The 80% Rule is a well-established financial guideline in retirement planning, suggesting that retirees should aim for an income that is around 80% of their pre-retirement earnings to maintain their lifestyle. This benchmark assumes that retirees will generally have lower regular expenses, with some potential changes in spending. To illustrate, if a retiree's annual pre-retirement income was $100,000, the goal post-retirement would be to generate $80,000 from various sources like savings, investments, Social Security benefits, and retirement accounts. While this rule serves as a good baseline, it is crucial to acknowledge that it is a broad guideline and may not cater to everyone's unique circumstances. Factors such as lifestyle choices and existing financial obligations can significantly affect the necessary retirement income. Similarly, significant pre-existing debts like mortgage payments could mean higher than the standard 80% expenses. One key reason why you might need less money during retirement is that you will no longer be saving for retirement. Typically, financial advisors recommend saving 10%-20% of your income for retirement. Once you retire, this becomes a chunk of money that you no longer need to set aside, thereby reducing your total expenses. For most working adults, a significant portion of income goes towards transportation-related costs such as commuting to work, car maintenance, fuel, or public transportation fees. After retirement, these costs usually decrease significantly as the daily commute to work is no longer required. For many people, retirement also comes with a reduction in housing costs. Some retirees opt to downsize to a smaller home, reducing expenses on maintenance, utilities, and property taxes. Moreover, many retirees will have paid off their mortgages by the time they retire, eliminating another significant monthly expense. While some expenses decrease, others, like healthcare, can increase during retirement. According to the Fidelity Retiree Health Care Cost Estimate, an average retired couple age 65 in 2024 may need approximately $330,000 saved (after tax) to cover health care expenses in retirement. Prescription medications, regular check-ups, and potential for increased medical care can significantly impact your retirement budget. Retirement is a time when people often travel more, take up new hobbies, and generally enjoy the leisure time they didn't have while working. These activities, while fulfilling, can add to the expenses during retirement. It's vital to factor these into your retirement plan if you hope to maintain an active lifestyle. According to the U.S. Department of Health and Human Services, there's roughly a 70% chance that an individual turning 65 today will require some form of long-term care services and assistance in their later years. This could mean needing home health care, assisted living, or nursing home care, all of which can be costly. Inflation is the rate at which the general level of prices for goods and services is rising and subsequently, purchasing power is falling. Over time, inflation can significantly erode the purchasing power of your retirement savings. A cost of living that seems comfortable today might not be sufficient in a few decades due to inflation. The 80% rule assumes that you will increase your withdrawals to keep up with inflation. In other words, you're not just withdrawing 80% of your final salary every year. Instead, you're increasing the amount you withdraw each year to maintain your purchasing power despite inflation. Social Security and some retirement plans include Cost-Of-Living Adjustments (COLAs) to counteract the effects of inflation. COLAs are periodic increases in benefits, ensuring that the purchasing power of these benefits is not eroded by inflation. However, it's crucial to remember that not all retirement income sources have COLAs, so you may need additional savings or investment strategies to cover this gap. Everyone's retirement goals and lifestyles are different. Some people aspire to travel extensively, buy a second home, or engage in hobbies that might be costly. For them, maintaining their pre-retirement standard of living may require more than 80% of their pre-retirement income. Life is unpredictable, and retirement is no different. Unexpected expenses can arise, such as sudden healthcare costs, major home repairs, or helping out family members in need. Having a cushion of savings above the 80% income replacement level can provide additional security. Today, people are living longer than ever before, which means retirement savings need to last longer too. If you retire at 65 and live until 95, that's 30 years of income that your retirement savings need to provide. Considering the potential of a longer retirement, it might be prudent to aim for more than 80% of your pre-retirement income. As mentioned before, many retirees experience a significant decrease in their living expenses. If the mortgage is paid off, children have moved out, and there's no need for commuting or work clothes, the costs can drastically drop. In this scenario, some retirees might comfortably live on much less than 80% of their pre-retirement income. If you've managed to set up sources of passive income – such as rental income, dividends from investments, or royalties – these can continue to generate income during retirement. For individuals with substantial passive income, the need to draw from retirement savings may be less, and thus, an 80% replacement ratio might be too high. For individuals with larger estates or a desire to leave a significant portion of their wealth to charities or as inheritances, spending less during retirement might be a strategic choice. By living on less than 80% of their pre-retirement income, they can preserve more of their wealth for these purposes. Everyone's retirement needs and goals are unique, depending on their debt, lifestyle, health, and aspirations. Therefore, rather than blindly following the 80% rule, it's critical to individualize your retirement planning based on these factors. This approach helps ensure that your retirement income will adequately support your specific needs and lifestyle. Several tools and methods can help calculate a more personalized estimate of retirement income needs. Online retirement calculators are one popular tool. These allow you to input your specific data – such as age, income, savings, and desired retirement age – to generate a tailored retirement income estimate. Other methods involve more detailed calculations and might require the help of a financial advisor. These consider factors such as projected healthcare costs, planned retirement activities, and anticipated inflation and investment returns. Financial advisors can play a valuable role in personalizing retirement planning. They can help with complex calculations, suggest suitable investment strategies, and guide decisions about when to claim Social Security benefits or how to minimize taxes. A financial advisor with expertise in retirement planning can be an invaluable resource in preparing for this significant life transition. The 4% rule is another popular guideline in retirement planning. It suggests that if you withdraw 4% of your retirement savings in the first year and adjust that amount for inflation each year afterward, your savings should last for 30 years. Like the 80% rule, the 4% rule is a starting point and should be adjusted based on individual circumstances. Strategic planning can help maximize Social Security benefits. The age when you start claiming these benefits can significantly affect the amount you receive over your lifetime. While you can start collecting benefits as early as age 62, your monthly benefit increases if you delay claiming until after your full retirement age – up to age 70. Annuities are financial products that can provide a steady income stream during retirement. When you purchase an annuity, you're essentially buying a guaranteed income. Other potential sources of guaranteed income might include pensions and bond ladders. These strategies can help supplement your retirement income and provide peace of mind that you'll have money coming in each month. By understanding various rules of thumb, like the 80% rule, and considering personal factors, each person can strategize their retirement planning for a comfortable and secure future. The 80% rule, while a broad guideline, remains a valuable starting point for retirement planning. It provides a straightforward method for estimating how much income you might need to maintain your standard of living in retirement. However, it's essential to remember that this rule is not one-size-fits-all, and it should be tailored to suit your personal circumstances. Factors such as lifestyle choices, health status, debt levels, and personal goals all play a part in determining how much income you will need in retirement. The 80% rule can be adjusted upwards or downwards based on these considerations. Proactive retirement planning is vital to ensure a financially secure and enjoyable retirement. It allows you to forecast potential expenses and income in retirement, helping you to prepare and save adequately. Delaying retirement planning could lead to a shortfall in retirement income, making it difficult to maintain your desired lifestyle.The 80% Rule in Retirement Planning

