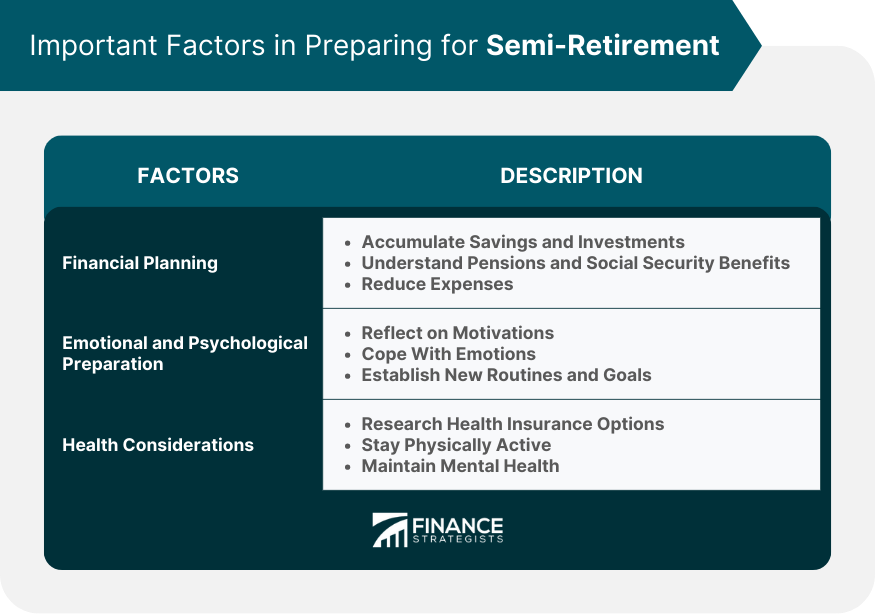

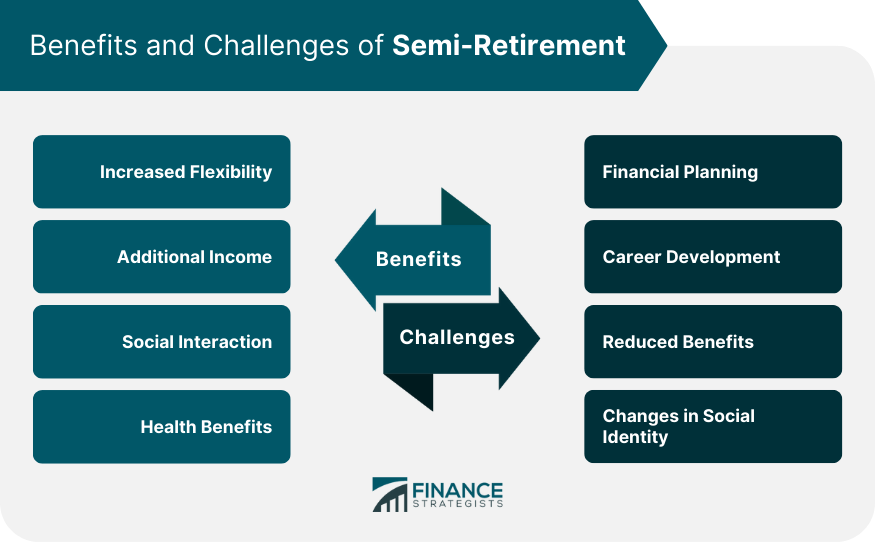

Semi-retirement is a transitional stage between full-time work and complete retirement. It typically involves reducing one's work hours or workload, allowing for more leisure time and a slower pace of life, while still maintaining some level of income and employment. Semi-retirees may choose to work part-time, freelance, or take on consulting roles in their field of expertise. People may choose semi-retirement for various reasons, such as seeking a better work-life balance, wanting to pursue hobbies or interests, or gradually easing into full retirement. Factors that influence the decision to semi-retire include financial security, health, personal interests, and job satisfaction. Preparing for semi-retirement requires building a strong financial foundation. This includes accumulating adequate savings and investments to cover living expenses and ensure financial security during the transition. Understanding how your pension and Social Security benefits will be impacted by semi-retirement is essential. Consult with financial advisors or your pension provider to assess your situation and make informed decisions. Reducing expenses can be a crucial part of preparing for semi-retirement. Adopting a frugal lifestyle and eliminating unnecessary costs can help stretch your income during this period. Take time to reflect on your reasons for choosing semi-retirement and how it aligns with your values and goals. This self-awareness will help you navigate the transition more smoothly. Semi-retirement can bring a mix of emotions. It's essential to acknowledge and address these feelings to adapt to new routines and expectations. Creating new routines and setting achievable goals can help maintain a sense of purpose and direction during semi-retirement. It's crucial to understand your health insurance options during semi-retirement. Research and compare available plans to determine the best coverage for your needs. Maintaining an active lifestyle is vital for overall well-being. Regular exercise can help prevent health issues and improve your quality of life during semi-retirement. Staying mentally sharp is essential during semi-retirement. Engage in cognitive activities, learn new skills, and maintain social connections to support mental health. Semi-retirees can explore various part-time job opportunities that align with their skills and interests. Online job boards, networking, and local resources can aid in finding suitable positions. Part-time work can provide a steady income, social interaction, and the opportunity to learn new skills or explore different industries during semi-retirement. Semi-retirees can use their experience and knowledge to offer freelance or consulting services in their field, allowing them to maintain control over their workload and schedule. Developing a solid client base requires networking, marketing, and providing high-quality services. Strong relationships with clients can lead to ongoing work and referrals. Evaluate your interests, skills, and market opportunities to identify a viable small business or passion project to pursue during semi-retirement. Develop a comprehensive business plan and explore available resources, such as grants, loans, and mentoring programs, to support your small business or passion project during semi-retirement. Investing in real estate can generate passive income through rental properties, allowing semi-retirees to earn money without actively working. Investing in dividend-paying stocks can provide a steady stream of passive income, contributing to financial stability during semi-retirement. Creating an online business, such as an e-commerce store or a blog, can generate passive income through advertising, affiliate marketing, or product sales. Semi-retirees must find a balance between work and leisure activities to maintain overall well-being and prevent burnout. Identify your priorities and allocate