The average income of individuals aged 65 and above in the United States stood at approximately $75,254 per year, according to data from the U.S. Census Bureau. However, the income varies widely, depending on the individual's pre-retirement income, savings, and retirement planning. The average retirement income also sees considerable variation across different demographic groups and regions due to factors like lifespan, healthcare costs, and cost of living. It's also worth noting that the average retirement income directly influences retirees' quality of life, dictating their ability to meet basic living expenses, engage in leisure activities, travel, and manage unexpected costs. The maximum benefit amount varies depending on the age at which you retire. For instance, if you choose to retire at full retirement age in 2024, the maximum benefit you can receive would be $3,822. On the other hand, if you decide to retire at age 62 in 2024, the maximum benefit would be $2,710. However, if you delay retirement until age 70 in 2024, the maximum benefit would increase to $4,873. Pensions are becoming less common as companies increasingly move to defined contribution retirement plans like 401(k)s. Income from individual retirement accounts (IRAs) and employer-sponsored retirement plans like 401(k)s plays a significant role. The average withdrawal from these accounts varies widely based on the retiree's savings. Many retirees also draw income from personal investments in stocks, bonds, mutual funds, and real estate. The amount depends on the size and type of the investment portfolio. Other income sources include part-time work, rental properties, and annuities, contributing to the retirement income mix. A longer career and higher lifetime earnings generally lead to higher Social Security benefits and retirement account balances. This, in turn, can result in more retirement income available during the retirement years. The types of investments held by retirees and their performance can significantly impact investment income in retirement. Wise investment choices and favorable market conditions can contribute to higher retirement income, while poor investment decisions or market downturns may reduce income potential. The cost of living and lifestyle choices play a significant role in determining the income needed during retirement. Retirees in areas with higher living costs or those with expensive lifestyles may require more retirement income to cover their expenses. Healthcare expenses can be a significant financial burden during retirement, especially for retirees with chronic health conditions. Medical costs can consume a substantial portion of retirement income, affecting the overall average income available for other needs. Longer lifespans mean retirement savings must be stretched over a more extended period. The longer the retirement period, the more the average retirement income needs to be spread out, potentially impacting the amount available each year. Retirement income typically declines as individuals age. This decline is primarily attributed to a decrease in work income as retirees transition from active employment to retirement. Additionally, retirees may gradually spend down their retirement account balances, which can contribute to a decrease in overall income. Gender disparities exist in retirement income, with women tending to have lower retirement incomes compared to men. This discrepancy can be attributed to multiple factors, including lower lifetime earnings resulting from wage gaps and interrupted careers due to caregiving responsibilities. Moreover, women generally have longer lifespans, necessitating their retirement savings to stretch over a longer period. The cost of living varies significantly across different regions within the United States. This regional disparity can have a substantial impact on retirement income needs. Retirees residing in areas with higher costs of living may require more substantial retirement income to cover daily expenses and maintain their desired lifestyle. Retirement income directly affects the quality of life that retirees can enjoy. The following are some of the key areas where it has the most impact: Adequate retirement income ensures that retirees can cover their basic living expenses, including housing, food, utilities, and transportation, without financial stress. Retirement income also influences retirees' ability to engage in leisure activities and travel. A higher income can provide more opportunities for recreation and experiences. Retirees with more substantial incomes are better positioned to deal with unexpected costs, such as emergency medical expenses or home repairs. Understanding the average retirement income can provide a benchmark for retirement planning. However, there are also several strategies that retirees can employ to boost their income. One common strategy is to delay claiming Social Security benefits until the age of 70. For each year you delay past your full retirement age, your monthly benefit increases, which can significantly boost your retirement income. Investing in a diversified portfolio of stocks, bonds, and other assets can provide a source of income in retirement. It’s advisable to consult with a financial advisor to devise an investment strategy that suits your risk tolerance and income needs. Many retirees find part-time work or consulting in their field to be a fulfilling way to supplement their retirement income. This also keeps them active and engaged. Finally, retirees can boost their effective income by reducing their living costs. This could involve downsizing to a smaller home, moving to a region with a lower cost of living, or just cutting back on discretionary spending. The average retirement income, drawn from various sources like Social Security benefits, pensions, retirement account distributions, investment income, and other sources, stood at $75,254 per year in the U.S. for households aged 65 and over. Factors such as length of working life, salary history, investment choices, living cost, healthcare costs, and lifespan significantly influence this income. Disparities exist across age groups, genders, and regions. Retirement income directly affects the quality of life for retirees, impacting their ability to meet basic expenses, engage in leisure activities, handle unexpected costs, and overall, their standard of living. Strategies to enhance retirement income include maximizing Social Security benefits, smart investing, part-time work, and reducing living costs. Understanding the average retirement income can aid in better retirement planning and pave the way for a comfortable post-work life.What Is the Average Income for Retirees?

