Retirement transition planning is a comprehensive approach to preparing for one's transition from the workforce into retirement. It recognizes that this critical life stage goes beyond financial planning, encompassing emotional, physical, and lifestyle factors that contribute to a fulfilling retirement experience. By taking a holistic approach, retirement transition planning aims to create a smooth and successful shift to a new phase of life, marked by personal satisfaction and financial stability. The first step in preparing for retirement is to identify your values and priorities, as these will guide your decisions throughout the transition process. Consider what brings you happiness and fulfillment and what kind of retirement lifestyle aligns with your values. Retirement brings significant changes to your daily routine, which may require emotional adjustment. Anticipate these changes and develop strategies to maintain a sense of purpose and structure in your post-work life. Evaluate your financial situation by estimating your income sources, such as pensions, Social Security benefits, and investments. Additionally, project your expenses during retirement, including housing, healthcare, and leisure activities. Determine your financial goals and priorities for retirement, such as maintaining a certain standard of living, traveling, or supporting family members. This will help guide your financial planning and decision-making. Consider your current health status and any anticipated healthcare needs during retirement. This includes planning for potential long-term care and support services. Long-term care planning involves evaluating options for care services and insurance, determining how to fund these services, and discussing preferences with family members. Choose a target retirement date, keeping in mind factors such as your health, financial situation, and personal goals. Anticipate potential obstacles and challenges during your retirement transition, such as health issues, unexpected expenses, or changes in the economy. Create strategies to address potential challenges, such as building an emergency fund, obtaining appropriate insurance coverage, or maintaining a flexible retirement date. Develop a timeline with milestones to help guide your progress toward a successful retirement transition. Pensions and Social Security Benefits: Evaluate your eligibility for pensions and Social Security benefits, and determine the optimal timing for claiming these benefits. Investments and Savings: Review your investment portfolio and savings accounts, ensuring that they are appropriately diversified and aligned with your retirement goals. Part-Time Work or Entrepreneurship: Consider part-time work or entrepreneurial ventures as additional income sources during retirement. Reducing Debt and Liabilities: Develop a plan to reduce debt and liabilities, such as paying off mortgages or credit card balances, before entering retirement. Adjusting Spending Habits: Evaluate your spending habits and consider adjustments to help you live within your means during retirement. Implement tax planning strategies to minimize your tax burden during retirement, such as utilizing tax-advantaged retirement accounts or strategically withdrawing funds from different accounts. Establish or update your estate plan, including wills, trusts, and powers of attorney, to ensure your assets are distributed according to your wishes and minimize potential estate taxes. Developing New Hobbies and Interests: Explore new hobbies and interests that align with your passions and values, providing a sense of purpose and enjoyment during retirement. Exploring Travel and Relocation Options: Consider travel or relocation plans to experience new cultures, climates, and environments that match your retirement lifestyle preferences. Strengthening Social Connections: Maintain and strengthen social connections by joining clubs, attending events, or engaging in community activities, which can help support mental well-being and reduce feelings of isolation. Volunteering and Philanthropic Activities: Participate in volunteering or philanthropic activities, offering a sense of purpose and fulfillment while giving back to your community. Incorporate regular exercise and physical activities into your retirement routine to maintain overall health, mobility, and mental well-being. Schedule regular checkups and screenings to monitor your health and detect potential issues early, allowing for timely intervention and treatment. Participate in mentally stimulating activities, such as reading, attending lectures, or learning new skills, to keep your mind sharp and engaged. Develop strategies for managing stress and maintaining emotional health, such as practicing mindfulness, seeking professional help, or connecting with support networks. Explore options for long-term care services, such as home care, assisted living, or nursing homes, and plan for how to fund these services, should they become necessary. Evaluate your progress toward your retirement goals and make adjustments as needed, adapting to changes in your personal circumstances or the economic environment. Be prepared to modify your retirement transition plan in response to changes in your life, such as health issues, family dynamics, or unexpected expenses. Consult with financial planners, legal professionals, and healthcare providers to obtain expert advice and support throughout your retirement transition. Retirement transition planning is a comprehensive and holistic approach to preparing for the transition from working life to retirement. By addressing emotional, financial, physical, and lifestyle aspects, individuals can create a smooth and successful path to a fulfilling and financially secure retirement. Key components of retirement transition planning include assessing readiness, creating a plan with a timeline and milestones, diversifying income sources, managing expenses, tax and estate planning, lifestyle considerations, and maintaining health and wellness. It is crucial to regularly review and adjust the plan to adapt to changes in personal circumstances and seek professional advice when needed. By engaging in proactive retirement transition planning, individuals can ensure they are well-prepared for this significant life stage, allowing them to enjoy the benefits of a fulfilling and secure retirement.Definition of Retirement Transition Planning

