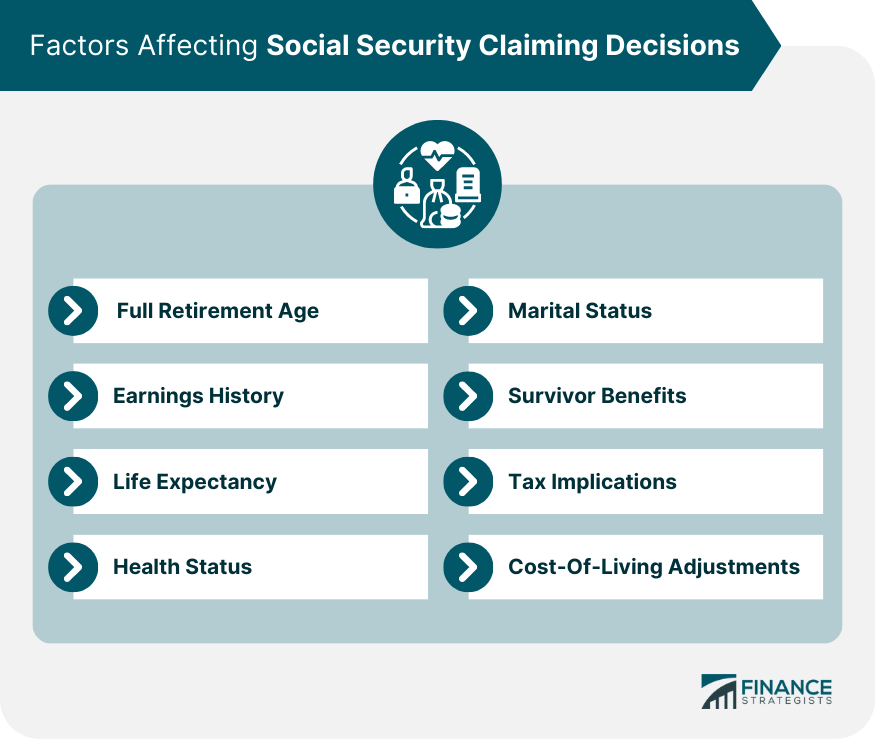

Social Security claiming strategies refer to the various methods and approaches that individuals can use to maximize their Social Security benefits. These strategies involve making decisions about when to start claiming benefits, how to coordinate benefits with a spouse, and other factors that can impact the amount of benefits an individual receives. Before diving into claiming strategies, it is essential to understand the factors that can impact your Social Security benefits. Your Full Retirement Age (FRA) is the age at which you can claim your full Social Security benefits. For individuals born in 1955, the full retirement age is 66 years and two months, and this age incrementally increases until it reaches 67 for those born in 1960 or later. Your Social Security benefits are calculated based on your 35 highest-earning years. If you have fewer than 35 years of earnings, zero-earning years will be included in the calculation, which may reduce your benefits. Estimating your life expectancy can help you decide when to claim benefits, as claiming early or late may impact the total benefits you receive over your lifetime. Consider your current health and any family history of longevity when determining when to claim benefits. If you have health issues or a family history of shorter lifespans, you may want to claim benefits earlier. Married couples have unique strategies available to them, such as coordinating their claiming decisions to maximize benefits. If you are widowed or a surviving divorced spouse, you may be eligible for survivor benefits. These benefits can impact your claiming strategy. Social Security benefits may be subject to federal income taxes, depending on your income level. Understanding the tax implications can help you plan your claiming strategy. Social Security benefits are adjusted annually for inflation, which can impact the value of your benefits over time. There are several claiming strategies to consider, depending on your circumstances and goals. Advantages: Claiming benefits at 62 provides you with an immediate source of income and increases the likelihood of receiving benefits for a longer period if you have a shorter life expectancy. Disadvantages: Claiming at 62 reduces your monthly benefit amount, as you receive benefits for a longer period. This reduction is permanent and may impact your financial security in retirement. Advantages: Claiming at FRA allows you to receive your full benefit amount, which can provide greater financial stability in retirement. Disadvantages: If you have a shorter life expectancy or need the income earlier, waiting until FRA to claim may not be the best strategy. Advantages: Delaying your claim beyond FRA results in delayed retirement credits, which increase your monthly benefit amount. This can be advantageous if you have a longer life expectancy or other sources of income. Disadvantages: Delaying your claim reduces the number of years you receive benefits, which may not be optimal if you have a shorter life expectancy. Synchronizing Claiming With Spouse's Age and Benefits: Coordinating when each spouse claims benefits can help maximize combined benefits. File-and-Suspend Strategy: This strategy was eliminated by the Bipartisan Budget Act of 2015 but allowed one spouse to file for benefits and then suspend