time accordingly to achieve a fulfilling and balanced lifestyle during semi-retirement. Stay connected with friends, family, and former colleagues to combat social isolation and maintain a strong support network during semi-retirement. Explore new social circles by joining clubs, participating in community events, or volunteering to create new friendships and connections. Semi-retirement offers an opportunity to explore new hobbies and interests, promoting personal growth and satisfaction. Continuous learning helps maintain cognitive health and keeps you engaged with the world around you. Enroll in classes, attend workshops, or learn new skills to stay sharp during semi-retirement. Travel can be a rewarding aspect of semi-retirement. Plan trips and experiences that align with your interests, budget, and lifestyle. Semi-retirement may be an ideal time to relocate, whether for a change of scenery, a lower cost of living, or to be closer to family and friends. Here are some of the benefits and challenges of semi-retirement: Increased Flexibility: Semi-retirement allows individuals to have a better work-life balance, and the flexibility to choose when and where they work. Additional Income: Continuing to work part-time or on a flexible schedule can provide additional income during retirement years, which can be beneficial for financial planning. Social Interaction: Semi-retirement can provide the opportunity for continued social interaction, intellectual stimulation, and a sense of purpose and accomplishment. Health Benefits: Studies show that semi-retirement can have health benefits, including improved physical and mental health. Financial Planning: Semi-retirement can pose a challenge for financial planning, as it can be difficult to predict future income and expenses. Career Development: Continued part-time work may limit opportunities for career advancement or new job opportunities. Reduced Benefits: Part-time work may not come with the same benefits as full-time employment, such as health insurance, retirement contributions, or paid time off. Changes in Social Identity: Semi-retirement can challenge an individual's sense of identity, as they transition from full-time work to part-time or retirement status. Semi-retirement can offer a variety of benefits and challenges, and individuals should carefully consider their personal and financial goals before making the transition. Understanding the tax implications of semi-retirement is essential. Consult a tax professional to ensure compliance with laws and maximize deductions and credits. Be aware of the rules surrounding withdrawals from retirement accounts, such as IRAs and 401(k)s, to avoid penalties and manage your financial resources effectively. Understand how working during semi-retirement may impact your eligibility for Social Security and Medicare benefits to avoid unintended consequences. Familiarize yourself with age discrimination laws to protect your rights as a semi-retiree in the workforce. Semi-retirement represents a flexible approach to the traditional retirement concept, allowing individuals to maintain a balance between work and leisure while continuing to generate income. Careful financial planning, understanding the impact on pensions and Social Security benefits, and reducing expenses are crucial steps in preparing for this transition. Exploring part-time work, freelancing, starting a business, or creating passive income sources can provide a variety of career and income opportunities during semi-retirement. Establishing priorities, nurturing social connections, and pursuing hobbies and interests help maintain a healthy work-life balance and overall well-being. Finally, understanding tax and legal implications is essential to make informed decisions and protect your rights as a semi-retiree. Embracing the opportunities and challenges presented by semi-retirement can lead to personal growth, satisfaction, and a fulfilling life experience.What Is Semi-Retirement?

