A retirement income portfolio refers to the collection of investments and assets that individuals build and manage to generate a steady stream of income during their retirement years. It is designed to provide financial stability and support after an individual stops working and relies primarily on their accumulated savings and investments. Retirement income portfolios typically consist of various investment vehicles, such as stocks, bonds, mutual funds, annuities, real estate, and other assets that generate income. Retirement shouldn't be about scrimping and saving. It's about enjoying the fruits of their labor. The composition of the portfolio depends on an individual's risk tolerance, investment goals, time horizon, and personal circumstances. It provides a stable and reliable income stream during retirement, safeguarding you against financial hardships. It supports lifestyle maintenance and unexpected expenses management without the fear of depleting your savings. Retirement income portfolios are designed to generate income to cover living expenses and maintain the desired lifestyle after retirement. By diversifying investments across different asset classes, individuals can create a reliable source of income. Inflation erodes the purchasing power of money over time. A well-structured retirement income portfolio takes into account the impact of inflation and includes investments that have the potential to provide returns that outpace inflation, preserving the value of the portfolio. Retirement income portfolios aim to balance risk and return. By diversifying investments across various asset classes, such as stocks, bonds, and real estate, individuals can reduce the overall risk and volatility of their portfolio while potentially maximizing returns. With increasing life expectancy, individuals need to plan for the possibility of living longer than expected. A well-structured retirement income portfolio considers longevity risk by incorporating investments that can provide income throughout an extended retirement period. Life circumstances and financial goals can change during retirement. A well-structured portfolio allows for flexibility and adjustments as needed, enabling individuals to adapt to evolving needs, market conditions, and unexpected expenses. Retirement income portfolios can also be structured to leave a financial legacy for future generations or support charitable causes. Careful planning and asset allocation can ensure that there are assets remaining to be passed on to heirs or beneficiaries. These are investments that provide a fixed return over a specified period. Examples include bonds, Treasury bills, certificates of deposit (CDs), and bond mutual funds. Fixed income investments are generally considered less risky than stocks and can provide a steady stream of income through interest payments. Stocks of companies that regularly distribute a portion of their earnings as dividends can be an attractive option for generating income. Dividend payments can provide a consistent cash flow, and some companies have a history of increasing their dividends over time. However, dividend-paying stocks carry more market risk compared to fixed income investments. Annuities are insurance products that offer a guaranteed income stream in exchange for a lump sum payment or periodic contributions. They can be immediate, where the income starts right away, or deferred, where the income begins at a future date. Annuities provide a reliable income source, but it's important to carefully review their terms, fees, and potential limitations before investing. REITs are companies that own, operate, or finance income-generating real estate properties. Investing in REITs allows individuals to gain exposure to the real estate market without directly owning properties. REITs typically generate income through rental payments or property sales, and they are required to distribute a significant portion of their taxable income to shareholders. It's crucial to assess your risk tolerance and investment objectives when selecting income-generating investments. Some investments, like stocks, carry higher market risks but offer potential for higher returns. Others, such as fixed income investments, provide more stability but may have lower potential returns. Aligning your investments with your risk tolerance and objectives is essential to maintain a comfortable balance between risk and income generation. Your time horizon and income needs will influence the selection of investments in your retirement income portfolio. If you have a longer time horizon before retirement, you may be more willing to take on higher-risk investments with greater growth potential. As you approach retirement, it's generally advisable to gradually shift towards more conservative investments that prioritize income generation and capital preservation. Diversification involves spreading investments across different asset classes, sectors, and geographic regions to reduce risk. A well-diversified retirement income portfolio typically includes a mix of income-generating investments to mitigate the impact of market fluctuations. Asset allocation involves determining the percentage of your portfolio allocated to different investment categories based on your risk tolerance and goals. Before building a retirement income portfolio, it's important to determine your income needs and goals. Consider factors such as your desired lifestyle, anticipated expenses, healthcare costs, and any other financial obligations. This assessment will help you determine how much income you need to generate from your portfolio to support your retirement. When allocating assets for income generation, it's important to consider the risk and return characteristics of different