them, enabling the other spouse to claim spousal benefits. Restricted Application Strategy: This strategy allows eligible individuals to claim spousal benefits while delaying their own retirement benefits. Survivor Benefit Maximization: Maximizing survivor benefits involves coordinating claiming decisions to ensure the highest possible benefit for the surviving spouse. Claiming Benefits on Ex-Spouse's Record: Divorced individuals may be eligible to claim benefits on their ex-spouse's record, potentially increasing their own benefits. Impact on Ex-Spouse's Benefits: Claiming benefits on an ex-spouse's record does not affect the ex-spouse's benefits or their current spouse's benefits. Survivor Benefits for Divorced Spouses: Divorced spouses may also be eligible for survivor benefits if they meet certain criteria. Timing of Survivor Benefits: Widows and widowers can choose when to claim survivor benefits, which can impact their overall retirement income strategy. Coordination With Personal Retirement Benefits: Claiming survivor benefits can be coordinated with personal retirement benefits to maximize total benefits received. Understanding how your pension may impact your Social Security benefits is crucial for creating a comprehensive retirement plan. Coordinating Social Security benefits with withdrawals from 401(k) and IRA accounts can help optimize your retirement income. Annuities can provide a guaranteed source of income in retirement, which can influence your Social Security claiming strategy. Understanding the impact of required minimum distributions on your retirement income and taxes can help you plan your Social Security claiming strategy. The Bipartisan Budget Act of 2015 eliminated some claiming strategies, such as the file-and-suspend strategy, but did not affect others like restricted applications. Future Social Security reforms could impact claiming strategies, making it essential to stay informed about potential changes. Understanding and selecting the most suitable Social Security claiming strategy is essential for maximizing your lifetime benefits and ensuring financial security during retirement. To make the best decision, it is important to consider factors such as full retirement age, earnings history, life expectancy, health status, marital status, survivor benefits, tax implications, and cost-of-living adjustments. By exploring different claiming strategies, such as claiming at the earliest eligibility age, full retirement age, or delaying claims, as well as coordinating claims with a spouse, you can optimize your benefits. Additionally, it is crucial to stay informed about legislative changes and coordinate Social Security benefits with other retirement income sources like pensions, 401(k)s, and IRAs. Lastly, working with a financial advisor can provide personalized advice and help evaluate the long-term impact of various claiming strategies on your retirement income and overall financial well-being.Definition of Social Security Claiming Strategies

Factors Affecting Social Security Claiming Decisions

Full Retirement Age (FRA)

Earnings History

Life Expectancy

Health Status

Marital Status

Survivor Benefits

Tax Implications

Cost-Of-Living Adjustments

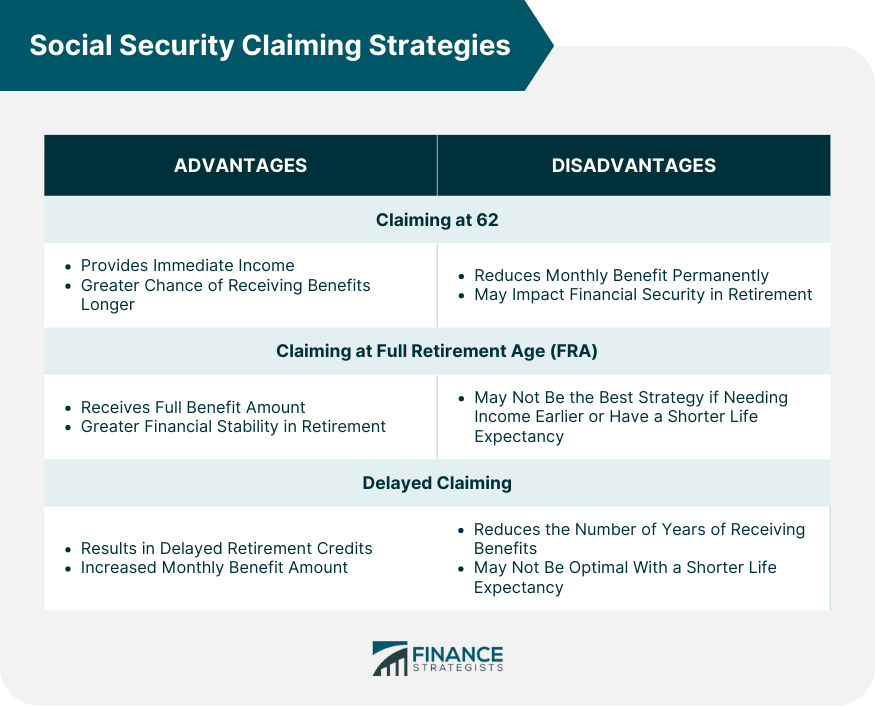

Social Security Claiming Strategies

Claiming at the Earliest Eligibility Age (62)

