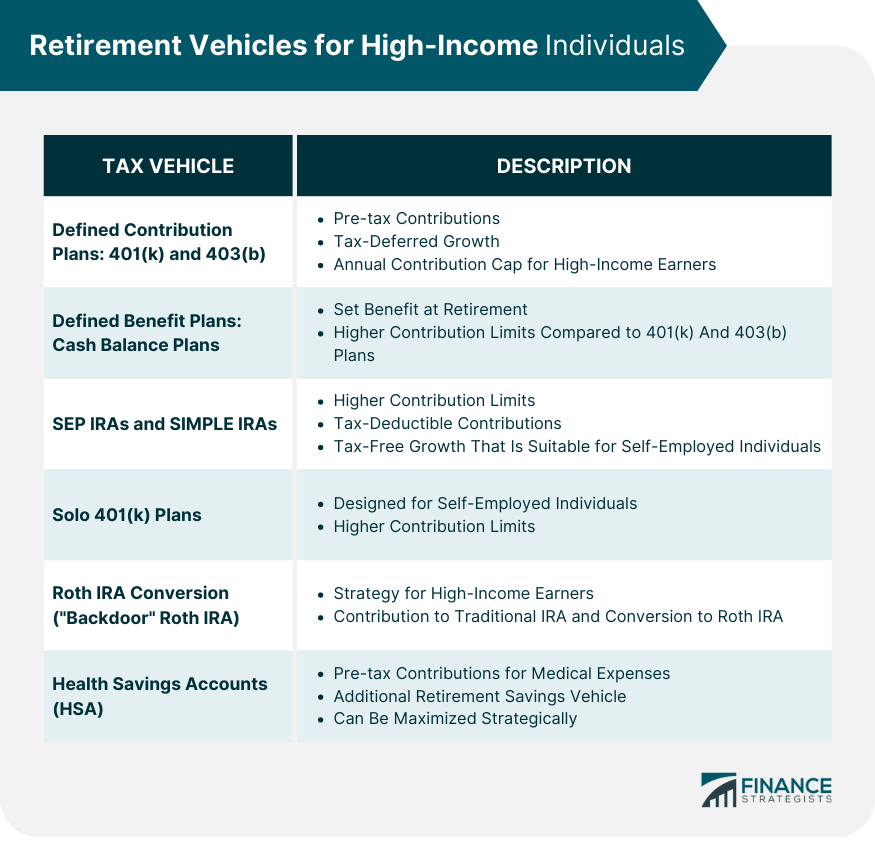

Retirement vehicles for high income refer to financial products and investment strategies specifically designed to help individuals with high incomes save for their retirement. These retirement vehicles provide a means to accumulate wealth in a tax-efficient manner, potentially allowing for higher contributions and greater growth compared to traditional retirement saving options. The purpose of these specialized strategies is to optimize wealth accumulation and tax savings to secure a comfortable retirement for high-income earners. Understanding these retirement vehicles is crucial for high-income individuals as it directly impacts their retirement planning, influencing their financial security in their retirement years. Don't let a high income become a retirement roadblock. Turn high earnings into a lifetime of prosperity. Defined contribution plans, specifically 401(k) and 403(b) plans, are the most common retirement saving vehicles. These plans allow individuals to make pre-tax contributions directly from their salaries, reducing taxable income. The funds then grow tax-deferred until withdrawal. For high-income earners, the limitation of these plans is the annual contribution cap, which may restrict the amount they can save for retirement. Unlike defined contribution plans, defined benefit plans, such as cash balance plans, provide a set benefit at retirement. These plans are often favored by high-income individuals due to their higher contribution limits compared to 401(k) and 403(b) plans. High-income earners can accumulate a significant nest egg over time using a cash balance plan. Simplified Employee Pension (SEP) IRAs and Savings Incentive Match Plans for Employees (SIMPLE) IRAs are excellent options for high-income earners, especially those who are self-employed or own a small business. These plans offer higher contribution limits than traditional IRAs and allow tax-deductible contributions. The tax-free growth of investments and the ability to make larger contributions make these plans a good choice for high-income earners. Solo 401(k) plans are designed for self-employed individuals or small business owners with no employees. They offer the same benefits as a traditional 401(k) but with higher contribution limits. This allows high-income earners to save more for retirement while reducing their current tax liability. A backdoor Roth IRA is a strategy for high-income earners who earn too much to contribute to a Roth IRA directly. This strategy involves contributing to a traditional IRA and then converting those funds to a Roth IRA. The conversion triggers a taxable event, but the funds grow tax-free after that. HSAs are unique retirement vehicles that allow individuals to contribute pre-tax dollars for medical expenses. However, if used strategically, HSAs can also serve as an additional retirement savings vehicle. High-income individuals can maximize their HSA contributions for future healthcare costs in retirement while enjoying the tax benefits. High-income earners often face higher tax liabilities. Therefore, tax-efficient strategies are crucial in their retirement planning. Investing in tax-efficient funds, such as index funds and ETFs, can reduce the tax burden. These funds generate fewer capital gains due to their low turnover, reducing the taxable income for the investor. Tax harvesting involves selling investments at a loss to offset capital gains from other investments. This strategy can reduce overall tax liability, making it a useful tool for high-income earners. Understanding tax brackets and leveraging deductions is crucial. By contributing to tax-deductible retirement accounts, high-income earners can potentially reduce their taxable income and fall into a lower tax bracket. Apart from the traditional retirement vehicles, there are several non-traditional avenues