Important Factors in Preparing for Semi-Retirement

Financial Planning

Savings and Investments

Pensions and Social Security

Reducing Expenses

Emotional and Psychological Preparation

Understanding Personal Motivations

Coping With the Transition

Establishing New Routines and Goals

Health Considerations

Health Insurance Options

Staying Physically Active

Maintaining Mental Health

Career and Income Opportunities in Semi-Retirement

Part-Time Employment

Freelancing and Consulting

Starting a Small Business or Pursuing a Passion Project

Passive Income Streams

Real Estate Investments

Dividend-Paying Stocks

Online Businesses

Lifestyle Changes and Work-Life Balance in Semi-retirement

Time Management

Social Connections

Pursuing Hobbies and Interests

Travel and Relocation

Benefits and Challenges of Semi-Retirement

Benefits

Challenges

Legal and Tax Implications of Semi-Retirement

Tax Considerations

Legal Issues

Final Thoughts

Semi-Retirement FAQs

Semi-retirement is a lifestyle choice where individuals reduce their working hours or change their career path while still earning income. It offers more flexibility and can be a stepping stone between full-time employment and full retirement, which involves completely ceasing work and relying on savings, investments, and social benefits for financial support.

People may opt for semi-retirement for various reasons, such as seeking a better work-life balance, spending more time with family, pursuing hobbies or interests, managing health issues, or transitioning into a new career or business venture.

Financial preparation for semi-retirement involves accumulating adequate savings and investments, understanding how pensions and Social Security benefits will be impacted, and reducing expenses to ensure financial security during the transition.

During semi-retirement, individuals can explore part-time employment, freelancing or consulting, starting a small business or pursuing a passion project, and generating passive income through real estate investments, dividend-paying stocks, or online businesses.

To maintain a healthy work-life balance, semi-retirees should establish priorities, allocate time for work and leisure activities, and engage in hobbies and interests. To maintain social connections, they can continue nurturing existing relationships and build new social networks through clubs, community events, or volunteering.

True Tamplin is a published author, public speaker, CEO of UpDigital, and founder of Finance Strategists.

True is a Certified Educator in Personal Finance (CEPF®), author of The Handy Financial Ratios Guide, a member of the Society for Advancing Business Editing and Writing, contributes to his financial education site, Finance Strategists, and has spoken to various financial communities such as the CFA Institute, as well as university students like his Alma mater, Biola University, where he received a bachelor of science in business and data analytics.

To learn more about True, visit his personal website or view his author profiles on Amazon, Nasdaq and Forbes.