Managing fixed retirement income is a critical aspect of a prosperous and worry-free retirement. This financial discipline allows retirees to meet their living expenses, handle unexpected costs, and enjoy the pleasures of their golden years. With a finite income, unplanned expenses or financial mishaps can severely strain a retiree's budget. Thus, successful management of retirement income necessitates creating a detailed budget that accommodates both essential and non-essential expenses. It also involves establishing an emergency fund, reducing unnecessary expenses, and seeking avenues to maximize income. Furthermore, it's important to stay informed about changes in the financial environment or government policies affecting retirement income. Proper management of fixed retirement income not only ensures financial stability but also enables retirees to maintain their lifestyles and fulfill their retirement dreams. Remember, the goal isn't merely to survive retirement but to thrive in it.

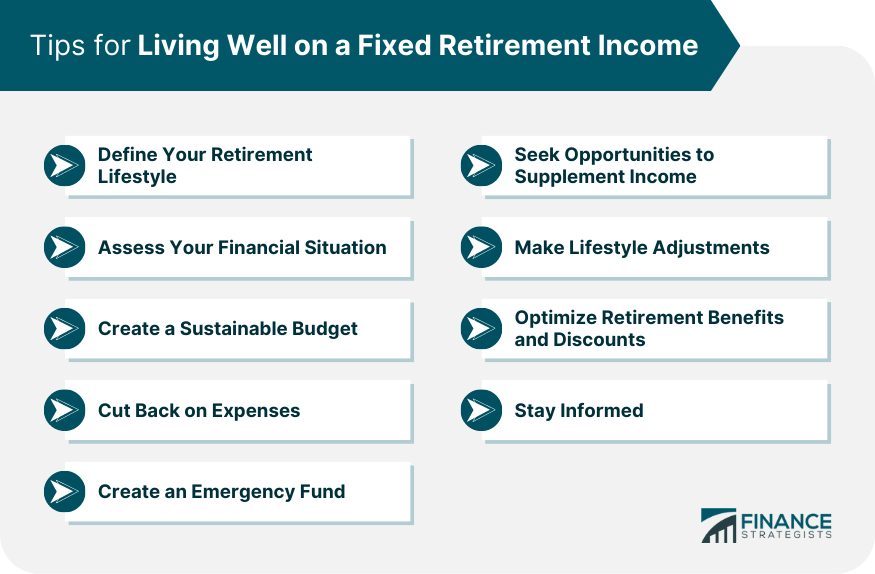

Navigating life on a fixed retirement income can be challenging. However, with some careful planning and practical strategies, it's possible to live comfortably without sacrificing the quality of life. Here are some tips to help you live well on a fixed retirement income. The first step in determining whether living well on a fixed retirement income is possible is to define what "living well" means to you. Everyone's idea of a fulfilling retirement is unique, and it's important to align your expectations with your financial reality. Reflect on the activities, experiences, and possessions that truly bring you joy and prioritize them in your retirement plan. By focusing on what truly matters to you, you can allocate your limited resources more effectively. To evaluate the feasibility of living well on a fixed retirement income, it's crucial to assess your financial situation comprehensively. Calculate your retirement income from sources such as pensions, Social Security, and investments. Consider any potential fluctuations or adjustments in income over time. Then, take stock of your expenses and identify areas where you can potentially reduce or optimize your spending. This assessment will give you a clearer picture of your financial standing and help you make informed decisions. Developing a realistic budget is key to managing your fixed retirement income effectively. Analyze your income and expenses, and create a detailed budget that accounts for both essential needs and discretionary spending. Prioritize your needs, such as housing, healthcare, and groceries, while identifying areas where you can cut back on non-essential expenses. By carefully managing your budget, you can strike a balance between enjoying your retirement and ensuring your financial stability. After creating your budget, you may find areas where you can reduce spending. For instance, you might be able to save on utilities by being more energy-efficient or save on groceries by planning meals and shopping sales. You might also consider downsizing your home or relocating to a more affordable area. Having an emergency fund is crucial to avoid going into debt when unforeseen expenses arise. It's good to have at least three to six months' worth of living expenses saved up. This can give you peace of mind knowing that you can handle unexpected expenses. While living on a fixed retirement income, it can be beneficial to explore opportunities to supplement your finances. Consider part-time employment or freelance work that aligns with your skills and interests. This can not only provide an additional income stream but also keep you engaged and fulfilled during retirement. Moreover, explore ways to monetize your hobbies or pursue passion projects that have the potential to generate income. Every additional dollar earned can contribute to enhancing your retirement lifestyle. Living well on a fixed retirement income often requires embracing lifestyle adjustments. Evaluate your current spending habits and identify areas where you can make changes without sacrificing your well-being. For instance, consider downsizing your living arrangements to reduce housing costs, explore cost-effective transportation options, or