that high-income earners can explore to build their retirement nest egg. Real estate can be a lucrative investment for high-income earners. It provides an additional stream of income and potential capital appreciation over time. It's also an excellent hedge against inflation. High-income earners can invest in various real estate properties such as rental homes, commercial properties, and even real estate investment trusts (REITs). Annuities are insurance products that provide a steady income stream during retirement. They can be a valuable addition to the retirement portfolio of high-income earners. Fixed annuities, variable annuities, and indexed annuities are some options to consider. However, annuities come with their own set of complexities and potential downsides, so it is essential to understand them thoroughly before investing. Certain types of life insurance policies, such as whole life or universal life, have a cash value component that can grow over time and be used during retirement. They offer tax benefits and can provide a tax-free income stream in retirement. Investing for retirement is not without risks. High-income earners, like any other investors, need to balance risk and reward, keeping in mind their retirement goals and time horizon. Investment choices should be based on individual risk tolerance, investment goals, and time horizon. A diversified portfolio can help manage risks while providing opportunities for growth. Market volatility can affect retirement savings. It's crucial to have a solid investment strategy that factors in potential market downturns. High-income earners should have a mix of assets that can withstand market fluctuations. Inflation can erode purchasing power over time, making it essential to consider when planning for retirement. High-income earners should consider investment options that offer potential growth or income that can outpace inflation. High-income earners can benefit significantly from professional financial advice due to the complexity of their situation. A competent financial advisor can provide valuable advice, taking into account the unique circumstances and needs of high-income individuals. They can help optimize retirement contributions, navigate tax implications, and create a comprehensive retirement plan. Estate planning is crucial for high-income earners. It ensures that their wealth is distributed according to their wishes and minimizes estate taxes. This process can be complex, requiring expertise in areas such as trusts, tax laws, and wealth transfer strategies. Retirement planning for high-income earners is a multifaceted task that necessitates strategic consideration. It involves various retirement vehicles, each with distinct advantages, limitations, and tax implications. Traditional retirement options such as 401(k), 403(b), SEP IRAs, and SIMPLE IRAs, along with strategies like a backdoor Roth IRA and the use of Health Savings Accounts, can play key roles. Tax strategies, including tax-efficient investing, tax harvesting, and judicious use of tax brackets and deductions, are critical. Non-traditional retirement vehicles such as real estate investment, annuities, and life insurance can also provide beneficial avenues. Mitigating risks like market volatility and inflation and ensuring proper planning and consultation, especially with a financial advisor and for estate planning, are crucial steps. Ultimately, the goal is to optimize wealth accumulation, tax savings, and risk management to ensure a comfortable and secure retirement for high-income individuals.What Are Retirement Vehicles for High Income?

Retirement Vehicles Suited for High-Income Individuals

Defined Contribution Plans: 401(k) and 403(b)

Defined Benefit Plans: Cash Balance Plans

SEP IRAs and SIMPLE IRAs

Solo 401(k) Plans

Roth IRA Conversion ("Backdoor" Roth IRA)

Health Savings Accounts (HSA)

