Normal Retirement Age (NRA) refers to the age at which an individual becomes eligible to receive full retirement benefits without any reduction due to early retirement. This age is usually established by government regulations, pension plans, or retirement account rules. NRA is a crucial factor to consider when planning for retirement, as it can significantly impact the amount of benefits an individual receives. Understanding one's NRA is essential in financial planning, as it helps individuals determine when they can retire without facing a reduction in their benefits. Planning for retirement around the NRA can ensure that individuals maximize their retirement income and avoid financial stress. Additionally, knowing the NRA can help individuals make informed decisions about when to start saving for retirement, as well as when to claim their Social Security benefits. The concept of NRA has evolved over time in the United States. When Social Security was first introduced in 1935, the NRA was set at 65. This age was chosen based on life expectancy and labor market conditions at the time. Since then, the NRA has undergone several changes due to factors such as increased life expectancy, changes in labor market dynamics, and modifications to Social Security and pension plan rules. Today, the NRA varies depending on the specific retirement plan and the individual's year of birth. As people live longer, the cost of providing Social Security benefits increases. To address this, policymakers may raise the NRA to reflect longer life expectancies. For example, when Social Security was first established in 1935, the NRA was 65. Over time, it has been gradually increased to 67 for individuals born in 1960 or later. Further increases may be necessary in the future. During times of economic downturn, policymakers may lower the NRA to provide more benefits for those who are unable to work. This can help support individuals who may have lost their jobs or who are unable to find employment due to economic conditions. For example, during the Great Recession in the late 2000s, lawmakers proposed lowering the NRA to provide more benefits for older workers who were unable to find jobs. Changes in government policies, such as tax laws and Social Security reform, can have a significant impact on the NRA. For example, in 1983, lawmakers passed the Social Security Amendments of 1983, which gradually increased the NRA from 65 to 67. This change was part of a larger package of reforms designed to address the solvency of the Social Security system. Changes in the size and makeup of the population can lead to changes in the NRA. For example, as the baby boomer generation ages, there will be a larger number of people who are eligible for Social Security benefits. This could put pressure on policymakers to increase the NRA to ensure the long-term viability of the Social Security system. Public opinion can also influence policymakers' decisions about the NRA, particularly as retirement becomes a more pressing concern for more people. For example, if there is a groundswell of support for lowering the NRA to allow workers to retire earlier, policymakers may be more likely to consider this option. Alternatively, if there is concern about the long-term solvency of Social Security, policymakers may be more likely to raise the NRA to ensure the system's stability. In the United States, the NRA for Social Security benefits depends on the individual's year of birth. For those born in 1937 or earlier, the NRA is 65. For those born between 1938 and 1959, the NRA gradually increases from 65 to 67, depending on the specific year of birth. For individuals born in 1960 or later, the NRA is 67. It is essential to note that claiming Social Security benefits before reaching the NRA results in a reduction in monthly benefits, while delaying benefits beyond the NRA leads to an increase in benefits. The NRA for pension plans may vary depending on the specific plan and its rules. In general, pension plans set an NRA, typically between 65 and 67, at which participants can begin receiving full benefits. Some plans may offer early retirement options, allowing participants to retire before reaching the NRA but at a reduced benefit level. It is crucial for individuals to understand their specific pension plan's rules and requirements when planning for retirement. For Individual Retirement Accounts (IRAs), the NRA is not as clearly defined as it is for Social Security or pension plans. Instead, the focus is on the age at which individuals can begin taking penalty-free distributions from their IRA. For traditional IRAs, this age is 59 and a half. For Roth IRAs, qualified distributions can be taken after the account has been open for at least five years, and the account owner is at least 59 and a half years old. Delaying retirement beyond the NRA can have both benefits and drawbacks. On the one hand, working longer can increase retirement savings, lead to higher Social Security benefits, and potentially provide continued access to employer-sponsored health insurance. Additionally, a shorter retirement period can reduce the risk of outliving one's savings. On the other hand, delaying retirement may come at the expense of personal well-being and overall quality of life, as individuals may have less time to enjoy their retirement years and face potential health issues that could limit their ability to engage in desired activities. To maximize retirement savings, individuals can consider several strategies, such as starting to save early, diversifying investments, and taking advantage of employer-sponsored retirement plans and matching contributions. Additionally, individuals can explore options like catch-up contributions for those over 50, delaying claiming Social Security benefits to increase monthly payouts, and considering part-time work or a phased retirement approach to ease the transition into full retirement. Retirement planning involves several risks, including longevity risk (the risk of outliving one's savings), market risk (the risk of investment losses), and inflation risk (the risk of purchasing power erosion over time). To mitigate these risks, individuals should consider diversifying their investments, maintaining an emergency fund, and periodically reviewing and adjusting their retirement plans as needed to ensure they remain on track to meet their financial goals. The Normal Retirement Age (NRA) is a critical factor in retirement planning, as it determines the age at which individuals can receive full retirement benefits without any reduction due to early retirement. The NRA varies depending on the specific retirement plan, such as Social Security, pension plans, or IRAs, and the individual's year of birth. Various factors can influence the NRA, including demographic trends, economic conditions, and changes in government policies. Understanding these factors can help individuals better plan for their retirement and make informed decisions about when to claim benefits and how to maximize their retirement savings. Overall, the NRA plays a significant role in retirement planning, as it can impact the amount of benefits an individual receives and determine when they can retire without facing a reduction in their benefits. By understanding their NRA and considering factors that may influence it, individuals can make more informed decisions about their retirement and work towards a secure financial future.What Is the Normal Retirement Age (NRA)?

