Social Security early retirement is a program that allows individuals to begin receiving Social Security retirement benefits as early as age 62. This is earlier than the full retirement age, which is the age at which individuals can receive their full Social Security retirement benefits. When an individual takes Social Security early retirement, their monthly benefit amount is reduced from what it would have been if they had waited until their full retirement age to begin receiving benefits. The reduction in monthly benefits is calculated based on the number of months between the individual's age at the time they begin receiving benefits and their full retirement age.

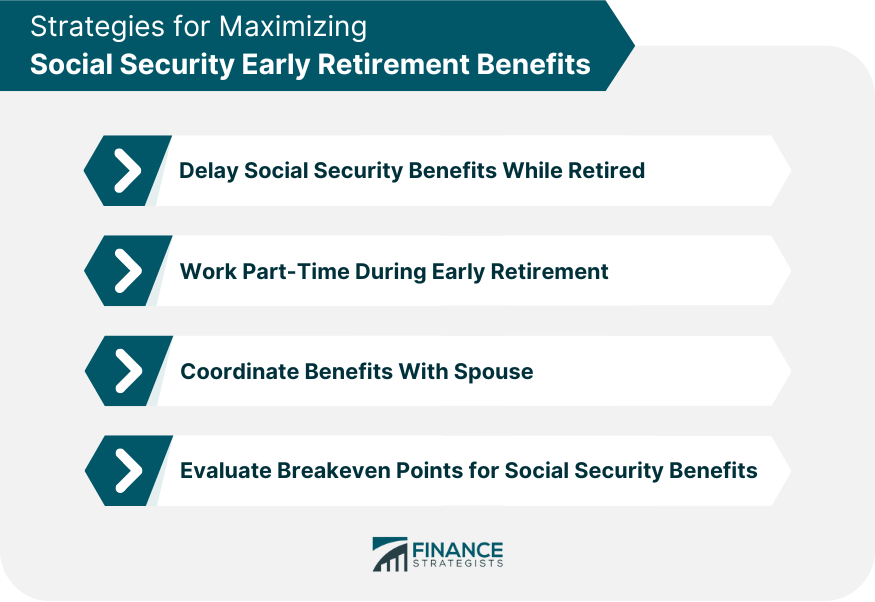

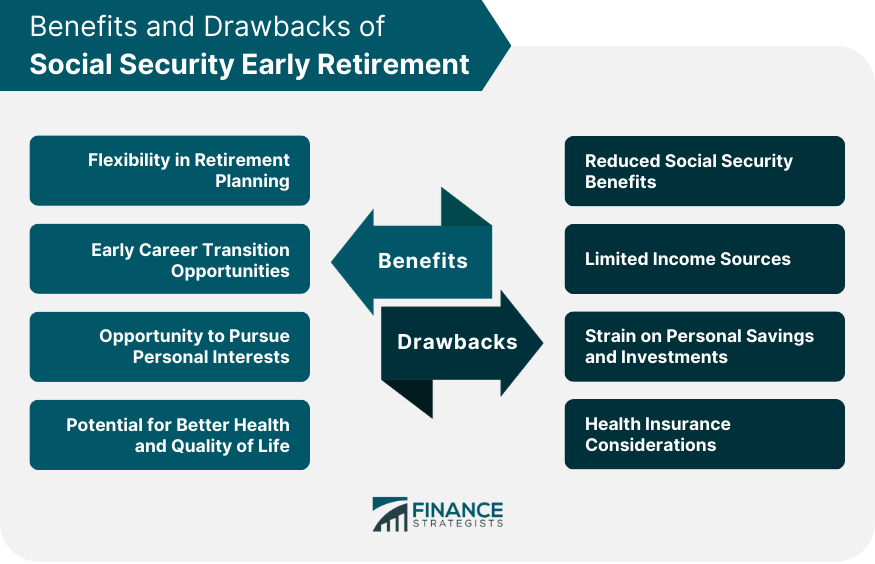

To be eligible for Social Security early retirement, individuals must meet certain requirements. The age at which you can start receiving Social Security benefits is called the Full Retirement Age (FRA). The FRA varies depending on your year of birth and is typically between 66 and 67 years old. However, the SSA allows individuals to start receiving benefits as early as age 62, although at a reduced amount. To be eligible for Social Security benefits, you must have earned a specific number of Social Security credits throughout your working career. Credits are earned by working and paying Social Security taxes. The required number of credits for early retirement is typically 40, equivalent to approximately 10 years of work. One strategy for maximizing benefits is to retire early but delay claiming Social Security benefits until your FRA or later. This approach allows your benefits to increase before you begin receiving them. Working part-time during early retirement can help supplement income, reduce the reliance on savings and investments, and potentially increase your Social Security benefits. Couples can maximize their Social Security benefits by coordinating when each spouse claims benefits. This may involve one spouse claiming benefits early while the other waits until their FRA or later. Understanding the breakeven points for Social Security benefits can help you determine the optimal time to claim benefits based on your personal circumstances and financial goals. Early retirement offers individuals more flexibility in their retirement planning. It allows them to choose when they want to retire and provides the freedom to pursue personal interests, and hobbies, or even start a new career. Retiring early gives individuals the chance to transition into a new career, start a business, or devote more time to personal interests, such as volunteering or traveling. For some people, early retirement may lead to improved health and quality of life. Reduced work-related stress and increased leisure time can contribute to a healthier and more fulfilling lifestyle. The most significant drawback of early retirement is the reduction in Social Security benefits. When you claim benefits before your FRA, your monthly benefit amount is permanently reduced. The reduction depends on how many months before your FRA you begin receiving benefits. Relying solely on Social Security benefits for income during early retirement may be challenging. Other sources of income, such as pensions or investments, may not be accessible or sufficient to cover living expenses during this time. Early retirement may put a strain on personal savings and investments, as individuals will need to rely on these resources for a longer period. Medicare eligibility begins at age 65, which means early retirees may need to find alternative health insurance options until they are eligible for Medicare. Early retirees may need to explore alternative health insurance options, such as purchasing private insurance or continuing coverage through a spouse's employer. Before considering early retirement, it is essential to evaluate your personal savings and investments to ensure they can provide sufficient income throughout your retirement years. Developing a realistic retirement budget can help you determine whether early retirement is financially feasible. Your budget should account for living expenses, healthcare costs, taxes, and discretionary spending. Early retirement may have tax implications that should be considered when planning your retirement. For example, withdrawing from certain retirement accounts before age 59½ may result in penalties