Claiming at Full Retirement Age

Delayed Claiming (Up to Age 70)

Social Security Claiming Strategies for Married Couples

Social Security Claiming Strategies for Divorced Individuals

Social Security Claiming Strategies for Widows and Widowers

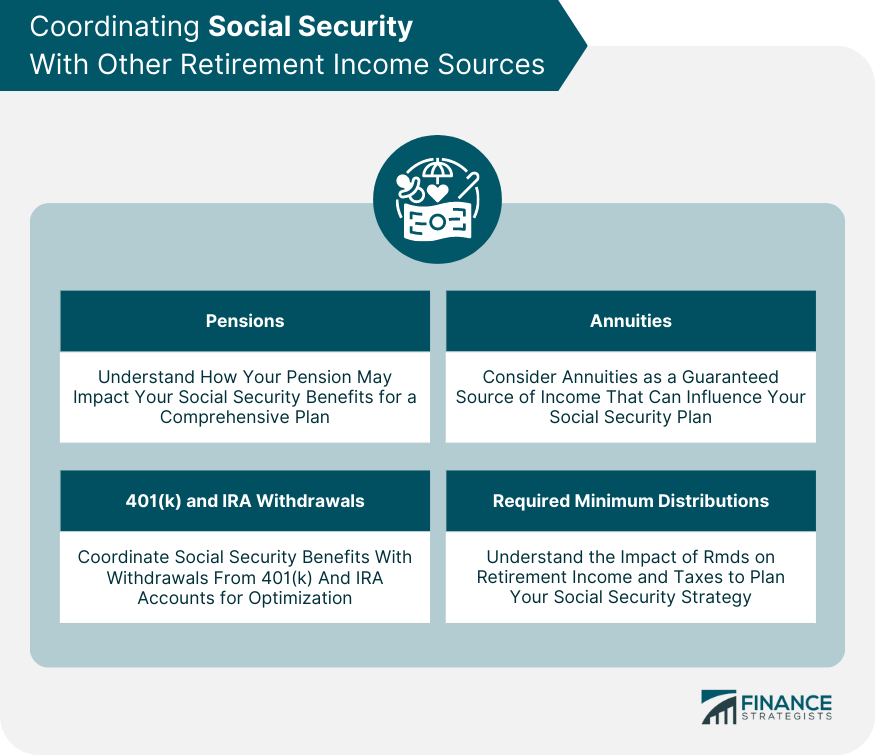

Coordinating Social Security With Other Retirement Income Sources

Pensions

401(k) and IRA Withdrawals

Annuities

Required Minimum Distributions

Impact of Legislative Changes on Claiming Strategies

Bipartisan Budget Act of 2015

Potential Future Reforms

Bottom Line

Social Security Claiming Strategies FAQs

Popular strategies include claiming at the earliest eligibility age (62), claiming at full retirement age, and delaying claiming until age 70. Married couples can also consider synchronizing claims, using the restricted application strategy, and maximizing survivor benefits.

Life expectancy and health status can influence the optimal claiming strategy, as individuals with shorter life expectancies or health issues may benefit from claiming earlier, while those with longer life expectancies or better health may benefit from delaying their claims.

Legislative changes can eliminate or modify claiming strategies. For example, the Bipartisan Budget Act of 2015 eliminated the file-and-suspend strategy but did not affect restricted applications. Staying informed about potential changes can help you adapt your strategy as needed.

Marital status can open up additional claiming strategies, such as coordinating claims with a spouse or maximizing survivor benefits. Divorced individuals may be eligible to claim benefits on their ex-spouse's record, which can impact their overall strategy.

A financial advisor can provide personalized advice, taking into account your unique circumstances and goals, to help you develop an optimal claiming strategy. They can also help evaluate the long-term impact of different strategies on your retirement income and financial security.

True Tamplin is a published author, public speaker, CEO of UpDigital, and founder of Finance Strategists.

True is a Certified Educator in Personal Finance (CEPF®), author of The Handy Financial Ratios Guide, a member of the Society for Advancing Business Editing and Writing, contributes to his financial education site, Finance Strategists, and has spoken to various financial communities such as the CFA Institute, as well as university students like his Alma mater, Biola University, where he received a bachelor of science in business and data analytics.

To learn more about True, visit his personal website or view his author profiles on Amazon, Nasdaq and Forbes.