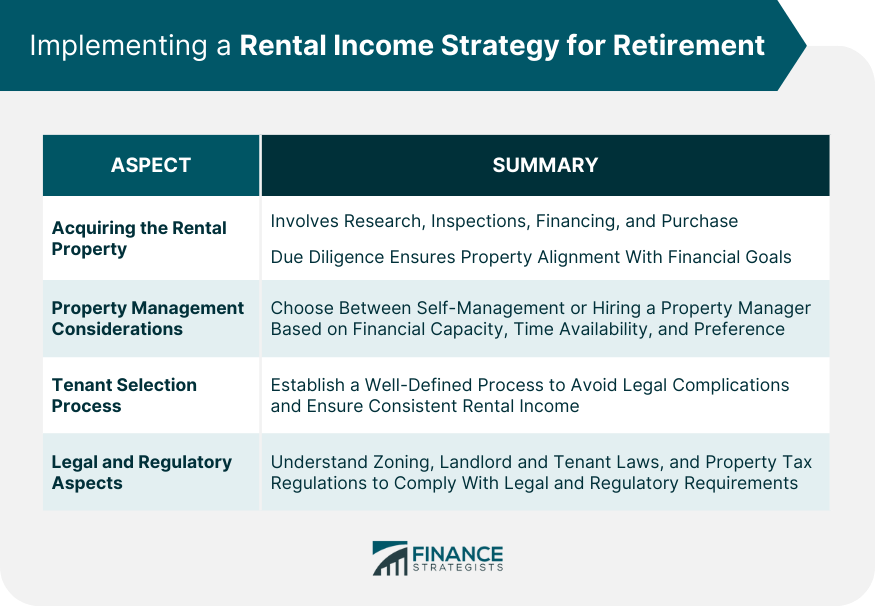

Implementing the Rental Income Strategy for Retirement

Acquiring the Rental Property

Property Management Considerations

Self-Management vs Hiring a Property Manager

Tenant Selection Process

Legal and Regulatory Aspects

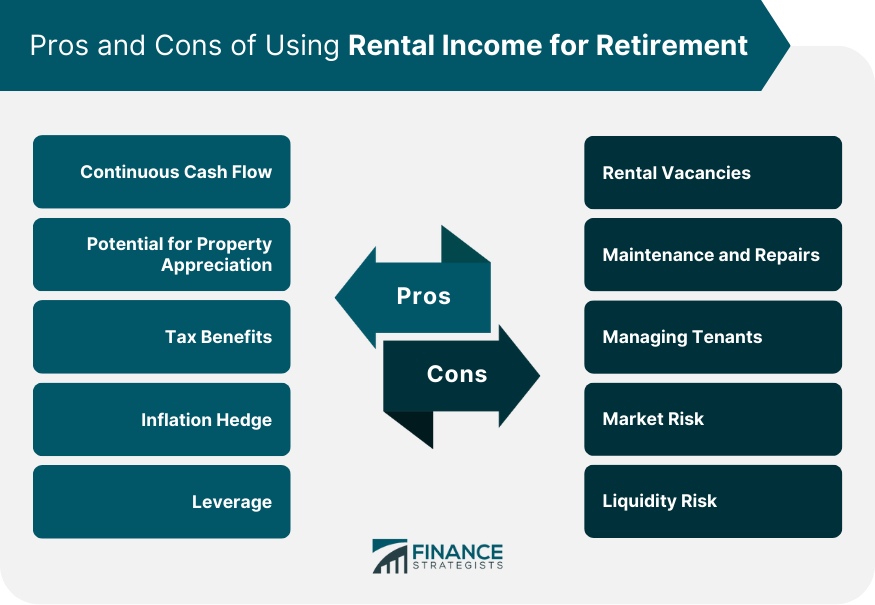

Pros and Cons of Using Rental Income for Retirement

Pros

Cons

Role of Rental Income in a Balanced Retirement Plan

Combining Rental Income With Other Retirement Savings

Ensuring Adequate Diversification

Adjusting the Plan Over Time Based on Market Conditions and Personal Needs

The Bottom Line

Rental Income in Retirement FAQs

Rental income for retirement serves as a steady stream of cash flow that complements other retirement income sources like social security, pensions, or withdrawals from retirement accounts. It can provide stability against market volatility, potentially keep pace with inflation, and contribute to an increase in net worth through property appreciation.

Benefits of rental income for retirement include continuous cash flow, potential property appreciation, tax benefits, and an inflation hedge. Downsides include rental vacancies, costs of maintenance and repairs, tenant management challenges, market risks, and liquidity risks.

Preparing for rental income for retirement involves assessing your financial capability, deciding on the type of rental property, and understanding the role of real estate in your investment portfolio. It's essential to conduct thorough due diligence before acquiring any property.

Key considerations when implementing rental income for retirement include the process of acquiring the rental property, deciding between self-management or hiring a property manager, and understanding the legal and regulatory aspects of owning and renting out a property.

To ensure the sustainability of rental income for retirement, it's essential to adapt to changes in market conditions and personal needs. This might involve adjusting rent prices, managing property upkeep efficiently, or even diversifying property types and locations. Ongoing review and flexibility are key to managing rental income in retirement.

True Tamplin is a published author, public speaker, CEO of UpDigital, and founder of Finance Strategists.

True is a Certified Educator in Personal Finance (CEPF®), author of The Handy Financial Ratios Guide, a member of the Society for Advancing Business Editing and Writing, contributes to his financial education site, Finance Strategists, and has spoken to various financial communities such as the CFA Institute, as well as university students like his Alma mater, Biola University, where he received a bachelor of science in business and data analytics.

To learn more about True, visit his personal website or view his author profiles on Amazon, Nasdaq and Forbes.