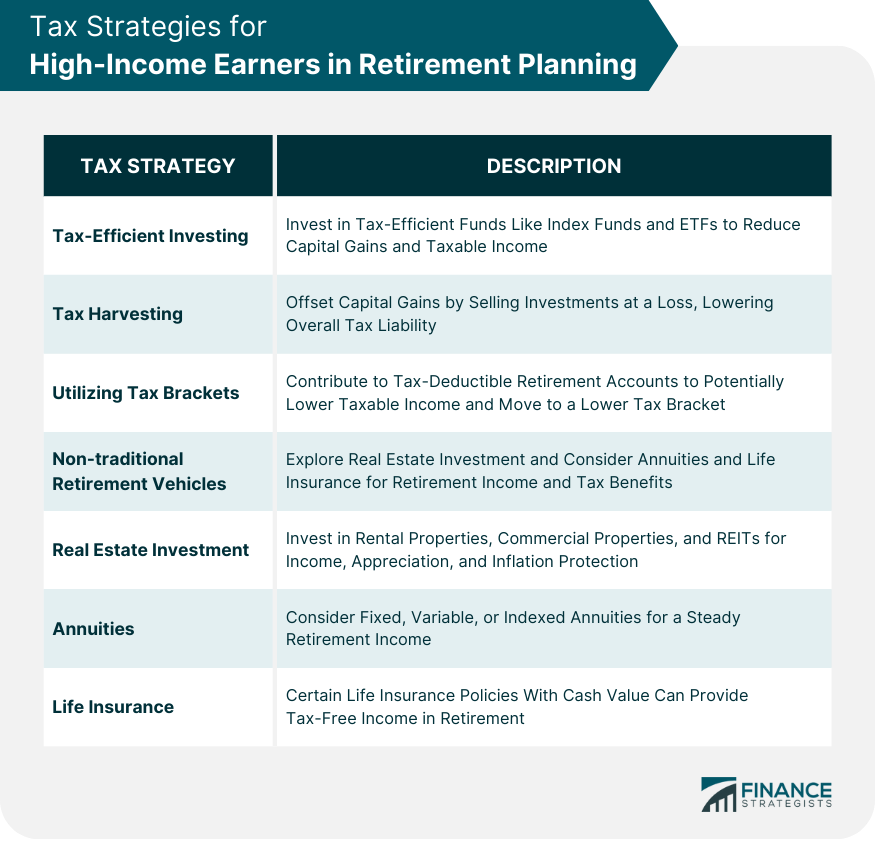

Tax Strategies for High-Income Earners in Retirement Planning

Tax-Efficient Investing Strategies

Tax Harvesting

Utilizing Tax Brackets and Deductions

Non-traditional Retirement Vehicles

Real Estate Investment

Annuities

Life Insurance

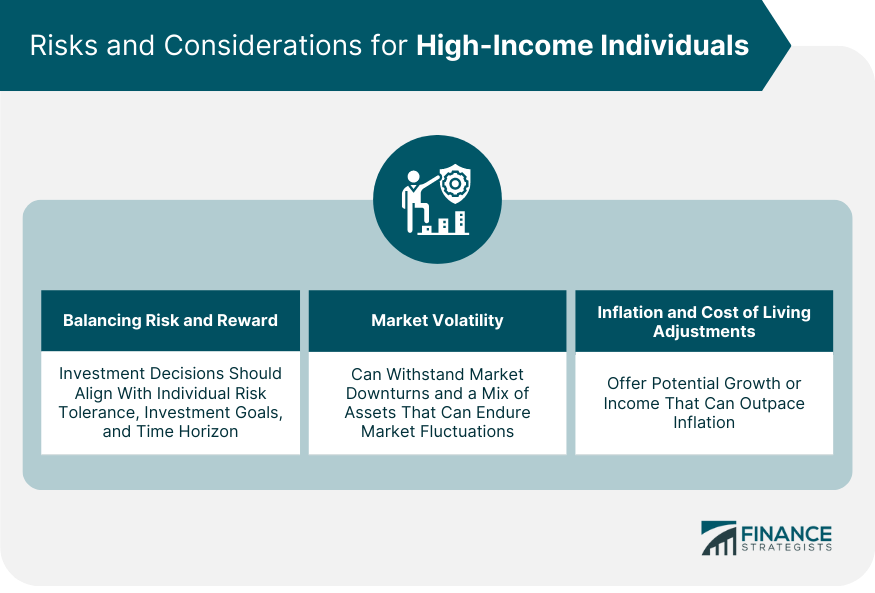

Risks and Considerations for High-Income Individuals

Balancing Risk and Reward

Market Volatility

Inflation and Cost of Living Adjustments

Planning and Consultation

Importance of Working With a Financial Advisor

Estate Planning for High-Income Individuals

Conclusion

Retirement Vehicles for High Income FAQs

Traditional retirement vehicles for high-income earners include defined contribution plans such as 401(k) and 403(b), defined benefit plans like cash balance plans, Simplified Employee Pension (SEP) IRAs, Savings Incentive Match Plans for Employees (SIMPLE) IRAs, and Solo 401(k) plans. High-income earners can also use strategies like the backdoor Roth IRA and Health Savings Accounts (HSA).

Tax strategies play a crucial role when using retirement vehicles for high-income individuals. These strategies include investing in tax-efficient funds, tax harvesting to offset capital gains, and leveraging tax brackets and deductions by contributing to tax-deductible retirement accounts to potentially reduce taxable income.

Non-traditional retirement vehicles for high-income earners include real estate investment, annuities, and certain types of life insurance policies that have a cash value component. These vehicles can provide additional income streams and potential capital appreciation over time.

High-income earners, like any investors, need to balance risk and reward. Risks include market volatility that can affect retirement savings and inflation, which can erode purchasing power over time. It's essential to have a solid investment strategy that can withstand market fluctuations and investment options that can outpace inflation.

Given the complexity of retirement planning for high-income individuals, professional financial advice can be beneficial. A competent financial advisor can help optimize retirement contributions, navigate tax implications, and create a comprehensive retirement plan. They can also assist with estate planning, ensuring wealth is distributed according to the individual's wishes and minimizing estate taxes.