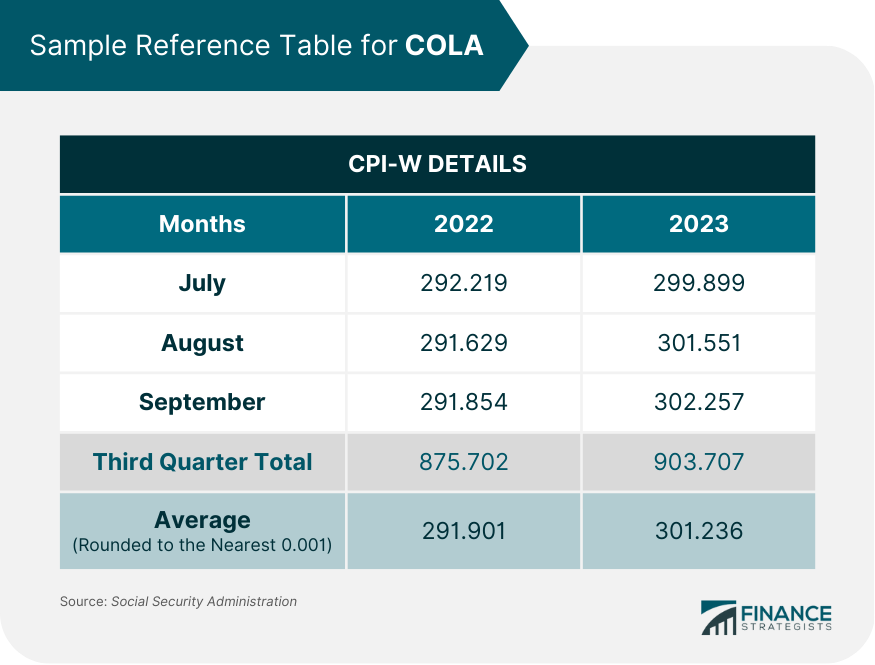

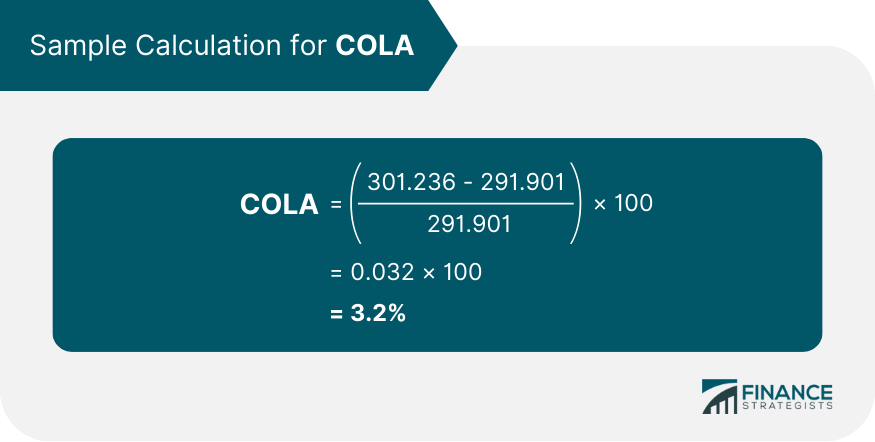

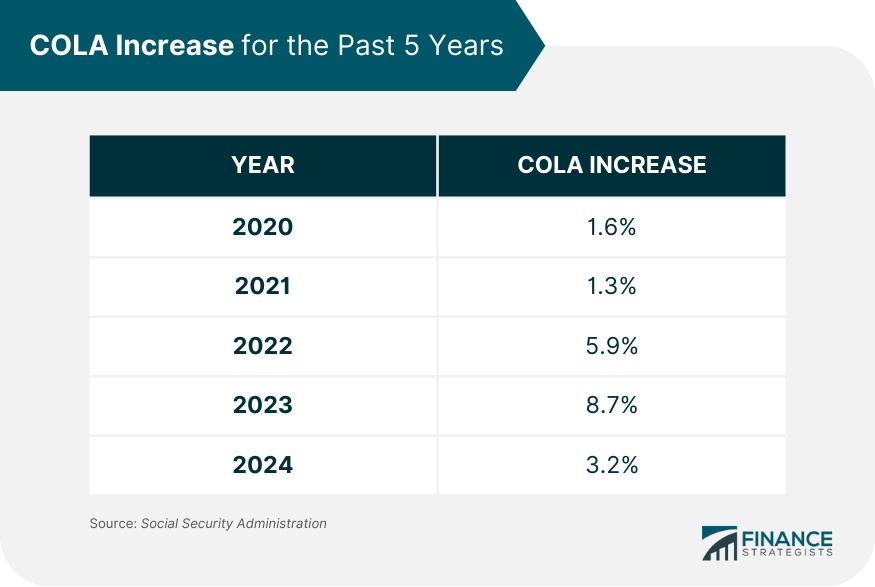

A Cost-of-Living Adjustment (COLA) is an alteration made to salaries or other benefits payments such as Social Security or pensions due to changes in the cost of living from one time period to another. The adjustment attempts to maintain a consistent standard of living for individuals or groups despite the effects of inflation, which can erode the purchasing power of income. COLA adjustments are typically implemented annually, although adjustments may be made more or less frequently depending on local conditions. The COLA for 2024 increased by 3.2% in the United States. COLA is an essential financial tool many employers use to ensure that salaries remain in line with inflation. By periodically increasing wages in tandem with fluctuations in the cost of goods and services, COLA helps provide employees with financial stability. Employers may also use a COLA to help keep the salaries of relocated workers in line with the cost of living standards in their new location. COLA enables these employees to enjoy a similar standard of living, even if they have been assigned to a new site. COLA also plays a critical role in pension programs, such as Social Security, providing retirees with stable income despite changes in the inflation rate. Accounting for COLA often makes the difference between acceptable and insufficient living standards for retirees while providing a reliable baseline income they can depend upon. It also ensures that market fluctuations do not disproportionately affect those on fixed incomes. The Social Security Act specifies that the COLA must be based on the Bureau of Labor Statistics (BLS) Consumer Price Index for Urban Wage Earners and Clerical Workers. To determine the COLA, we must first obtain the average third-quarter CPI-W of the previous year and the current year. The resulting number for each year must then be rounded off to the nearest tenth of one percent (0.001). In the table below is a sample calculation: Finally, the percentage increase from the previous year to the current year is computed. Based on the table above, the calculation would be: If no growth is indicated, or if the rounded number in the calculation equals zero, then there will not be any Cost of Living Adjustment for that year. However, this is rarely the case. As indicated in the table below, there has been a series of COLA increases for the last five years: Checking out cost-of-living indexes for potential new locales is essential to relocation planning. A COLA adjustment can mitigate some of the financial stress associated with relocating to a location where the cost of living is higher than one’s current location. Many employers provide COLA to their relocated employees, and they consider variations in living costs when determining their workers’ adjusted salaries. The amount of COLA included in a salary package may vary, but it typically covers the difference between the employee’s old and new locations. A COLA for relocation helps employees maintain their current standard of living after moving to more expensive areas, thus making relocation an easier transition overall. Retiring after a long work career is an exciting prospect for many people, but retirement comes with challenges. Many seniors rely heavily on the earnings from their retirement plans such as Social Security, Pension, and 401(k)s to finance their lifestyle in later life. COLA can be a powerful tool for maintaining your standard of living when you retire. By accounting for inflation, COLA theoretically increases payments from government sources so that retirees can keep up with the rising costs of daily goods and services. When budgeting for your retirement plan, it is crucial to think strategically about investing in COLA-linked accounts