investments. Balancing higher-risk investments with more conservative options can help manage risk while potentially maximizing returns. For example, you may allocate a portion of your portfolio to higher-yielding dividend stocks for income growth potential, while also including fixed income investments for stability. A balanced retirement income portfolio aims to strike a balance between income stability and growth potential. This involves selecting investments that offer steady income streams, such as fixed income investments and dividend-paying stocks, as well as investments that have the potential for capital appreciation over time, such as growth-oriented stocks or equity funds. Diversification is key to managing risk in a retirement income portfolio. Allocate investments across different asset classes, such as stocks, bonds, real estate, and potentially alternative investments like commodities or precious metals. Each asset class may perform differently under varying market conditions, so diversification helps reduce the impact of a single investment's performance on the overall portfolio. Within each asset class, select investments with varying risk profiles to further diversify your portfolio. For example, within the bond portion, consider a mix of government bonds, corporate bonds, and high-yield bonds. This diversification helps mitigate risks associated with specific sectors or individual companies. DRIPs allow investors to automatically reinvest dividends back into the underlying investment, typically in the form of additional shares. This strategy can enhance long-term growth potential and compound income over time. SWPs enable retirees to receive a regular stream of income from their portfolio. With SWPs, a predetermined amount is systematically withdrawn from the portfolio at regular intervals, providing a consistent income stream while potentially preserving the principal. Bond laddering involves investing in a range of bonds with staggered maturity dates. This strategy helps manage interest rate risk and provides a steady stream of income as bonds mature and are reinvested. Maximizing your Social Security benefits can significantly enhance your retirement income. Strategies such as delaying your benefits past the eligible age, coordinating benefits with a spouse, or utilizing spousal or survivor benefits can help maximize your lifetime Social Security income. Consulting with a financial advisor or utilizing online tools can aid in optimizing your Social Security strategy. Longevity risk refers to the possibility of outliving your retirement savings. To manage this risk, consider strategies like purchasing annuities that provide guaranteed income for life, considering longevity insurance products, or implementing a systematic withdrawal plan that takes into account your life expectancy. These strategies provide a level of protection against the risk of depleting your savings prematurely. Developing tax-efficient withdrawal strategies can help minimize the tax impact on your retirement income. This may involve withdrawing funds from tax-advantaged accounts, such as Roth IRAs or Health Savings Accounts (HSAs), before tapping into taxable accounts. Additionally, being strategic about timing withdrawals and considering the tax implications of capital gains and dividends can optimize your tax situation. Healthcare and insurance costs can have a significant impact on retirement expenses. It's essential to plan for potential healthcare needs and consider the cost of Medicare premiums, supplemental insurance, long-term care insurance, and other healthcare-related expenses. Evaluating different insurance options and factoring in potential medical costs can help you better estimate your retirement income needs. Regularly reviewing your retirement income portfolio is crucial to assess its performance and ensure it remains aligned with your goals. Conduct periodic evaluations to analyze investment performance, review asset allocation, and consider any necessary adjustments based on changing market conditions and personal circumstances. Rebalancing involves adjusting your portfolio's asset allocation to maintain the desired risk and return profile. Market fluctuations can lead to imbalances in your portfolio, so periodically rebalancing by selling overperforming assets and reinvesting in underperforming ones helps ensure your portfolio remains in line with your investment objectives. Your income needs and circumstances may change throughout retirement. It's important to regularly assess your income withdrawal strategy and make adjustments as necessary. Factors such as changes in living expenses, unexpected financial obligations, market conditions, or alterations in your risk tolerance may warrant a review and potential modification of your withdrawal strategy. Building and managing a well-structured retirement income portfolio is a critical aspect of financial planning that ensures income stability, protection against inflation, effective risk management, and flexibility during your retirement years. The retirement income portfolio, which comprises a diverse range of investments like stocks, bonds, real estate, and annuities, is designed to cater to your financial needs, risk tolerance, and personal circumstances. By strategically allocating assets, balancing income stability with growth potential, diversifying investments, and adopting income-generating strategies, you can create a robust financial plan for your golden years. Regularly reviewing and adjusting your portfolio ensures it remains aligned with your evolving needs and market conditions. In essence, a well-curated retirement income portfolio is the cornerstone of a secure, worry-free retirement.Overview of Retirement Income Portfolios