find affordable alternatives for leisure activities and entertainment. By making conscious choices and adopting a frugal mindset, you can maintain a fulfilling lifestyle within your financial means. Maximize the benefits available to you as a retiree. Educate yourself about all the retirement benefits, entitlements, and discounts offered by governmental, corporate, and community organizations. This may include healthcare benefits, senior citizen discounts, reduced rates for travel and entertainment, and more. Taking advantage of these perks can significantly contribute to your financial well-being and enable you to enjoy a higher quality of life on a fixed retirement income. Stay informed about financial news and updates to policies that may impact your retirement income. This can help you anticipate changes and adapt your financial plan accordingly. Additionally, be aware of scams that target retirees to protect your hard-earned money. Living well on a fixed retirement income relies heavily on strategic planning and thoughtful decision-making. Understanding the different income sources lays the groundwork while crafting a sustainable budget drives your financial direction. It's important to identify areas for cost reduction and simultaneously explore opportunities to increase income. Establishing an emergency fund is an essential safety net that provides financial peace of mind. Adapting lifestyle choices can further stretch your budget while promoting better health. Staying informed about financial trends and policy changes aids in preemptive planning and protects against potential scams. Beyond financial management, it's key to remember the importance of enjoyment during retirement. With strategic management, your fixed retirement income can not only maintain your financial stability but also fuel your retirement dreams.Importance of Managing Fixed Retirement Income

Have questions about retirement planning? Click here.Smart Tips for Living Well on a Fixed Retirement Income

Define Your Retirement Lifestyle

Assess Your Financial Situation

Create a Sustainable Budget

Cut Back on Expenses

Create an Emergency Fund

Seek Opportunities to Supplement Income

Make Lifestyle Adjustments

Optimize Retirement Benefits and Discounts

Stay Informed

Final Thoughts

Tips for Living Well on a Fixed Retirement Income FAQs

Some practical strategies include understanding your income sources, creating a sustainable budget, cutting back on expenses, creating an emergency fund, maximizing income opportunities, making lifestyle adjustments, and staying informed about financial matters.

You can reduce expenses by being energy-efficient to save on utilities, planning meals and shopping sales to save on groceries, downsizing your home or relocating to a more affordable area, and cutting out unnecessary subscriptions or expenses.

Having an emergency fund is crucial because it provides a financial safety net when unexpected expenses arise. It helps avoid going into debt and provides peace of mind knowing that you can handle unforeseen costs.

You can maximize income by working part-time or consulting, turning a hobby into a source of income, generating passive income through property rentals, or exploring other income-generating opportunities that align with your skills and interests.

Staying informed allows you to anticipate changes that may impact your retirement income. It helps you adapt your financial plan accordingly and make informed decisions. Additionally, being aware of scams targeting retirees can help protect your financial assets.

True Tamplin is a published author, public speaker, CEO of UpDigital, and founder of Finance Strategists.

True is a Certified Educator in Personal Finance (CEPF®), author of The Handy Financial Ratios Guide, a member of the Society for Advancing Business Editing and Writing, contributes to his financial education site, Finance Strategists, and has spoken to various financial communities such as the CFA Institute, as well as university students like his Alma mater, Biola University, where he received a bachelor of science in business and data analytics.

To learn more about True, visit his personal website or view his author profiles on Amazon, Nasdaq and Forbes.