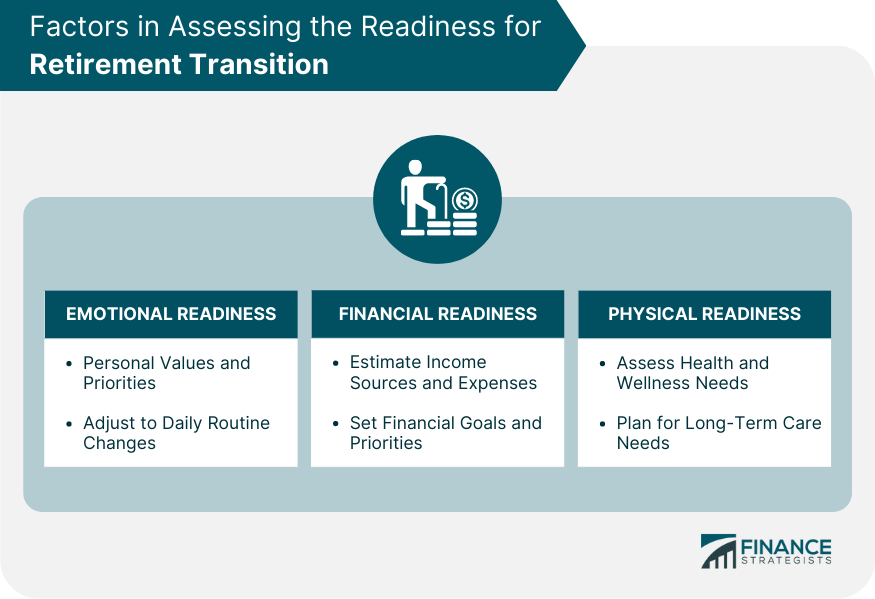

Factors in Assessing the Readiness for Retirement Transition

Emotional Readiness

Identifying Personal Values and Priorities

Adjusting to Changes in Daily Routine

Financial Readiness

Estimating Income Sources and Expenses

Setting Financial Goals and Priorities

Physical Readiness

Assessing Health and Wellness Needs

Planning for Long-Term Care Needs

Creating a Retirement Transition Plan

Setting a Target Retirement Date

Identifying Potential Obstacles and Challenges

Developing Strategies to Overcome Obstacles

Establishing a Timeline and Milestones

Financial Planning for Retirement

Diversifying Income Sources

Managing Expenses and Budgeting

Tax Planning and Strategies

Estate Planning and Legacy Considerations

Lifestyle Planning for Retirement

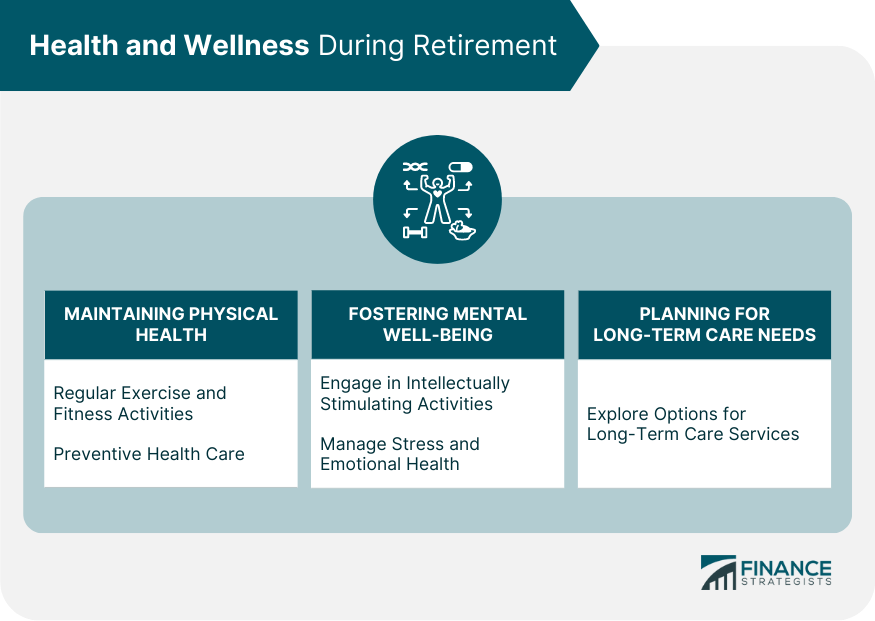

Health and Wellness During Retirement

Maintaining Physical Health

Regular Exercise and Fitness Activities

Preventive Health Care

Fostering Mental Well-Being

Engaging in Intellectually Stimulating Activities

Managing Stress and Emotional Health

Planning for Long-Term Care Needs

Reviewing and Adjusting Your Retirement Transition Plan

Regularly Monitoring Progress Toward Goals

Adapting to Changes in Personal Circumstances

Seeking Professional Advice and Support

Conclusion

Retirement Transition Planning FAQs

Retirement transition planning is the process of preparing for the shift from working life to retirement, considering financial, emotional, physical, and lifestyle aspects. It is important because it helps ensure a smooth and successful transition to a fulfilling and financially secure retirement, addressing potential challenges and aligning your goals with your retirement lifestyle.

To assess your readiness for retirement, consider three key aspects: emotional readiness, financial readiness, and physical readiness. Emotional readiness involves identifying personal values and priorities and adjusting to changes in daily routines. Financial readiness includes estimating income sources and expenses and setting financial goals and priorities. Physical readiness involves assessing health and wellness needs and planning for long-term care needs.

