Social Security Representative Payee is a person or organization appointed by the Social Security Administration (SSA) to manage the Social Security benefits of a beneficiary who is unable to do so themselves. The Representative Payee is responsible for using the benefits for the beneficiary's current and future needs, keeping records of expenses, and reporting any changes in the beneficiary's circumstances to the SSA. The SSA regularly monitors the use of benefits by Representative Payees and can take legal action if there is evidence of misuse. Children under the age of 18 who receive Social Security benefits may need a Representative Payee to manage their finances on their behalf. Adults with disabilities that hinder their ability to manage finances may qualify for a Representative Payee to ensure their needs are met. Elderly individuals experiencing cognitive declines, such as dementia or Alzheimer's, may require a Representative Payee to manage their finances effectively. Beneficiaries with substance abuse problems may need a Representative Payee to prevent misuse of funds and address essential needs. The Social Security Administration may determine that other individuals require a Representative Payee based on their unique circumstances. The SSA identifies beneficiaries who need a Representative Payee and helps appoint a suitable individual or organization to fulfill this role. The prospective Representative Payee must complete and submit Form SSA-11, the "Request to be Selected as Payee" form, to the SSA for evaluation. Applicants must provide documentation proving their identity, relationship to the beneficiary, and ability to manage finances responsibly. The SSA reviews the application and conducts interviews with the applicant and the beneficiary to determine the suitability of the proposed Representative Payee. The SSA considers the applicant's relationship with the beneficiary, prioritizing close family members and friends. The applicant must demonstrate financial responsibility and the capacity to manage the beneficiary's funds effectively. The SSA evaluates the applicant's trustworthiness and decision-making abilities to ensure the beneficiary's best interests are served. The Representative Payee deposits the beneficiary's Social Security payments into a designated account. The Representative Payee must prioritize the beneficiary's essential needs, including food, shelter, clothing, medical care, and utilities. Any remaining funds should be saved or invested in the beneficiary's best interest, following the SSA's guidelines. Representative Payees are required to submit annual reports to the SSA detailing how the beneficiary's funds were used. The Representative Payee must inform the SSA of any significant changes in the beneficiary's situation that may affect their benefits. The Representative Payee must be vigilant against fraud and report any suspicious activity to the SSA immediately. The Representative Payee should clearly communicate their role and responsibilities to the beneficiary. When possible, the Representative Payee should involve the beneficiary in financial decisions to promote autonomy and understanding. The Representative Payee must be responsive to the beneficiary's concerns and work to resolve any grievances. Close relatives, such as parents, siblings, or adult children, can serve as Representative Payees for beneficiaries. Trusted friends may also be appointed as Representative Payees if they have a close relationship with the beneficiary and can manage their finances effectively. Legal guardians or conservators may be designated as Representative Payees to manage the beneficiary's finances. Non-profit organizations that provide social services may be appointed Representative Payees for beneficiaries lacking suitable individual options. Long-term care facilities or institutions that provide care to beneficiaries may also serve as Representative Payees. Government agencies may sometimes be appointed as Representative Payees to manage beneficiaries' finances properly. If a Representative Payee is found to be mismanaging the beneficiary's funds, they may be removed or replaced. A Representative Payee may be changed or removed if there is evidence of abuse or exploitation of the beneficiary. If a beneficiary can manage their finances, the Representative Payee may be removed, and the beneficiary may regain control of their benefits. Beneficiaries or concerned parties should report any issues with the current Representative Payee to the SSA. The SSA will investigate reported concerns and determine if a change or removal of the Representative Payee is warranted. If the SSA decides that the current Representative Payee is unsuitable, they will appoint a new Representative Payee to manage the beneficiary's finances. Social Security Representative Payees are vital in managing the finances of beneficiaries who cannot do so themselves, such as minors, adults with impairments, seniors with cognitive decline, and individuals with substance abuse issues. The SSA oversees the appointment process, including evaluating the applicant's relationship with the beneficiary, financial management abilities, and trustworthiness. Representative Payees manage Social Security benefits, recordkeeping, reporting, and communicating with the beneficiary. They can be individuals like family members or friends or organizations such as non-profit agencies, care facilities, or government agencies. If necessary, the SSA can change or remove a Representative Payee due to improper fund management, abuse, or exploitation or when the beneficiary regains the ability to manage their finances. Understanding the significance, responsibilities, and procedures surrounding Representative Payees helps ensure the proper management of beneficiaries' finances and promotes their best interests.What Is a Social Security Representative Payee?