Breakdown of Average Retirement Income by Source

Social Security Benefits

Pension Income

Retirement Account Distributions

Investment Income

Other Income

Factors That Influence Average Retirement Income

Length of Working Life and Salary History

Investment Choices and Performance

Living Cost and Lifestyle Choices

Healthcare Costs

Lifespan and Longevity

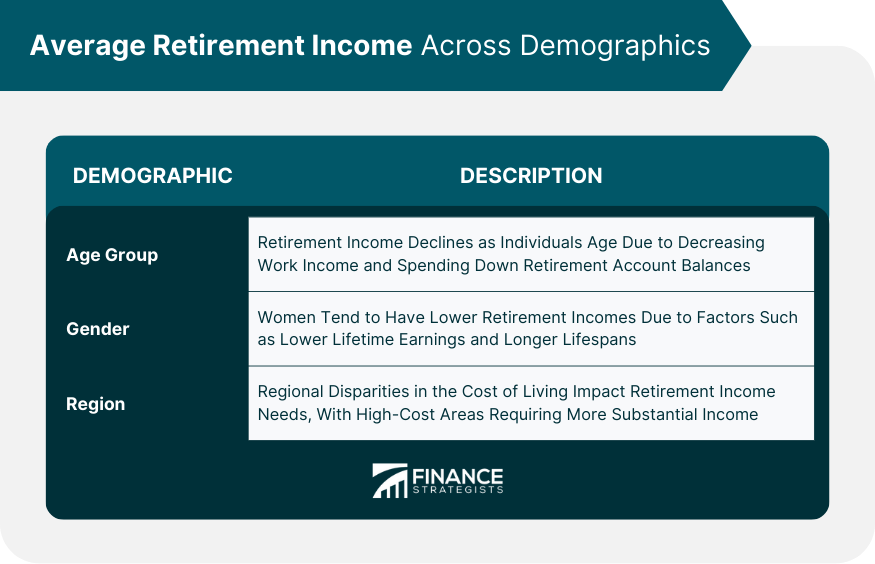

Comparing Average Retirement Income Across Demographics

By Age Group

By Gender

By Region

Impact of Average Retirement Income on Quality of Life

Ability to Meet Basic Living Expenses

Potential for Leisure Activities and Travel

Preparedness for Unexpected Costs

Strategies for Boosting Retirement Income

Maximizing Social Security Benefits

Smart Investment Strategies

Part-Time Work or Consulting

Reducing Living Costs

Conclusion

What Is the Average Income for Retirees? FAQs

The median retirement income in the United States for households aged 65 and over was approximately $32,000 per year in 2019.

Social Security benefits play a significant role in retirees' income. As of 2021, the average monthly benefit for retired workers was approximately $1,555, or roughly $18,660 annually.

Pensions are less common nowadays, but about 30% of households aged 65 and over still receive pension income. The median annual pension income for those 65 and older was $13,000 in 2019.

Retirement account distributions, such as those from IRAs and 401(k)s, vary widely based on individual savings. These distributions contribute to retirees' overall income.

Several factors influence average retirement income, including length of working life and salary history, investment choices and performance, living costs and lifestyle choices, healthcare costs, and lifespan and longevity.

True Tamplin is a published author, public speaker, CEO of UpDigital, and founder of Finance Strategists.

True is a Certified Educator in Personal Finance (CEPF®), author of The Handy Financial Ratios Guide, a member of the Society for Advancing Business Editing and Writing, contributes to his financial education site, Finance Strategists, and has spoken to various financial communities such as the CFA Institute, as well as university students like his Alma mater, Biola University, where he received a bachelor of science in business and data analytics.

To learn more about True, visit his personal website or view his author profiles on Amazon, Nasdaq and Forbes.