Delayed retirement credits refer to the additional benefits that individuals can earn by delaying their Social Security retirement benefits beyond their full retirement age (FRA). If individuals choose to delay claiming Social Security retirement benefits beyond their full retirement age, they can earn delayed retirement credits. Delayed retirement credits result in an increased monthly benefit amount. They can be advantageous for individuals who can afford to delay claiming and expect to live longer, as it can result in higher monthly benefits for the rest of their lives. However, the decision of when to claim Social Security retirement benefits, whether to claim early, at full retirement age, or to delay, is a personal one and depends on various factors, such as individual financial circumstances, health, and retirement plans. The Social Security system was established in the United States to support eligible individuals during retirement financially. The system has evolved over time, but its primary purpose remains the same: to ensure that retirees have basic financial support. Individuals must have a sufficient work history and meet specific age requirements to be eligible for Social Security benefits. The Full Retirement Age (FRA) determines Social Security benefits. The FRA is when an individual becomes eligible for their full Social Security benefit without any reductions or increases. The FRA varies depending on one's birth year and can range from 65 to 67 years. Knowing your FRA is essential for making informed decisions about retirement planning. Delaying retirement beyond the FRA can result in increased Social Security benefits. The increase in benefit amount is due to delayed retirement credits, which accrue for each month that an individual delays claiming their Social Security benefits. The factors affecting the benefits increase to include the individual's birth year and the number of months by which retirement is delayed. Individuals can use the Social Security Administration's online tools to calculate the increased benefit or consult with a financial professional. There are several financial reasons for choosing to delay retirement, including: Increased Social Security Benefits: Delaying retirement can result in a higher monthly benefit, providing additional financial security during retirement. Larger Retirement Savings: Continuing to work allows individuals to contribute more to their retirement savings, potentially increasing their overall nest egg. Continuation of Employer-Sponsored Benefits: Some individuals may choose to delay retirement to maintain valuable employer-sponsored benefits, such as health insurance or retirement contributions. Personal factors that may influence the decision to delay retirement include: Longer Life Expectancy: With increased life expectancies, individuals may work longer to ensure adequate financial resources during retirement. Desire to Remain Active and Engaged: Some individuals may find fulfillment in their careers and choose to continue working to maintain a sense of purpose and social connections. Uncertainty About the Future: Economic or personal uncertainties may lead some individuals to delay retirement to ensure financial stability. Economic factors that may influence the decision to delay retirement include: Fluctuating Markets and Investment Returns: Volatile markets and uncertain investment returns may encourage individuals to continue working to maintain financial security. Changing Tax Laws: Tax law changes may impact retirement income, leading some individuals to delay retirement to adjust their financial plans. Potential Changes to Social Security: Uncertainty surrounding the future of Social Security may lead individuals to delay retirement to maximize their benefits. Delaying retirement may have health and wellness implications, such as: Physical Limitations and Health Risks: Continuing to work can exacerbate existing health issues or increase the risk of work-related injuries. Mental Health Considerations: Delaying retirement may contribute to increased stress or feelings of burnout, negatively impacting mental health. There are several opportunity costs associated with delaying retirement, including: Reduced Time for Leisure and Personal Interests: Delaying retirement may limit the time available for travel, hobbies, and other personal pursuits. Limited Time With Family and Friends: Continuing to work can reduce the time spent with loved ones, impacting relationships and overall well-being. The future of Social Security remains uncertain, with potential changes to benefit adjustments and eligibility criteria. Individuals should monitor developments related to Social Security and consider the potential implications for their retirement plans. Individuals considering delaying retirement should evaluate their financial situation by: Estimating Retirement Income: Projecting expected income from Social Security, pensions, and personal savings can help individuals determine if delaying retirement is financially beneficial. Evaluating Expenses and Lifestyle Adjustments: Assessing anticipated expenses during retirement and considering any necessary lifestyle adjustments can help individuals make informed decisions about delaying retirement. Considering Other Sources of Income: Individuals may want to explore alternative income sources, such as rental properties or part-time work, to supplement their retirement income. Healthcare is a critical factor in the decision to delay retirement. Individuals should consider the following healthcare-related factors: Medicare Eligibility and Coverage Options: Medicare eligibility begins at age 65, regardless of one's FRA. Delaying retirement may impact the timing of Medicare enrollment and the choice of coverage options. Maintaining Private Insurance: Individuals who continue working may have access to employer-sponsored health insurance, which could be more comprehensive than Medicare. Long-Term Care Planning: Delaying retirement may provide additional time to plan and save for long-term care expenses, such as nursing home care or home health services. Individuals considering delaying retirement can explore various work-related strategies, including: Flexible Work Arrangements: Negotiating flexible work hours or remote work opportunities can help ease the transition into retirement while still providing financial benefits. Phased Retirement: Some employers offer phased retirement programs, allowing employees to reduce their work hours gradually while maintaining some benefits. Pursuing a Second Career or Part-Time Work: Individuals who wish to remain active in the workforce may consider transitioning to a new career or pursuing part-time employment in their field or an area of interest. Delayed retirement credits refer to the additional benefits individuals can earn by postponing their Social Security retirement benefits beyond their full retirement age (FRA). By delaying claiming, individuals can increase their monthly benefit amount, providing greater financial security during retirement. The decision to delay retirement depends on factors such as financial circumstances, health, and retirement plans. While delaying retirement offers advantages such as increased benefits and larger retirement savings, there are also considerations like health and wellness concerns and opportunity costs. Individuals should assess their personal finances, evaluate healthcare considerations, and explore work-related strategies when considering delayed retirement. It's important to monitor potential changes to Social Security and make informed decisions based on individual circumstances.What Are Delayed Retirement Credits?

