Retirement spending strategies are important because they provide a framework for individuals to effectively manage their finances during retirement. Without a plan, retirees risk outliving their savings, overspending, or not being able to afford the lifestyle they desire. Such strategies allow individuals to make informed decisions about how much to spend and how to invest their savings, taking into account factors such as inflation, unexpected expenses, and changes in market conditions. The age at which an individual retires can significantly impact their spending strategy. Retiring earlier means a longer retirement period, which requires a more conservative spending approach to ensure the funds last. Conversely, retiring later can allow for a more aggressive spending strategy. Understanding life expectancy is essential in creating a spending strategy that ensures financial stability throughout retirement. Individuals should consider their family's health history and lifestyle factors when estimating how long their retirement savings need to last. A retiree's income sources play a crucial role in determining their spending strategy. These sources can include social security, pensions, annuities, and investments. The stability and reliability of these income streams can affect the level of risk a retiree is willing to take with their spending. Healthcare costs and long-term care expenses can significantly impact a retiree's spending strategy. Individuals should consider their current health status, potential future health issues, and the cost of long-term care insurance when developing their retirement spending plans. A retiree's desired lifestyle will directly impact their spending strategy. Travel, hobbies, and social activities all factor into the amount of money needed to maintain the desired lifestyle throughout retirement. Inflation and market risks can affect the value of a retiree's investments and purchasing power over time. A successful spending strategy should account for these factors and include appropriate risk management techniques. The 4% rule is a widely used retirement spending strategy that suggests withdrawing 4% of the initial retirement portfolio in the first year and adjusting the withdrawal amount annually for inflation. This rule was developed in the 1990s by financial advisor William Bengen based on historical market data. The 4% rule accounts for inflation by adjusting the withdrawal amount each year. This ensures that the retiree's purchasing power remains consistent throughout their retirement. While the 4% rule is simple and easy to understand, it has several limitations. Critics argue that the rule may not be suitable for all individuals, particularly those with different risk tolerances or investment portfolios. Additionally, the rule is based on historical data, which may not accurately predict future market conditions. The bucket strategy divides a retiree's portfolio into different "buckets" based on the time horizon for when the funds will be needed. Each bucket is invested according to its designated time frame, with a more conservative approach for shorter time horizons and a more aggressive approach for longer time horizons. The asset allocation for each bucket should reflect the risk tolerance and investment goals for that particular time horizon. Typically, the first bucket includes cash and short-term investments, while the second and third buckets contain a mix of stocks, bonds, and other assets. To implement the bucket strategy, retirees should periodically replenish the first bucket with funds from the other buckets as needed. This approach allows for a more flexible spending strategy, as the retiree can adjust their withdrawals based on the performance of their investments. A dynamic spending strategy involves adjusting the withdrawal amount based on market performance. This approach helps retirees maintain their desired lifestyle while also preserving their wealth during market downturns. When the market performs well, retirees can increase their spending, and during the poor market performance, they can reduce their withdrawals to preserve their portfolio's value. To implement a dynamic spending strategy, retirees should establish spending guardrails, which are predetermined limits for increasing or decreasing spending based on market performance. These guardrails help to maintain a balance between enjoying retirement and ensuring the longevity of the retirement portfolio. The dynamic spending strategy offers the advantage of flexibility, allowing retirees to adapt their spending based on changing market conditions. However, it also requires ongoing monitoring and decision-making, which may be challenging for some individuals. Determining the appropriate withdrawal rate is crucial for balancing spending with preserving wealth throughout retirement. A too-high withdrawal rate may result in running out of funds, while a too-low withdrawal rate may lead to an unnecessarily frugal lifestyle. It's essential to regularly review and adjust the withdrawal rate based on changes in market conditions, personal circumstances, and financial goals. A well-diversified portfolio can help reduce risk and support a sustainable spending strategy throughout retirement. Diversification involves spreading investments across various asset classes, such as stocks, bonds, and real estate, to minimize the impact of market volatility on the retirement portfolio. Taxes can significantly impact a retiree's spending strategy. By understanding the tax implications of different income sources and withdrawal strategies, retirees can optimize their spending plan to minimize taxes and maximize their disposable income. Long-term care expenses can be a significant financial burden during retirement. By planning for these expenses, such as purchasing long-term care insurance or setting aside dedicated funds, retirees can ensure they are financially prepared for any future care needs. Many retirees wish to support their favorite charities during retirement. By incorporating charitable giving into their spending strategy, retirees can maintain their philanthropic commitments while also benefiting from potential tax advantages. Estate planning is essential for ensuring that retirees' assets are distributed according to their wishes upon their death. By working with a financial professional, retirees can develop an estate plan that aligns with their legacy goals and minimizes potential tax liabilities for their heirs. For those who wish to leave an inheritance to their loved ones, it's essential to factor in these plans when developing a retirement spending strategy. This may involve adjusting withdrawal rates, asset allocation, or other financial planning elements to preserve the desired amount of wealth for future generations. Developing a well-defined retirement spending strategy is essential for ensuring financial stability and achieving desired lifestyle goals throughout retirement. By considering factors such as age, life expectancy, income sources, health status, and lifestyle goals, retirees can develop a personalized spending plan that balances their needs and objectives. Furthermore, implementing key strategies such as the 4% rule, bucket strategy, or dynamic spending strategy can provide flexibility and security in managing retirement funds. Incorporating personal values and legacy goals, such as charitable giving and estate planning, can help retirees create a spending strategy that aligns with their overall life objectives. W Working with a financial professional can provide valuable guidance and support in developing, monitoring, and adjusting retirement spending strategies over time. Having a well-defined retirement spending strategy is crucial for a successful and fulfilling retirement. Importance of Retirement Spending Strategies