and additional taxes. Consulting a financial advisor can be beneficial in preparing for early retirement. A professional can help you develop a comprehensive retirement plan, assess your financial readiness, and guide you in making informed decisions about Social Security benefits and other financial matters. Social Security early retirement allows individuals to receive benefits at 62, but the monthly benefit amount is permanently reduced. Individuals must have earned a specific number of Social Security credits and meet age requirements to be eligible. Strategies for maximizing benefits include delaying Social Security benefits while retired, working part-time during early retirement, coordinating benefits with a spouse, and evaluating breakeven points. Early retirement offers flexibility in retirement planning, opportunities for early career transition or pursuing personal interests, and potential for better health and quality of life. The drawbacks include reduced Social Security benefits, limited income sources, and possible strain on personal savings and investments. Financial planning is crucial, including assessing personal savings and investments, creating a realistic retirement budget, understanding tax implications, and seeking professional financial advice.Definition of Social Security Early Retirement

Eligibility for Social Security Early Retirement

Age Requirements

Work History and Social Security Credits

Strategies for Maximizing Social Security Early Retirement Benefits

Delaying Social Security Benefits While Retired

Working Part-Time During Early Retirement

Coordinating Benefits With Spouse

Evaluating Breakeven Points for Social Security Benefits

Benefits of Social Security Early Retirement

Flexibility in Retirement Planning

Opportunity for Early Career Transition or Pursuing Personal Interests

Potential for Better Health and Quality of Life

Drawbacks of Social Security Early Retirement

Reduced Social Security Benefits

Limited Income Sources

Possible Strain on Personal Savings and Investments

Health Insurance Considerations

Medicare Eligibility

Alternative Health Insurance Options

Importance of Financial Planning for Social Security Early Retirement

Assessing Personal Savings and Investments

Creating a Realistic Retirement Budget

Understanding Tax Implications

Seeking Professional Financial Advice

Final Thoughts

Social Security Early Retirement FAQs

The minimum age for Social Security early retirement is 62. However, claiming benefits at this age results in permanently reduced monthly payments compared to waiting until your full retirement age.

Social Security early retirement leads to a permanent reduction in your monthly benefits. The reduction depends on how many months before your full retirement age you start receiving benefits, with a greater reduction for earlier claims.

Yes, you can continue working while receiving Social Security early retirement benefits. However, there are income limits, and if you exceed these limits, your benefits may be temporarily reduced until you reach your full retirement age.

To maximize Social Security early retirement benefits, you can consider delaying claiming benefits until your full retirement age or later, working part-time during early retirement, coordinating benefits with your spouse, and evaluating breakeven points for Social Security benefits.

Financial planning is crucial for Social Security early retirement as it helps you assess your personal savings and investments, create a realistic retirement budget, understand tax implications, and make informed decisions about when to claim benefits. Consulting a financial advisor can further assist you in preparing for a secure early retirement.

True Tamplin is a published author, public speaker, CEO of UpDigital, and founder of Finance Strategists.

True is a Certified Educator in Personal Finance (CEPF®), author of The Handy Financial Ratios Guide, a member of the Society for Advancing Business Editing and Writing, contributes to his financial education site, Finance Strategists, and has spoken to various financial communities such as the CFA Institute, as well as university students like his Alma mater, Biola University, where he received a bachelor of science in business and data analytics.

To learn more about True, visit his personal website or view his author profiles on Amazon, Nasdaq and Forbes.