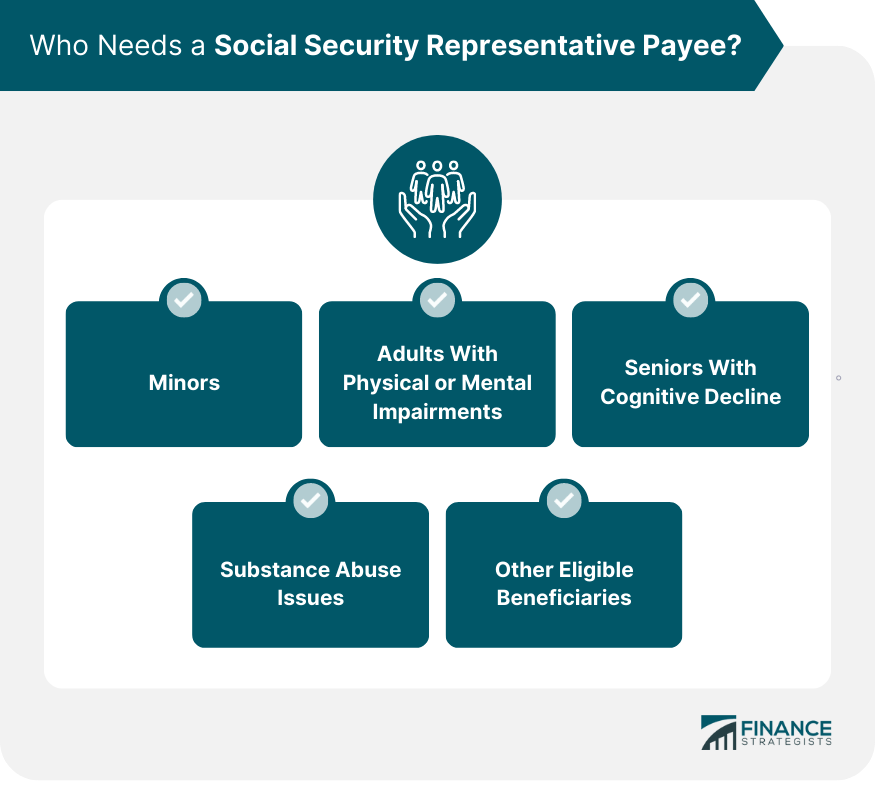

Who Needs a Social Security Representative Payee?

Minors

Adults With Physical or Mental Impairments

Seniors With Cognitive Decline

Substance Abuse Issues

Other Eligible Beneficiaries

How to Appoint a Social Security Representative Payee

Role of the Social Security Administration (SSA)

Application Process

Form SSA-11

Required Documents

Evaluation Process

Selection Criteria for a Representative Payee

Relationship to the Beneficiary

Ability to Manage Finances

Trustworthiness and Good Judgment

Responsibilities of a Social Security Representative Payee

Managing Social Security Benefits

Depositing Payments

Paying for Basic Needs

Managing Surplus Funds

Recordkeeping and Reporting

Annual Accounting Reports

Changes in Circumstances

Fraud Prevention and Reporting

Communicating With the Beneficiary

Explaining the Role of the Representative Payee

Involving the Beneficiary in Financial Decisions

Addressing Concerns and Grievances

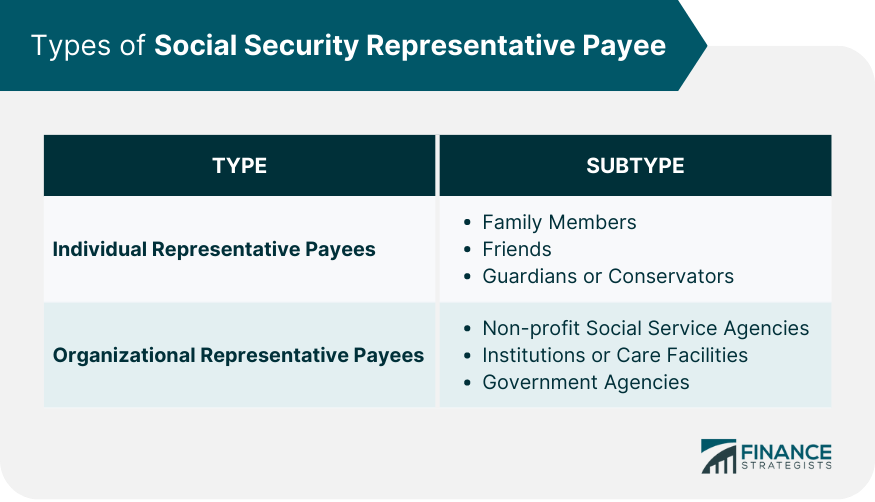

Types of Social Security Representative Payee

Individual Representative Payees

Family Members

Friends

Guardians or Conservators

Organizational Representative Payees

Non-profit Social Service Agencies

Institutions or Care Facilities

Government Agencies

Changing or Removing a Social Security Representative

Reasons for Change or Removal

Improper Management of Funds

Abuse or Exploitation

Beneficiary Regains Ability to Manage Finances

Process for Changing or Removing a Representative Payee

Reporting Concerns to the SSA

Investigation by the SSA

Appointing a New Representative Payee if Necessary

Conclusion

Social Security Representative Payee FAQs

A Social Security Representative Payee is a person or an organization appointed by the Social Security Administration (SSA) to receive and manage Social Security benefits on behalf of a beneficiary who is unable to do so themselves.

A person or an organization can become a Social Security Representative Payee if the SSA appoints them to manage the Social Security benefits of a beneficiary who is unable to do so themselves.

The responsibilities of a Social Security Representative Payee include managing the Social Security benefits of the beneficiary, using the funds for the beneficiary's current and future needs, keeping records of expenses, and reporting any changes in the beneficiary's circumstances to the SSA.

You can apply to become a Social Security Representative Payee by contacting the SSA and completing the required application forms. The SSA will then determine if you are eligible to serve as a Representative Payee based on their evaluation of your ability to manage the beneficiary's funds.

Yes, a Social Security Representative Payee can be held accountable for misusing benefits. The SSA regularly monitors the use of benefits by Representative Payees and can take legal action if there is evidence of misuse.

True Tamplin is a published author, public speaker, CEO of UpDigital, and founder of Finance Strategists.

True is a Certified Educator in Personal Finance (CEPF®), author of The Handy Financial Ratios Guide, a member of the Society for Advancing Business Editing and Writing, contributes to his financial education site, Finance Strategists, and has spoken to various financial communities such as the CFA Institute, as well as university students like his Alma mater, Biola University, where he received a bachelor of science in business and data analytics.

To learn more about True, visit his personal website or view his author profiles on Amazon, Nasdaq and Forbes.