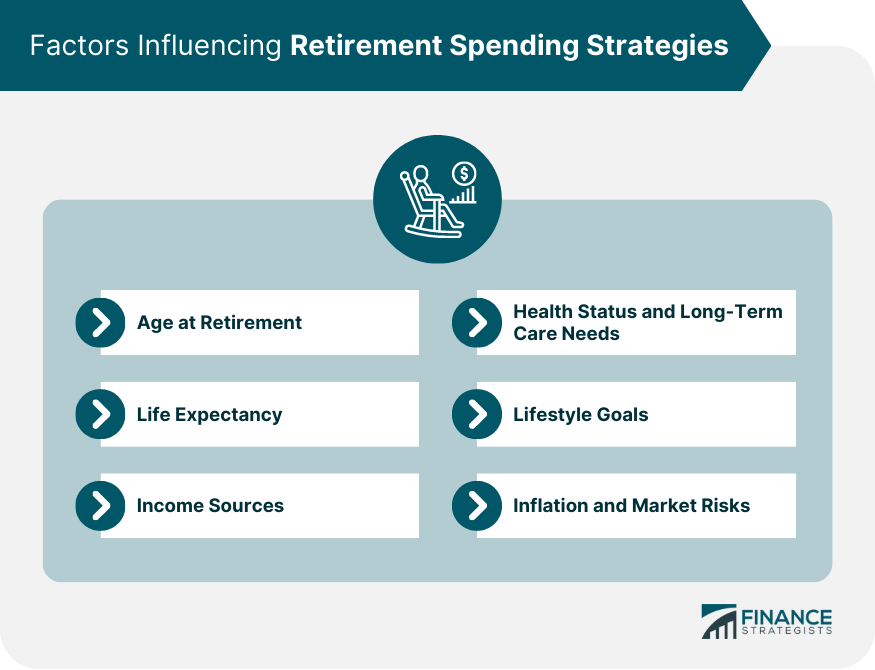

Factors Influencing Retirement Spending Strategies

Age at Retirement

Life Expectancy

Income Sources

Health Status and Long-Term Care Needs

Lifestyle Goals

Inflation and Market Risks

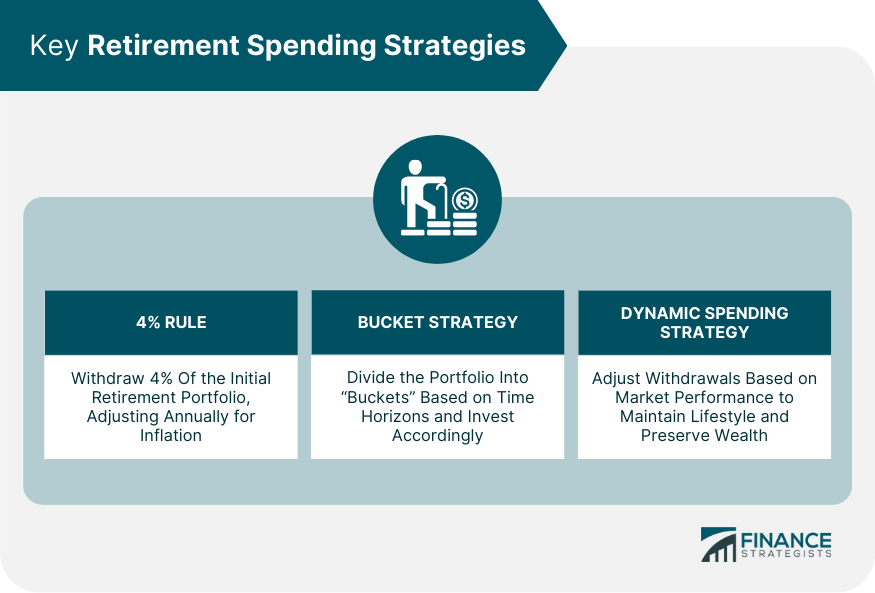

Key Retirement Spending Strategies

4% Rule

Bucket Strategy

Dynamic Spending Strategy

Balancing Spending With Preserving Wealth

Withdrawal Rate Considerations

Portfolio Diversification

Minimize Taxes

Factoring in the Potential for Long-Term Care Expenses

Incorporating Personal Values and Legacy Goals

Charitable Giving

Estate Planning

Inheritance Considerations

Bottom Line

Retirement Spending Strategies FAQs

There are three main types of retirement spending strategies: the 4% rule, the bucket strategy, and the dynamic spending strategy. The 4% rule suggests withdrawing 4% of the initial retirement portfolio in the first year and adjusting the withdrawal amount annually for inflation. The bucket strategy divides a retiree's portfolio into different time horizons and invests accordingly, while the dynamic spending strategy adjusts withdrawals based on market performance.

Retirees can balance spending and preserving wealth by determining an appropriate withdrawal rate, maintaining a well-diversified portfolio, minimizing taxes, and planning for potential long-term care expenses. Regularly reviewing and adjusting the withdrawal rate based on market conditions and personal circumstances is also crucial for ensuring financial stability throughout retirement.