Social Security and Delayed Retirement Credits

Overview of the Social Security System

Full Retirement Age (FRA)

Impact of Delayed Retirement on Social Security Benefits

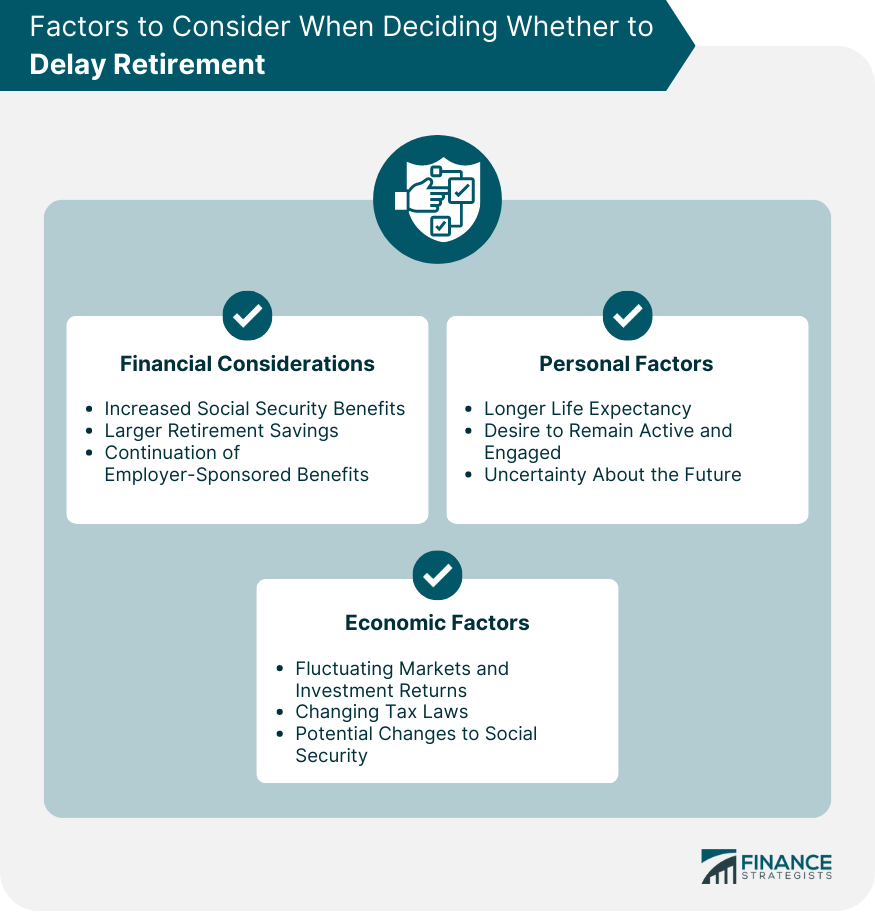

Factors to Consider When Deciding Whether to Delay Retirement

Financial Considerations

Personal Factors

Economic Factors

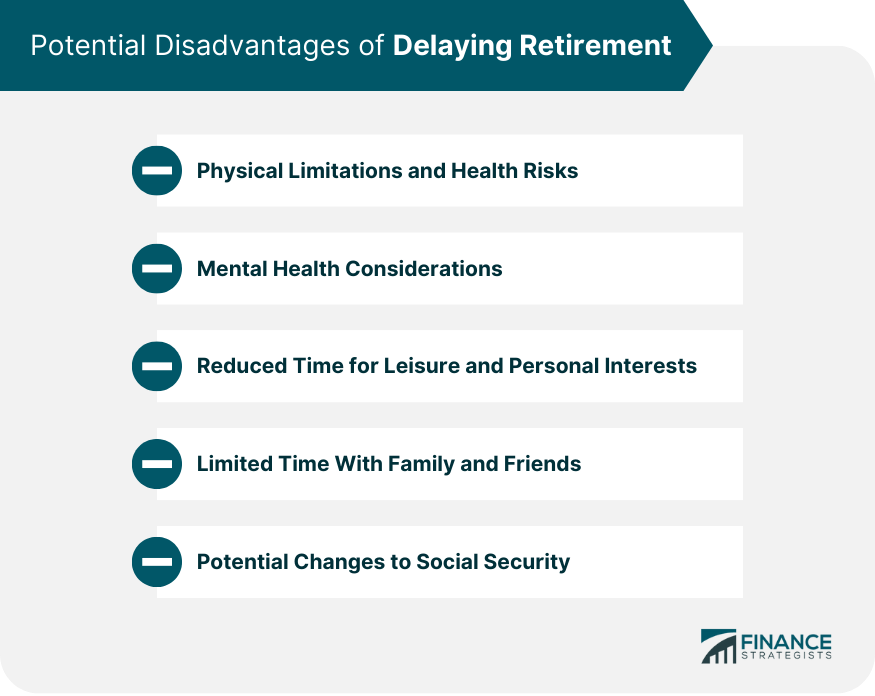

Potential Disadvantages of Delaying Retirement

Health and Wellness Concerns

Opportunity Costs

Potential Changes to Social Security

Considerations and Strategies for Delaying Retirement

Assessing Personal Finances

Healthcare Considerations

Work-Related Strategies

Conclusion

Delayed Retirement Credits FAQs

Delayed Retirement Credits (DRCs) are incremental increases in Social Security retirement benefits that individuals can earn by delaying the start of their benefits beyond their full retirement age (FRA). DRCs result in a permanent increase in the monthly benefit amount.

Delayed retirement credits increase your monthly Social Security benefit if you delay receiving it beyond your full retirement age, typically by about 8% per year of delay. Conversely, starting benefits early before your full retirement age results in a permanent reduction in your monthly benefit.

You can earn Delayed Retirement Credits for delaying the start of your Social Security retirement benefits up until age 70. DRCs stop accruing at age 70, so there is no additional benefit to delaying the start of benefits beyond that age.

Yes, there is a limit to the number of Delayed Retirement Credits you can earn. DRCs accrue only until age 70, so the maximum increase in your monthly benefit amount will depend on the number of months you delay claiming benefits between your full retirement age and age 70.

No, Delayed Retirement Credits stop accruing at age 70, so there is no additional benefit to delaying the start of Social Security retirement benefits beyond that age.

True Tamplin is a published author, public speaker, CEO of UpDigital, and founder of Finance Strategists.

True is a Certified Educator in Personal Finance (CEPF®), author of The Handy Financial Ratios Guide, a member of the Society for Advancing Business Editing and Writing, contributes to his financial education site, Finance Strategists, and has spoken to various financial communities such as the CFA Institute, as well as university students like his Alma mater, Biola University, where he received a bachelor of science in business and data analytics.

To learn more about True, visit his personal website or view his author profiles on Amazon, Nasdaq and Forbes.