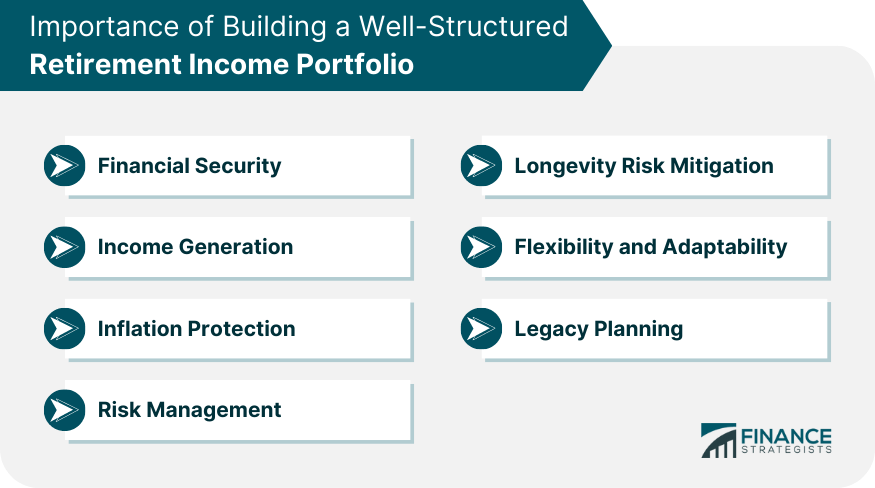

Importance of Building a Well-Structured Retirement Income Portfolio

Financial Security

Income Generation

Inflation Protection

Risk Management

Longevity Risk Mitigation

Flexibility and Adaptability

Legacy Planning

Key Components of Retirement Income Portfolios

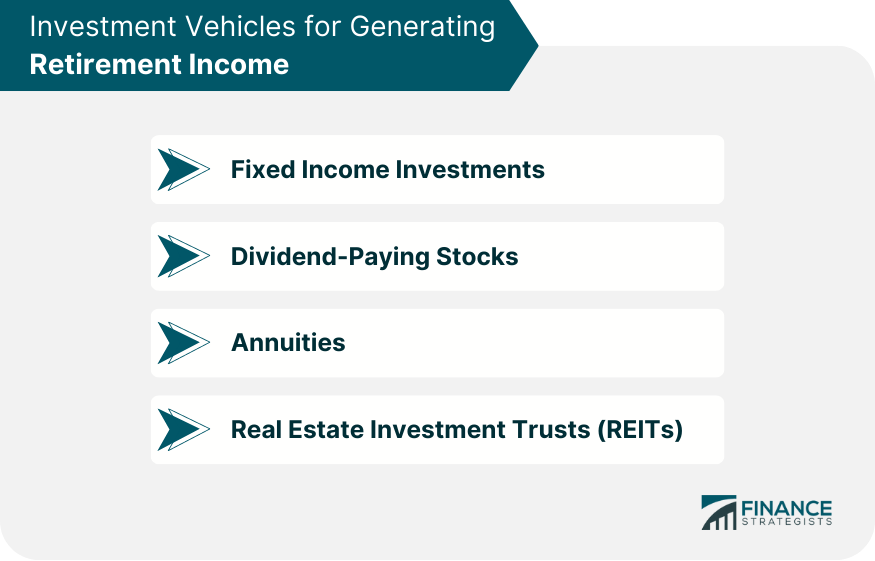

Investment Vehicles for Generating Retirement Income

Fixed Income Investments

Dividend-Paying Stocks

Annuities

Real Estate Investment Trusts (REITs)

