Retirement Planning Strategies

Retirement planning involves creating a financial plan that ensures financial security during retirement.

Setting your retirement goals, calculating your required money, and making investments to increase your retirement savings are part of this.

Retirement planning can be challenging for many people, especially if you are starting later in life. However, saving for retirement is achievable at any age.

Have questions about Retirement Planning? Click here.

Financial experts suggest retirement planning strategies that you can use to help you have a comfortable and secure retirement.

Estimate Your Needs

There are some tips for estimating how much money you will need to save and be able to maintain a particular lifestyle upon retirement.

- Determine Your Expenses. Determine current expenses from housing, transportation, healthcare, and other costs to know the amount required for your retirement expenses.

- Consider Your Lifestyle. Consider the activities and hobbies you enjoy and how much you typically spend on them.

- Factor in Inflation. You will likely need more money to maintain the same standard of living, so be sure to factor inflation into your estimate.

- Use Online Retirement Calculators. Information such as your current age, income, and savings required by online resources which can help you estimate retirement needs.

Consult a Financial Advisor

Securing the services of a financial advisor can help you understand your retirement savings options and craft a retirement savings plan that meets your goals.

Financial advisors offer various services to help clients prepare for retirement, including:

- Social Security. They can help clients evaluate their options for Social Security, including estimating future benefits.

- Taxes. They can assist clients in understanding taxes and how their taxes will be affected in retirement.

- Retirement Budget. They can help clients establish a realistic budget for retirement spending.

- Healthcare Cost. Estimating potential healthcare costs involves providing information on Medicare coverage and the cost of healthcare.

Consider Your Savings Options

There are various savings options available for those starting to save for retirement later in life, such as the following.

- Individual Retirement Accounts (IRAs). IRAs are tax-advantaged savings accounts that allow individuals to save for retirement. There are two main types of individual retirement plans, traditional and Roth.

Contributions to a traditional IRA may be pre-tax or after-tax. In contrast, contributions to a Roth IRA are made with after-tax dollars. Both types of IRAs offer the potential for tax-deferred growth on investments. - 401(k)s. A 401(k) is a retirement savings plan sponsored by an employer. Employees contribute a portion of their salary to their 401(k) on a tax-deferred basis, and most employers also offer matching contributions.

- 403(b)s. A 403(b) is a retirement savings plan that is similar to a 401(k). But it is available to employees of specific tax-exempt organizations, such as schools and non-profit organizations.

- 457(b)s. A 457(b) plan is a tax-advantaged retirement savings account available to government workers, such as state and municipal authorities, public school teachers, county and city employees, and first responders.

It is essential to compare the features and potential benefits of these different retirement savings options to determine the best fit for your situation.

Eliminate Debts

Consider eliminating debts before beginning retirement savings for the following benefits:

- Reduce Interest Charges. Interest charges on debt can increase over time, making it more expensive. You can free up more money for retirement savings by paying off debt.

- Improve Credit Score. High debt levels can negatively impact your credit score. It makes it more challenging to have loans or credit card approvals in the future.

- Maximize Budget Flexibility: Paying off debts may give you flexibility in handling your budget. You can take care of necessary living expenses or save for retirement.

Maximize Your Contribution Limits

There are annual contribution limits for various retirement savings accounts, such as 401(k)s, 457(b)s, 403(b)s and IRAs.

These limits are set by the Internal Revenue Service (IRS). They are designed to help ensure that individuals do not overcontribute to their accounts.

Suppose you are starting to save for retirement late. In that case, it is essential to maximize your contribution to your 401(k) or any other plan to catch up on your savings and make the most of your retirement savings.

Here is a table with the current annual contribution limits:

Take Advantage of Catch-up Contributions

Catch-up contributions are additional contributions that individuals can make to their retirement accounts.

These contributions allow individuals who may have fallen behind on retirement savings to catch up and increase their retirement savings.

They are available to individuals over a certain age, typically 50, depending on the type of account.

Here is a summary of the catch-up contributions available with corresponding limits:

Note that these catch-up contribution limits are subject to change annually.

Decide When to Take Social Security

You are entitled to the full benefit if you wait until full retirement age to get your Social Security income.

For every month before your full retirement age that you begin receiving benefits, your benefits will be reduced by a modest percentage.

Consider your retirement timetable to prevent making costly errors by claiming Social Security payments too soon.

Additionally, consider saving up for the years when you will not receive Social Security benefits.

Reduce Your Expenses

Reducing your expenses can be an effective way to increase your retirement savings.

There are many ways to lower your expenses, depending on your circumstances.

- Track Spending. Look for areas where you can cut back on your spending, such as dining out or entertainment expenses.

- Reduce Housing Costs. Consider downsizing to a smaller home or negotiating a lower rent or mortgage payment. Look for ways to save on utility bills and subscriptions.

