The U.S., unlike most countries, imposes taxes based on citizenship rather than residence. This means that U.S. citizens and resident aliens are taxed on their worldwide income, including foreign retirement income, regardless of where they live. The legal basis for this is laid out in the Internal Revenue Code (IRC), particularly sections 61, 871, and 877. The primary group impacted by this law is U.S. citizens. However, resident aliens - individuals who are not U.S. citizens but meet the substantial presence test or hold a Green Card - are also subject to these tax obligations. Those who renounce their U.S. citizenship or terminate long-term residency may also face significant tax implications under the Expatriation Tax provisions. Foreign pensions are a common form of retirement income for U.S. expatriates or citizens who have worked overseas. Under U.S. tax law, distributions from a foreign pension are typically taxed as income in the year they're received. Annuities are contracts that provide income for a specified period, often for the remainder of the annuitant's life. Annuities can be purchased individually or through an employer. The IRS generally treats annuity payments from a foreign source the same way as those from a domestic source. U.S. citizens living abroad who receive foreign Social Security benefits may be surprised to learn that these payments may be subject to U.S. tax. The exact tax treatment can be complex and depends on factors such as the tax treaty between the U.S. and the country providing the benefits. Distributions from foreign retirement accounts, such as a foreign IRA equivalent, are generally taxable in the U.S. However, there can be exceptions and special rules. For example, under some tax treaties, a distribution from a foreign pension plan might be taxable only in the country where the plan is based, or the taxable amount might be limited. U.S. citizens must report their global income annually using Form 1040. In addition, they may need to file Form 8938 to report specified foreign financial assets if the total value exceeds a certain threshold. Finally, FinCEN Form 114, also known as FBAR, must be filed if the total value of foreign financial accounts exceeds $10,000 at any point during the calendar year. Taxpayers may need to make quarterly estimated tax payments throughout the year. The final settlement occurs when they file their annual tax return, which is generally due on April 15th. Those living abroad get an automatic two-month extension to file their tax return without requesting an extension. The U.S. has tax treaties with many countries to prevent double taxation, i.e., being taxed on the same income in both countries. These agreements can also limit the amount of tax withheld from payments that a U.S. resident receives from the treaty country. Depending on the specific treaty, U.S. citizens and resident aliens may be able to reduce their U.S. tax liability on foreign retirement income. Each treaty has unique provisions, so it's crucial to read and understand the agreement applicable to your situation. The IRS provides a list of tax treaties on its website. If you live in a country with a treaty, it’s recommended to consult with a tax professional who specializes in international taxation to ensure you're leveraging all potential benefits. The FEIE allows qualifying U.S. citizens and resident aliens to exclude a certain amount of their foreign earned income from their U.S. taxable income. As of 2024, the maximum exclusion was $126,500 per year, but this amount is subject to annual adjustments for inflation. If you pay or accrue tax to a foreign country on your foreign retirement income, you may be able to offset these taxes through the Foreign Tax Credit (FTC). The FTC aims to alleviate the burden of dual-taxation and is generally available for both earned and unearned income. Depending on the taxpayer's situation, other deductions and credits may be available, such as the Child Tax Credit, the Credit for Other Dependents, and the Foreign Housing Deduction or Exclusion. Distributions from foreign retirement accounts are generally considered taxable income in the U.S. The tax treatment of these distributions can be complex, depending on factors like the type of plan, the country of origin, and whether the contributions were pre-tax or post-tax. Certain exceptions and special rules may apply to retirement plan distributions. For instance, some tax treaties allow for favorable treatment of certain types of foreign pensions or retirement accounts. It's essential to consult with a tax advisor to understand these nuances. Tax treaties may provide relief from U.S. taxation on certain types of retirement plan distributions. Taxpayers claiming such benefits may need to disclose this to the IRS using Form 8833 (Treaty-Based Return Position Disclosure). Failure to report foreign retirement income can result in substantial penalties. The IRS can assess penalties, interest, and sometimes even criminal charges for severe non-compliance. Penalties can also apply for failing to file necessary information returns, like Form 8938 and FBAR. The IRS offers the Offshore Volinary Disclosure Program for taxpayers who have failed to report foreign financial assets and pay all taxes due in respect of those assets. This program encourages taxpayers to become compliant by offering reduced penalties compared to those that would be assessed if the IRS discovers non-compliance. Understanding U.S. tax laws on foreign retirement income is crucial for U.S. citizens and resident aliens. Such income encompasses foreign pensions, annuities, Social Security benefits, and retirement account distributions, all of which generally face U.S. taxation. Remember to report global income and specific foreign assets using the required forms and pay taxes timely to avoid penalties. The role of tax treaties is significant in potentially reducing tax liabilities by preventing double taxation. Moreover, several credits, deductions, and exclusions like the FEIE and FTC can further decrease your tax burden. Given the complexity of the tax codes and the potential nuances of each taxpayer's situation, it is beneficial to engage a tax professional specializing in international taxation. They can navigate these intricate laws, ensure proper compliance, and help take full advantage of any tax-saving opportunities.Overview of US Tax on Foreign Retirement Income