Considerations When Selecting Income-Generating Investments

Risk Tolerance and Investment Objectives

Time Horizon and Income Needs

Diversification and Asset Allocation

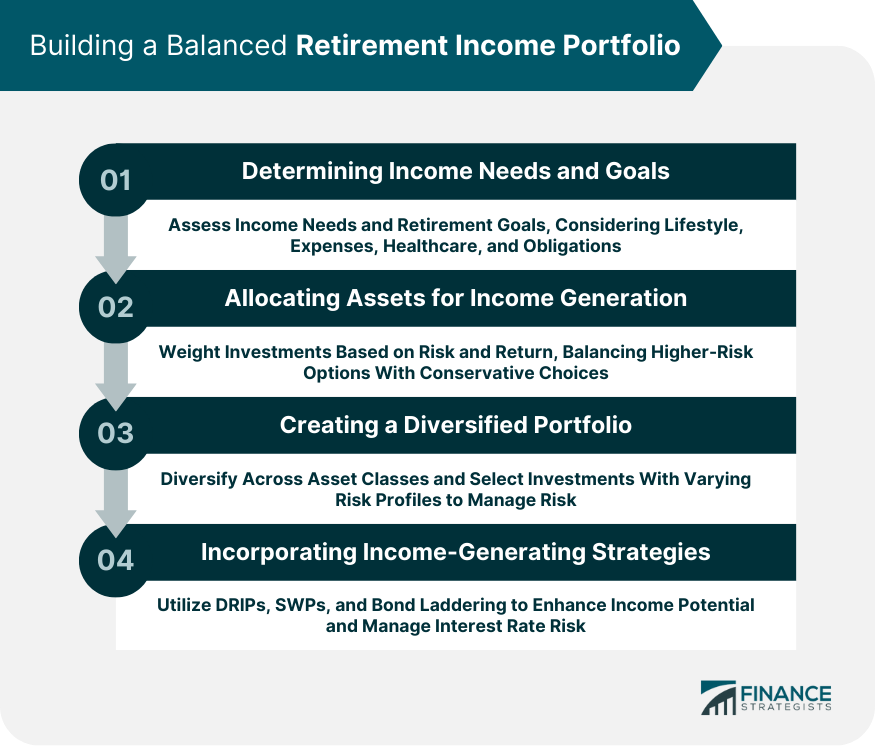

Building a Balanced Retirement Income Portfolio

Determining Income Needs and Goals

Allocating Assets for Income Generation

Weighting Investments Based on Risk and Return

Balancing Income Stability and Growth Potential

Creating a Diversified Portfolio

Spreading Investments Across Different Asset Classes

Selecting Investments With Varying Risk Profiles

Incorporating Income-Generating Strategies

Dividend Reinvestment Plans (DRIPs)

Systematic Withdrawal Plans (SWPs)

Bond Laddering

Strategies for Maximizing Retirement Income

Social Security Optimization

Longevity Risk Management

Tax-Efficient Withdrawal Strategies

Consideration of Healthcare and Insurance Costs

Monitoring and Adjusting Retirement Income Portfolios

Regular Portfolio Reviews and Performance Assessments

Rebalancing Investments as Needed

Adjusting Income Withdrawal Strategies Based on Changing Circumstances

Conclusion

Retirement Income Portfolios FAQs

A retirement income portfolio refers to a collection of investments specifically designed to generate income during retirement.

Building a retirement income portfolio is crucial because it helps ensure a sustainable and reliable income stream to support one's financial needs during retirement.

The key components of a retirement income portfolio include fixed income investments, dividend-paying stocks, annuities, and real estate investment trusts (REITs).

Allocating assets for income generation involves weighting investments based on their risk and return characteristics, balancing income stability with growth potential.

Strategies to maximize retirement income within a portfolio include optimizing Social Security benefits, managing longevity risk, employing tax-efficient withdrawal strategies, and considering healthcare and insurance costs.