- Refinance Debts. If you have high-interest debts, such as credit card debts or loans, consider refinancing to a lower interest rate to save money on interest payments.

- Freeze Credit Cards. Consider temporarily freezing your credit cards using your issuer's website or app. In this way, you can refrain from making new purchases.

Final Thoughts

Retirement planning may seem challenging for late starters. However, it is essential to remember numerous strategies to ensure a financially secure future.

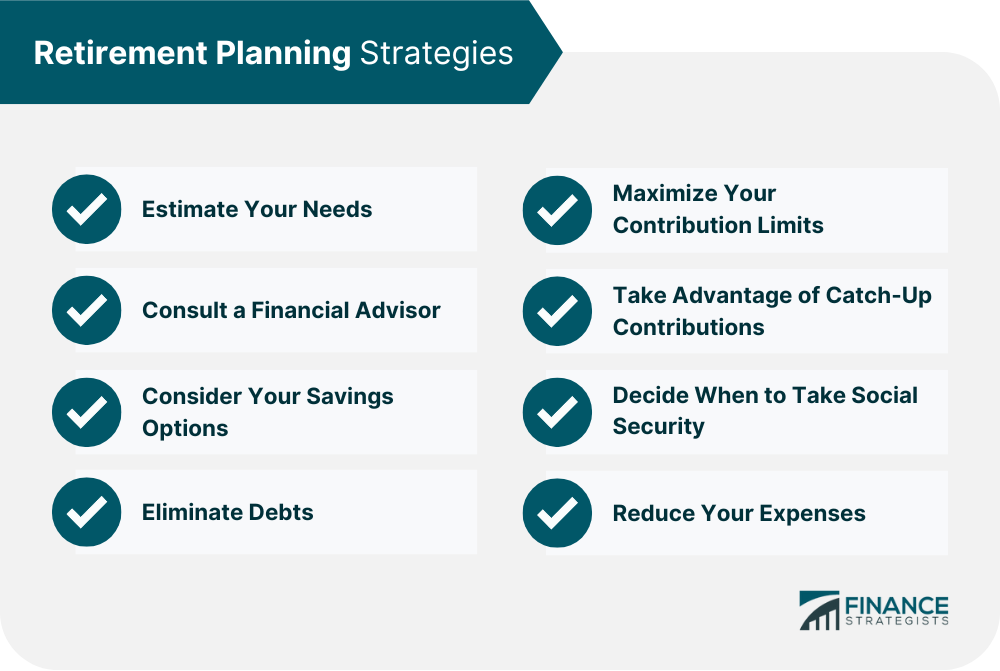

Among these strategies are:

- estimating your needs

- consulting a financial advisor

- considering your savings options

- eliminating debts

- maximizing your contribution limits

- taking advantage of catch-up contributions

- deciding when to take social security

- reducing your expenses.

Consulting with a financial advisor can be the most crucial step in retirement planning, especially for those starting late.

You can get expert advice and guidance to help you create a customized and successful retirement plan.

Retirement Planning Strategies for Late Starters FAQs

The best strategy for late starters is to set a solid financial plan and stick to it, start saving early and often, create an emergency fund in case of unexpected expenses, and invest in low-risk accounts to maximize returns while minimizing risk. Additionally, you should also consider consulting with a financial advisor to make sure you are on track and making decisions that will help reach your long-term goals.

Late starters should focus on investing in low-risk accounts such as bonds, CDs, and index funds which tend to provide steady returns with minimal risk. Additionally, it is important to make sure you are taking advantage of any employer-sponsored savings plans and contributing the maximum amount allowed in order to maximize your contributions.

If you are unable to save enough for retirement on your own, it is important to look into other options such as Social Security, an employer-sponsored retirement plan, or annuities. Additionally, it is important to consider consulting with a financial advisor who can help you make informed decisions and adjust your strategy if necessary.

The best way to know if your retirement savings are on track is to consult with a financial advisor who can review your current financial situation and make sure you are making decisions that will help you reach your goals. Additionally, keeping up-to-date with the latest tax laws can also help ensure that you maximize your contributions and reap all of the benefits available to you.

When creating a retirement plan, it is important to consider factors such as your age, current income and expenses, long-term goals, risk tolerance, tax situation, and any other special considerations. Additionally, it is important to make sure you are taking advantage of any employer-sponsored retirement plans or other savings options available to you and to adjust your strategy as needed.

True Tamplin is a published author, public speaker, CEO of UpDigital, and founder of Finance Strategists.

True is a Certified Educator in Personal Finance (CEPF®), author of The Handy Financial Ratios Guide, a member of the Society for Advancing Business Editing and Writing, contributes to his financial education site, Finance Strategists, and has spoken to various financial communities such as the CFA Institute, as well as university students like his Alma mater, Biola University, where he received a bachelor of science in business and data analytics.

To learn more about True, visit his personal website or view his author profiles on Amazon, Nasdaq and Forbes.