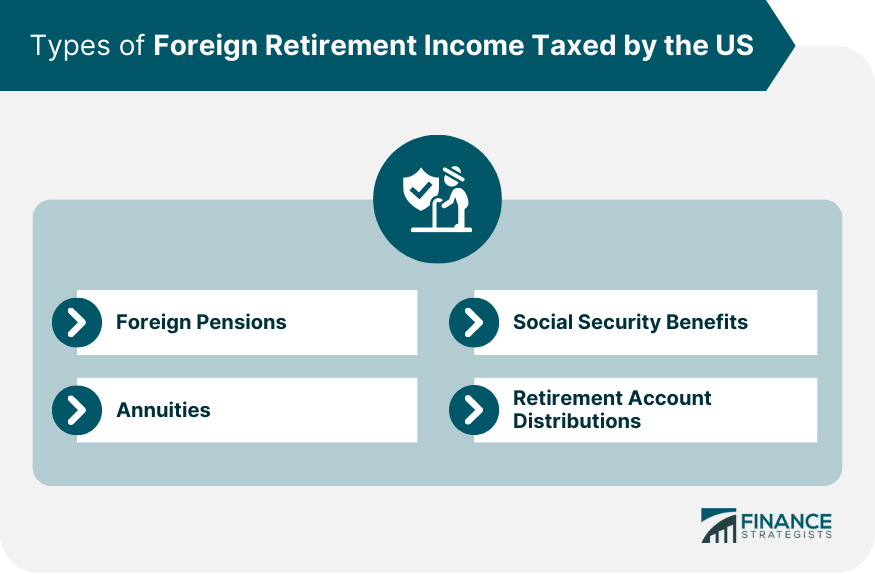

Types of Foreign Retirement Income Taxed by the US

Foreign Pensions

Annuities

Social Security Benefits

Retirement Account Distributions

How US Citizens Report and Pay Taxes on Foreign Retirement Income

IRS Reporting Requirements

Schedule of Tax Payments

Understanding Tax Treaties

Purpose

How Tax Treaties Affect US Tax on Foreign Retirement Income

Applicable Tax Treaties

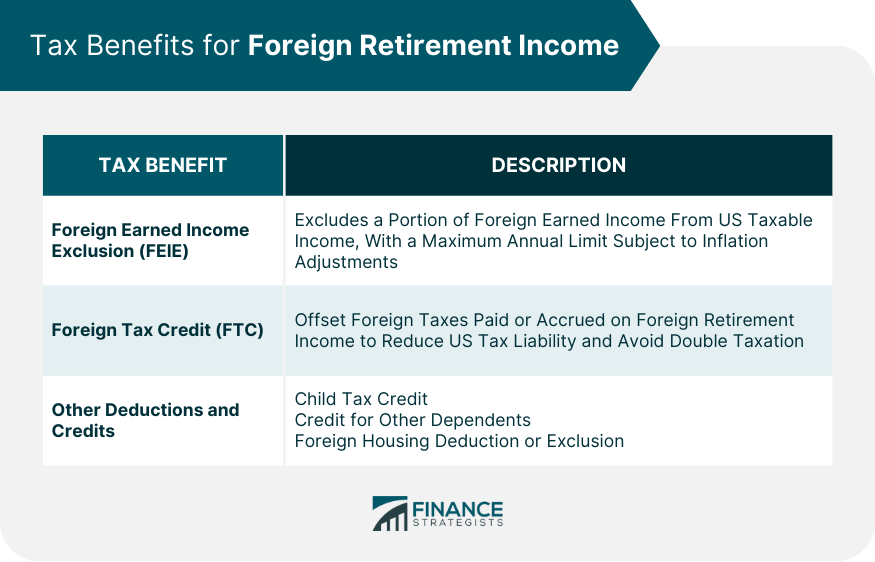

Possible Tax Credits and Exemptions

Foreign Earned Income Exclusion (FEIE)

Foreign Tax Credit (FTC)

Other Possible Deductions and Credits

Retirement Plan Distributions from Foreign Accounts

US Tax Implications

Exceptions and Special Rules

Treaty-Based Positions for Distributions

Consequences for Non-compliance

Potential Penalties

IRS Offshore Voluntary Disclosure Program

Conclusion

US Tax on Foreign Retirement Income FAQs

The U.S. taxes various forms of foreign retirement income. This includes foreign pensions, annuities, Social Security benefits, and retirement account distributions. Each of these income sources is generally subject to U.S. tax, but there can be exceptions and special rules based on tax treaties and specific situations.

The U.S. taxes its citizens and resident aliens on their worldwide income, including foreign retirement income. This is based on citizenship rather than residency. Foreign retirement income is usually taxed as regular income, but the specifics can vary based on tax treaties and other factors.

U.S. citizens and resident aliens are required to report their global income annually using Form 1040. They may also need to file Form 8938 for specified foreign financial assets if they exceed a certain threshold, and FinCEN Form 114, or FBAR, if foreign financial accounts exceed $10,000 at any point during the year.

U.S. citizens can reduce their tax liability on foreign retirement income through the Foreign Earned Income Exclusion (FEIE), the Foreign Tax Credit (FTC), and potentially other deductions and credits. Tax treaties with various countries may also provide opportunities to reduce U.S. tax liability on foreign retirement income.

True Tamplin is a published author, public speaker, CEO of UpDigital, and founder of Finance Strategists.

True is a Certified Educator in Personal Finance (CEPF®), author of The Handy Financial Ratios Guide, a member of the Society for Advancing Business Editing and Writing, contributes to his financial education site, Finance Strategists, and has spoken to various financial communities such as the CFA Institute, as well as university students like his Alma mater, Biola University, where he received a bachelor of science in business and data analytics.

To learn more about True, visit his personal website or view his author profiles on Amazon, Nasdaq and Forbes.