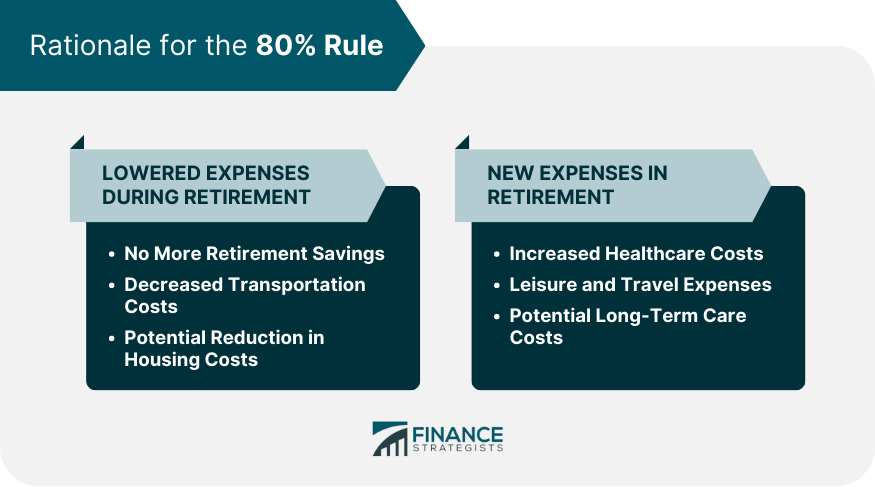

Rationale for the 80% Rule

Lowered Expenses During Retirement

No More Retirement Savings

Decreased Transportation Costs

Potential Reduction in Housing Costs

New Expenses in Retirement

Increased Healthcare Costs

Leisure and Travel Expenses

Potential Long-Term Care Costs

Role of Inflation and Cost of Living Increases

Understanding Inflation and Its Impact on Retirement Funds

How the 80% Rule Considers Inflation

Cost of Living Adjustments and Their Impact on Retirement Income

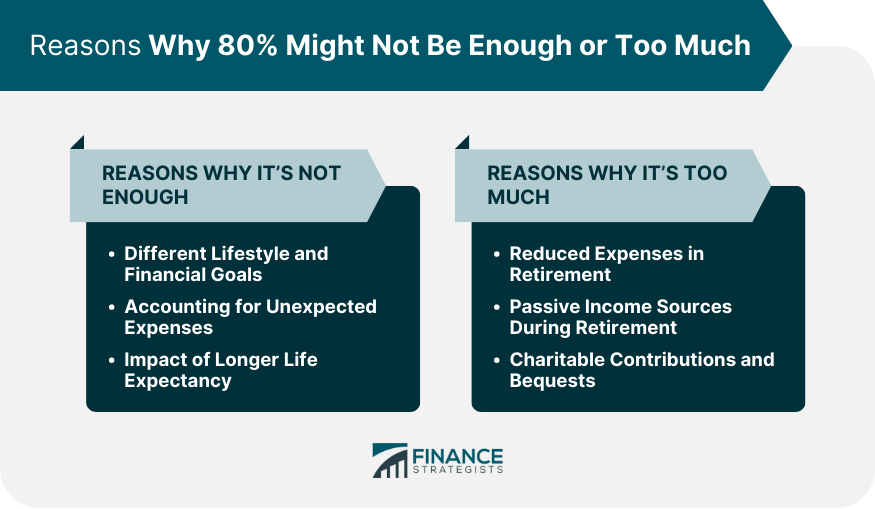

Why 80% Might Not Be Enough for Everyone

Different Lifestyle and Financial Goals

Accounting for Unexpected Expenses

Impact of Longer Life Expectancy

Why 80% Might Be Too Much for Some People

Reduced Expenses in Retirement

Passive Income Sources During Retirement

Charitable Contributions and Bequests

Personalizing Retirement Savings Goals

Importance of Individualizing Retirement Planning

Methods to Calculate Personalized Retirement Income Needs

Role of Financial Advisors in Retirement Planning

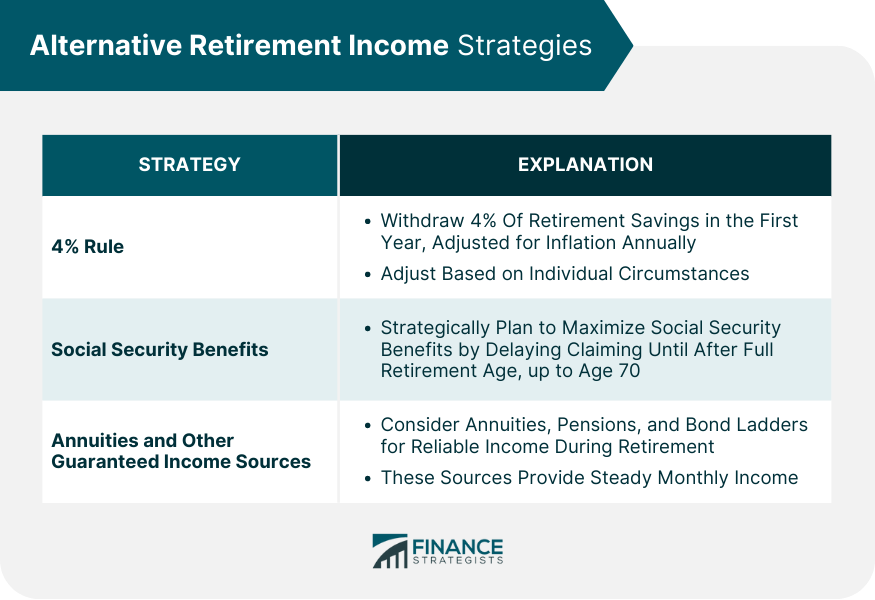

Alternative Retirement Income Strategies

The 4% Rule and Its Applicability

Maximizing Social Security Benefits

Annuities and Other Guaranteed Income Sources

The Bottom Line

Why Do I Need 80% of My Income for Retirement? FAQs

The 80% rule is a guideline suggesting you'll need about 80% of your pre-retirement income to maintain your standard of living in retirement, given the assumption that certain expenses will decrease.

Not necessarily. The 80% rule is a starting point, but your lifestyle choices, health status, and personal goals may require you to adjust this figure up or down.

Some individuals may need more than 80% if they plan to travel extensively, support family members, have significant healthcare costs, or encounter unexpected expenses in retirement.

If your expenses significantly decrease in retirement (like paid-off mortgage or reduced commuting costs), or if you have passive income sources, you might need less than 80% of your pre-retirement income.

A personalized approach is best. Consider your expected retirement expenses, lifestyle goals, health, and any potential income sources. A financial advisor can help tailor a plan to your specific situation.

True Tamplin is a published author, public speaker, CEO of UpDigital, and founder of Finance Strategists.

True is a Certified Educator in Personal Finance (CEPF®), author of The Handy Financial Ratios Guide, a member of the Society for Advancing Business Editing and Writing, contributes to his financial education site, Finance Strategists, and has spoken to various financial communities such as the CFA Institute, as well as university students like his Alma mater, Biola University, where he received a bachelor of science in business and data analytics.

To learn more about True, visit his personal website or view his author profiles on Amazon, Nasdaq and Forbes.