and monitoring how much money you will need each year to maintain a comfortable lifestyle post-retirement. If you need more help with retirement planning, you can consult a financial professional who can support you through this process. A Cost-of-Living Adjustment is an alteration made to salaries or other benefits payments such as Social Security or pensions due to changes in the cost of living from one time period to another. COLA is calculated annually based on changes in a fixed index such as the Consumer Price Index for Urban Wage Earners and Clerical Workers. It accounts for inflation, making it easier for individuals to weigh their financial resources against the rising costs of goods and services. Depending on one’s situation, a COLA may also offer some additional cushion in times of economic stress or changes. For example, employers can use COLA to increase the salaries of relocated workers and help them maintain their previous standard of living. In addition, COLA remains an especially beneficial option for people on a fixed income, such as a pension. For instance, COLA increases Social Security benefits so that retirees can keep up with the rising costs of daily goods and services. Ultimately, knowledge about COLA and how to calculate it can be helpful for individuals who want to mitigate the effects of inflation. With this in mind, they can effectively plan for times of financial stress and prepare accordingly.What Is a Cost-of-Living Adjustment (COLA)?

This increase is usually based on the Consumer Price Index for Urban Wage Earners and Clerical Workers (CPI-W), which measures changes in prices of goods and services, including food, housing, clothing, transportation, energy, medical care, recreation, and education.Importance of COLA

How COLA Is Calculated

COLA for Relocations

COLA and Retirement Income

Final Thoughts

Cost-of-Living Adjustment (COLA) FAQs

Cost-of-living adjustment (COLA) is a mechanism that helps individuals and groups maintain their standard of living despite economic changes. It adjusts income levels based on the Consumer Price Index for Urban Wage Earners and Clerical Workers (CPI-W) to ensure that incomes remain consistent with inflation.

The COLA adjustment for 2024 is 3.2% based on the Social Security Administration's calculation of CPI-W.

To calculate your COLA increase for 2024, determine the percentage increase in Consumer Price Index-Wage Earners and Clerical Workers (CPI-W) from last year's third-quarter average to this year's third-quarter average. The COLA rate is then calculated by taking the resulting figure and rounding it up to the nearest tenth of one percent (0.001).

Yes, all individuals receiving Social Security benefits will get a 3.2% increase in their monthly payments beginning in January 2024.

In addition to Social Security COLA, there are other types of COLA, such as those for salary increases and pension adjustments. These can be used to adjust income levels for workers to keep up with inflation. Employers may also use these adjustments when relocating employees or giving out pay raises, while retirees may receive a Cost of Living Adjustment on their pensions or Social Security benefits.

True Tamplin is a published author, public speaker, CEO of UpDigital, and founder of Finance Strategists.

True is a Certified Educator in Personal Finance (CEPF®), author of The Handy Financial Ratios Guide, a member of the Society for Advancing Business Editing and Writing, contributes to his financial education site, Finance Strategists, and has spoken to various financial communities such as the CFA Institute, as well as university students like his Alma mater, Biola University, where he received a bachelor of science in business and data analytics.

To learn more about True, visit his personal website or view his author profiles on Amazon, Nasdaq and Forbes.