What Are Retirement Plan Loans?

A retirement plan loan is a type of loan that allows individuals to borrow money from their own retirement savings account, such as a 401(k) or IRA, and repay the loan with interest over time.

The loan is typically secured by the individual's retirement account balance and is subject to certain rules and limitations set by the Internal Revenue Service (IRS).

To qualify for a retirement plan loan, the individual must be an active participant in a qualified retirement plan, such as a 401(k) or 403(b), and the plan must allow for loans.

The maximum amount that can be borrowed is typically a percentage of the individual's account balance, up to a maximum amount set by the IRS.

Before deciding to take a loan from a retirement plan, it is crucial to understand the potential advantages and disadvantages, as well as the rules and regulations surrounding such loans.

This knowledge can help individuals make informed decisions about whether a retirement plan loan is the best option for their financial needs.

Types of Retirement Plans That Allow Loans

401(k) Plans

Many 401(k) plans allow participants to borrow money from their account balances. The specific terms and conditions for loans may vary depending on the plan's provisions and the employer's policies.

403(b) Plans

Similar to 401(k) plans, 403(b) plans often permit participants to take loans from their account balances. These plans are typically offered by non-profit organizations, schools, and hospitals.

457(b) Plans

Governmental 457(b) plans may also allow loans, depending on the plan's provisions. These plans are typically offered by state and local government employers.

Thrift Savings Plan (TSP)

The Thrift Savings Plan, a retirement savings plan for federal employees and members of the uniformed services, also permits loans under specific conditions.

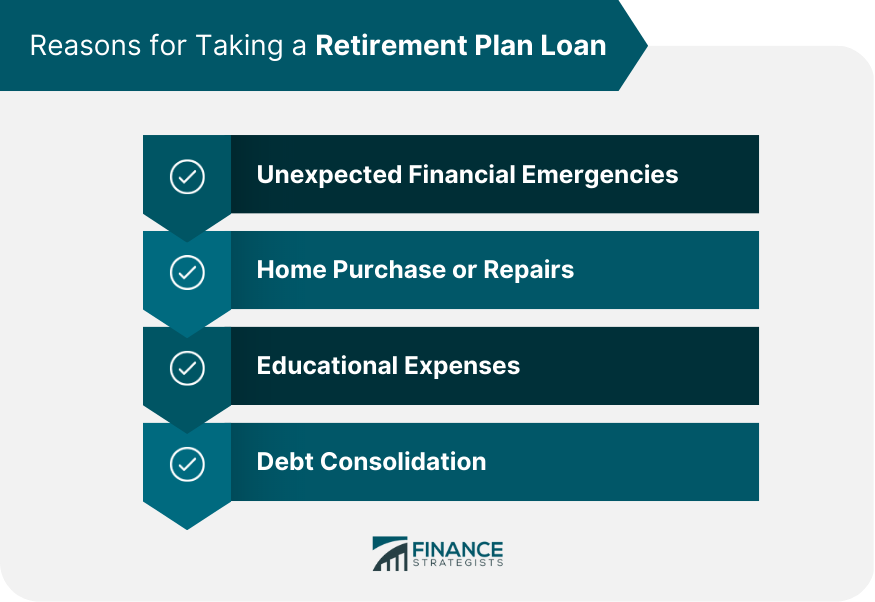

Reasons for Taking a Retirement Plan Loan

Unexpected Financial Emergencies

One common reason individuals take a loan from their retirement plan is to cover unexpected financial emergencies, such as medical expenses or urgent home repairs.

Home Purchase or Repairs

Some retirement plan loans can be used to help finance the purchase of a primary residence or to fund necessary home repairs or improvements.

Educational Expenses

Retirement plan loans may also be taken to cover educational expenses for the account holder, their spouse, or their children.

Debt Consolidation

In some cases, individuals may use retirement plan loans to consolidate high-interest debt, such as credit card balances or personal loans.

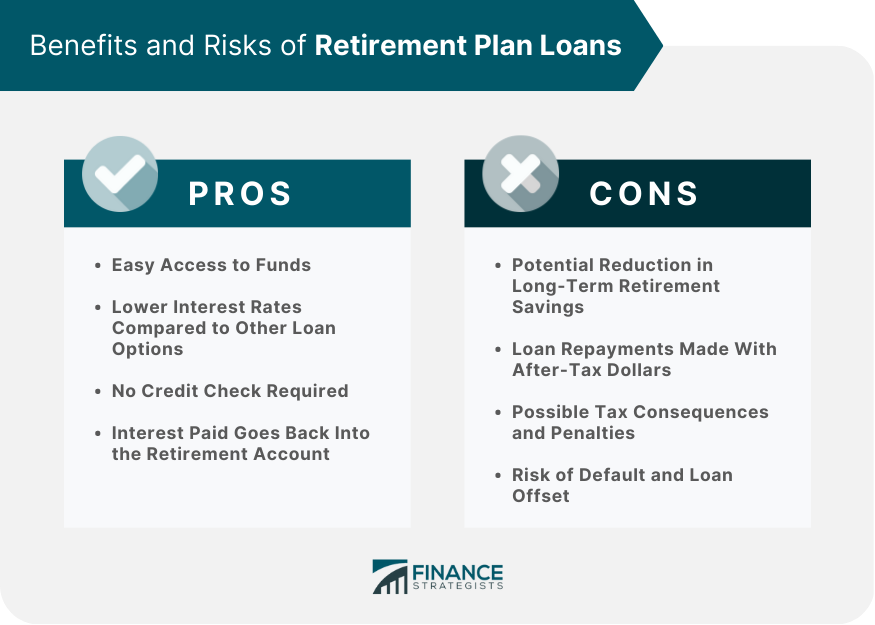

Advantages of Retirement Plan Loans

Easy Access to Funds

Retirement plan loans generally offer easy access to funds, with relatively quick approval processes and minimal paperwork.