A comprehensive retirement transition plan should include setting a target retirement date, identifying potential obstacles and challenges, developing strategies to overcome obstacles, establishing a timeline and milestones, diversifying income sources, managing expenses and budgeting, tax planning, estate planning, lifestyle planning, and health and wellness considerations.

Maintaining a healthy and fulfilling lifestyle during retirement involves developing new hobbies and interests, exploring travel and relocation options, strengthening social connections, participating in volunteering and philanthropic activities, maintaining physical health through regular exercise and preventive health care, and fostering mental well-being through intellectual stimulating activities and stress management.

It is essential to regularly monitor your progress toward retirement goals and make necessary adjustments as needed. Adapting to changes in personal circumstances, such as health issues or changes in family dynamics, and seeking professional advice and support can help ensure a successful retirement transition. The frequency of reviewing and adjusting your plan may depend on your individual circumstances, but a good practice is to revisit your plan at least annually or whenever significant life changes occur.

True Tamplin is a published author, public speaker, CEO of UpDigital, and founder of Finance Strategists.

True is a Certified Educator in Personal Finance (CEPF®), author of The Handy Financial Ratios Guide, a member of the Society for Advancing Business Editing and Writing, contributes to his financial education site, Finance Strategists, and has spoken to various financial communities such as the CFA Institute, as well as university students like his Alma mater, Biola University, where he received a bachelor of science in business and data analytics.

To learn more about True, visit his personal website or view his author profiles on Amazon, Nasdaq and Forbes.