Personal values and legacy goals can be incorporated into retirement spending strategies through charitable giving, estate planning, and inheritance considerations. By aligning spending plans with philanthropic commitments, desired asset distribution, and preserving wealth for future generations, retirees can create a spending strategy that reflects their overall life objectives.

Financial professionals can help retirees develop personalized spending strategies that align with their unique needs, circumstances, and goals. They can provide valuable advice on managing risk, minimizing taxes, and adjusting spending plans as needed. Additionally, financial professionals can assist with estate planning and incorporating personal values and legacy goals into the overall spending strategy.

Retirees should regularly review and adjust their retirement spending strategies based on changes in personal circumstances, market conditions, and financial goals. Working with a financial professional can help retirees stay on track and make the necessary adjustments to their spending strategy throughout their retirement.

True Tamplin is a published author, public speaker, CEO of UpDigital, and founder of Finance Strategists.

True is a Certified Educator in Personal Finance (CEPF®), author of The Handy Financial Ratios Guide, a member of the Society for Advancing Business Editing and Writing, contributes to his financial education site, Finance Strategists, and has spoken to various financial communities such as the CFA Institute, as well as university students like his Alma mater, Biola University, where he received a bachelor of science in business and data analytics.

To learn more about True, visit his personal website or view his author profiles on Amazon, Nasdaq and Forbes.