Lower Interest Rates Compared to Other Loan Options

Interest rates on retirement plan loans are typically lower than those on personal loans or credit cards, making them a potentially more affordable borrowing option.

No Credit Check Required

Since retirement plan loans are based on the borrower's account balance, there is no credit check required, making them accessible to individuals with poor or limited credit histories.

Interest Paid Goes Back Into the Retirement Account

The interest paid on a retirement plan loan is credited back to the borrower's account, potentially helping to offset the impact of the loan on long-term retirement savings.

Disadvantages and Risks of Retirement Plan Loans

Potential Reduction in Long-Term Retirement Savings

Taking a loan from a retirement plan can reduce the account's earning potential, as the borrowed funds are no longer invested and generating returns.

Loan Repayments Made With After-Tax Dollars

Retirement plan loan repayments are made with after-tax dollars, which can result in a higher effective interest rate compared to other loan options.

Possible Tax Consequences and Penalties

If a retirement plan loan is not repaid within the specified time frame or the borrower fails to meet the repayment terms, the loan may be treated as a taxable distribution, resulting in income taxes and potential early withdrawal penalties.

Risk of Default and Loan Offset

If a borrower defaults on a retirement plan loan or leaves their job before repaying the loan, the remaining balance may be treated as a taxable distribution, resulting in additional taxes and possible penalties.

Rules and Regulations for Retirement Plan Loans

Maximum Loan Amount and Repayment Terms

Retirement plan loans are subject to limits on the amount that can be borrowed, typically up to 50% of the vested account balance or $50,000, whichever is less.

Repayment terms generally range from one to five years, though longer terms may be allowed for loans used to purchase a primary residence.

Restrictions on Loan Purpose

Some retirement plans may impose restrictions on the purposes for which loans can be taken, such as limiting loans to specific expenses like home purchases or educational costs.

Repayment Requirements

Borrowers must make regular payments, typically through payroll deductions, to repay their retirement plan loans. Payments must include principal and interest, and any missed payments could result in a loan default.

Consequences of Default or Failure to Repay

Failing to repay a retirement plan loan within the specified time frame or defaulting on the loan can result in significant tax consequences and penalties, as the unpaid balance may be treated as a taxable distribution.

Alternatives to Retirement Plan Loans

Home Equity Loans or Lines of Credit

Homeowners may consider using a home equity loan or line of credit as an alternative to borrowing from their retirement plan. These options typically offer lower interest rates than personal loans or credit cards and may provide tax advantages.

Personal Loans

Personal loans from banks or other financial institutions can be another option for individuals who need funds and do not wish to borrow from their retirement plan.

Interest rates on personal loans may be higher than those on retirement plan loans, but they generally do not require collateral and have more flexible repayment terms.

Borrowing From Family or Friends

In some cases, individuals may consider borrowing money from family or friends as an alternative to taking a retirement plan loan.

This option can offer more flexibility and potentially lower interest rates, but it can also strain personal relationships if repayment terms are not clearly defined and followed.

Financial Hardship Withdrawals

Some retirement plans may allow for financial hardship withdrawals, which can provide access to funds without requiring repayment.

However, these withdrawals are typically subject to income taxes and possible penalties, and should be considered carefully due to their potential impact on long-term retirement savings.

Conclusion

Weighing the Pros and Cons of Retirement Plan Loans

Before taking a loan from a retirement plan, individuals should carefully weigh the pros and cons, considering the potential impact on their long-term retirement savings and the availability of alternative borrowing options.

Understanding the Long-Term Impact on Retirement Savings

Taking a loan from a retirement plan can have significant long-term consequences for retirement savings, as the borrowed funds are no longer invested and generating returns.

Borrowers should carefully evaluate their financial situation and repayment ability before deciding to take a retirement plan loan.

Exploring Alternative Options Before Taking a Loan From a Retirement Plan

There are several alternatives to retirement plan loans, including home equity loans, personal loans, borrowing from family or friends, or financial hardship withdrawals.

Individuals should explore these options and consider their unique financial needs and circumstances before deciding to take a loan from their retirement plan.

Retirement Plan Loans FAQs

A retirement plan loan allows participants in a qualified retirement plan, such as a 401(k) or 403(b), to borrow money from their retirement account balance.

The amount participants can borrow from their retirement plan varies based on the plan's specific rules and limitations. However, the Internal Revenue Service (IRS) sets a maximum loan amount of the lesser of $50,000 or 50% of the participant's vested account balance.

The terms of a retirement plan loan depend on the specific plan, but loans are typically required to be repaid within five years. Interest rates on the loan are usually based on the prime rate at the time the loan is issued.

The main advantage of taking a retirement plan loan is that participants can access money in their retirement accounts without paying taxes or penalties. Additionally, interest paid on the loan goes back into the participant's account, rather than to a third-party lender.

The main disadvantage of taking a retirement plan loan is that it reduces the participant's retirement savings, which can impact their long-term financial security. Additionally, if the participant leaves their job before the loan is fully repaid, the outstanding balance may become due immediately or be subject to taxes and penalties.

True Tamplin is a published author, public speaker, CEO of UpDigital, and founder of Finance Strategists.

True is a Certified Educator in Personal Finance (CEPF®), author of The Handy Financial Ratios Guide, a member of the Society for Advancing Business Editing and Writing, contributes to his financial education site, Finance Strategists, and has spoken to various financial communities such as the CFA Institute, as well as university students like his Alma mater, Biola University, where he received a bachelor of science in business and data analytics.

To learn more about True, visit his personal website or view his author profiles on Amazon, Nasdaq and Forbes.