Historical Context

Evolution of NRA in the US

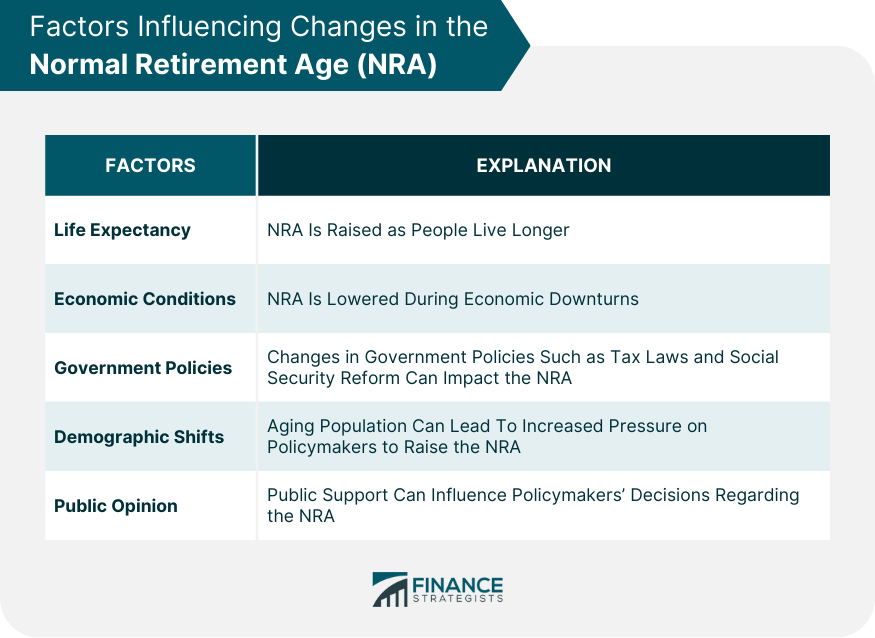

Factors That Influence Changes in NRA

Life Expectancy

Economic Conditions

Government Policies

Demographic Shifts

Public Opinion

Current State of NRA

NRA for Social Security

NRA for Pension Plans

NRA for Individual Retirement Accounts (IRAs)

Impact of NRA on Retirement Planning

Benefits and Drawbacks of Delaying Retirement

Strategies to Maximize Retirement Savings

Risks Associated With Retirement Planning

Bottom Line

Normal Retirement Age (NRA) FAQs

The NRA is the age at which an individual becomes eligible for full retirement benefits from Social Security or pension plans.

Several factors, such as life expectancy, economic conditions, and government policies, can influence changes in NRA over time.

The current NRA for Social Security is 67 for individuals born in 1960 or later. It varies based on birth year and can be as low as 65 for those born before 1938.

Delaying retirement can increase your Social Security benefits, but it may not be the best option for everyone. Factors such as health and financial needs should be considered.

It is possible that the NRA could change in the future due to various economic, political, and social factors. Any changes would likely be announced well in advance to allow for adequate planning.

True Tamplin is a published author, public speaker, CEO of UpDigital, and founder of Finance Strategists.

True is a Certified Educator in Personal Finance (CEPF®), author of The Handy Financial Ratios Guide, a member of the Society for Advancing Business Editing and Writing, contributes to his financial education site, Finance Strategists, and has spoken to various financial communities such as the CFA Institute, as well as university students like his Alma mater, Biola University, where he received a bachelor of science in business and data analytics.

To learn more about True, visit his personal website or view his author profiles on Amazon, Nasdaq and Forbes.